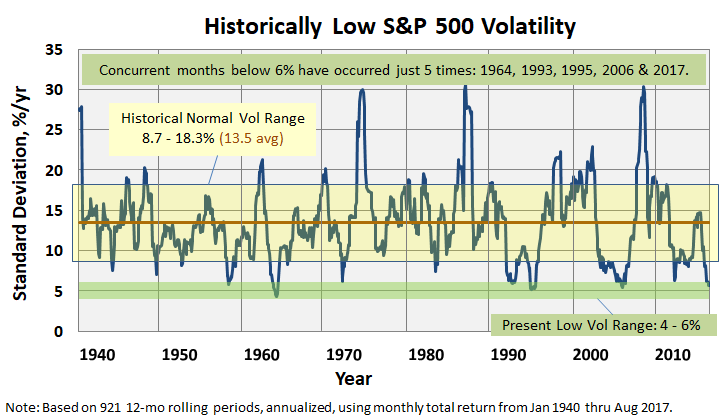

On Tuesday January 15th, we will host a webinar discussing latest features of the MFO Premium search tool site. This time we are fortunate to be joined by Brad Ferguson of Halter Ferguson Financial, a fee-only independent financial advisor based in Indianapolis. Brad will highlight the Ferguson analysis tool, one of the site’s newest features, which helps investors identify funds with equity-like returns but tempered volatility.

Other topics covered on the call will be Continue reading →