For most of us, saving money is the first step to investing, yet 25% to 35% of Americans are living paycheck to paycheck. This article looks at why people are living paycheck to paycheck and how lower- and middle-income Americans in particular may be able to increase emergency savings leading to saving more for retirement. The concepts are just as relevant to higher-income people as well.

In addition to volunteering at Habitat For Humanity, I also volunteer at a local non-profit organization, Neighbor To Neighbor, which offers programs in eviction avoidance, utility shut-off avoidance, affordable housing, housing search, foreclosure prevention, and counseling including financial coaching, debt consolidation, and reverse mortgages. Many of the people seeking assistance at Neighbor To Neighbor have experienced an unfortunate circumstance such as temporary or permanent loss of employment, unexpected health issue, divorce, loss of a loved one, rent inflation, or an accident. My role is to prescreen people to get the appropriate assistance within Neighbor To Neighbor and direct them to external sources of assistance.

As a housing opportunity resource for Northern Colorado, Neighbor to Neighbor (N2N) services are designed to meet each individual where they are now – from homeless and low-income individuals seeking a place to live; to families needing assistance to secure their existing homes; to prospective buyers ready to explore the homebuying process. Our trained housing professionals assist clients through obstacles and develop personalized solutions to help them achieve their housing goals.

I hope this article offers some useful ideas on how to cut spending and save more. It is divided into the following sections:

- Section 1, Steve Balmer Explains Today’s Economy to Non-Economists

- Section 2, Financial Literacy: Emergency Savings versus Retirement Savings

- Section 3, Americans’ Financial Stress

- Section 4, Assessing Spending Habits

- Section 5, Financial Counseling versus Financial Advisors

- Section 6, Improving Saving Habits

STEVE BALMER EXPLAINS TODAY’S ECONOMY TO NON-ECONOMISTS

Key Point: The economy has been stronger than expected while interest rates were rising. It is an opportune time to get your financial house in order and save for less fortunate times.

Steve Balmer spent 34 years growing Microsoft, 10 years owning the LA Clippers, and started the non-profit USA Facts which is rated by Media Bias/Fact Check as “Least Biased”, “Very High Factual Reporting”, and “High Credibility”. Mr. Balmer provides this fourteen-minute video, “Is The Economy Strong?” explaining the state of the (2023) economy in simple terms. He covers economic growth, inflation (gas, groceries, rent, housing), employment, income, taxes, government benefits, demographic shifts, and poverty thresholds.

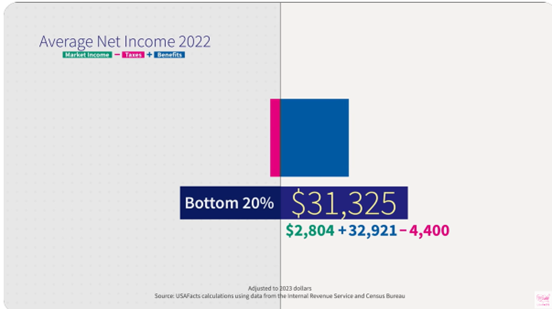

Figure #1 shows the net income of the Bottom 20% income group which is Market Income (Wages, savings added to retirement accounts, employer benefits, and income from investments) minus taxes (Federal, State, and local) plus government benefits (Social Security, Medicare/Medicaid, food stamps, tax credits, unemployment benefits…). The net income in 2022 of the Bottom 20% was $31,325 which was mostly government benefits, and the net income for the Middle 20% was $68,575. That was a year of high government spending to lessen the impact of the COVID pandemic, and that spending is ending this year.

Figure #1: 2022 Average Net Income for Bottom 20% of Income Levels

Mr. Balmer ended on a positive note, he continues “to be amazed at the innovation and dynamism of the U.S. economy and the work ethic of Americans. The American worker and American economy should never ever be underestimated.”

In my opinion, the rising national debt will most likely result in higher taxes and/or cuts to government spending if Congress fails to address the shortfalls. Social Security was originally created to meet the basic needs of older Americans for food and shelter during the Great Depression. High housing costs and inflation are impacting seniors relying on Social Security.

FINANCIAL LITERACY: EMERGENCY SAVINGS VERSUS RETIREMENT SAVINGS

Key Point: People should prioritize building emergency savings, reducing debt, and then begin to make small contributions to retirement savings.

Various articles estimate the number of people living paycheck to paycheck to be between 25% and 75%. From this section, I believe that 25% to 35% of people are living paycheck to paycheck and another 25% to 35% may not have enough in savings to cover three months of living expenses. Let’s start with a definition of living paycheck to paycheck from Investopedia:

“’Paycheck to paycheck’ is an expression that describes an individual who would be unable to meet their financial obligations if they were unemployed. Those living paycheck to paycheck devote their salaries predominantly to expenses. The phrase may also mean living with limited or no savings and refer to people who are at greater financial risk if they were suddenly unemployed or faced another financial emergency.”

Now let’s take a look at the definition of “emergency savings” and “retirement savings” from “15+ American Savings Statistics to Know in 2024” in FinMasters by David Moadel:

- Emergency savings are kept in reserve to meet immediate goals or cover unexpected expenses or job loss. They are typically kept in savings accounts or other accounts that allow easy access.

- Retirement savings are intended for use after retirement and are usually invested in an IRA, 401(k), or brokerage account. These savings types are equally important, but data on them are collected separately.

Overall, 22% of households self-reported having no emergency savings, and over a third have some savings but cannot cover three months of living expenses. Approximately 40% are more secure.

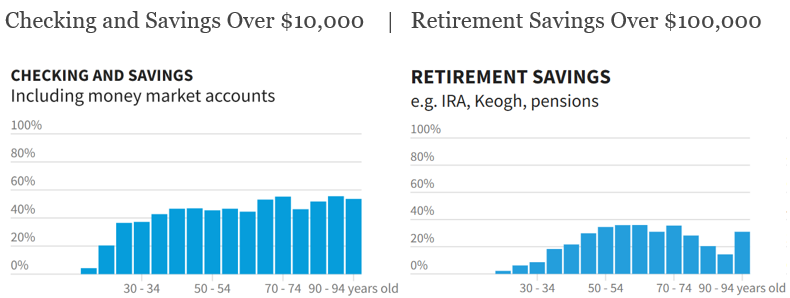

USA Facts published “Nearly half of American households have no retirement savings” using the 2022 Survey of Consumer Finances by the Federal Reserve. They have interactive charts for Checking/Savings, Retirement Savings, Financial Assets, and Net Worth. In Figure #2, I show the percentage of people by age with at least $10,000 in their checking and savings accounts along with the percentage of people with at least $100,000 in their retirement accounts. About 30% to 50% of people fit into one of these categories.

Figure #2: Percent of People with Emergency Savings Over $10,000, Over $100,00o in Retirement Savings by Age

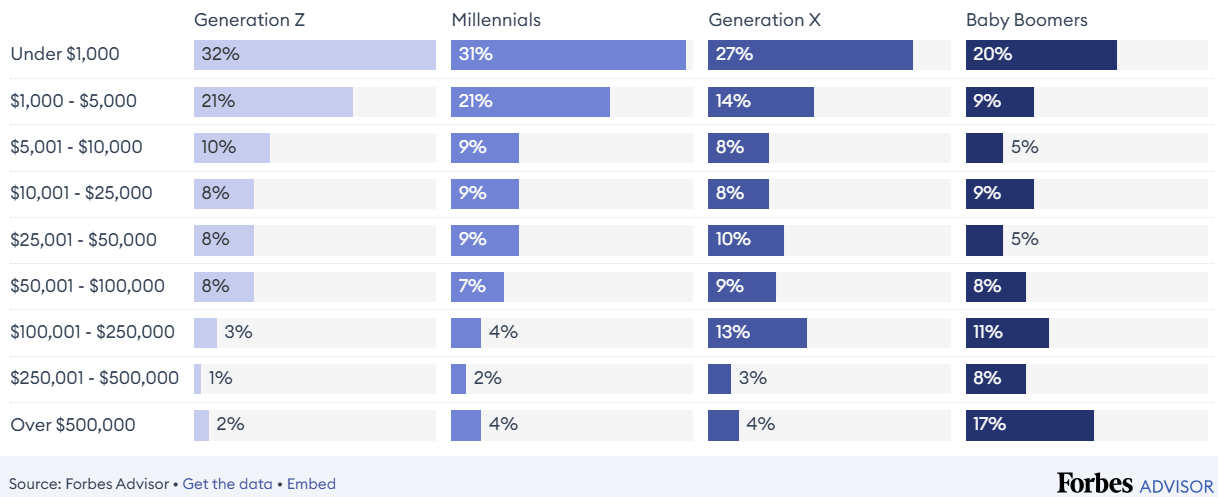

Forbes Advisor’s latest online survey of one thousand Americans is summarized by Jamela Adam in “American Savings By Generation: How Balances And Goals Vary By Age.” Ms. Adam writes, “According to our survey, roughly 28% of Americans across all four generations currently have less than $1,000 in personal savings, including emergency funds, non-workplace retirement accounts, and investments.” Figure #3 contains the total savings from the survey. In the event of an emergency, respondents said they would dip into their savings (59%), and use debt such as credit cards or loans (30%) while others said they would sell belongings or cut expenses (29%).

Figure #3: Total Savings (including emergency funds, retirement accounts, and investments) by Age Group

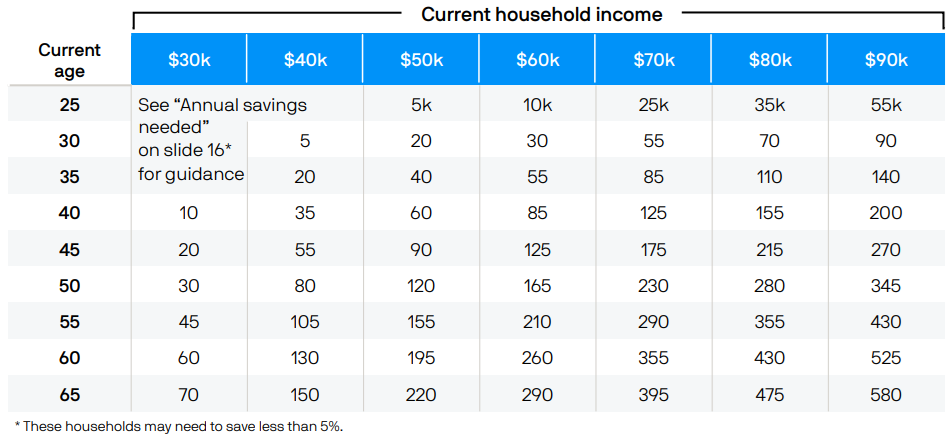

It helps to set goals. JP Morgan’s “2024 Guide to Retirement” provides a useful table of checkpoints by age and income level based on an assumed contribution rate of 5% and asset allocation of 60% stocks/40% bonds prior to retirement. Most people can save more than the table below by increasing their savings rate as their income rises.

Table #1: Retirement Savings Checkpoints by Income and Age

AMERICANS’ FINANCIAL STRESS

Key Point: About 25% of Americans are financially stressed, but some in the lower-middle-income groups may have room to save more and reduce debt. Having savings provides more financial freedom to overcome emergencies.

One of the services that Neighbor To Neighbor offers is “housing search” to help people find an apartment that they can afford. Many homeless people have jobs, but cannot afford housing. Some are living paycheck to paycheck and face eviction because they cannot afford the increase in rent.

The US Census Bureau estimates that approximately 37 million people (11%) lived in poverty in 2023. Eighteen million (13.5%) were food insecure at some time during 2023, according to the U.S. Department of Agriculture. Over 21 million renter households spent more than 30% of their income on housing costs in 2023, representing nearly half of the renter households in the United States for whom rent burden is calculated according to the U.S. Census Bureau.

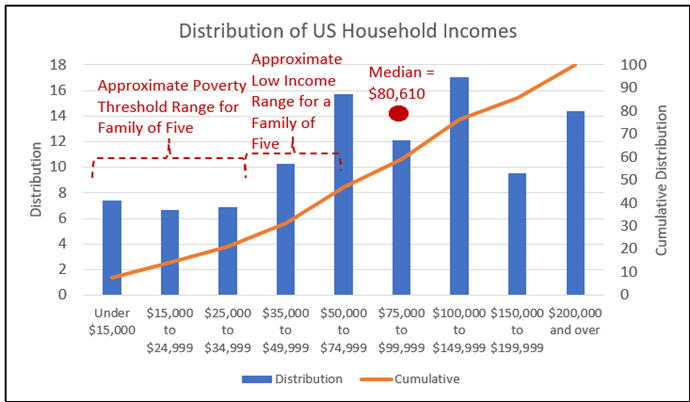

I created the chart below from another US Census Bureau Report, “Income in the United States: 2023”, showing the income distribution in 2023. The poverty threshold depends upon household size. The three lowest income ranges in Figure #4 represent 21% of households. Some people will progress from the lower income groups to the higher groups as they gain experience, education, and/or skills. Others may move up and down between the levels based on job stability, job opportunities, health, or life events and preferences.

Figure #4: Distributions of US Household Incomes (2023)

Source: Author Using US Census Bureau Report “Income in the United States: 2023”

Gili Malinsky at CNBC explains why people are living paycheck to paycheck in “More Americans say they are living paycheck to paycheck this year than in 2023—here’s why”. The reasons cited are:

- 69% cite inflation

- 59% cite a lack of savings

- 28% cite rising interest rates

- 33% cite credit card debt

- 28% cite medical or healthcare bills

- 21% cite layoffs or loss of income

- 15% cite student loans

Having credit card debt is both expensive and risky. Khristopher J. Brooks wrote “Americans continue to rack up credit card debt, hitting a record $1.14 trillion” for CBS News Money Watch. He described that U.S. consumers collectively owe a record $1.14 trillion in credit card debt. He adds, “About 7.18% of cardholders fell into delinquency in the second quarter, up from 5% in the previous quarter…” Many adults have more credit card debt than money saved in emergency savings. The average credit card interest rate is now over 24%.

ASSESSING SPENDING HABITS

Key Point: Having an awareness of commercial temptations and the desire for financial independence can help develop better savings habits.

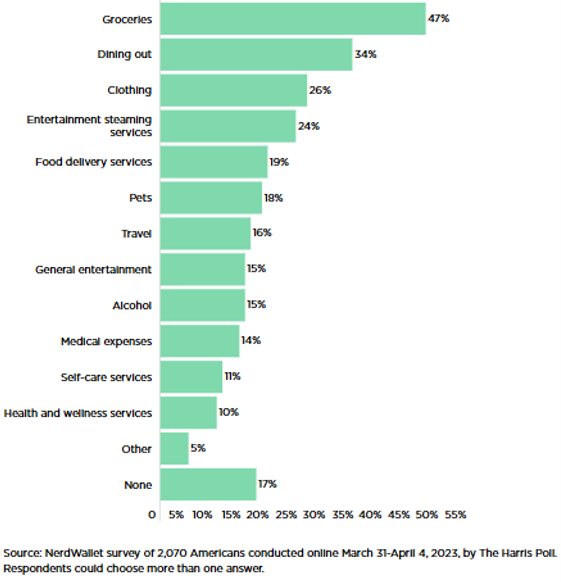

Most people have a budget, but people often fail to stick to that budget. Andrew Marder at NerdWallet describes a survey that finds over 80% of Americans that have a monthly budget overspend in “Most Americans Have a Monthly Budget, but Many Still Overspend”. He adds that close to half of Americans say they want to prioritize emergency savings. Figure #5 shows the categories where respondents overspend. These categories represent opportunities for people to save money by adhering to their budget.

Figure #5: Overspending Categories

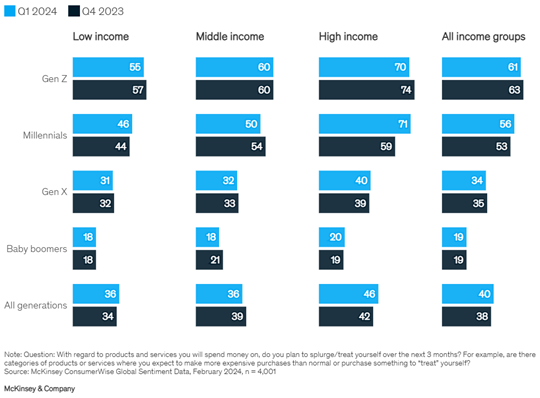

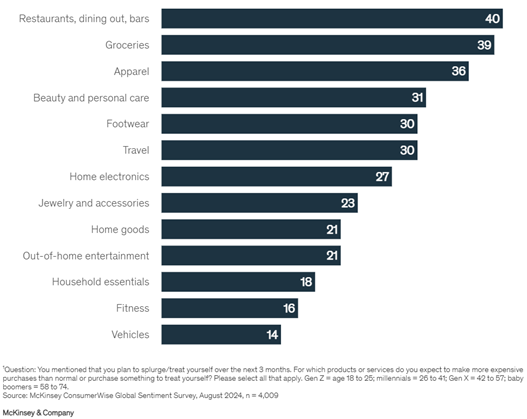

The McKinsey & Company article, “An update on US consumer sentiment: Consumer optimism rebounds—but for how long?” by Becca Coggins, Christina Adams, Kari Alldredge, and Warren Teichner finds that people are spending more on many of the above categories. Pessimism about the economy has declined over the past three years. Over a third of the “respondents say that stabilizing inflation has made them feel more optimistic about the economy”. The points that I took away are:

- Younger people tend to splurge more than older generations.

- Consumers indicated they planned to increase their spending on most essential, semi-discretionary, and discretionary items over the next three months.

- Seventy-six percent of consumers report trading down—that is, changing the type or quantity of purchases for better value and pricing…

- Consumers report trading down while at the same time signaling their intent to splurge. In the third quarter, more consumers across income and age groups indicated an intent to splurge compared with the previous quarter.

Figure #6: Share of Respondents Intending to Splurge in 2024, by Demographic, %

Figure #7: Categories Where Consumers Intend to Treat Themselves, % of All Respondents with Intent to Splurge

The above article describes spending increasing because of consumer optimism. Here is another article, “Gen Z and millennials are increasingly ‘doom spending.’ Here’s what it is and how to stop it” by Sawdah Bhaimiya at CNBC which describes younger people spending more because they are pessimistic about the economy and their future. When some people are depressed, they tend to spend more to pick themselves up. As an example, because of the high price of homes, some people may give up buying a home, and spend the money instead of saving for a down payment. One solution Ms. Bhaimiya offers is to increase the “pain of buying” such as driving to the store instead of the ease of online shopping. Ask yourself, “Do I really need this?”

Why are people spending more when many are living paycheck to paycheck or have little savings? “Inside the Psychology of Overspending and How to Stop” by Jessica Walrack in U.S. News and World Report describes why some people overspend. She lists five common reasons experts say Americans are overspending:

- Social Pressure: Buying what you see others buying as a way to signal that you can afford it, too.

- Lifestyle Creep: When your expenses unintentionally creep up as your income increases.

- Emotional Impulse Spending: A study reports that shopping enhances feelings of personal control, which suggests it’s likely to alleviate sadness.

- Not Accounting for Inflation: If you don’t adjust your budget to account for cost increases, you’ll likely find yourself overspending each month.

- Credit Misconceptions: The truth is that you have to pay back every dollar, plus interest and fees.

FINANCIAL COUNSELING VERSUS FINANCIAL ADVISORS

Key Point: Financial Counselors can assist in improving financial literacy and end living paycheck to paycheck if a person is willing to stick with it.

Financial advisors usually help to determine investments, asset location, and asset allocation, and produce a financial plan. Financial counselors provide a different service. People living paycheck to paycheck often have low savings so a financial counselor will probably be of more benefit than a financial advisor. John Egan describes the services and accreditation of a financial counselor as well as where to locate one in “What Is A Financial Counselor?” for Forbes Advisor.

Jean Folger provides a “Guide to Hiring a Financial Counselor“ in Investopedia. She lists typical support and guidance provided as:

- Build savings

- Create (and stick to) a budget

- Create a plan to pay down debt

- Deal with an immediate financial crisis

- Determine if you’re eligible for tax credits

- Improve your credit score

- Manage lines of credit

- Manage student loans

- Modify ineffective money habits

- Navigate available public benefits and community resources

- Set and realize financial goals

- Understand basic financial principles

- Improve your overall financial health

- Refer you to an investment advisor or financial planner when you’re ready

- Some financial counselors have extra training in other areas

Ms. Folger says that the price charged by a financial counselor is usually lower than when working with a financial advisor or certified financial planner. “Financial counselors who work in private practice may offer a free initial session and then charge a flat fee for any subsequent meetings. Others may charge an hourly rate or a monthly subscription,” she adds.

IMPROVING SAVING HABITS

Key Point: Create a budget. Cut out unnecessary subscriptions and services. Automate your savings. Pay off expensive debt or consolidate it with a lower interest rate. Just say “no” to those impulse purchases. Go for a walk in the park instead of walking through the mall. Consider a visit to a Financial Counselor.

Emily Batdorf wrote “Living Paycheck To Paycheck Statistics 2024” in Forbes Advisor, a “2023 survey conducted by Payroll.org.” When asked how people living paycheck to paycheck plan to save money, respondents cited three major strategies.

- Nearly 63% of respondents say making food at home and packing food when going out is their primary way of saving money.

- The second most common way to save was cutting back on nonessential expenses (57%).

- The third is shopping secondhand (50%).

Non-profit organizations like Habitat For Humanity, Goodwill, Salvation Army, and The Arc raise money through donations to their second-hand stores. There are many bargains. If you want to downsize or clean out your attic consider donating to a worthy organization.

To stop living paycheck to paycheck on your own, Julia Kagan suggests in “Living Paycheck to Paycheck: Definition, Statistics, How to Stop” at Investopedia that you can:

- Review your budget. Budgeting relies on tracking your expenses against your income… Look at every dollar you spend over a month to see if you can find out what may have increased your spending.

- Make sure you are saving. Living paycheck to paycheck often precludes saving. If you have little to no savings, start small—set aside 1% of each paycheck ($10 for every $1,000 you earn). And automate it so that you aren’t tempted to spend it.

- Pay off your debt. One downside of having no financial cushion is relying on credit cards with high APRs to cover emergencies of varying sizes. Depending on your situation, there are numerous ways to pay down credit card debt, including using a debt snowball strategy to pay off the smallest debt first, using a balance transfer on a credit card with 0% interest for a year or more, or getting a personal loan or a debt consolidation loan.

- Increase your income. Whether that means starting a side hustle, asking for a raise or a promotion, or finding a better-paying job, the extra cash can help you start setting aside more savings and/or paying off your debt faster.

Consider a non-profit financial counselor like the National Foundation for Credit Counseling (NFCC) which was founded in 1951 and works with consumers through one-on-one financial reviews. The press release, National Foundation for Credit Counseling Warns of Skyrocketing Consumer Financial Stress, describes a “critical level of financial strain where households are cutting back on food expenses and personal savings”.

Neighbor To Neighbor’s (where I volunteer) Financial Coaching includes 1) Personal Credit Score Analysis & Loan Options, 2) Personalized Budgeting Plan, and 3) Referrals for lenders, agents & other housing professionals. As part of the coaching, the manager helps clients analyze their spending habits to understand where they are spending their money.

Roughly two-thirds of employers offer 401(k) savings. Elizabeth Gravier says in an article at CNBC, “A 401(k) match is like free money — here’s how it works” that “98% of companies that offered a 401(k) in 2023 matched their employees’ contributions to some extent”. The typical match is 3 to 5%. This is an additional incentive to save at least the minimum amount to get the employer-matching contribution. If an employee contributes 5% and the employer contributes 3% then the savings rate is 8%.

For people with low and moderate incomes, the Retirement Savings Contributions Credit, also known as the Saver’s Credit, allows a person “to take a tax credit for making eligible contributions to your IRA or employer-sponsored retirement plan”. The maximum contribution amount is $2,000 ($4,000 if married filing jointly), making the maximum credit $1,000 ($2,000 if married filing jointly).

Closing

I believe in the “Pay yourself first” philosophy where you save money as a priority before you spend it. I also believe in maintaining emergency savings as a priority before investing. Life will have its challenges and emergency savings may be the difference between financial hardship and landing on your feet. If a person is living paycheck to paycheck then it may be worthwhile to visit a Financial Counselor/Coach.