Rotation City. U.S. equity and bonds Both of the below links are active; meaning the data shown is current dependent upon the viewing time. The

'etf' link is active during 'markets open' periods, showing data with a 1

5 minute delay. The closing daily data will stay in place until the next trading day begins (US markets are open). The page is linked with the '%Chg' column selected, which is a daily column. You may select any other column to sort returns for that time frame.

Major global and U.S. etf categories This list is set with

%Chg, which will be for changes for today, July 10; being from most positive to most negative returns.

Per a request, this link is added to this thread at this beginning page.

The data shown is an indicative gauge of direction and isn't a monitor of trading in an open and active market.

REF: Finviz shows about +

5% at midnight for Japan; while the active and open market there is +10% at this time.

FINVIZ futures3pm, Thursday:

Peeking around areas I watch, one finds weakness today with the Mag 7, and money flows to the Russell 2000; and other equity sectors. With lower inflation reported and possible FED rate cuts in the future, of course; one also finds interest rate sensitive areas having gains. The reported inflation is about 3%. Not the 2% the FED wants but probably close enough. Somewhere I have a link that expresses that the very long term official average CPI is 3.3%.

Bond yields, of course; have dropped today, per the hope of a rate cut. Many traditional bond funds first moved to small positive YTD returns last week. Those holding most bond funds today with find a nice price bump.

Well, enough from me. Let us discover what B of A and the other big players have to say. :)

Remain curious,

Catch

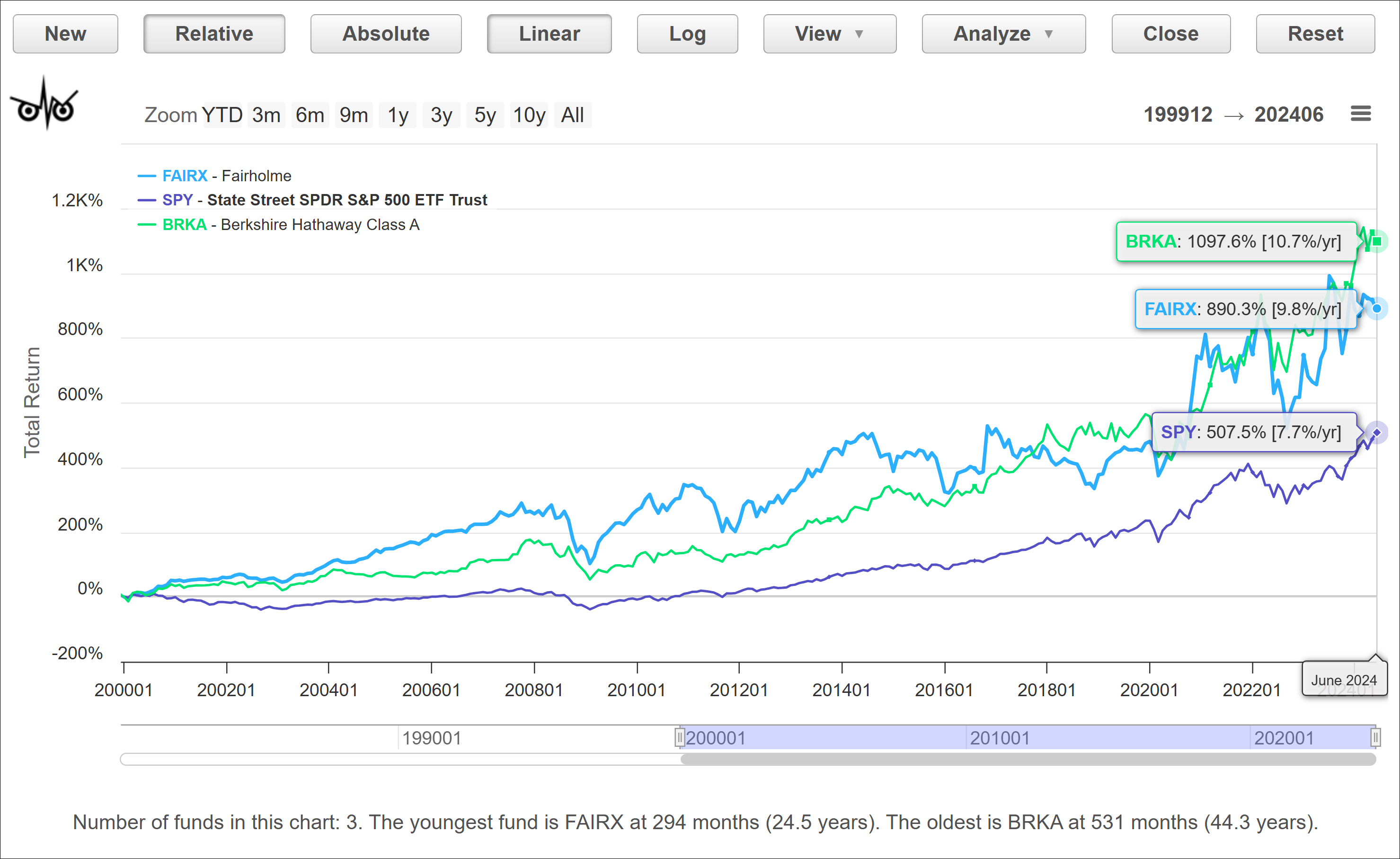

Good ol' Fairholme FAIRX approaching 2

5 year since launch.

Interesting that we are talking about Wood and Berkowitz with similar threads.

I find the chart below fascinating!

FAIRX Flows and Return Data Since Inception (Absolute Scale)

Over its long life,

it's actually beaten the SP500 handedly and has been almost as good as Buffett. Bruce's misstep and perhaps Morningstar's was the expectation set in its first decade. The life of a fund is only as long as its investors believe in the manager.

Return Comparison Since FAIRX Inception

Fido first impressions (vs Schwab) Apparently as the Schwab-TDA merger took shape, the company tried to walk the line between "not upsetting their existing customers" (mainly 'stodgy' B&H types) when trying to integrate a more active type of investor/trader from TDA ... my sense is that they erred on the side of caution to respect their existing asset base and didn't want to upset their more conservative investors with dramatic changes. So as a result, many TDA migrants are upset w/the Schwab experience.

That said, cash management issue at Schwab is just 100% customer-unfriendly and inexcusable, and adds an extra step/more friction to doing things, and their failure to allow DRIP of Canadian stocks is just annoying.

Speaking of idle cash, in 2023 Schwab made 50% of their revenue from interest on uninvested cash 25% from asset management (incl Schwab ETFs) 17% from trading (commissions and PFOF).

Good ol' Fairholme Something made me think of this today. I was on board those many years ago when it was the hottest thing going, the manager the focus of much adulation. Seem to recall I exited with a gain, but one much reduced from the top. Its fall from grace is old news. Hard to believe the following though:

--The fund still has over $1 billion AUM.

--Over one-third of those assets belong to the manager.

--80+% of the fund is invested in a single security.

--The fund charges 1% per annum for the privilege of ownership. (To a large extent the manager is paying himself.)

--Over the past 10 and 15 years the fund's returns land in the bottom 1% of its category (according to you-know-who).

--You-know-who accords the fund its Silver medal. (Huh?!)

Investing is such a personal endeavor it's difficult to understand what some people are thinking.

Buy Sell Why: ad infinitum. @PRESSmUP Looking at

5 year chart , go for it ! Key word here would be " taxable " ?

ADDED If Nav goes up , dividends going down ?

Cathie Wood nods at Ark’s ‘challenged’ returns but insists on future profits Here's The Barron's Daily take on her letter to investors:

Cathie Wood, the architect behind the ARK fund, has a delicate task in her latest letter to investors. The fund came to prominence with big gains in 2020 when the broader market was tanking. Now she has to explain both why her funds haven’t been doing well lately, and how they will do better.

It starts with Wood pointing out that her flagship fund, which focuses on “disruptive innovation,” is 72% below its peak while the S&P 500 is hitting all-time highs. The reason given is that the S&P is driven by just a few stocks, and the ARK fund has been hurt more than others by higher interest rates—implying that her high-growth picks have been disproportionately hit by weaker risk appetite for the past few years.

Of course, Wood famously sold Nvidia before it went on its spectacular run. And she recently started selling Tesla just as it started to climb more aggressively. These are both the very kinds of companies that fit the bill for ARK.

It’s a lesson for investors everywhere. Sometimes you can be right about big ideas and still get the timing wrong. Or, in some cases, you have the right idea and pick the wrong stocks. Getting timings right on market moves is very hard.

Second, it’s really hard to beat the market as an active investor, especially when the S&P 500 is up 26% over the past year. Even Warren Buffett’s vast wealth can largely be explained by compound interest—he has basically matched market returns for the past two decades.

There’s one more thing worth remembering when reading Wood’s letter. And it’s that her job is more about convincing investors to join her—getting the best returns for her investors is a secondary consideration. Recent outflows suggest it isn’t going well. She may well be right about the future and her stock picks may turn out to be excellent. The hard part is convincing others to join her.

AAII Sentiment Survey, 7/10/24 AAII Sentiment Survey, 7/10/24

BULLISH remained the top sentiment (49.2%, high) & bearish remained the bottom sentiment (21.7%, low); neutral remained the middle sentiment (29.1%, below average); Bull-Bear Spread was +27.

5% (high). Investor concerns: Elections, budget, inflation, economy, the Fed, dollar, Russia-Ukraine (124+ weeks), Israel-Hamas (39+ weeks), geopolitical. For the Survey week (Th-Wed), stocks up, bonds up, oil down, gold up, dollar down. NYSE %Above

50-dMA

51.19% (positive). New highs for SP

500 & Nasdaq Comp. #AAII #Sentiment #Markets

https://ybbpersonalfinance.proboards.com/post/1551/thread

Buy Sell Why: ad infinitum. ...

When I started my taxable position in SMH back in February (thanks again

@Stillers) I started small. The way it grows, it won't stay small long. And if there is one of those 30-3

5% down-drafts in the future, I won't be too bummed out to double down.

Will chips become commodities? Maybe, RAM pretty much is. But then people keep inventing new things to do with chips, see Nvidia. And they are in all things tech. What will make them obsolete?

Biological semis is my guess.

Glad you took the plunge with SMH. Semis are the gift that keeps on giving.

on the failure of focus @davidrmoran, I tried PV for 10 years, and the results were closer to your results. I double-checked TestFol and its numbers are the same as before.

It looks that TestFol has some error in the data for

XLG and its numbers for

XLG are consistently lower (compared with PV).

New picture with PV:

3 Years

IVV < OEF < XLG5 Years

IVV < OEF < XLG10 Years

IVV < OEF < XLGThat is what I was expecting because SP

500 has become increasingly concentrated in mega-stocks. But at the time of my previous post, I didn't suspect errors in TestFol, so simply noted that the results were unexpected.

Edit/Add, 7/11/24. I contacted

TestFol on this issue. It acknowledged the problem for

XLG and fixed it promptly. Interestingly, my old linked runs now show the updated data for

XLG (and they are now close to those from PV), but those for

OEF and

IVV are unchanged (i.e. I didn't have re-run those TestFol).

Many have now started using TestFol because after the recent update, FREE Portfolio Visualizer (PV) is quite limited or unfriendly. As this is sort of off topic for the OP, I won't post more here, but interested posters can find details at,

https://ybbpersonalfinance.proboards.com/post/1550/thread

January MFO Ratings Posted Good session. Healthy turn out today. Thank you!

Link to

video.

Link to

chart deck.

Buy Sell Why: ad infinitum. Buggy whips couldn't reinvent themselves into something else.

But you do have to keep up with the times. Radios were a big deal once upon a time. So were electric typewriters and main-frame computers.

Some things are practically commodities,

e.g., hard drives, routers.

And sometimes things take unexpected directions. High-end graphics cards were limited to dedicated gamers not too long ago.

When I started my taxable position in SMH back in February (thanks again

@Stillers) I started small. The way it grows, it won't stay small long. And if there is one of those 30-3

5% down-drafts in the future, I won't be too bummed out to double down.

Will chips become commodities? Maybe, RAM pretty much is. But then people keep inventing new things to do with chips, see Nvidia. And they are in all things tech. What will make them obsolete?

Biological semis is my guess.

on the failure of focus I compared SP

50/

XLG, SP100/

OEF, SP

500/

IVV. All 3 had comparable SDs, but,

performance-wise,

XLG <

OEF <

IVV.

I didn't expect that despite their ERs of 20 bps, 20bps, 3 bps, respectively.

TestFol XLG OEF IVV MAXEdit/Add. Performance for other timeframes,

3 Years

IVV < OEF < XLG5 Years

IVV < OEF < XLG10 Years

IVV < XLG < OEF

on the failure of focus Am I missing fund pairs or an insight?Probably too new to provide meaningful performance insight are the three Vanguard Advice Select funds.

Vanguard 2021 launch announcementIn particular, Vanguard Advice Select Dividend Growth (VADGX) is described as "A more concentrated version of the strategy used in Vanguard Dividend Growth Fund."

VADGX / VDIGX - Select wins over lifetime (since 11/9/2021)

Another of the funds, Vanguard Advice Select International Growth (VAIGX) is described as using "as a more concentrated version of the strategy used in Vanguard International Growth Fund" (VWIGX). However, since management of the latter is split between Baillie Gifford and Schroeder, this isn't a good pairing for comparison.

But a comparison with Baillie Gifford International Growth (BGESX) may be apt, especially since the two BG managers of VWIGX are the two longest managers at BGESX. Though BGESX is concentrated (

56 equity holdings, per M*), VAIGX is doubly focused, holding only 28 equity securities.

VAIGX / BGESX - Select wins over lifetime (since 11/9/2021), losing "only" 10.03%/year vs. an annualized 11.49% loss for the BG fund. Though the latter held the lead until February of this year.

IMHO what this really shows for Vanguard conspiracy theorists (I count myself among them) is that Vanguard is pushing investors either out or into managed accounts. These select funds are available only in managed accounts.

on the failure of focus @david_snowball I have tried to figure out how to capture concentration risk better for portfolios. I have not succeeded given the tools at hand. I am convinced however that most investors have few good ideas. All the money comes from those ideas and everything else is a go along waste of time. I would rather have managers focus than not focus. If they can't make money, then get out. But going with the non-focused is a waste of fees and money. It also doesnt taste a manager's level of conviction or investing skills. No person can have 7

5 good ideas for stocks and holding 1-1.

5% per position is just blah.

on the failure of focus Interesting. If it was not a matter of choosing / strategy, and was in other words more random, you might expect that fewer (notionally 'best of the best') would invariably be better.

Same as when you compare TR for XLG, VOO, and VONE 10-5-3-1y. Diworsification and all that.

on the failure of focus Long ago I developed a curiosity about whether focused / non-diversified / concentrated portfolios offered some distinctive advantage. The purest test I could imagine was finding paired sets of funds run by the same manager using the same strategy, one of which was a focused fund. Found five, one of which (ICAP / ICAP Select) is now dead.

Purely in total return, not risk-adjusted return, terms:

Ariel / Ariel Focus - Focus wins the 3-year race, loses the 5-year

Marsico / Marsico Focus - Focus wins 3-year and 5-year

Oakmark / Oakmark Select - Select loses 3-year and 5-year

Yacktman / Yacktman Focused - virtual tie for 3-year and 5-year, with Focus trailing by 15 bps

My interim conclusion: concentration is not a reliable tool for adding alpha. Am I missing fund pairs or an insight?

T. Rowe debuts first tax-free municipal bond ETF T. Rowe Price debuts its first tax-free municipal bond ETF (TAXE)

BALTIMORE, July 10, 2024 /PRNewswire/ -- T. Rowe Price (NASDAQ-GS: TROW), a global investment management firm, announced today the addition of its first federally tax-free fixed income exchange-traded fund (ETF) to its active ETF roster. T. Rowe Price Intermediate Municipal Income ETF (Ticker: TAXE) began trading today on the NASDAQ exchange.

The Intermediate Municipal Income strategy focuses on investment-grade intermediate-term municipal bonds with a weighted average effective maturity of four to 12 years. T. Rowe Price Intermediate Municipal Income ETF is co-managed by James Lynch and Charlie Hill, who collectively have

53 years of investment experience, and have served in portfolio management roles for other T. Rowe Price intermediate-term municipal bond strategies. This ETF is a new strategy, the first of the firm's fixed income active ETFs that is distinct from existing T. Rowe Price mutual funds.

T. Rowe Price Intermediate Municipal Income ETF (Ticker: TAXE)

Seeks the highest level of income exempt from federal income taxes consistent with moderate price fluctuation

Net expense ratio is 0.24%

< - >

https://www.prnewswire.com/news-releases/t-rowe-price-launches-its-first-active-tax-free-bond-exchange-traded-fund-302193635.html

Earnings Recession over for the 493 Good news for the rest of the S&P index. It's free at Yahoo.

Dinky linky.

Details:

According to data from BofA's US equity strategy team, earnings for the S&P 493 haven't registered year-over-year growth since the fourth quarter of 2022.

[snip]

The upcoming second quarter earnings period, however, should mark the end of what's been a stealth earnings recession for the vast majority of companies in the S&P 500. For the 493 non-Mag 7 stocks, earnings growth is forecast to clock in at 6%, 7%, and 13% annually over the second, third, and fourth quarters of 2024.

Punchline:

Yet, as often happens in the investing world, this peak of frustration with a market environment that has come to resemble celebrity culture, in which just a few stars draw the headlines, appears set to crescendo. At which point stocks that comprise "anything else" will meet an investor community eager to think about just that.

I better check my seatbelt.