It looks like you're new here. If you want to get involved, click one of these buttons!

SPR Quick Facts

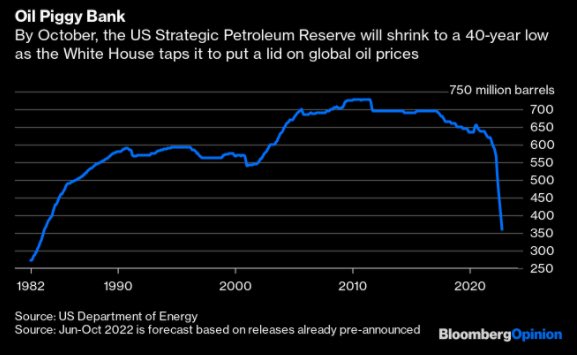

The Strategic Petroleum Reserve is a U.S. Government complex of four sites with deep underground storage caverns created in salt domes along the Texas and Louisiana Gulf Coasts.

Highest inventory - The SPR was filled to its then 727 million barrel authorized storage capacity on December 27, 2009; the inventory of 726.6 million barrels was the highest ever held in the SPR.

Previous Inventory Milestones

2008. Prior to Hurricane Gustav coming ashore on September 1, 2008, the SPR had reached 707.21 million barrels, the highest level ever held up until that date. A series of emergency exchanges conducted after Hurricane Gustav, followed shortly thereafter by Hurricane Ike, reduced the level by 5.4 million barrels.

2005. Prior to the 2008 hurricane releases, the former record had been reached in late August 2005, just days before Hurricane Katrina hit the Gulf Coast. Hurricane Katrina emergency releases of both crude oil sales and exchanges (loans) totaled 20.8 million barrels.

1977. First oil was delivered to the newly constructed SPR, 412,000 barrels of light sweet crude.

Current authorized storage capacity - 714 million barrels

Fill status - The SPR completed fill on December 27, 2009 with a cargo that arrived and began to unload on Christmas Day. The cargo was 493,000 barrels of Saharan Blend, a light sweet crude that was delivered to the Bryan Mound site. A sale and drawdown in 2011 reduced the inventory to 695.9 million barrels.

Current days of import protection in SPR - At the end of CY 2021 (as of December 31, 2021), the SPR’s crude oil inventory was 594.7 MMbbl. This is equivalent to approximately 1,206 days of supply of total U.S. petroleum net imports.

International Energy Agency requirement - 90 days of import protection (both public and private stocks). In past years, the United States has met its commitment with a combination of SPR stocks and industry stocks. The days of import protection may vary based on actual net U.S. petroleum imports and the inventory level of the SPR.

Average price paid for oil in the Reserve - $29.70 per barrel

Drawdown Capability

Maximum nominal drawdown capability - 4.4 million barrels per day

Time for oil to enter U.S. market - 13 days from Presidential decision

Investment to date - About $25.7 billion ($5 billion for facilities; $20.7 billion for crude oil).

And the hot dogs are still $1.50. Which reminds me of when the new CEO was contemplating raising that price:Costco has their giant rotisserie chicken for less than $5. Of course that up front membership fee can be an issue.

Marks suggests investors center on a neutral risk setting (think of a speedometer) suitable for their age, goals, tolerance, etc. He also recommends varying that a bit with one’s assessment of market valuation / dynamics. Therein lies the difficulty.Howard Marks - Which Way Now?

He suggests that rather than in/out or buy/sell, make portfolio adjustments according to own risk level.

https://www.oaktreecapital.com/insights/insight-video/market-commentary/insights-live-which-way-now

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla