It looks like you're new here. If you want to get involved, click one of these buttons!

Thanks @msf, I am still digesting what you wrote. Wondering if RMDs could be worked into this "Capital Gains Year" strategy where by:I'm playing this game by bundling cap gains into some years and ordinary income into others.

A few techniques to bundle ordinary income

- Do Roth conversions in "ordinary income years".

- Buy short term (1 year or less) CDs/T-bills in "cap gains years" that mature in "ordinary income years"

- Invest in muni (MM, bond) funds in "cap gains years", and taxable (Treasury, corporate) funds in "ordinary income years"

A couple of techniques to bundle cap gains

- Accelerate recognition of gains (sell and repurchase if desired) in "cap gains years"

- Sell "around" annual distributions - avoid distributions of ordinary income (if any) and repurchase after record date (recognizes additional cap gains)

Depending on how much space you have in your 0% cap gains bracket, creating more cap gains may or may not work out for you. In any case, the added cap gains are state-taxable, so that should be kept in mind as well.

On the flip side, Roth conversions may be partially or fully state tax-exempt, depending on the state. That's motivation to convert some money even if it eats into the 0% cap gains bracket.

Note that the numbers presented in the graph are incorrect.

Cap gains: $47,025 (top of 0% bracket) + $14,600 (std ded.) = $61,625, not $63,475

Ordinary inc: $47,150 (top of 12% bracket) + $14,600 (std ded.) = $61,750, not $63,475

Note also that the cap gains bracket does not line up exactly with the ordinary income bracket (as given by the IRS). Close, but different.

It looks like the author may have been adding in the 2023 extra deduction ($1,850) for being over age 65 (or blind). That would make the cap gains figure come out to $63,475.

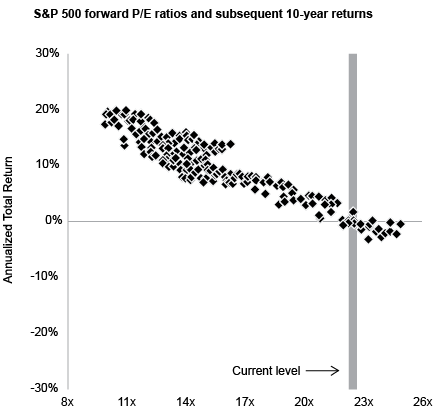

Gloomy details at the link.

A sell-off in global bond markets is accelerating, fueling concerns over government finances and raising the specter of higher borrowing costs for consumers and businesses around the world.

Thanks for your information Hank! Your comparisons are actually to those of "bee", which I quoted in my post to you above, but that is fine since this thread actually should link back to the OPs.”hank, are you willing to provide more personal details about your situation, so your opinions have some context?”

Which opinion? I’ll try to compare my situation to yours but not sure if that affects most of my opinions about investing or finance..

- “When I retired 13 years ago,”

I retired 25 years ago

- ”I attempted to project my future spending needs”

Ditto. I worked this out over the 2 or 3 years before retiring.

- “Over these years I have meet my spending needs with a combination of pension income (with a COLA), an Annuity Income (Savings that I converted to an Annuity), and some part time work.”

Pretty close. I have Social Security and a pension. While working I opted-in to a pension feature that adds 3% yearly of initial amount. Not really COLA - but helpful. The pension provides some supplemental health care coverage in combination with Medicare. I’m not as up-to-speed as I should be on the out-of-pocket expenses - but there are some. Never owned an annuity. No part time work. Active maintaining home infrastructure others might farm out.

- ”Since retirement, I have continue to contribute to my HSA and my IRA with contributions from part time work income. Recently I began managing one of my properties as a seasonal rental for additional income. I will work part time spending some of that work income and saving some into an IRA until age 73. My RMDs will then become a forced taxable event that may turn into an income source if needed or taxable savings if not needed."

Had a 403-B at work invested 100% in a global equities for 28 years. On retirement I converted it to a Traditional IRA and diversified the assets more broadly. In early ‘09 I converted about 40% to a Roth to take advantage of the crash. Made 2 smaller conversions over the next decade. 90% now in a Roth. RMDs alone from the Traditional are adequate to meet all my needs (along with SS & pension). The Roth provides a safety-net that might be needed for major infrastructure repair or other unexpected needs. I’m single and once-divorced. Own some nearby real estate that could be sold for additional cash. The home has a small fixed rate 3.13% mortgage (less than 20% of value) taken out for some renovation more than 5 years ago. Could pay it off, but think I can do better investing across a diversified portfolio consisting largely of OEFs, CEFs & ETFs.

Barron's, Vanguard Throws in the Towel on Its Managed Payout Fund, Feb 28, 2020Payout funds got their start during the 2007-2008 financial crisis when Vanguard and Fidelity both launched the products. The idea was appealing: Convert a retirement savings pool into a reliable income stream and offer investors peace of mind that they’d get a monthly paycheck, regardless of the market’s ups and downs.

...

Vanguard initially had three payout funds but merged them into one fund in January 2014. Fidelity developed a series of Income Replacement funds, paired with an optional monthly payout feature, but Fidelity rebranded the funds in 2017 as “Managed Retirement Income” with more of a high-income focus rather than managed payouts.

One hurdle: Managed payout funds have long had trouble hitting their income targets without dipping into capital—simply giving investors part of their money back. Annuities work similarly, though they have an insurance component that can keep the income flowing if the portfolio runs out of money.

What annuities do is pool risk. Some people die early, others later. Instead of each individual self insuring (collectively overinsuring), individuals pool their risk through an insurance company. This provides larger income streams safely.[U]sing a relatively simple model we estimate consumption could increase by approximately 80% for retirees if assets were converted to lifetime income streams, where the improvement rates are significantly higher for joint households

The Mechanics and Regulation of Variable Payout Annuities (50 pages. TL;DR)Variable payout annuities provide protection against longevity risk and allow for some participation in the higher (but more volatile) returns of corporate equities and other real assets. They also avoid the annuitization risk because their benefit payments vary with investment performance and are not fully determined by the prevailing conditions at the time of retirement. But VPAs are exposed to investment and inflation risks ...

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla