I celebrated my 69th birthday last month and will just be reaching my prime next year. I volunteer at Habitat For Humanity two days per week building homes for those that might not otherwise be able to afford them. I have been greatly influenced by the wisdom of the now elders in finance. My friend Dave Hogle and I used to take a three-hour drive to the nearest Costco and discuss every topic under the sun. Nearly two decades ago, Dave loaned me The Four Pillars of Investing: Lessons for Building a Winning Portfolio (2d edition, 2023) by William J. Bernstein (1948- ) who laid out the foundations of investing:

- Theory: Risk and return go hand in hand—you can’t make money without risk

- History: Understand past markets to understand today’s markets

- Psychology: Avoid the most common behavioral mistakes that tank portfolios

- Business: The cost of investment services can be high—unreasonably high

I earned my MBA in 1988 and have read dozens of investing books popular at the time, but it wasn’t until I was established in my career and began accumulating savings that books like The Four Pillars of Investing had a major impact. Charles Schwab (1937 – ) is another financial elder who greatly influenced me by showing that investing is more than buying and selling stocks with Charles Schwab’s New Guide to Financial Independence (2004):

“Put bluntly, do all you can to ‘teach your wife to be a widow’-or, if you, as the wife, are in charge of the finances, ‘teach your husband to be a widower’. Take the saying metaphorically: Don’t let yourself, or anyone in your family, be indispensable in terms of understanding family finances.”

My investing experience can loosely be divided into a diversified buy-and-hold strategy of funds with low fees exemplified by Vanguard and one that invests according to the business cycle as exemplified by Fidelity. I use advisory services by both Fidelity and Vanguard for a portion of my investments. The Vanguard approach is described well by Charles D. Ellis (86) author of Inside Vanguard (2022) and Winning the Loser’s Game: Timeless Strategies for Successful Investing. Howard Marks (79) is the co-founder and co-chairman of Oaktree Capital Management and is famous for following market cycles. Mr. Marks wrote Mastering the Market Cycle: Getting the Odds on Your Side (2021).

In this article, I review the philosophies of Warren Buffett, A. Gary Shilling, and Howard Marks for insights into how to invest in 2025.

- Section 1, Warren Buffett

- Section 2, A. Gary Shilling

- Section 3, Howard Marks

- Section 4, Charles D. Ellis

- Section 5, How to Prepare for 2025

Warren Buffett

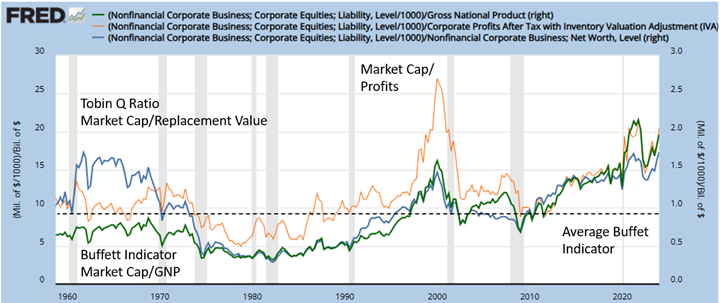

Warren Buffett (93) is the CEO of Berkshire Hathaway which I wrote about in the July MFO newsletter. The “Buffett Rule” was part of the tax plan proposed by President Barack Obama in 2011 (Investopedia). It was named after Mr. Buffett who believed in a tax structure that did not favor the wealthy. The Buffett Indicator is the ratio of stock market capitalization to gross national product. In Figure #1, I show the Buffett Indicator along with the Tobin Q Ratio, and Market Capitalization to Profits. All three methods indicate high stock valuations currently which imply lower secular returns.

Figure #1: Buffett Indicator Stock Market Valuation

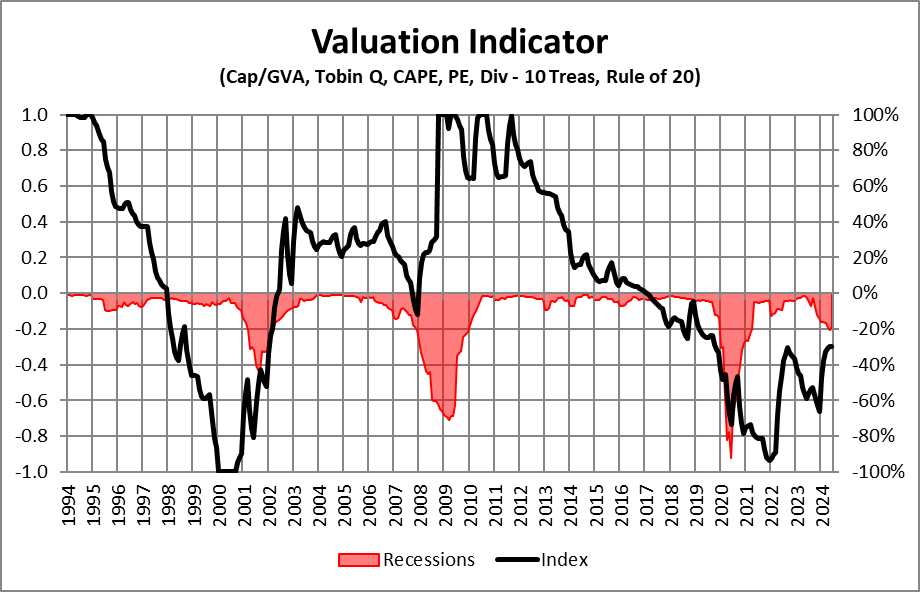

All valuation methods contain shortcomings and they are better long-term indicators of secular returns than short-term trading tools. Figure #2 contains my composite of valuation methods that address inflation, interest rates, and cyclically adjusted returns where a positive one is very positive for secular returns and a minus one is very negative. I believe the stock market is highly valued and secular returns are likely to be below average.

Figure #2: Author’s Composite of Valuation Methods

A. Gary Shilling

I read The Age of Deleveraging by A. Gary Shilling (87), who expected slow growth and deflation following the financial crisis. Growth was slow and inflation low, but massive stimulus dampened the impact. I have paid attention to the insights of Dr. Shilling, especially on bonds.

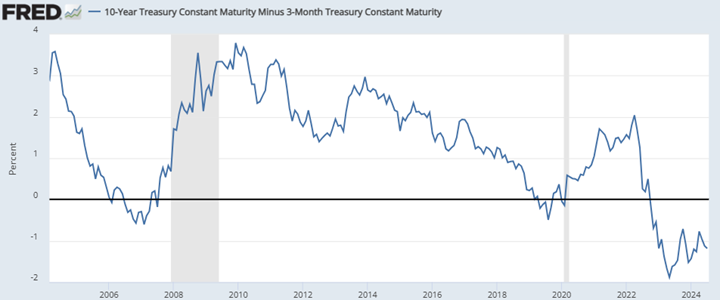

Dinah Wisenberg Brin wrote, “Gary Shilling: Investment Climate ‘Unhealthy’ for Stocks” for ThinkAdvisor. Dr. Shilling said in his monthly Insights newsletter, “The current investment climate is unhealthy. Economic growth has slowed, stocks are expensive, the Fed is unlikely to cut interest rates in the near term and speculation is still rampant and begging to be slashed.” He expresses concerns over the inverted yield curve, weakening labor market, and slowing consumer spending. He likes Treasury Bonds and cash and recommends avoiding speculative stocks.

Figure #3 shows that the 10-year Treasury to 3-Month Treasury maturity Yield Curve is still strongly inverted. Investors expect a decline in longer-term interest rates. Recessions usually follow periods of pronounced yield curve inversions and often occur shortly after the yield curve has been uninverted.

Figure #3: Ten-Year Maturity Minus 3-Month Treasury Yield Curve

For the next one to three years, I expect bonds to outperform stocks because when interest rates fall, bond values rise. In addition, stock valuations are high which implies lower returns. The Federal Reserve has kept interest rates high to slow the economy and lower inflation.

Howard Marks

I identify with the philosophy of Howard Marks (79), co-founder of Oaktree Capital Management, who wrote in Mastering the Market Cycle: Getting the Odds on your Side:

“In my view, the greatest way to optimize the positioning of a portfolio at a given point in time is through deciding what balance it should strike between aggressiveness/defensiveness. And I believe the aggressiveness/ defensiveness should be adjusted over time in response to changes in the state of the investment environment and where a number of elements stand in their cycles.”

Mr. Howards wrote “Market Outlook: The Definition of Insanity” as part of The Roundup: Top Takeaways from Oaktree Conference 2024.

…I believe fixed income investing may be better positioned today in risk/return terms than equity investing. Liquid credit instruments currently offer yields in the high single digits, and the yields on private credit are in the low double digits. These yields are highly competitive with the excellent historical returns on equities… These yields also exceed most investors’ required returns and are considerably less uncertain than the returns on equity and other ownership strategies. In other words, they have a high probability of delivering what they promise.

Mr. Howards also wrote The Folly of Certainty on July 17th to remind us that we don’t know what we don’t know and that political and market outcomes are uncertain. He concludes, “So, if anything, it reinforces my bottom line: making predictions is largely a loser’s game.”

Charles D. Ellis

Charles Ellis (86) is the author of Winning the Loser’s Game where he has the following to say about beating the market and the difficulty that individuals have in general.

Unhappily, the basic assumption that most institutional investors can outperform the market is false. Today, the institutions are the market. Institutions do over 95 percent of all exchange trades and an even higher percentage of off-board and derivatives trades. It is precisely because investing institutions are so numerous and capable and determined to do well for their clients that investment has become a loser’s game. Talented and hardworking as they are, professional investors cannot, as a group, outperform themselves. In fact, given the cost of active management—fees, commissions, market impact of big transactions, and so forth—investment managers have and will continue to underperform the overall market…

Holding onto a sound policy through thick and thin is both extraordinarily difficult and extraordinarily important work. This is why investors can benefit from developing and sticking with sound investment policies and practices. The cost of infidelity to your own commitments can be very high.

How to Prepare for 2025

From the comments by the wise financial elders, we see stocks are highly valued, opportunities lie in fixed income, and individual investors should not try to time the markets. I advocate for individual investors to consult with a Financial Advisor. I also advocate using the Bucket Approach. The Bucket Approach allows me to be ultra-conservative in Bucket #1 for short-term withdrawal needs, conservative in Bucket #2 for intermediate needs, and aggressive in Bucket #3 for legacy investing. There is a psychological advantage to understanding that the volatility is mostly occurring in investments that I won’t need for many years.

To prepare for 2025, there are things that we can do as part of a long-term strategy. I topped up our Bucket #1 for short-term living expenses. We rebalanced Bucket #2 to reduce risk assets and to increase fixed income to meet withdrawal needs for the next several years. We consulted with our Financial Advisor and adjusted our plan to be more tax-efficient. Fidelity manages a portion of my Bucket #3 legacy assets according to the business cycle and for tax-smart strategies, and their Third Quarter Outlook can be found here.

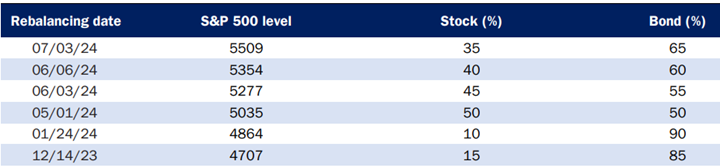

I own several funds in the Bucket #2 accounts that I manage to dampen downturns, for diversification, or to adjust allocations according to the market cycles. David Snowball wrote Standpoint Multi-Asset Fund: Forcing Me to Reconsider, and I wrote One of a Kind: American Century Avantis All Equity Markets ETF (AVGE). Information about the Thermostat Fund (COTZX/CTFAX) can be found at the Columbia Thermostat website and Morningstar. Columbia Thermostat adjusts allocations to stocks and bonds based on market conditions and valuations. As can be seen in Table #1, they have been lowering allocations to stocks from 50% in May to 35% in July. This fund is most appropriate to be held in a tax-advantaged account. This is consistent with the findings in this article.

Table #1: Columbia Thermostat Rebalancing Allocations.

Source: Columbia Thermostat website

Christine Benz describes withdrawal strategies and taxes in “Get a Tax-Smart Plan for In-Retirement Withdrawals” where she says, “it’s usually best to hold on to the accounts with the most generous tax treatment while spending down less tax-efficient assets.” She provides some examples of tax-deferred and tax-efficient portfolios for savers and retirees in “Our Best Investment Portfolio Examples for Savers and Retirees”.

Closing

As I write this closing, Real Gross Domestic Product for the second quarter was just released and is 2.8% annualized. The economy has remained surprisingly resilient for the past two years. Personal Consumption Expenditures: Chain-type Price Index shows that inflation has declined for over two years to about 2.6%. My strategy is not dependent on the timing of interest rate cuts; however, I expect at least two interest rate cuts this year.