It looks like you're new here. If you want to get involved, click one of these buttons!

Holmes was a better writer than that. We pay taxes, not taxation. His words, excerpted from the source, Compania General de Tabacos v. Collector, 275 U.S. 87 (1927), were "Taxes are what we pay for civilized society". Priceless (no mention of price).“Taxation is the price we pay for civilization.” Oliver Wendell Holmes. According to fellow Supreme Court Justice Felix Frankfurter: “[Holmes] did not have a curmudgeon’s feelings about his own taxes. A secretary who exclaimed ‘Don’t you hate to pay taxes!’ was rebuked with the hot response, ‘No, young feller. I like to pay taxes. With them I buy civilization.”

"The good news is America provides plenty of legal ways for people to avoid paying taxes, and the wealthier investors are, the more ways there are. "1852, Journal of the House of Representatives of the State of Vermont, October Session, 1851, Appendix: Report of the Committee Appointed by the Governor to Take into Consideration the Financial Affairs of the State, Start Page 368, Quote Page 369, Printed by Chauncey Goodrich, Burlington, Vermont. (Google Books full view) link

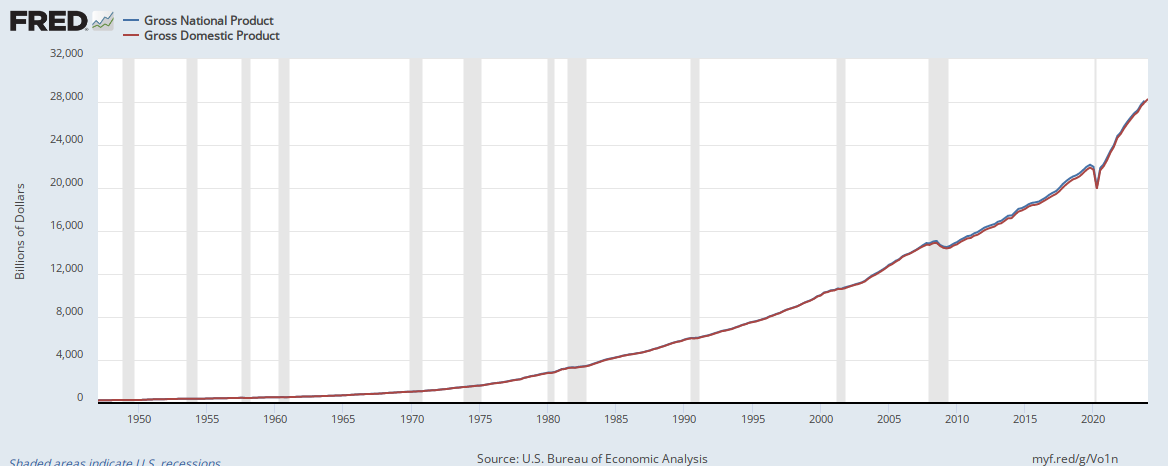

GDP curve doesn't look better (or worse) than GNP to these eyes.i think the statistical measuring rods are just not showing RELEVANT data. Maybe they did, in days gone by. Before federal agencies re-defined stuff to make things look better than they actually are. It's all too mushy and opaque and convoluted. So THAT doesn't help anything, either.

*Edited to add: remember when it was GNP that was reported? Not GDP?

https://apps.bea.gov/scb/2021/03-march/0321-reprint-gnp.htmGDP measures the goods and services produced within the country's geographical borders, by both U.S. residents and residents of the rest of the world. GNP measures the goods and services produced by only U.S. residents, both domestically and abroad.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla