“We are living through investment regime change”

Objective and strategy

Seafarer Overseas Value pursues long-term capital appreciation. The fund typically invests in common stocks, though the managers have the ability to add both preferred stocks and fixed-income securities. The investable universe includes both emerging markets, as traditionally conceived, and companies domiciled in selected foreign developed nations (including Australia, Hong Kong, Ireland, Israel, Japan, New Zealand, Singapore, and the United Kingdom) when those companies have “significant economic and financial linkages to developing countries.”

The portfolio is built through bottom-up security selection based on fundamental research. The managers are looking for “securities priced at a discount to their intrinsic value.”

Adviser

Seafarer Capital Partners is an investment adviser focused on emerging markets. Founded in 2011, Seafarer is a wholly employee-owned firm located in the San Francisco Bay. Both of their strategies aim to provide long-term investment portfolios that offer sustainable growth, reasonable income, suitable diversification, and volatility mitigation. The firm’s goal is to build lasting wealth for clients over time. Seafarer specializes in co-mingled, long-only emerging markets funds. The firm serves as the investment adviser to the Seafarer Overseas Growth and Income Fund and the Seafarer Overseas Value Fund. Morningstar estimates that the firm has a bit over $2 billion in AUM with a quarter billion in inflows over the preceding 12 months (from 3/20/23).

Managers

Paul Espinosa, Brent Clayton, and Andrew Foster.

Paul Espinosa, Brent Clayton, and Andrew Foster.

Mr. Espinosa is the Lead Portfolio Manager of the fund and has been so since its inception, which means he has primary responsibility for the day-to-day management of the fund’s portfolio. Before joining Seafarer in 2014, Mr. Espinosa was an equity research analyst at Legg Mason, where he focused on global emerging markets. That was preceded by stints at Citigroup Asset Management and J.P. Morgan.

Mr. Clayton became co-manager in February 2023 though he has been with Seafarer since 2018. Before that, he was Co-Portfolio Manager, Head of Fundamental Research, and Equity Analyst at LR Global Partners, an investment firm focused on value-based investing in frontier and emerging markets.

Mr. Foster is one of Seafarer’s founders, its CIO, and a Lead Portfolio Manager of the Seafarer Overseas Growth and Income Fund. Before founding Seafarer Capital Partners in 2011, Mr. Foster was a Lead Portfolio Manager, Acting Chief Investment Officer, Director of Research at Matthews International Capital Management, and adviser to the Matthews Asia funds.

The Seafarer team is admirably and exclusively focused on their funds. While managers at many other advisers split their time between a half dozen funds, a couple of hedge funds, and a bunch of separate accounts, the Seafarer Funds managers focused on … well, the Seafarer Funds.

| Other funds managed | Other pooled vehicles managed | Other accounts managed | |

| Andrew Foster | 0 | 0 | 0 |

| Paul Espinosa | 0 | 0 | 0 |

| Lydia So | 0 | 0 | 0 |

| Kate Jaquet | 0 | 0 | 0 |

Source: Statement of Additional Information (2022)

Strategy capacity and closure

Seafarer has both a commitment to and tradition of closing their funds when it is in their current shareholders’ best interest to do so. We do not have a formal calculation of the strategy’s capacity, but the combination of a concentrated portfolio (around 40 names) and substantial small cap exposure (currently 10 stocks with market caps below $1 billion) implies a cap in the lower billions.

Management’s stake in the fund

Ms. Espinosa has invested between $100,000 and $500,000 in his fund. Co-manager Andrew Foster has invested over $1 million, and Mr. Clayton, who recently moved from analyst to co-manager, has invested between $10,000 – $50,000 in the fund.

A note on vigilance: having skin in the game generally leads managers to be rather more risk conscious than others. (Ma & Tang, “Portfolio manager ownership and mutual fund risk taking,” 2018) Having your boss’s skin in the game ramps that up by an amount surpassed only by having your in-laws’ skin in the game.

Opening date

May 31, 2016

Minimum investment

The minimum for Investor shares is $2,500, and for Institutional shares, $25,000. The Investor minimum is reduced for both retirement accounts and accounts set up with an automatic investing plan.

Expense ratio

The Investor shares carry a net e.r., after waivers, of 1.15% on assets of $85 million dollars, as of July 2023. Institutional shares charge 1.05%, net.

Comments

Close your eyes and imagine seeing “an emerging markets city.” What do you see? The crowded streets of Mumbai? An open-air spice market in Istanbul? A shining sea of skyscrapers ringed by tin-roofed huts?

Do the same exercise with professional investors and, instead of cityscapes, there’s a tumult of concepts: obscure and unreliable accounting, opaque corporate structures, arcane market rules, wild currency fluctuation, endless government meddling … an unmanageable swamp.

Do the same exercise with professional investors and, instead of cityscapes, there’s a tumult of concepts: obscure and unreliable accounting, opaque corporate structures, arcane market rules, wild currency fluctuation, endless government meddling … an unmanageable swamp.

Conclude the exercise with Paul Espinosa, and an entirely different picture appears:

He sees some of the best management teams in the world whose members have graduated from some of the world’s best universities and who have been tested in some incredibly challenging markets. These teams, he suggests, “by virtue of their cosmopolitan domicile, tend to have a mixture of domestic and international management, and at the risk of overgeneralizing, a degree of professionalism that one does not always find elsewhere.”

He sees some of the best-run, most competitive corporations which are steadily earning market share in the US and Europe by out-competing their domestic competitors. Samsung might be one example, and China’s WH Group, owner of Smithfield in the US, might be another, but Mr. Espinosa thinks the clearest is Ambev.

Ambev was formed in 1998 through the merger of two Brazilian brewers: Brahma and Atarctica. The management team that oversaw that corporate marriage was the one that developed the now famous “zero-budgeting” process employed by 3G Capital and Warren Buffet to manage the Kraft-Heinz merger. The serial acquisitions to build the Ambev empire in the Americas culminated with the merger with Interbrew (Belgium-based) and subsequent merger with Anheuser Busch (US-based). The dominant shareholders of Anheuser-Busch InBev are the original Brazilian and Belgian families. The top management of ABI has also been Brazilian. At its heart, ABI is the manifestation of a Brazilian takeover of the global brewing industry.

He sees consistent mispricing driven by the location of corporate offices since many of the largest mutual funds are constrained from touching “the emerging markets.”

He sees consistent mispricing driven by the size of the corporations since huge and passive funds are constrained by liquidity screens from looking at smaller firms; in consequence, 201 of 224 emerging markets funds fall solidly in Morningstar’s “large cap” box.

He sees consistent mispricing driven by the fact that many rock-solid investments do not bear the traditional markers of “growth stocks,” the preferred style of most EM investors. Only 50 of the 224 emerging markets funds fall into the “value” realm.

He sees Anheuser Busch, “a global brewer that derives most of its revenue from emerging markets,” and the street of Brussels.

He sees problems investing in countries where politicians, rather than managers and boards, control the decisions that corporations make (Mr. Foster was once told that any significant layoffs at Sberbank would have to be reviewed by Mr. Putin himself), and so his exposure to China and Russia has been one-third of his peers. Morningstar celebrated Seafarer’s flagship as one of the few EM funds to miss the Russian collapse (Katharine Lynch, “Just 8% of Emerging-Markets Funds Miss Russian Collapse,” 3/9/2022).

And he sees those differences clearly enough that Overseas Value has an active share of 98. It was the best-performing diversified emerging markets fund of 2022, posting a loss of -0.7% against a peer average of -20.8%, and has earned both MFO’s Great Owl designation and Morningstar’s backward-looking Five-Star and forward-looking Silver recognitions.

MFO does not endorse using short term returns as a way to make investment decisions; that’s nothing but a recipe for heartache. Seafarer has a 6.8-year track record. Over the past five- and six-year periods, it has been a top-five diversified EM fund based on both total returns and risk-adjusted returns (reflected in its Sharpe ratio, as well as the more risk-sensitive Sortino and Martin ratios and Ulcer Index). Morningstar places its total returns over five years in the top 3% of its peer group (as of 3/28/2023).

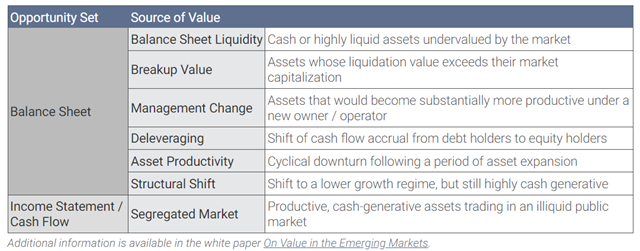

The process: In broad terms, Mr. Espinosa works within a universe of approximately 450 EM value stocks whose net value is something like $1.5 trillion. His discipline is built around identifying the most compelling investments by assessing each corporation against a rubric that identifies seven potential sources of value.

He invests, generally for the long-term, in the 40 most compelling opportunities. Turnover tends to be in the teens, and he reports that the last time he removed a name from the portfolio was in the third quarter of 2021.

Bottom Line

Mr. Espinosa sees an epochal change in investment reality coming. The story for the past three decades has been the same: buy the US, buy large caps, buy growth, buy investment grade debt, buy indexes and you’re sure to win. His tone is less derisive than sorrowful:

The cost of preconceptions became apparent in 2022. In the United States, fixed income instruments generated returns as negative as those of equity securities. The returns of emerging market equity indexes were comparable to those of the S&P 500 in a down year. The traditional safety of the fixed income asset class was conspicuous by its absence, as was the beta historically associated with emerging market equities.

While investors could have anticipated both the risk associated with prospective bond returns when interest rates are pegged to the floor and the diminished risk associated with the lower valuations of emerging markets compared with U.S. equities, how many acted on said investment conditions? Arguably, a meaningful set of investors identified these insights last year, but few invested with anticipation, otherwise market returns would not have proven as costly.

It is indeed difficult for an investor to overcome the preconception that a balanced portfolio is safer than an equity-only one, or that emerging market equity indexes are more volatile than a U.S. market index.

Another preconception the future may challenge is the view that emerging market (EM) corporates are riskier than developed market ones, at least on a selective basis. Seafarer’s work over the years has revealed a growing list of EM companies that are managed just as well as leading global corporates and have expanded internationally, including into developed markets, mirroring the behavior of multinational corporations that expand into emerging markets. Moreover, many of these EM companies’ management teams are battle tested in navigating high inflation, volatile foreign exchange rates, and erratic economic growth – challenges that developed market management teams have faced less acutely, and few Chinese management teams have faced at all. I would argue that these select EM corporates redefine risk in a way that may transcend the traditional definition of risk in terms of countries. The traditional definition of risk may prove a handicap to generating investment returns in select EM corporates in the same way that preconceptions proved a handicap to investors in 2022.

We are living through an investment regime change, and I find the foregoing redefinition of risk a reason to be optimistic about the prospect for future investment returns even in a slower-growth world. That is, as long as the investor is selective and unencumbered by preconceptions.

Seafarer has a long history of dogged independence, of managing to preserve their investors’ wealth, and of producing reasonable returns in unreasonable markets. Seafarer Overseas Value Fund has embodied those family traits and has served its investors exceptionally well, even in markets that did not favor their style. As the world begins to grapple with the realities that Seafarer has already mastered, their prospects seem exceptionally bright. It surely deserves a place on any equity investor’s due-diligence list.

Fund website

The Seafarer Funds site is incredibly rich. It presents a wealth of historic fund composition and performance data that is largely unmatched for the investor. Seafarer Overseas Value Fund’s homepage is clean and readable. You can learn a lot there. I particularly like Paul’s habit of flagging the potential sources of value for each reported holding. An example from their January 2023 portfolio review illustrates the notion:

The Fund’s appreciation this quarter appears to relate to the combination of low valuations and improving profit prospects of the Fund’s holdings. China’s relaxation of its zero-Covid policies contributed to significant appreciation of several China-related holdings. Specifically, the share price of Melco International (Asset Productivity and Breakup Value source of value; the “source of value” for a Fund holding is hereafter referenced in parentheses), a casino owner and operator in Macau, rose 38.69% in U.S. dollar terms during the fourth quarter, on the expectation that the relaxation of travel restrictions in China would increase the number of visitors to Macau, which had fallen to an all-time low. The share prices of Shangri-La (Breakup Value and Asset Productivity), a hotel owner and operator, and DFI Retail (Management Change and Asset Productivity), a multi-format retailer operating in Asia, rose for the same reason.