To help you make better decisions, we’ve begun gathering publicly-available active share data released by fund companies. Because we know that compact portfolios are also correlated to higher degrees of independence, we’ve included that information too for all of the funds we could identify.

| Fund |

Ticker |

Active share |

Benchmark |

Stocks |

| Artisan Emerging Markets (Adv) | ARTZX |

79.0 |

MSCI Emerging Markets |

90 |

| Artisan Global Equity | ARTHX |

94.6 |

MSCI All Country World |

57 |

| Artisan Global Opportunities | ARTRX |

95.3 |

MSCI All Country World |

41 |

| Artisan Global Value | ARTGX |

90.5 |

MSCI All Country World |

46 |

| Artisan International | ARTIX |

82.6 |

MSCI EAFE |

68 |

| Artisan International Small Cap | ARTJX |

97.8 |

MSCI EAFE Small Cap |

45 |

| Artisan International Value | ARTKX |

92.0 |

MSCI EAFE |

50 |

| Artisan Mid Cap | ARTMX |

86.3 |

Russell Midcap Growth |

65 |

| Artisan Mid Cap Value | ARTQX |

90.2 |

Russell Value |

57 |

| Artisan Small Cap | ARTSX |

94.2 |

Russell 2000 Growth |

68 |

| Artisan Small Cap Value | ARTVX |

91.6 |

Russell 2000 Value |

103 |

| Artisan Value | ARTLX |

87.9 |

Russell 1000 Value |

32 |

| ASTON/River Road Dividend All Cap Value | ARDEX | 88.5 | Russell 3000 Value | 61 |

| ASTON/River Road Dividend All Cap Value II | ADVTX | 88.3 | Russell 3000 Value | 53 |

| ASTON/River Road Independent Value | ARIVX | 98.6 | Russell 2000 Value | 20 |

| ASTON/River Road Select Value | ARSMX | 95.4 |

Russell 2500 Value |

69 |

| ASTON/River Road Small Cap Value | ARSVX | 96.0 | Russell 2000 Value | 67 |

| Barrow All-Cap Core Investor | BALAX |

92.7 |

S&P 500 |

182 |

| Conestoga Small Cap | CCASX |

94.1 |

Russell 2000 Growth |

48 |

| Conestoga SMid Cap Investors | CCSMX |

93.3 |

Russell 2500 Growth |

50 |

| Diamond Hill Select | DHLTX |

89 |

Russell 3000 Index |

35 |

| Diamond Hill Large Cap | DHLRX |

80 |

Russell 1000 Index |

49 |

| Diamond Hill Small Cap | DHSIX |

97 |

Russell 2000 Index |

68 |

| Diamond Hill Small-Mid Cap | DHMIX |

97 |

Russell 2500 Index |

62 |

| DoubleLine Equities Growth | DLEGX |

88.9 |

S&P 500 |

38 |

| DoubleLine Equities Small Cap Growth | DLESX |

92.7 |

Russell 2000 Growth |

65 |

| Driehaus EM Small Cap Growth | DRESX |

96.4 |

MSCI EM Small Cap |

102 |

| FPA Capital | FPPTX |

97.7 |

Russell 2500 |

28 |

| FPA Crescent | FPACX |

90.3 |

Barclays 60/40 Aggregate |

50 |

| FPA International Value | FPIVX |

97.8 |

MSCI All Country World ex-US |

23 |

| FPA Perennial | FPPFX |

98.9 |

Russell 2500 |

30 |

| Guinness Atkinson Global Innovators | IWIRX |

99 |

MSCI World |

28 |

| Guinness Atkinson Inflation Managed Dividend | GAINX |

93 |

MSCI World |

35 |

| LG Masters International | MSILX | 89.9 | MSCI EAFE | 90 |

| LG Masters Smaller Companies | MSSFX | 98.2 | Russell 2000 | 52 |

| LG Masters Equity | MSEFX | 84.2 | Russell 3000 | 85 |

| LindeHansen Contrarian Value | LHVAX |

87.1 * |

Russell Midcap Value |

23 |

| Parnassus Equity Income | PRBLX |

86.9 |

S&P 500 |

41 |

| Parnassus Fund | PARNX |

92.6 |

S&P 500 |

42 |

| Parnassus Mid Cap | PARMX |

94.9 |

Russell Midcap |

40 |

| Parnassus Small Cap | PARSX |

98.8 |

Russell 2000 |

31 |

| Parnassus Workplace | PARWX |

88.9 |

S&P 500 |

37 |

| Pinnacle Value | PVFIX |

98.5 |

Russell 2000 TR |

37 |

| Poplar Forest Partners Fund | PFPFX |

90.2 |

S&P 500 |

30 |

| Third Avenue Value | TAVFX | 98.1 | MSCI World | 37 |

| Third Avenue International Value | TAVIX | 97.0 | MSCI World ex US | 34 |

| Third Avenue Small Cap Value | TASCX |

94.3 |

Russell 2000 Value |

37 |

| Third Avenue Real Estate | TAREX |

91.1 |

FTSE EPRA/NAREIT Developed |

31 |

| Touchstone Capital Growth | TSCGX |

77 |

Russell 1000 Growth |

58 |

| Touchstone Emerging Markets Eq | TEMAX |

80 |

MSCI Emerging Markets |

68 |

| Touchstone Focused | TFOAX |

90 |

Russell 3000 |

37 |

| Touchstone Growth Opportunities | TGVFX |

78 |

Russell 3000 Growth |

60 |

| Touchstone Int’l Small Cap | TNSAX |

97 |

S&P Developed ex-US Small Cap |

97 |

| Touchstone Int’l Value | FSIEX |

87 |

MSCI EAFE |

54 |

| Touchstone Large Cap Growth | TEQAX |

92 |

Russell 1000 Growth |

42 |

| Touchstone Mid Cap | TMAPX |

96 |

Russell Midcap |

33 |

| Touchstone Mid Cap Growth | TEGAX |

87 |

Russell Midcap Growth |

74 |

| Touchstone Mid Cap Value | TCVAX |

87 |

Russell Midcap Value |

80 |

| Touchstone Midcap Value Opps | TMOAX |

87 |

Russell Midcap Value |

65 |

| Touchstone Sands Capital Select | TSNAX |

88 |

Russell 1000 Growth |

29 |

| Touchstone Sands Growth | CISGX |

88 |

Russell 1000 Growth |

29 |

| Touchstone Small Cap Core | TSFAX |

99 |

Russell 2000 |

35 |

| Touchstone Small Cap Growth | MXCAX |

90 |

Russell 2000 Growth |

81 |

| Touchstone Small Cap Value | FTVAX |

94 |

Russell 2000 Value |

75 |

| Touchstone Small Cap Value Opps | TSOAX |

94 |

Russell 2000 Value |

87 |

| William Blair Growth | WBGSX |

83 |

Russell 3000 Growth |

53 |

* LindeHansen notes that their active share is 98 if you count stocks and cash. To the extent that cash is a conscious choice (i.e., “no stock in our investable universe meets our purchase standards, so we’ll buy cash”), count both makes a world of sense. I just need to find out how other investors have handled the matter.

ARE YOU ACTIVE? WOULD YOU LIKE SOMEONE TO NOTICE?

We’ve been scanning fund company sites, looking for active share reports. If we’ve missed you, we’re sorry. Help us correct the oversight by sending us the link to where you report your active share stats. We’d be more than happy to offer a permanent home for the web’s largest open collection of active share data.

ACTIVE SHARE DEFINED

K. J. Martijn Cremers and Antti Petajisto introduced the new measure of active portfolio management, called Active Share, which represents the share of portfolio holdings that differ from the benchmark index holdings.

Below is the formal definition and explanation, extracted from their 2009 paper, entitled “How Active Is Your Fund Manager? A New Measure That Predicts Performance.”

Active Share can thus be easily interpreted as the “fraction of the portfolio that is different from the benchmark index.” [I]t provides information about a fund’s potential for beating its benchmark index—after all, an active manager can only add value relative to the index by deviating from it.

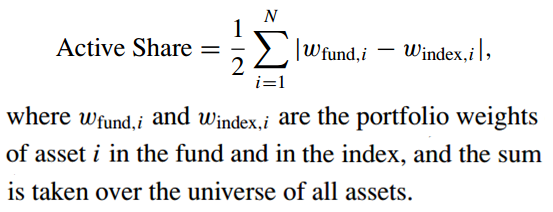

Our new intuitive and simple way to quantify active management is to compare the holdings of a mutual fund with the holdings of its benchmark index. We label this measure the Active Share of a fund, and we define it as

As an illustration, let us consider a fund with a $100 million portfolio benchmarked against the S&P 500. Imagine that the manager starts by investing $100 million in the index, thus having a pure index fund with five hundred stocks. Assume that the manager only likes half of the stocks, so he eliminates the other half from his portfolio, generating $50 million in cash, and then he invests that $50 million in those stocks he likes.

This produces an Active Share of 50% (i.e., 50% overlap with the index). If he invests in only fifty stocks out of five hundred (assuming no size bias), his Active Share will be 90% (i.e., 10% overlap with the index). According to this measure, it is equally active to pick fifty stocks out of a relevant investment universe of five hundred or ten stocks out of hundred—in either case you choose to exclude 90% of the candidate stocks from your portfolio.