On Wednesday, 8 January, at 11 a.m. Pacific (2 p.m. Eastern), we will be conducting our year-end webinar to review funds and MFO Premium updates. If you can make it, please join us by registering here.

We will use MultiSearch Pre-Set screens and other custom criteria to review fund performance in 2024. MultiSeach is the site’s main tool, enabling searches with numerous screening criteria. We will also demo some of the many features across the site.

Significant upgrades this year include:

- Introduced “Parent” and “White Label” into MultiSearch and Fund Family Scorecard, as motivated by MFO piece: You Too Can Start an ETF.

- Introduced Price-Based Metrics, as described in our December commentary.

- Expanded Fund Family Scorecard, including family annual revenue based on assets under management and expense ratio.

- Introduced Quarterly Metrics tool, as described in our October commentary.

- Expanded Averages to include peer groups of Category, SubType, Type, and other classifications, like actively managed funds and ETFs (convenience symbols AV-ACTIVE and AV-ETFS, respectively).

- Refinements to Calendar Year category averages and flow sums.

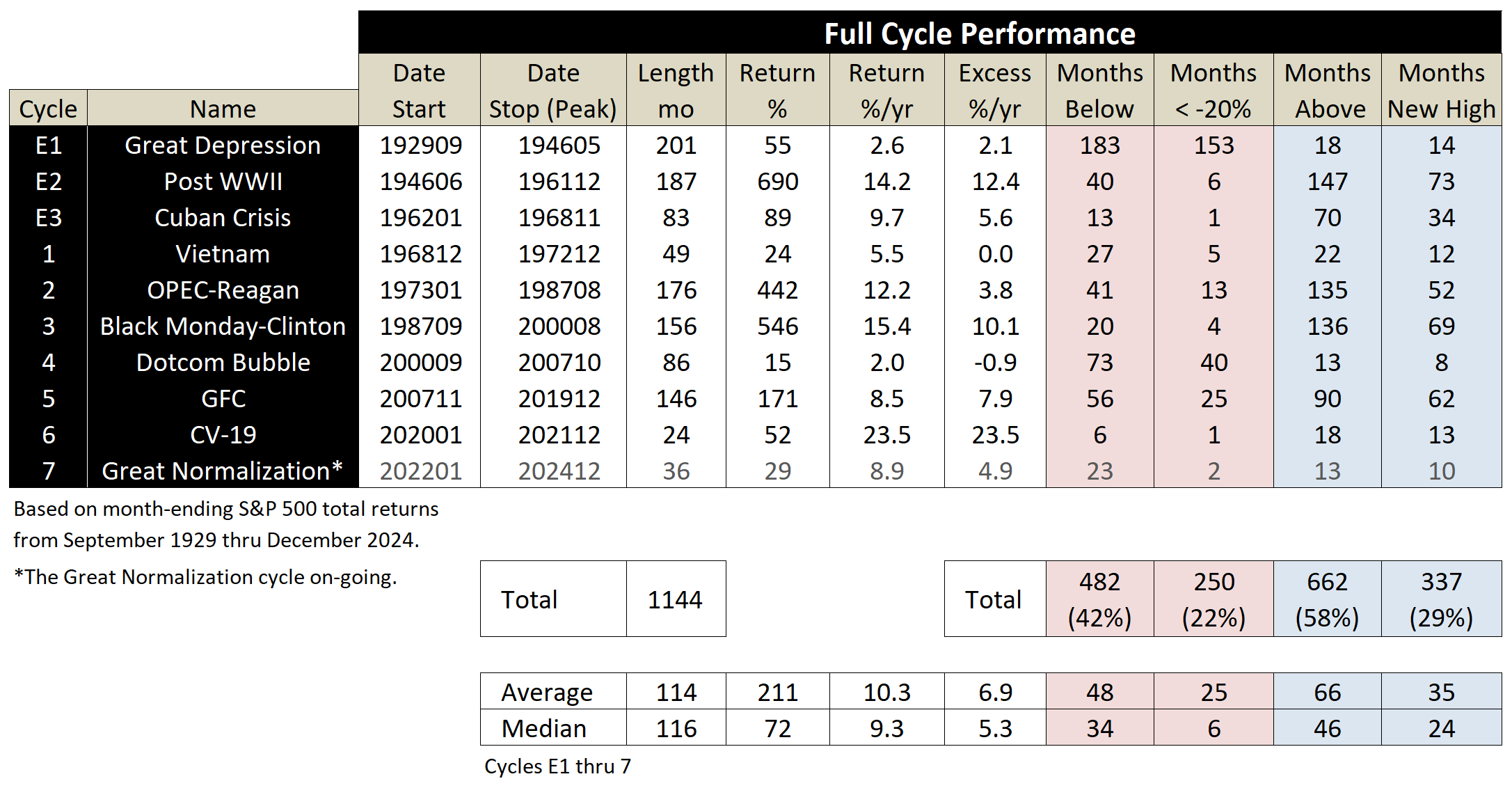

December marked the 36th full month of The Great Normalization (TGN) market cycle and the 27th month of this market’s bull run, including 10 months at all-time highs. The run has propelled the S&P 500 70% so far, netting investors 29% after the -24% drawdown in 2022, or a normal-like 9% per year. The 30-day T-Bill has also been 4% annualized over this time, which too is about normal. Bonds, however, have generally lagged.

MFO Premium includes the following range of search tools, several with free access (linked and emboldened below) for the MFO community:

- MultiSearch

- Great Owls

- Fund Alarm (Three Alarm and Honor Roll)

- Averages

- Dashboard of Profiled Funds

- Dashboard of Launch Alerts

- Portfolios

- QuickSearch

- Fund Family Scorecard

- Definitions

The site also enables the following analyses:

- Charts

- Flows

- Compare

- Correlation

- Rolling Averages

- Trend

- Ferguson Metrics

- Calendar Year and Period Performance

A screenshot of the various tools can be found on the home page.