Dear friends,

It’s been that kind of month. Oh so very much that kind of month. In addition to teaching four classes and cheering Will on through 11 baseball games, I’ve spent much of the past six weeks buying a new (smaller, older but immaculate) house and beginning to set up a new household. It was a surprisingly draining experience, physically, psychologically and mentally. Happily I had the guidance and support of family and friends throughout, and I celebrated the end of April with 26 signatures, eight sets of initials, two attorneys, one large and one moderately-large check, and the arrival of a new set of keys and a new garage door clicker. All of which slightly derailed my focus on the world of funds. Fortunately the indefatigable Charles came to the rescue with …

It’s been that kind of month. Oh so very much that kind of month. In addition to teaching four classes and cheering Will on through 11 baseball games, I’ve spent much of the past six weeks buying a new (smaller, older but immaculate) house and beginning to set up a new household. It was a surprisingly draining experience, physically, psychologically and mentally. Happily I had the guidance and support of family and friends throughout, and I celebrated the end of April with 26 signatures, eight sets of initials, two attorneys, one large and one moderately-large check, and the arrival of a new set of keys and a new garage door clicker. All of which slightly derailed my focus on the world of funds. Fortunately the indefatigable Charles came to the rescue with …

The Existential Pleasures of Engineering Beta

He is a student of financial markets, investor behavior, trend-following, and market bubbles. He pursues absolute return, value, and momentum strategies. And, he likes companies that deliver cash to shareholders.

He recognizes alpha is elusive, so instead focuses on engineering beta, which promises a more pragmatic and enduring reward.

In a field full of business majors and MBAs, he holds degrees in engineering and biology.

He distills a wealth of financial literature, research, and conditions into concise and actionable investing advice, shared through books, his blog, and lectures.

Given low-cost ETFs and mutual funds available today, he thinks people generally should no longer need to hire advisors, or “brokers back in the day,” at 1-2% fees to tell them how to allocate buy-and-hold portfolios. “It kind of borderlines on criminal,” he tells Michael Covel in a recent interview, since such advisors “do not do enough to justify their fees.”

He is a portfolio manager and CIO of Cambria Investment Management, L.P., which he co-founded along with Eric Richardson in 2006. It is located in El Segundo, CA.

His down-to-earth demeanor is at once confident and refreshingly approachable. He cites philosopher Henry David Thoreau: “There is no more fatal blunderer than he who consumes the greater part of his life getting his living.”

The Paper. Mebane (pronounced “meb-inn”) started his career as biotech equity analyst during the genome revolution and internet bubble. While at University of Virginia, he attended an advanced seminar in security analysis taught by the renowned hedge fund manager John Griffin of Blue Ridge Capital. In fulfillment of the Chartered Market Technician program, Mebane drafted a paper that became the basis for “A Quantitative Approach To Tactical Asset Allocation,” published in the Journal of Wealth Management in 2007.

The paper originally included the words “market timing,” but he soon discovered that to a lot of people, the phrase comes with “enormous emotional baggage” and “can immediately shut-down all synapses in their brains.” Similar to Ed Thorp’s experience with his first academic paper on winning at blackjack, Mebane had to change the title to get it published. (It continues to stimulate synapses, as discussed in David’s July 2013 commentary, “Timing Method Performance Over Ten Decades” and periodically on the MFO discussion board.)

He attributes the paper’s ultimate popularity to 1) its simple presentation and explanation of the compelling results, and 2) the fortuitous timing of the publication itself – just before the financial meltdown of 2008/9. Practitioners of the method during that period were rewarded with a maximum drawdown of only -2% through versus -51% for the S&P 500.

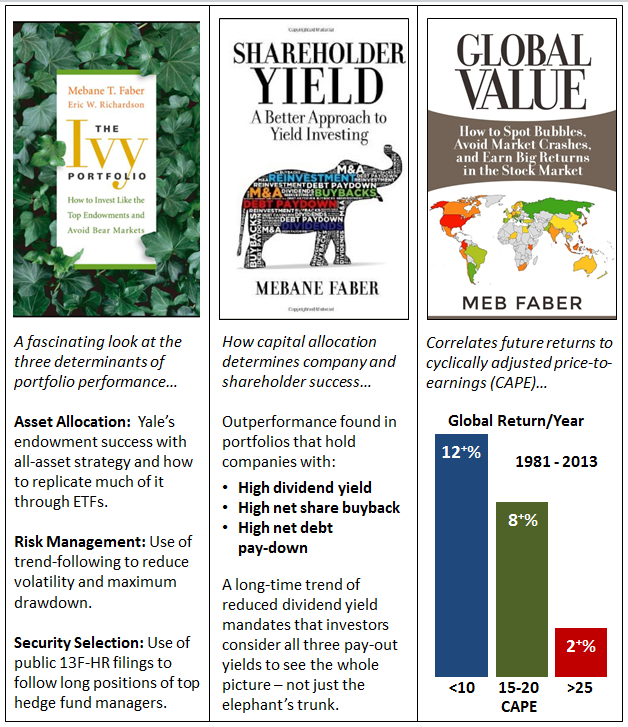

The Books. There are three. All insightful, concise, and well-received:

- The first published by Wiley in 2009, entitled “The Ivy Portfolio: How to Invest Like the Top Endowments and Avoid Bear Markets.”

- The second, self-published in 2013, entitled “Shareholder Yield: A Better Approach to Dividend Investing.”

- The third, also self-published and just released, “Global Value: How to Spot Bubbles, Avoid Market Crashes, and Earn Big Returns in the Stock Market.”

As summarized above, each contains straight-forward strategies that investors can follow on their own using publically available information. That said, each also forms the basis of ETFs launched by Cambria Investment Management.

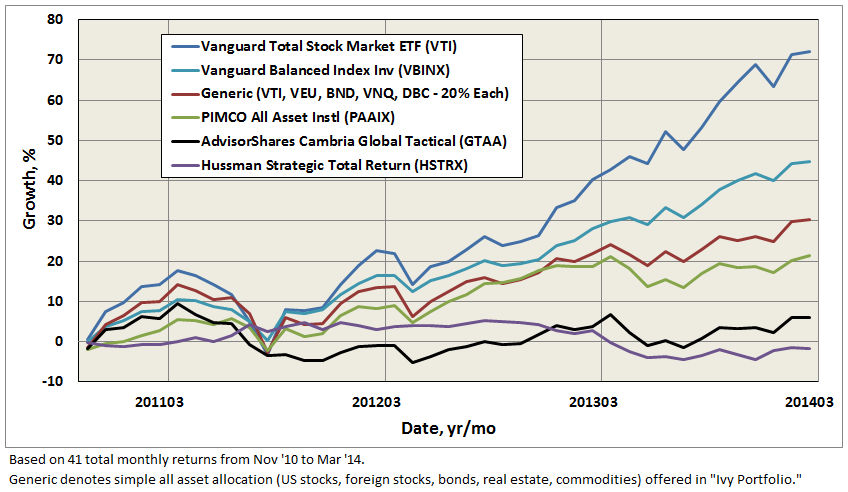

The First Fund. Last December, Mebane tweeted “Diversification was deworseification in 2013.” To understand what he meant, just compare US stock return against just about all other asset classes – it trounced them. Several all-asset strategies have underperformed during the current bull market, as seen in the comparison below, including AdvisorShares Cambria Global Tactical ETF Fund (GTAA). GTAA was Cambria’s first ETF, launched in November 2010, as a sub-advisor through ETF house AdvisorShares, and based on the strategy outlined in “The Ivy Portfolio.”

If it helps, Mebane is in good company. Rob Arnott’s all asset and John Hussman’s total return strategies have not received much love lately either. In fact, since GTAA’s inception, the “generic” all-asset allocation of US stocks, foreign stocks, bonds, REITs, and broad commodities has underperformed US equity index by 40% and traditional 60/40 balanced index by 15%.

GTAA’s actual portfolio currently shows more than 50 holdings, virtually all ETFs. Looking back, the fund has held substantial cash at times, approaching 40% in mid-2013…”assuming a defensive posture and utilizing cash as an alternative to its long positions.”

Market volatility has likely hurt GTAA as well. Its timing strategy, shown to thrive in trending markets, can struggle with short-term gyrations, which have been present in commodity, foreign equity, and real estate markets during this time. Finally, AdvisorShares’ high expense ratio, even after waivers, only adds to the headwind. At the 3.5-year mark, GTAA remains at $36M assets under management (AUM).

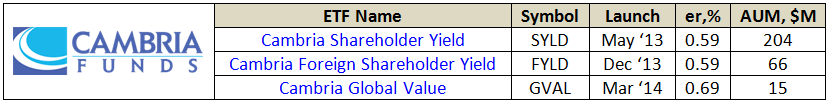

The New Funds. Cambria has since launched three other ETFs, based on the strategies outlined in Mebane’s two new books, but this time the funds were kept in-house to have “control over the process and charge reasonable fees.” Each fund invests in some 100 companies with capitalizations over $200M. And, each has quickly attracted AUM, rather remarkably given the proliferation of ETFs today. They are:

GVAL is the newest and actually tracks to a Cambria-developed index, maintained daily. It focuses on companies that trade 1) below their assessed intrinsic value, and 2) in countries with the most undervalued markets determined by parameters like CAPE, as depicted in earlier figure. These days, Mebane believes that means outside the US. “We certainly don’t think the [US] market is in a bubble, rather, valuations will be a headwind. There are much better opportunities abroad.”

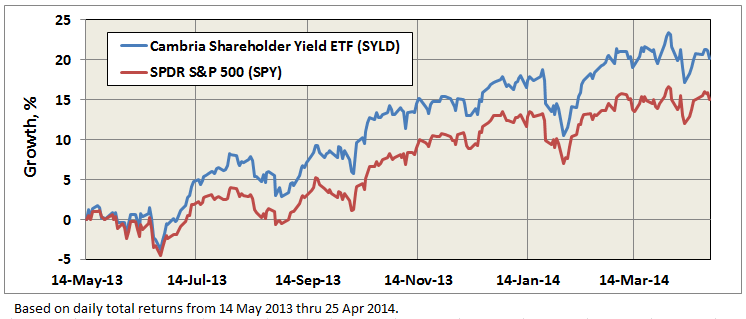

SYLD is actively managed and focuses primarily on US companies that exhibit strong characteristics of returning free cash flow to their shareholders; specifically, “shareholder yield,” which comprises dividend payments, share buybacks, and debt pay-down. FYLD seeks the same types of companies, but in developed foreign countries and it passively tracks to Cambria’s FYLD index.

Mebane believes that these are the first ETFs to incorporate the shareholder yield strategy. And, based on their reception in the crowded ETF market, he seems pretty pleased: “I certainly think alpha is possible…lots of jargon across smart beta, alpha, etc., but beating a market cap index is a great first step.” Morningstar’s Samuel Lee noted them among best new ETFs of 2013. Approaching its first year, SYLD is certainly off to a strong start:

Interestingly, none of these three ETFs employ explicit draw-down control or trend-following, like GTAA, although GVAL does “start moving to cash if markets don’t pass an absolute valuation filter … no sense in buying what is cheapest when everything is expensive,” Mebane explains. SYLD too has the discretion to take the entire portfolio to “Temporary Defensive Positions.”

When asked if his approach to risk management is changing, given the incorporation of more traditional strategies, he asserts that he’s “still a firm believer in trend-following and future funds will have trend components.” (Other funds in pipeline at Cambria include Global Momentum ETF and Value and Momentum ETF).

Mebane remains one of the largest shareholders on record among the portfolio managers at AdvisorShares. His overall skin-in-the-game? “100% of my investable net worth is in our funds and strategies.”

The Blog. mebfaber.com (aka “World Beta”) started in November 2006. It is a pleasant blend of perspective, opinion, results from his and other’s research – quantitative and factual, images, and references. He shares generously on both personal and professional levels, like in the recent posts “My Investing Mentor” and “How to Start an ETF.”

There is a great reading list and blogroll. There are sources for data, references, and research papers. It’s free, with occasional plugs, but no annoying pop-ups. For the more serious investors, fund managers, and institutions, he offers a premium subscription to “The Idea Farm.”

He once wrote actively for SeekingAlpha, but stopped in 2010, explaining: “I find the quality control of the site is poor, and the respect for authors to be low. Also, [it] becomes a compliance risk and headache.”

He strikes me as having the enviable ability to absorb enormous about of information, from past lessons to today’s water-hose of publications, blogs, tweets, and op-eds, then distill it all down to chart a way forward. Asked whether this comes naturally or does he use a process, he laughs: “I would say it comes unnaturally and painfully!”

29Apr14/Charles

It Costs How Much?

by Edward Studzinski

A democracy is a government in the hands of men of low birth, no property, and vulgar entitlements.

Aristotle

One of the responses I received to last month’s diatribe about mutual fund fees was that the average mutual fund investor did not object to them because they were unseen. They painlessly and invisibly disappeared every quarter. The person who pointed this out noted that lawyers charged a bill for services rendered, as did accountants. Why then, should not a quarterly mutual fund statement show the gross amount invested at the beginning of the period, the investment appreciation or depreciation, and then the deduction of fees to arrive at a net amount invested at the end of the period ? Not a bad idea. But one that has been resisted (or gutted) at every turn by the industry and one that the regulators have never felt strongly enough to move forward on.

But do clients truly understand what they are giving up or what they are actually paying? Charlie Ellis, in an article in the current issue of the Financial Analysts Journal would argue that they do not. He goes on to make the case that the enormity of the fees as a percentage makes the 2% and 20% that many hedge funds charge seem reasonable in comparison. His rationale is thus. Assume an S&P 500 Index Fund achieves in a year a total return of 36% and charges investment management fees of 5 basis points (0.05%). Assume your other investment is Mick the Bookie’s Select Investment Fund which had a total return of 41% over the same period and charges 85 basis points (0.85%). Your incremental return is 500 basis points (5%) for which you paid an extra 80 basis points (0.80%). Ellis would argue, and I believe correctly so, that your incremental fee for achieving that excess return was SIXTEEN PER CENT. And don’t forget that the money that went into the account to begin with was already your money that you had earned.

So, one question that I hear coming is – the outside trustees or directors have to approve fees annually and they wouldn’t do it if it was not fair and reasonable, especially given the returns. Answer #1 – eighty per cent of the time the active manager does not beat the benchmark and achieve an excess return. Answer #2 – the 20% of the time when the active manager beats the return, it is not on a sustainable basis, but rather almost random. Answer #3 – rarely does the investor actually get a benchmark beating return because he or she moves their investments too frequently to even achieve the performance numbers advertised by the investment management firm. Answer #4 – all too rarely do the outside trustees or directors have an aligned vested interest in the fee question (a) because in most instances they have at best a de minimis investment in the fund or funds that they are overseeing and (b) oddly enough the outside trustees or directors often have more of a vested interest in the success of the investment management company. Growth and profitability there will lead to increases in their fees.

So you say, I must be getting something of value for the incremental fees at those times when the investment returns don’t justify the added expense? Well, sadly, if recent history is any guide, the kinds of things you have gotten for such excess incremental fees include things like vicarious interests in yachts and sports cars; race horses in Lexington, Kentucky; and multiple homes and pent houses on the lake front in the greater Chicago area. I could go on and on in a similar vein. Rather than outperforming benchmarks or making money for investors, the primary goal has morphed to the creation and accumulation of substantial personal wealth, often to the tune of hundreds of millions of dollars.

To paraphrase Don Corleone in that scene in New York City where he says to the heads of the Five Families, “How did we let things go so far?” I don’t have a good answer for that. I suspect that the painlessness of fee extraction explains part of it. Having had the present administration in Washington serving in the role of defender of Middle Class America, one has to wonder why they have allowed the savings and investments of the Middle Class to effectively be clipped by dollars and cents every month. What has happened is one of the great hidden wealth transfers in our society, similar to what happens when hackers get into a bank computer and start skimming fractions of cents from millions of transactions. It is not solely the administration’s fault however, as neither the regulators nor the courts have wanted to clean up the fee mess. Everyone really wants to believe that there is a Santa Claus, or more appropriately, a Horatio Alger ending to the story.

One might hope that financial publications such as Morningstar, would through their media outlets as well as their conferences, address the subject of fees and their excessive nature. Certainly when they first started with their primary conference at the Grand Hyatt at Illinois Center in Chicago, there was a decided tilt to the content and substance that favored and indeed championed the small investor. However, since then in terms of content the current big Morningstar conference here has taken on more of an industry tilt or bias.

Why do I keep harping on this subject? For this reason – mutual fund investors cannot negotiate their own fees. Institutional investors can, and corporate and endowment investors do just that, every day. And often, their fee agreements with the investment manager will have a “most favored nation” clause, which means if someone else in the institutional world with a similar amount of assets negotiates a lower fee agreement with that investment firm the existing clients get the benefit of it. If you sit in enough presentations from fund managers, it becomes obvious that, public industry statements notwithstanding, in many instances the mutual fund business (and the small investor) is being used as the cash cow that subsidizes the institutional business.

Remember, expenses matter as they lessen the compounding ability of your investment. That in turn keeps the investment from growing as much as it should have over a period of time. With interest rates and tax rates where they are, it is hard enough to compound at a required rate to meet future accumulation targets without having even further degradation occur from the impact of high fees. Rule Number One of investing is “Don’t lose money” and Rule Number Two is “Don’t forget Rule Number One.” However, Rule Number Three is “Keep the expenses low to maximize the compounding effect.”

From Russia, with Love

While journalist Brett Arends bravely offered to explain “Why I’m going to invest in the Russian stock market” – roughly, Russian stocks are cheap and Putin couldn’t be that crazy, right? – a whole series of Russia-oriented funds have amended their statements of principal risks to include potential financial warfare:

SSgA Emerging Markets (SSEMX)

In response to recent political and military actions undertaken by Russia, the United States and European Union have instituted numerous sanctions against certain Russian officials and Bank Rossiya. These sanctions, and other intergovernmental actions that may be undertaken against Russia in the future, may result in the devaluation of Russian currency, a downgrade in the country’s credit rating, and a decline in the value and liquidity of Russian stocks. These sanctions could result in the immediate freeze of Russian securities, impairing the ability of the Fund to buy, sell, receive or deliver those securities. Retaliatory action by the Russian government could involve the seizure of U.S. and/or European residents’ assets and any such actions are likely to impair the value and liquidity of such assets. Any or all of these potential results could push Russia’s economy into a recession. These sanctions, and the continued disruption of the Russian economy, could have a negative effect on the performance of funds that have significant exposure to Russia, including the Fund.

SPDR BofA Merrill Lynch Emerging Markets Corporate Bond ETF (EMCD) uses the same language, apparently someone was sharing drafts.

iShares MSCI Russia Capped ETF (ERUS) posits similar concerns:

The United States and the European Union have imposed economic sanctions on certain Russian individuals and a financial institution. The United States or the European Union could also institute broader sanctions on Russia. These sanctions, or even the threat of further sanctions, may result in the decline of the value and liquidity of Russian securities, a weakening of the ruble or other adverse consequences to the Russian economy. These sanctions could also result in the immediate freeze of Russian securities, impairing the ability of the Fund to buy, sell, receive or deliver those securities. Sanctions could also result in Russia taking counter measures or retaliatory actions which may further impair the value and liquidity of Russian securities.

ING Russia Fund (LETRX) adds the prospect that they might not be able to honor redemption requests:

… the sanctions may require the Fund to freeze its existing investments in Russian companies, prohibiting the Fund from selling or otherwise transacting in these investments. This could impact the Fund’s ability to sell securities or other financial instruments as needed to meet shareholder redemptions. The Fund could seek to suspend redemptions in the event that an emergency exists in which it is not reasonably practicable for the Fund to dispose of its securities or to determine the value of its net assets.

I’ve continued my regular investments in two diversified emerging markets funds whose managers have earned my trust: Andrew Foster at Seafarer Overseas Growth & Income (SFGIX) and Robert Gardiner at Grandeur Peak Emerging Markets Opportunities (GPEOX). I don’t think I have nearly the expertise needed to run toward that particular fire, nor to know when it’s gotten too hot. I wish Mr. Arends well, but would advise others to consider finding a manager whose experience and judgment is tested and true.

Here’s my rule of thumb: Avoid rules of thumb at all costs

The folks on our discussion board have posted links to two “rule of thumb” articles about investing. Just a quick word on why they’re horrifying.

Rule One: You need to invest $82.28 a day!

The story comes from USA Today, by way of Lifehacker. “Want to live well in old age? You’d better get cracking: $82.28 a day to be exact.”

That’s $29,000 a year. Cool! That’s just $1000 more than the average per capita income in the US! In fairness, though, it’s just 54% of the median family income: $53,046. So here’s the advice: if you’re living paycheck-to-paycheck, remember to set aside 54% of your income. BankRate.com, by the way, advises you to invest 10%. Why 10%? Presumably because it’s a nice round number.

Rule Two: Your age should be your bond allocation!

More of the same: where to put it? Your bond allocation should be equal to your age, which Lifehacker shares from Bankrate.com. But why is this a good rule of thumb? Like “remember to drink eight glasses of water each day,” it’s catchy and memorable but I’ve seen no research that validates it.

Forbes magazine places it #1 on its list of “10 Terrible Pieces of Investment Advice.” Fund companies flatly reject it in their own retirement planning products. The target-date 2030 funds are designed for folks about 50; that is, people who might retire in 15 years or so. If this advice were sound, some or all of those funds would have 50% in bonds. They don’t. T. Rowe Price Retirement 2030 is 16% bonds, American Funds is 10%, Fidelity is 12%, TIAA-CREF is 21% and Vanguard 20%. JPMorgan (23%) and BlackRock (30-33%) seem to represent the high end.

Especially at the end of a three decade bull market in bonds, we owe it to ourselves and our readers to be particularly thoughtful about quick ‘n’ easy advice.

I’m sorry, they paid Gabelli what?

The folks are MFWire did a nice, nearly snarky story on The Mario’s most recent payday. (I’m Sorry, They Paid Gabelli What?). I’ll share the intro and suggest that you read one of the two linked stories:

The folks are MFWire did a nice, nearly snarky story on The Mario’s most recent payday. (I’m Sorry, They Paid Gabelli What?). I’ll share the intro and suggest that you read one of the two linked stories:

Mario Gabelli made $85 million in salary in 2013.

That’s one eighth the global domestic product of Somoa.

According to USA Today, the GAMCO founder, chief executive and investment officer was paid not only $85 million last year, but his three-year total compensation came to over $215 million.

No wonder he looks like that.

Morningstar Goes on Autopilot

On April 23rd, Morningstar’s Five-Star Investor feature trumpeted “9 Core Funds That Beat the Market,” which they might reasonably have subtitled “Small funds need not apply.”

Morningstar highlights nine funds in the article, with assets up to $101 billion. Those are drawn from a list of 28 that made the cut. Of those 28, one has under a billion in assets.

The key to making the cut: Morningstar must designate it a “core” fund, a category for which there are no hard-and-fast rules. They’re generally large cap and generally diversified, but also fairly large. There’s only one free-standing fund with under $250 million in assets that they think of as “core.”

There are a lot of “core” funds under $250 million but that occurs only when they’re part of a target-date suite: Fidelity Retirement 2090 might have only $12 in it but it becomes “core” because the whole Fido series is core.

Morningstar’s implied judgments (“we don’t trust anyone over 30 or with under a billion in assets”) might be fair, but would be fairer if more explicit.

They followed that up with a list of 4 Medalist Ideas for Long-Short Strategies.”Some of the funds we like in this area are Robeco Boston Partners Long/Short Equity, Robeco Boston Partners Research Fund, MainStay Marketfield, and Wasatch Long/Short.”

I’d describe those as Long-Closed, Recently-Closed, Bloated (they had $1 billion three years ago and $21 billion today; trailing 12 month performance is exactly mediocre which might be a blip or might be the effects of the $11 billion they picked up last year) and Very Solid, respectively.

Russel Kinnel finished the month by asking “How Bloated is your Fund?” He calculates a “bloat ratio” which “tries to find out how much a fund trades and how liquid its holdings are. It multiplies turnover by the average day’s trading volume of a fund’s holdings (asset-weighted).” At base, Russel’s assumption is that the only cost of bloat is a loss of the ability to trade quickly in and out of stocks.

With due respect, that seems silly. As assets grow, fund managers necessarily target the sorts of stocks that they can trade and begin avoiding the ones that they can’t. If your fund’s size constrains you to invest mostly in stocks worth $10 billion or more (the upper end of the mid-cap range), your investable universe is just 420 stocks. You may trade those 420 effectively, but you’re not longer capable of benefiting from the 6360 stocks at below $10 billion.

Observer Fund Profiles:

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

Martin Focused Value (MFVRX): it’s easy for us to get stodgy as we age; to become sure that whatever we did back then is quite exactly what we should be doing today. Frank Martin, who has been doing this stuff for 40 years, could certainly be excused if he did stick with the tried and true. But he hasn’t. There’s clear evidence that this absolute value equity investor has been grappling with new ideas and new evidence, and they’ve led him to construct his portfolio around the notion of “an antifragile dumbbell” (with insights credited to Nassim Talib). His argument, as much as his fund, are worth your attention.

Conference Call Upcoming

We’re toying with the possibility of talking with Dr. Ian Mortimer (Oxford, no less) and Matt Page of Guinness Atkinson Global Innovators (IWIRX), which targets investments in firms that are demonstrably engaged in creative thinking and are demonstrably beginning from it. They appear to be the single best performer in Lipper’s global growth category and we know from our work on Guinness Atkinson Inflation-Managed Dividend (GAINX) that they’re awfully bright and articulate. Both of their funds have small asset bases, distinctive and rigorous disciplines and splendid performance. The hang-up is the time difference between here and London; our normal nighttime slot (7:00 Eastern) would be midnight for them. Hmmm … we’ll work on it.

Launch Alert

It says something regrettable about the industry that Morningstar reports 156 new funds since mid-March, of which 153 are new share classes of older funds, one is Artisan Global High Income (ARTFX) and two aren’t terribly interesting. We’ll keep looking… Found another worth noting, just launched 4/28: Whitebox Tactical Income (WBIVX/WBINX).

Funds in Registration

Funds currently in registration with the SEC will generally be available for purchase around the end of June, 2014. Our dauntless research associate David Welsch tracked down 17 new no-load funds in registration this month. There are several intriguing possibilities:

Catalyst added substantially to their collection of quirky funds (uhhh … Small Cap Insider Buying (CTVAX) might be a decent example) with the registration of five more funds, of which three (Catalyst Absolute Total Return, Catalyst/Stone Beach Income Opportunity and Catalyst/Groesbeck Aggressive Growth Funds) will be sub-advised by folks with strong documented performance records.

LSV GLOBAL Managed Volatility Fund will follow the recent vogue for investing in low-volatility stocks. The fund gains credibility from the pedigree of its managers (“L” is a particularly renowned academic who was one of the path-breaking researchers in behavioral finance) and by the strength of the other four LSV funds (all three of the rated funds have earned four stars, though tend toward high volatility).

North Star Bond Fund will invest primarily in the bonds, convertible securities and (potentially) equities issued by small cap companies. I’m not sure that I know of any other fund with that specialization. The management team includes North Star’s microcap and opportunistic equity managers. Their equity funds have had very solid performance in not-quite three years of operation (though I’m a bit puzzled by Morningstar’s assignment of the North Star Opportunity fund to the “aggressive allocation” category given its high stock exposure). In any case, this strikes me as an interesting idea and we’re apt to follow up in the months after launch.

All of the new registrants are available on the May Funds in Registration page.

Manager Changes

On a related note, we also tracked down 52 sets of fund manager changes. The most intriguing of those include the exit of Stephen and Samuel Lieber, Alpine Woods founders and Alpine Small Cap’s founding managers, from Alpine Small Cap (ADIAX) and Chuck McQuaid’s long-anticipated departure from Columbia Acorn (ACRNX).

Active share updates

“Active share” is a measure of the degree to which a fund’s portfolio differs from what’s in its benchmark index. Researchers have found that active share is an important predictor of a fund’s future performance. Highly active fund are more like to outperform their benchmarks than are index funds (which should never outperform the index itself) or “closet index” funds which charge for active management but really only play around the edges of an indexed portfolio.

In March, we began publishing a list of active share data for as many funds as we could. And the same time, we asked folks to share data for any funds that we’d missed. We’re maintaining a master list of all funds, which you can get to by clicking on our Resources tab:

Each month we try to update our list with new funds submitted by our readers. This month folks shared seven more data reports:

| Fund | Ticker | Active share | Benchmark | Stocks |

| LG Masters International | MSILX | 89.9 | MSCI EAFE | 90 |

| LG Masters Smaller Companies | MSSFX | 98.2 | Russell 2000 | 52 |

| LG Masters Equity | MSEFX | 84.2% | Russell 3000 | 85 |

| Third Avenue Value | TAVFX | 98.1 | MSCI World | 37 |

| Third Avenue International Value | TAVIX | 97.0 | MSCI World ex US | 34 |

| Third Avenue Small Cap Value | TASCX | 94.3 | Russell 2000 Value | 37 |

| Third Avenue Real Estate | TAREX | 91.1 | FTSE EPRA/NAREIT Developed | 31 |

Thanks to jlev, one of the members of the Observer’s discussion community and Mike P from Litman Gregory for sharing these leads with us. Couldn’t do it without you!

The return of Jonathan Clements

Jonathan Clements had an interesting valedictory column when he left The Wall Street Journal. He said he had about three messages for his readers and he’d repackaged them into 1008 columns: “Forget spending more money at the mall — and instead spend more time with friends. Your bank account may still be skimpy, but your life will be far, far richer.”

Apparently he’s found either a fourth message to share, or renewed passion for the first three, because he returned to the Journal in April. Oddly, his work appears only on Sundays and only online; he doesn’t even use a Dow Jones email address. When I asked him about the plan, he noted:

I didn’t want a fulltime position with the WSJ again, at least not at this juncture. The column gives a little variety to my week. But most of my time is currently devoted to a new personal-finance book. The book is a huge undertaking, and it wouldn’t be possible if I was fulltime at the WSJ.

He’s written several really solid columns (on the importance of saving even in a zero-interest environment and on the role of dividend funds in a retirement portfolio) and has a useful website that shares personal finance resources and works to dispel the rumor that he’s an accomplished writer of erotica. (Really.)

On whole, I’m glad he’s back.

MFO in the news!

Indeed

The English-language version of the article by Javier Espinosa, “Travel Guide: Do Acronyms Aid ‘Emerging’ Investing?” ran on April 7th but lacked the panache of the Malay version.

MFO on the road

For those of you interested in dropping by and saying “hi,” we’ll be present at a couple conferences this summer.

I’ve been asked to provide the keynote address at the Cohen Client Conference, August 20 – 21, 2014. The conference, in Milwaukee, is run by Cohen Fund Audit Services. This will be Cohen’s third annual client conference. Last year’s version, in Cleveland OH, drew about 100 clients from 23 states.

I’ve been asked to provide the keynote address at the Cohen Client Conference, August 20 – 21, 2014. The conference, in Milwaukee, is run by Cohen Fund Audit Services. This will be Cohen’s third annual client conference. Last year’s version, in Cleveland OH, drew about 100 clients from 23 states.

Cohen offers the conference as a way of helping fund professionals – directors, compliance officers, tax and accounting guys, operating officers and the occasional curious hedge fund manager –develop both professional competence and connections within the fund community. Which is to say, the Cohen folks promised that there would be both serious engagement – staff presentations, panels by industry experts, audience interaction – and opportunities for fellowshipping. (My first, unworthy impulse is to drive a bunch of compliance officers over to Horny Goat Brewing, buy a round or two, then get them to admit that they’re making stuff up as they go.)

Cohen offers the conference as a way of helping fund professionals – directors, compliance officers, tax and accounting guys, operating officers and the occasional curious hedge fund manager –develop both professional competence and connections within the fund community. Which is to say, the Cohen folks promised that there would be both serious engagement – staff presentations, panels by industry experts, audience interaction – and opportunities for fellowshipping. (My first, unworthy impulse is to drive a bunch of compliance officers over to Horny Goat Brewing, buy a round or two, then get them to admit that they’re making stuff up as they go.)

The good and serious folks at Cohen want to offer fund professionals help with fund operations, accounting, governance, tax, legal and compliance updates, and sales, marketing and distribution best practices.

And they want me to say something interesting and useful for 45 minutes or so. Hmmm … so here’s a request for assistance. Many of you folks work in the industry (I don’t) and all of you know the sorts of stuff I talk about. What do you think I could say that would most help someone trying to be a good fund trustee or operations professional? Drop me a line through this link, please!

For more information about the conference itself, you can contact

Chris Bellamy, 216-649-1701 or [email protected] or

Megan Howell, 216-774-1145 or [email protected].

They’d love to hear from you. So would I.

We’ll also spend three full days in and around the Morningstar Investment Conference, June 18 – 20, in Chicago. We try to divide our time there into thirds: interviewing fund managers and talking to fund reps, listening to presentations by famous guys, and building our network of connections by spending time with readers, friends and colleagues. If you’d like to connect with us somewhere in the bowels of McCormick Place, just let me know.

We’ll also spend three full days in and around the Morningstar Investment Conference, June 18 – 20, in Chicago. We try to divide our time there into thirds: interviewing fund managers and talking to fund reps, listening to presentations by famous guys, and building our network of connections by spending time with readers, friends and colleagues. If you’d like to connect with us somewhere in the bowels of McCormick Place, just let me know.

Briefly Noted . . .

Interesting developments in the neighborhood of Gator Focus Fund and Gator Opportunities Fund. At the end of February, Brad W. Olecki and Michael Parks resigned from their positions as Trustees of the Trust. No new Trustees have been appointed. On the same date Andres Sandate resigned from his position as President, Secretary and Treasurer of the Trust.

Do recall that, for reasons that continue to elude me, ING Funds have been rebranded as Voya Funds.

LS Opportunity Fund (LSOFX) just reclassified itself from “diversified” to “non-diversified.” It’s not clear why or what effect that will have on its 100 stock portfolio.

SMALL WINS FOR INVESTORS

IMS Capital Management is reorganizing three of its funds (IMS Capital Value,Strategic Income Fund, and Dividend Growth funds) into a new series of the 360 funds. I’m guessing they’ll be rebranded and the advisor is guessing that the reorganization will result in lower administration, fund accounting and transfer agency costs.” With luck, those savings will be passed along to investors.

Effective immediately, the Leader Total Return Fund (LCTRX) has discontinued the redemption fee.

Vanguard has decreased, generally by one basis point, the expense ratios on seven of its ETFs include Vanguard Total Bond Market ETF (BND), Vanguard FTSE Developed Markets ETF (VEA), Vanguard Value ETF (VTV), Vanguard Growth ETF (VUG), Vanguard Small-Cap ETF (VB) and a couple others

CLOSINGS (and related inconveniences)

First Eagle Overseas Fund (SGOVX) will close to new investors on May 9, 2014. Good fund but with $15 billion in AUM, its best days might be in the past.

Grandeur Peak Global Reach (GPROX) closed on April 30th. That closure was the subject of our first mid-month alert to readers, which we sent to 4800 of you about 10 days before the closure was effective. We heard back from four readers who said that the information was useful to them. My hope is that we didn’t overly annoy the other 99.9% of recipients.

On May 9, 2014, the Wasatch Frontier Emerging Small Countries Fund (WAFMX) will close to new investors. Wasatch avers that it “takes fund capacity very seriously. We monitor assets in each of our funds carefully and commit to shareholders to close funds before asset levels rise to a point that would alter our intended investment strategy.” At $1.2 billion with investments in Nigeria, Kuwait and Kenya, it seems like a prudent move for a fund with top decile returns. (Thanks to JimJ on the Observer’s discussion board for timely notice of the closing.)

OLD WINE, NEW BOTTLES

Bridgehampton Value Strategies Fund (BVSFX) is being rebranded as the Tocqueville Alternative Strategies Fund. Same management and a “substantially similar” strategy but lower expenses for investors. The change becomes effective on June 27, 2014. Looks like a pretty decent fund.

The Board of John Hancock Rainier Growth Fund decided to axe Rainier and hire Baillie Gifford to manage it. As of mid-April, it was rechristened as JHancock Select Growth Fund (RGROX).

Neuberger Berman Dynamic Real Return Fund (NDRAX) becomes Neuberger Berman Inflation Navigator Fund on June 2.

Hansberger International Growth Fund is being reorganized into the Madison Fund.

On June 2, 2014, Neuberger Berman International Select Fund changed its name from Neuberger Berman International Large Cap Fund. Two year record, slightly below-average returns and absolutely no investor interest.

Neuberger Berman Emerging Markets Income Fund’s name has changed to Neuberger Berman Emerging Markets Debt Fund.

Effective on May 1, 2014, Parnassus Equity Income Fund (PRBLX) became Parnassus Core Equity Fund while Parnassus Workplace Fund (PARWX) became Parnassus Endeavor. There were no changes to management, strategy or fees.

Effective December 29, 2014, the T. Rowe Price Retirement Income Fund (TRRIX) will change its name to the T. Rowe Price Retirement Balanced Fund. It’s a really solid fund but with 40% of its portfolio in equities, it’s probably not what most folks think of as a “retirement income” fund.

OFF TO THE DUSTBIN OF HISTORY

Ever wonder why it’s “The Dustbin of History”? It’s Leon Trotsky’s dismissal of the Menshevik revolutionaries, who he saw as failed agents: “You are pitiful, isolated individuals. You are bankrupts; your role is played out. Go where you belong from now on – in the dustbin of history!” It was in Russian, of course, so translations vary (occasional “the trash heap of history”) but the spirit is there.

CMG SR Tactical Bond Fund (CMGTX/CMGOX) liquidated on April 29, 2014. Nope, I’d never heard of it either.

The Board of Directors of Nomura Partners Funds approved the merger of The Japan Fund (NPJAX) into Matthews Japan (MJFOX), effective in late July, 2014. Japan Fund has sort of bounced from adviser to adviser over the years and is more the victim of Nomura’s decision to get out of the U.S. fund business than of crippling incompetence. The investors are getting a stronger fund with lower expenses, with the merger boosting MJFOX’s size by about 30%.

Morgan Stanley Institutional Total Emerging Markets Portfolio (MTEPX) will liquidate on May 30, 2014.

Principal intends to merge Principal Large Cap Value Fund I (PVUAX) into the Large Cap Value Fund III (PESAX). Shareholders are scheduled to rubbersta vote on the proposal at the end of May. Neither fund is particularly attractive, but the dying fund actually has the stronger record of the two.

On April 17, 2014, Turner’s Board of Trustees decided ed to close and liquidate the Turner Market Neutral Fund (TMNFX) on or about June 1, 2014. Three stars but also $3 million in assets. Sadly the performance was decent and steadily improving.

Vanguard continues with its surprising shakeup. It has decided to merge Vanguard Tax-Managed Growth and Income Fund (VTMIX) into Vanguard 500 Index Fund (VFISX) on about May 16, 2014. Why surprising? VTMIX has over $3 billion in assets, 0.08% expenses, a “Gold” analyst rating and four stars, which are not usually characteristics associated with descendent funds. Vanguard is looking to lower investor expenses (by about three basis points in this case) and simplify their line-up. On an after-tax basis, it looks like investors will gain two basis points in returns.

World Commodity Fund (WCOMX) has closed and will liquidate on May 26, 2014. It’s got rather less than a million in the portfolio and has, over the course of its seven-and-a-half year life, managed to turn a $10,000 initial investment into $10,120 which averages out to rather less than 0.10% per year. That saddest part? That’s not nearly the worst record, at least over the past five years, in either the “natural resources equity” or “broad commodities” groups.

In Closing . . .

Thanks to folks who’ve been supporting MFO financially, with a special tip of the cap to Capt. Neel (thank you, sir) and the Right Reverend Rick (I’m guided here by Luke: “In every way and everywhere we accept this with all gratitude”).

Especially for the benefit of the 6000 first-time readers we see each month, if you’re inclined to support the Observer, the easiest way is to use the Observer’s Amazon link. The system is simple, automatic, and painless. We receive an amount equivalent to about 7% of the value of almost anything you purchase through our Amazon link (used books, Kindle downloads, groceries, sunscreen, power tools, pool toys …). You might choose to set it as a bookmark or, in my case, you might choose to have one of your tabs open in Amazon whenever you launch your browser. Some purchases generate a dime, some generate $10-12 and all help keep the lights on!

Especially for the benefit of the 6000 first-time readers we see each month, if you’re inclined to support the Observer, the easiest way is to use the Observer’s Amazon link. The system is simple, automatic, and painless. We receive an amount equivalent to about 7% of the value of almost anything you purchase through our Amazon link (used books, Kindle downloads, groceries, sunscreen, power tools, pool toys …). You might choose to set it as a bookmark or, in my case, you might choose to have one of your tabs open in Amazon whenever you launch your browser. Some purchases generate a dime, some generate $10-12 and all help keep the lights on!

June: the month for income. With the return of summer turbulence and Janet Yellen’s insistent dovishness about rates, we thought we’d take some time to look at four new funds that promise high income and managed volatility:

Artisan High Income (ARTFX) run by former Ivy High Income manager Bryan Krug. The fund has drawn $76 million in its first six weeks.

Dodge & Cox Global Bond, which went live on May 1.

RiverNorth Oaktree High Income (RNOTX), which combines RiverNorth’s distinctive CEF strategy with Oaktree’s first-rate institutional income one.

(maybe) West Shore Real Asset Income (AWSFX) which combines an equity-oriented income strategy with substantial exposure to alternative investments. We’ve had a couple readers ask, and we’ve been trying to learn enough to earn an opinion but it’s a bit challenging.

We’ve also scheduled a conversation with the folks at Arrowpoint, adviser to the new Meridian Small Cap Growth Fund (MSGAX) which is run by former Janus Triton managers Brian Schaub and Chad Meade.

As ever.