When Bubbles Burst: China Edition

Posted on July 8, 201

5 by David Ott

Acropolis Investment Management

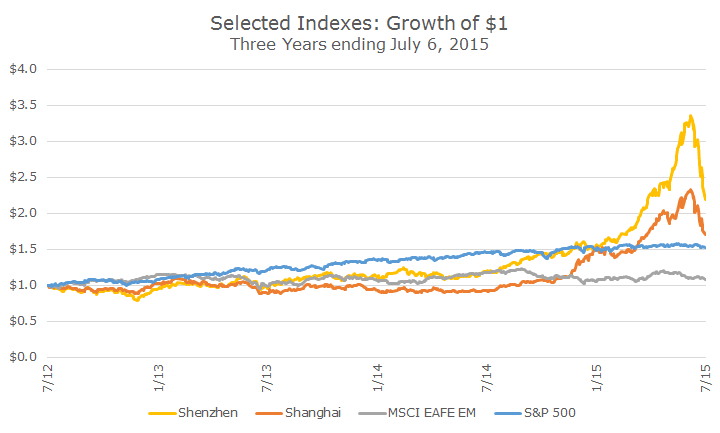

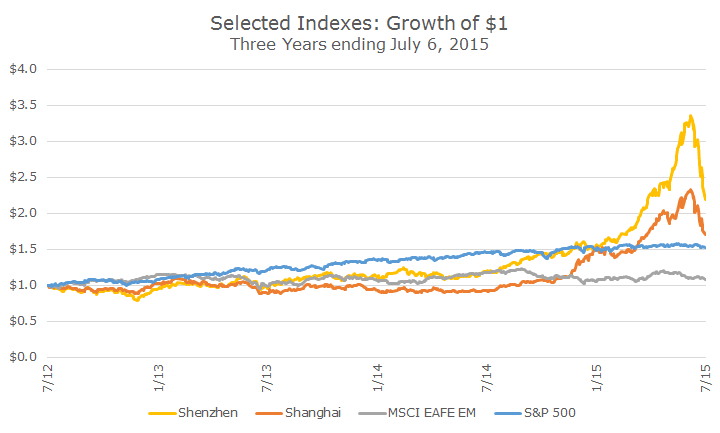

You may be looking at the largely flat emerging markets returns in that chart, feeling nervous about Greece and China and wondering whether you should have emerging markets exposure at all. I completely understand the question and have two answers that I’ll bet you can anticipate.

First, having two assets that you expect to earn positive rates of return over long periods that don’t move in lockstep with each other is a huge benefit to a portfolio – it’s the basis for diversification. If all assets were correlated with each other, you couldn’t lower portfolio risk by having the two assets.

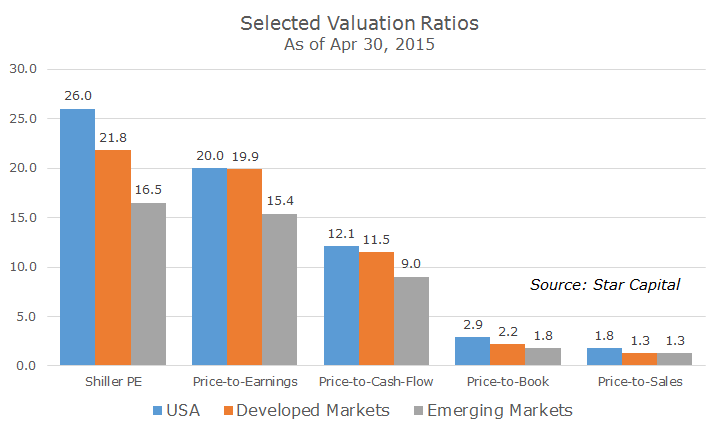

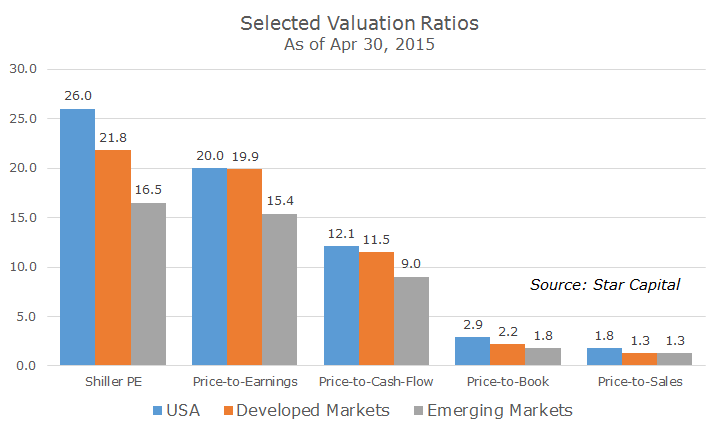

Second, the valuations overseas are much more attractive than they are in the US (and if you put a positive spin on the recent declines, you can say that they are getting more attractive every day).

One of the better (though highly imperfect) measures of valuation is the Shiller PE ratio, which looks at current prices compared to 10 years of earnings to remove some of the volatility in the ‘e’ part of the ratio.

The PE-ratio of the S&P

500 is currently around 26, which historically is very expensive. I wrote in February of 2014 that the market was overvalued on this basis and it’s more true today than it was then (which is why you don’t make big moves based on the Shiller PE ratio).

Whether you look at the Shiller PE or several other valuation metrics, you can see that emerging markets are the cheapest across the board. That doesn’t tell us anything about returns in the short run, but if the future is like the past, it should tell a lot about long-term future returns.

This entry was posted in Daily Insights

http://acrinv.com/when-bubbles-burst-china-edition/Round and round we go !

Managing Rate Hike Expectations Down… Again

If the US economy is still poised to grow, why are Treasury yields tumbling? Greece is probably the explanation. China’s sagging stock market isn’t helping either. The weakness in equities is unnerving investors in Asia and around the world at a time when global growth appears to be faltering. Markit Economics noted earlier this week in its global PMI report that growth in June weakened to its slowest pace in five months as output in emerging markets contracted.

Is the Fed likely to start raising rates in the current climate? Probably not, although we’ll know more after Sunday, when the new-world-post-ultimatum order for Europe emerges. Meantime, it’s risk-off for a world that’s forced to endure another phase of blowback that can be traced to the Great Recession… six years later, and counting. When the dust clears, it’s not unreasonable to imagine that we’ll be back where we started: modest growth and more than a few caveats.

That, of course, will lay the groundwork for a renewal in forecasting that a rate hike is just around the corner. http://www.capitalspectator.com/managing-rate-hike-expectations-down-again/

http://www.capitalspectator.com/managing-rate-hike-expectations-down-again/