There may be a place for tax-exempt municipal bond funds in the portfolios of middle-class and upper-middle-class American households as well as for those in the upper-income group. I have about 15% of my fixed-income funds invested in municipal bonds. They may be suitable in long-term after-tax accounts where you want to reduce taxes. State-focused municipal bond funds may also reduce state income taxes. This article discusses five Lipper Municipal Bond categories with respect to increasing yield while managing risk.

I own Vanguard Tax-Exempt Bond Index ETF (VTEB), Fidelity Tax-Free Bond (FTABX), Vanguard High-Yield Tax-Exempt Inv (VWAHX), Vanguard Tax-Exempt Bond Index Admiral (VTEAX), and Fidelity Intermediate Municipal Income (FLTMX) from the Municipal General & Insured Debt and Municipal Intermediate Debt categories. Note that Vanguard High-Yield Tax-Exempt Inv (VWAHX) is in the Municipal General & Insured Debt category and not the Municipal High Yield category.

Tax Brackets For 2025

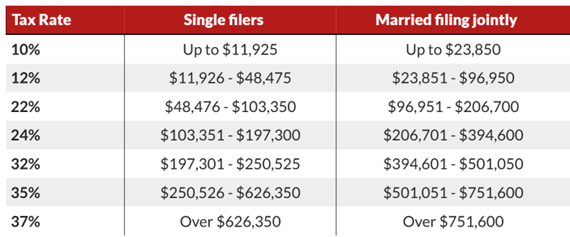

Daniel Bortz at AARP wrote Here Are the Federal Income Tax Brackets for 2025 with the following table. The key brackets are having income levels where marginal tax rates jump from 12% to 22% and from 24% to 32%. Another reason to own municipal bonds is to hold them in a long-term account where the income is not needed and you want to keep taxes low.

Table #1: Federal Income Tax Brackets for 2025.

Fidelity Tax Equivalent Yields Calculator

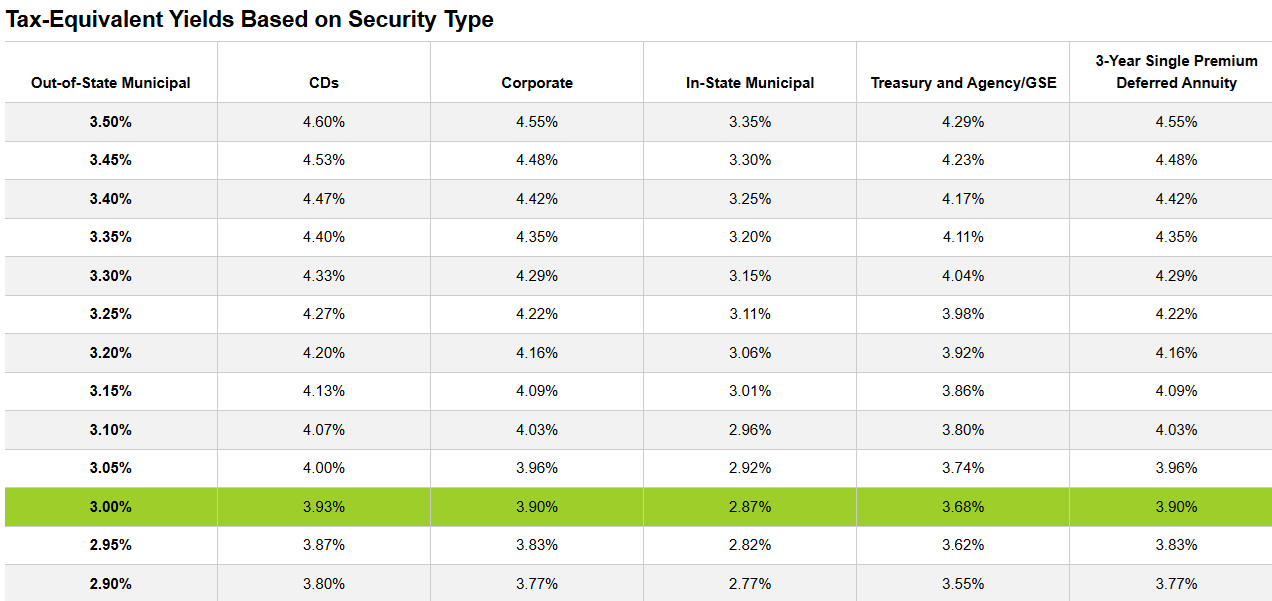

Fidelity has a nifty Calculator for Fixed Income Taxable-Equivalent Yields for Individual Bonds, CDs, & SPDAs. The link is provided here. The green shaded area is for an investor filing taxes “Married Filing Jointly” with $200,000 in household income and making 3% on an out-of-state municipal bond. The couple would have to make 3.68% on Treasury and Agency bonds to be the equivalent of 3% in tax-exempt yields. If I don’t need the income for several years in a particular account and the yields are close, then I favor municipal bonds. For municipal bonds to be competitive with Treasuries now, the couple would need to have a 3.5% yield on out-of-state municipal bonds which is doable.

Table #2: Fidelity Calculator for Fixed Income Taxable-Equivalent Yields

Lipper Categories with High Yields and Low to Moderate Risk

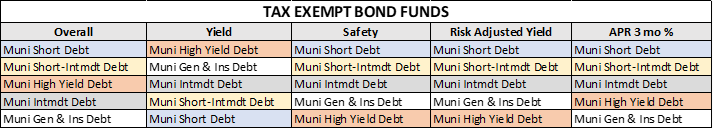

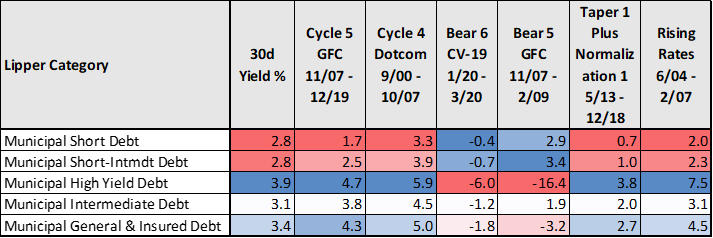

I created an “Overall” ranking system to combine Risk, Yield, Return, Quality, Trend, and Tax-Efficiency factors into an overall rating. Table #3 shows the categories sorted by “Overall, Yield, Safety, Risk Adjusted Yield, and Three-Month Return. Muni High Yield debt is attractive for yield, but not for safety. The categories may be appropriate for different Investment Buckets for short, intermediate, and long-term investing goals.

Table #3: Performance of Lipper Categories with High Yields

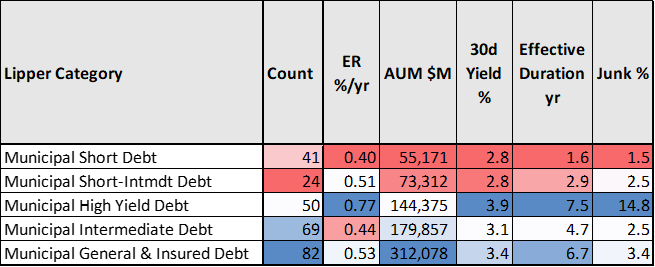

I extracted all mutual funds and exchange-traded funds using the MFO Premium Fund Screener and Lipper global dataset. What Table #4 tells us is that municipal short and short-intermediate debt categories don’t have as high assets under management as the other categories which have higher yields and longer durations. Note also that municipal high-yield debt has a lower percentage invested in low-rated “Junk” debt than taxable high-yield debt.

Table #4: Metrics for Lipper Categories with High Yields

Table #5 is based on the history of nearly 300 mutual funds and exchange-traded funds. Municipal intermediate debt and municipal general & insured debt have full cycle returns of 4% to 5% and low drawdowns. These are where the bulk of my investments in municipal bonds are. Municipal high-yield debt has higher yields and full-cycle returns, but also higher drawdowns.

Table #5: Performance of Lipper Categories with High Yields

The Chosen Few

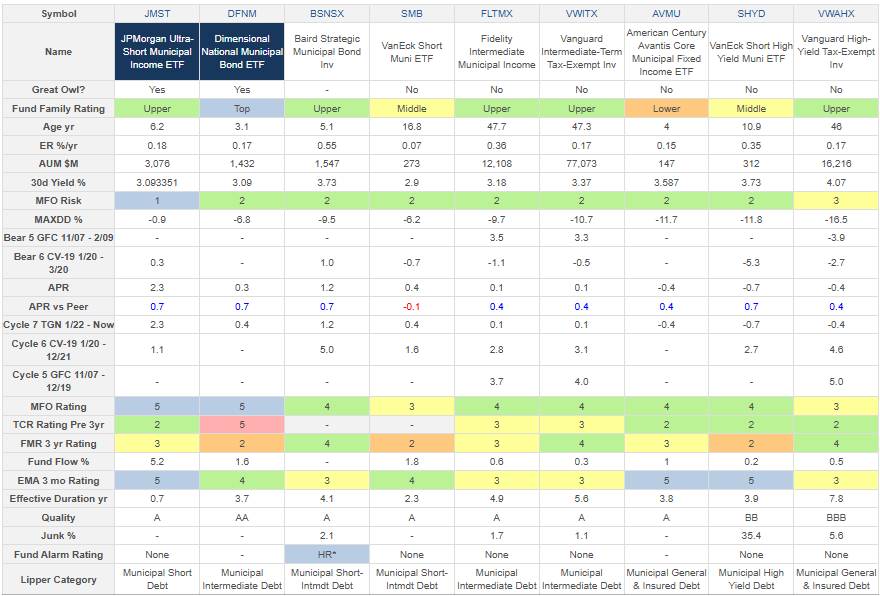

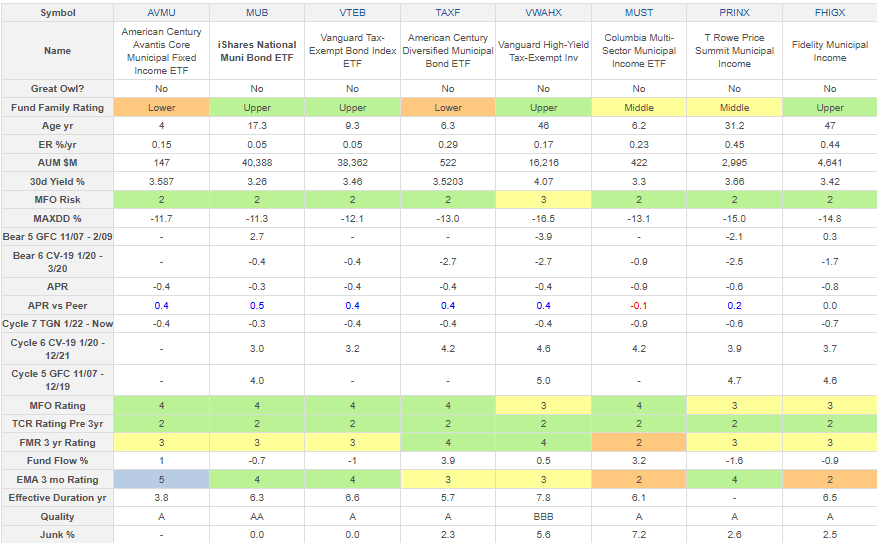

I selected one fund, most interesting to me as a moderately conservative investor, from each of the five Lipper Categories covered in the article. They are sorted loosely from lower risk on the left with yields around 3% to higher risk on the right with yields around 4%.

Table #6: Author’s Select High Performing Funds Per Lipper Category (3-Year Metrics)

JPMorgan Ultra-Short Municipal Income ETF (JMST) has averaged 3.4% for the past two years with low volatility. Vanguard High-Yield Tax-Exempt (VWAHX) has averaged 5.1% but with more volatility.

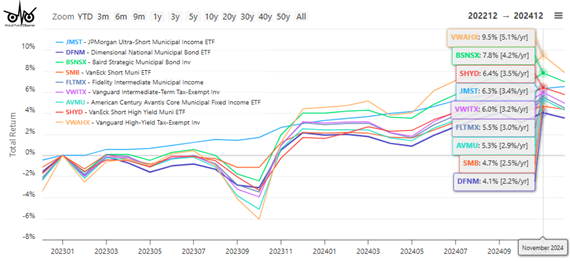

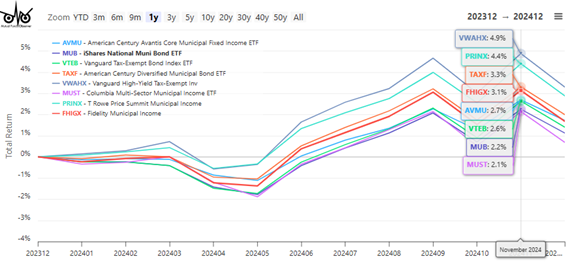

Figure #1: Author’s Select High Performing Funds Per Lipper Category

Municipal Short Debt

Lipper U.S. Mutual Fund Classification Short Municipal Debt Funds: Funds that invest in municipal debt issues with dollar-weighted average maturities of less than three years.

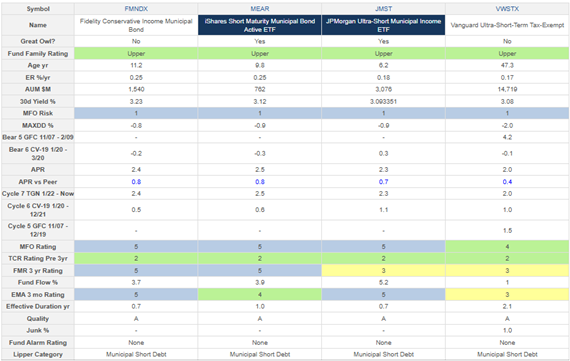

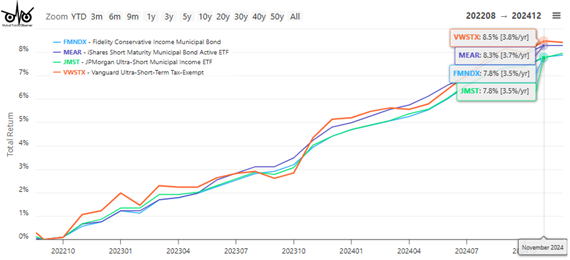

These are low-risk funds currently yielding over 3%. I favor MFO Great Owl iShares Short Maturity Municipal Bond Active ETF (MEAR).

Table #7: High-Performing Municipal Short Debt Funds (3-Year Metrics)

Figure #2: High-Performing Municipal Short Debt Funds (3-Year Metrics)

Municipal Short-Intermediate Debt

Lipper U.S. Mutual Fund Classification Short-Intermediate Municipal Debt Funds: Funds that invest in municipal debt issues with dollar-weighted average maturities of one to five years.

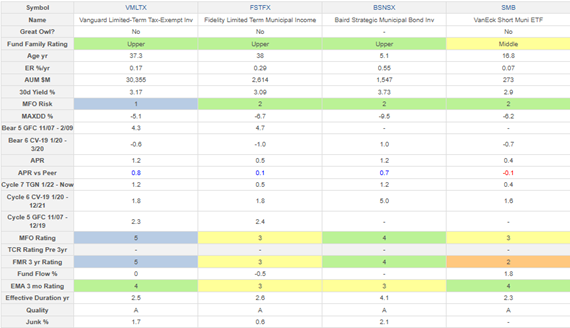

Municipal short-intermediate debt funds are a relatively low-risk option since short-term rates are expected to decline over the next few years. Yields are generally above 3.0%.

Table #8: High-Performing Municipal Short-Intermediate Debt Funds (3-Year Metrics)

Figure #3: High-Performing Municipal Short-Intermediate Debt Funds

Municipal Intermediate Debt

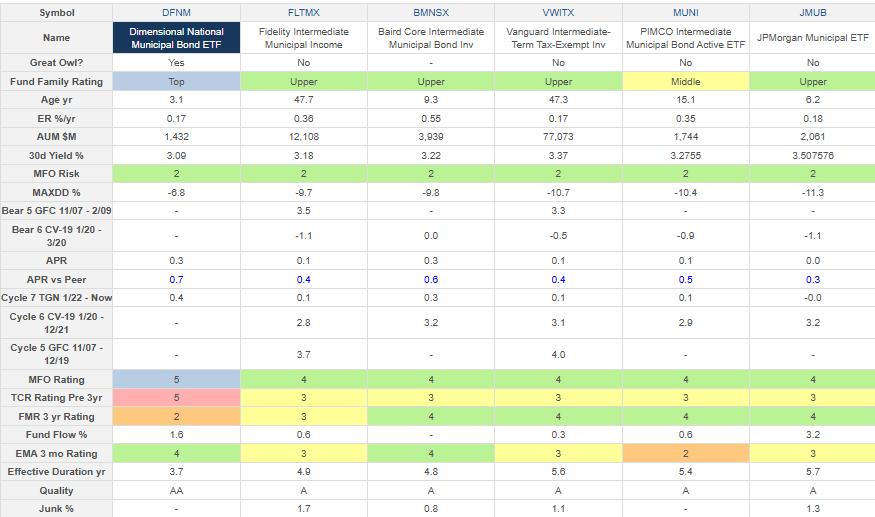

Lipper U.S. Mutual Fund Classification Intermediate Municipal Debt Funds: Funds that invest in municipal debt issues with dollar-weighted average maturities of five to ten years.

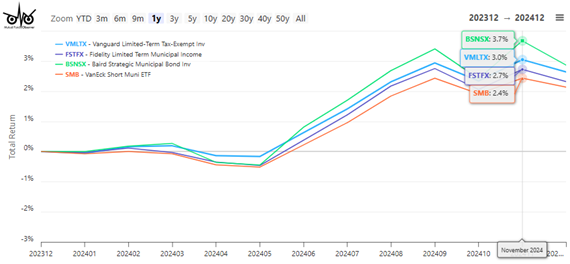

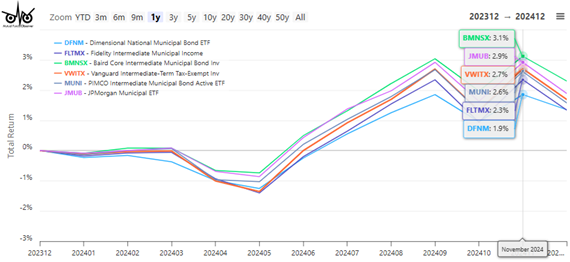

The high-performing municipal intermediate debt funds in Table #9 have returned 2.0% to 3.0% over the past year with a yield in the range of 3.0% to 3.5%. Of the ETFs, I like JPMorgan Municipal ETF (JMUB) for its higher return and yield, although it had a drawdown of 11.3% over the past three years. Those seeking higher risk-adjusted returns may prefer Dimensional National Municipal Bond ETF (DFNM).

Table #9: High-Performing Municipal Intermediate Debt Funds (3-Year Metrics)

Figure #4: High-Performing Municipal Intermediate Debt Funds

Municipal High Yield Debt

Lipper U.S. Mutual Fund Classification High Yield Municipal Debt Funds: Funds that typically invest 50% or more of their assets in municipal debt issues rated BBB or less.

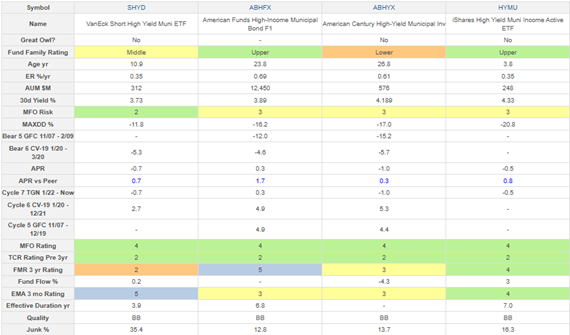

High-performing municipal high-yield debt funds have returned more than 7.0% for the past year with the exception of VanEck Short High Muni ETF (SHYD). I favor SHYD as a lower-risk venture into municipal high-yield bonds. High-yield funds may have a drawdown of 10% to 20% during a major bond downturn. They have had full cycle returns of 4.5% to 5.0% and yield 3.7% to 4.3%.

Table #10: High Performing Municipal High Yield Debt Funds (3-Year Metrics)

Figure #5: High Performing Municipal High Yield Debt Funds

Municipal General & Insured Debt

Lipper U.S. Mutual Fund Classification General & Insured Municipal Debt Funds: Funds that either invest primarily in municipal debt issues rated in the top three credit ratings or invest primarily in municipal debt issues insured as to timely payment.

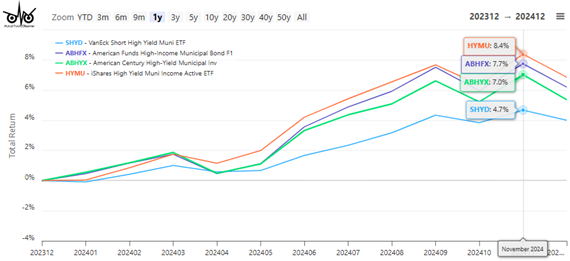

I own Vanguard High-Yield Tax Exempt (VWAHX) in the general & insured municipal debt category as opposed to a fund in the high-yield municipal debt category. While its drawdown during the past three years matches those in the high-yield municipal debt category, its performance during the financial crisis was much better. It has a yield of 4.1%.

Table #11: High-Performing Municipal General & Insured Funds (3-Year Metrics)

Figure #6: High-Performing Municipal General & Insured Funds

Closing

I have a loose target of having about 50% of my investments in Traditional IRAs, 25% in Roth IRAs, and 25% in after-tax accounts. Pensions, Social Security, after-tax investment income, and withdrawals from Traditional IRAs are taxable income. Managing taxes is part of my overall investment strategy. As a result of researching this article, I have invested more in taxable bonds with higher yields in some shorter-term accounts, and increased risk primarily in the municipal general & insured debt category in accounts that I managed to pass along as inheritance.

I will be meeting with a CPA later this year to review my tax management strategy. I am a firm believer in using Financial Advisors.