We’ve scheduled our year-end review webinar for Tuesday, 6 January at 9 am Pacific (noon Eastern). We will use MultiSearch Screens and other site tools to highlight performance of funds across different market segments, as described in our latest post A Good Year. Please join us by registering here.

Category Archives: Charles

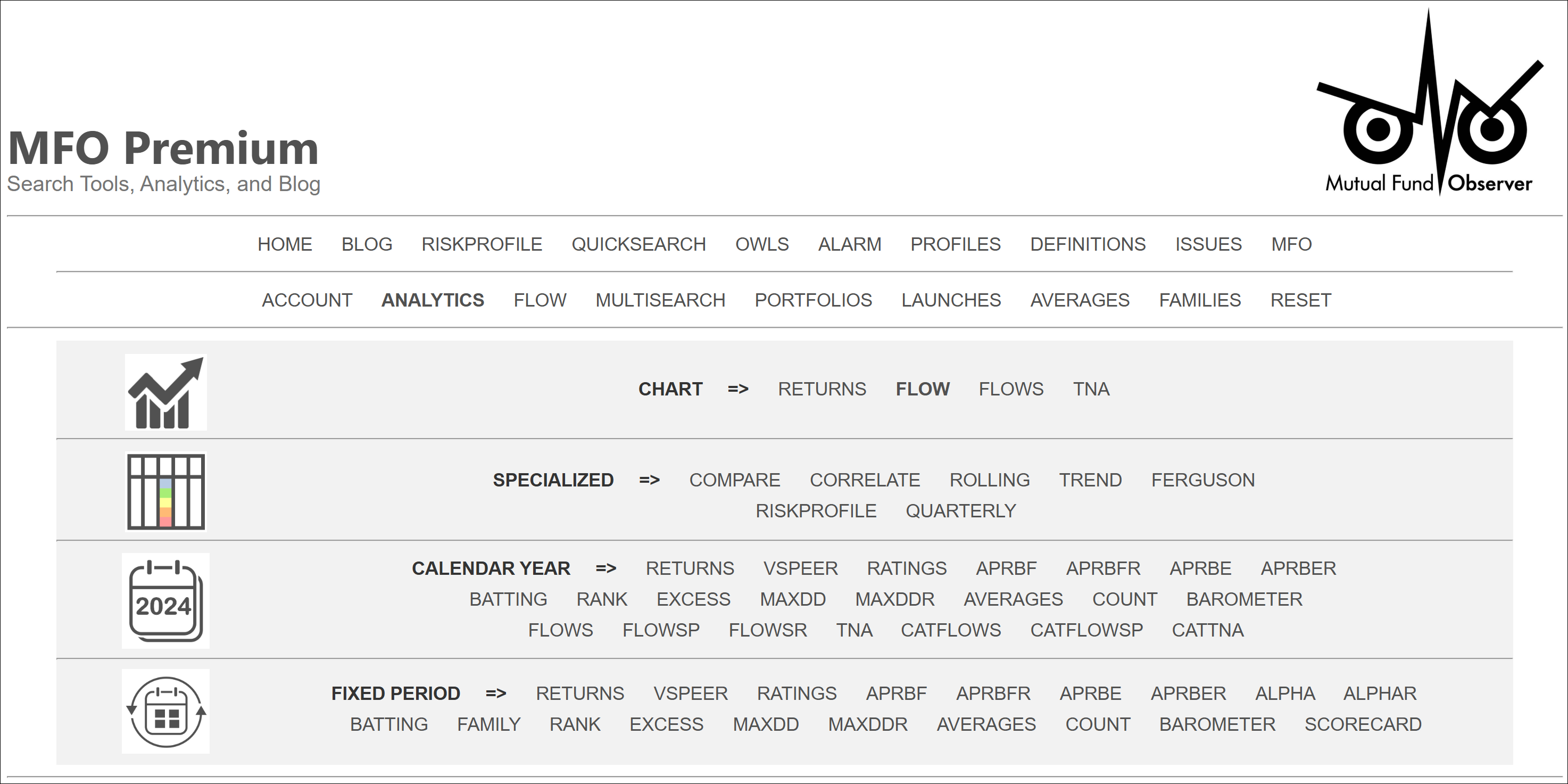

MFO Premium’s New Navigation Bar

The new Navigation Bar, which resides atop each page of our MFO Premium website, is depicted below. Continue reading →

TGN Bull Extends, Plus 2025 Mid-Year Review

Here are links to chart deck and video …

MFOP 2025 Mid-Year Review Chart Deck

MFOP 2025 Mid-Year Review Webinar Video

———–

We’ve scheduled our mid-year review webinar for Thursday (today), 3 July at 11 am Pacific (2pm Eastern). We will use MultiSearch ANALYTICS and PreSet Screens to highlight performance of funds across different market segments. Please join us by registering here.

A couple improvements Continue reading →

Daily FLOW Updates

This week we announced daily updates to our MFO Premium fund flow tool; specifically, FLOW, which combines four plots for a single fund: total return, total net assets (TNA, aka AUM), total net flows, and daily or monthly flows (depending on how reported), each versus same time period. On funds that Lipper updates daily, like SPY, TIBIX, and in fact for most funds (approx. 11,500 oldest share classes; 26,000 all share classes), this tool will now enable users to assess performance and flows through the Continue reading →

MFO Premium Year-End Review 2024

On Wednesday, 8 January, at 11 a.m. Pacific (2 p.m. Eastern), we will be conducting our year-end webinar to review funds and MFO Premium updates. If you can make it, please join us by registering here.

We will use MultiSearch Pre-Set screens and other custom criteria to review fund performance in 2024. MultiSeach is the site’s Continue reading →

You Too Can Start an ETF

At Tidal … The ETF Masters: Launch, Manage, and Grow Your ETF. We are an award-winning, full service ETF platform managing 183 ETFs in partnership with 68 issuers and responsible for $29bn+ AUM. Build Your ETF.

At ETF Architect … Want to easily create an ETF? Build, launch, and manage it with us. An Affordable, Turnkey, and Transparent White Label ETF Platform. Learn how we’ve helped innovative firms create new ETFs, convert separately managed accounts (SMAS), mutual funds, and hedge funds into ETFs, and tap the power of our platform to lower costs and streamline operations for existing ETFs. Create Your ETF. (Here’s an excellent presentation.)

MFO Premium Introduces Price-Based Metrics

A post on our Discussion Board recently called attention to two Closed End Funds: Barings Corporate Investors (MCI) and Barings Participation Investors (MPV).

MFO Premium Introduces Quarterly Metrics

Our friends and long-time MFO Premium subscribers at S & F Investment Advisors of Encino, CA asked recently if we could replicate metrics based on Lipper’s Global Data Feed that Barron’s stopped publishing; namely, Lipper Mutual Fund Investment Performance Averages – Specialized Quarterly Summary Report.

MFO Premium Introduces ETF Benchmarks

Our colleague Devesh Shah encouraged the incorporation of ETF Benchmarks into MFO Premium. Traditional benchmarks cannot be purchased. Similarly, category averages, which are the basis for much of the ratings on MFO Premium, also cannot be purchased. Establishing an ETF “benchmark,” Devesh argues, makes for a more relevant and practical comparison.

Furthermore, the Continue reading →

Morningstar Celebrates 40th Year – MICUS Chicago 2024

Morningstar held its annual investment conference [Morningstar Investment Conference US (MICUS) 2024] last week in Chicago, on 26 and 27 June. It employed a new venue and conference schedule: The Navy Pier and a chock-full, two-day agenda. The 292-foot-wide Pier, which opened originally in 1916, and was “built by the city for the people, is the largest in the world, projecting east 3,040 feet into Lake Michigan. It remains the longest public pier in the world today.”

The occasion also Continue reading →

MFO Premium Mid-Year Review 2024

On Wednesday, 10 July, at 11 a.m. Pacific (2 p.m. Eastern), we will be conducting our mid-year webinar to review funds and MFO Premium. If you can make it, please join us by registering here.

We will use MultiSearch Pre-Set screens and other custom criteria to review fund performance in 2024. MultiSeach is the site’s Continue reading →

December Brings S&P 500 To All-Time High

All fund risk and return metrics, ratings, and analytics were uploaded to MFO Premium Saturday, 30 December, reflecting performance through year-end. We used Refinitiv’s Friday data drop, which was last business day of year, to get an early peek at 2023 calendar year performance.

December is the second full year of The Great Normalization (TGN) market cycle. It also marks the 15th month of this market’s bull run and brings the Continue reading →

@MFOPremium Channel Demos Enhanced Chart Tool, Plus Fund Flows Preview

We rolled-out our interactive Total Return Chart Tool last year, as described in Introducing MFO Charts. Recently, we integrated several new features, including enhanced styling, eliminated display restriction (previously based on youngest fund), and added a legend placement option. Here’s a Continue reading →

Strong June Propels New Bull Market

Despite pervasive skepticism based on: Russian invasion. China US tension. Inflation. Rising rates. Bank collapses. Default fears. The S&P 500 has been climbing generally for 9 months. Axios describes this year’s market as “climbing a wall of worry.”

A strong June of 6.6% return propelled the index to 26% over its October low, which qualifies the advance as a new bull market. Continue reading →

Attendance Required – MICUS Chicago 2023

Morningstar held its annual investment conference [Morningstar Investment Conference US (MICUS) 2023] this past week beginning 24 April in Chicago, where tulip gardens bloomed on the city’s walkways.  Continue reading →

Morningstar held its annual investment conference [Morningstar Investment Conference US (MICUS) 2023] this past week beginning 24 April in Chicago, where tulip gardens bloomed on the city’s walkways.  Continue reading →

New Payment Portal for MFO Premium

This past week we upgraded our payment portal on MFO Premium from PayPal Standard to PayPal Commerce Platform. We’re hopeful the new portal will make subscribing and resubscribing easier and safer.

We introduced MFO’s Rating System nearly 10 years ago, which included metrics that we found difficult to obtain at the time, like Continue reading →

MFO Premium Webinar, 2022 Year End Review

On Friday, 6 January, we will be conducting our year-end webinar to review funds and MFO Premium. If you can make it, please join us by registering here. There will be just one session this year: 9 a.m. Pacific (noon Eastern).

We will use MultiSearch Pre-Set screens and other custom criteria to review fund performance in 2022. MultiSeach is the site’s main tool, enabling searches with numerous screening criteria. We will also demo some of the many features across the site.

MFO Premium includes the Continue reading →

Worst Year Ever

All fund risk and return metrics, ratings, and analytics were uploaded to MFO Premium today, 31 October, Halloween 2022. We used Lipper’s Friday data drop to get an early peek … and today markets seemed tame enough, so numbers should be pretty close to month’s end.

October was a decent one for equity funds, especially value. The Dow was up an extraordinary 14%. But still Continue reading →

Happy Preferencing!

All fund risk and return metrics, ratings, and analytics were uploaded to MFO Premium Sunday, 31 July, reflecting performance through July 2022.

When we run the monthly update that close to the last business day, we will normally re-run the ratings the following Saturday to pick up any late reporting funds. This past month that version was uploaded Sunday, 7 August. We also uploaded Continue reading →

The 100 Club?

In our April 2021 commentary, David highlighted: “The Total Stock Market Index is up 62% in the past 12 months. 291 funds (and uncounted ETFs) have 12-month returns in excess of 100% …” By the end of the bull run in December, that number had grown to 730 mutual funds and 1102, including ETFs. The S&P 500 ended up 90%.

If we examine just US & Global Equity funds and ETFs but exclude trading (e.g., leveraged) and sector funds, The 100 Club tallied 705 or more than a quarter of the 3000 products available in the US. Continue reading →