Updates

And the beat goes on. Five more mutual funds are becoming ETFs. On October 22, 2021, the Adaptive Fundamental Growth Fund, Adaptive Hedged High Income Fund, Adaptive Hedged Multi-Asset Income Fund, Adaptive Tactical Outlook Fund, and Adaptive Tactical Rotation Fund will be converted into the AI Quality Growth ETF, Adaptive High Income ETF, RH Hedged Multi-Asset Income ETF, RH Tactical Outlook ETF, and RH Tactical Rotation ETF, respectively. While the names and structure change, the investment strategies do not.

DFA is dancing to that very beat. Two more active DFA mutual funds have converted to ETFs: Dimensional International value ETF (DIV) and Dimensional DFA World ex US Core Equity 2 ETF (DFAX). That brings the DFA tally to nine ETFs, six of which are converted mutual funds, and about $40 billion in ETF assets.

Briefly Noted . . .

Franklin Templeton announced that it will acquire O’Shaughnessy Asset Management, LLC. The celebration of O’Shaughnessy focuses on SMAs and custom indexing services, with the acquisition of its one remaining fund (O’Shaughnessy Market Leaders Value) and four ETFs (mostly “quality dividend” focused) as a minor afterthought.

Stand by for the executions. Macquarie Asset Management purchased Waddell & Reed Financial and, through them, the Ivy Funds. Macquarie has “completed a thoughtful review” and will soon announce “a number of changes” to who manages a fund, benchmark changes, and, in some cases, investment strategy modifications and liquidations.

Perhaps as a warm-up exercise, Macquarie has resolved to liquidate and dissolve Delaware Ivy ProShares Russell 2000 Dividend Growers Index Fund, Delaware Ivy ProShares MSCI ACWI Index Fund, Delaware Ivy Cash Management Fund, Delaware Ivy VIP Government Money Market, Delaware Ivy VIP Global Bond, Delaware Ivy ProShares Interest Rate Hedged High Yield Index Fund, and Delaware Ivy ProShares S&P 500 Bond Index Fund on or about November 15, 2021.

Applying the SPACkling: Voya has added SPACs as investment options for the Global High Dividend Low Volatility, International High Dividend Low Volatility, Multi-Manager Emerging Markets Equity, Multi-Manager International Equity, Multi-Manager International Factors, and Multi-Manager International Small Cap funds.

Applying the SPACkling: Voya has added SPACs as investment options for the Global High Dividend Low Volatility, International High Dividend Low Volatility, Multi-Manager Emerging Markets Equity, Multi-Manager International Equity, Multi-Manager International Factors, and Multi-Manager International Small Cap funds.

VanEck Digital Transformation ETF announced some unhappy news (“Effective September 17, 2021, semiconductor and online money transfer companies will no longer be eligible for inclusion in the Index”) and then some news that might affect the fund’s tracking error (“Semiconductor and online money transfer companies that do not meet the above criteria may be added to the Index to reach a component number of 25”). Translation: “We have an investment universe so small that if we eliminate the two sectors we propose to eliminate, our portfolio violates other rules so … ummm, we’re going to squint really hard!”

SMALL WINS FOR INVESTORS

Effective October 1, 2021, Investor Class Shares, Y Class Shares and I Class Shares of Acadian Emerging Markets Portfolio will be available for purchase. Should you peek in? The fund has seen three years of pretty consistent outflows. By pretty much every measure we track, the fund has been mediocre since inception. Not bad, by any means, just “almost identical to its peer group average” on the standard measures of risk-adjusted performance.

After a four-month closure, DGI Balanced Fund has reopened to new investors. A curious fund. Opened in May. Drew a quarter billion in assets. Closed in June. Reopened and, as of 10/1/2021, has managed to turn a $10,000 initial investment into … well, $10,000.

CLOSINGS (and related inconveniences)

Nuveen High Yield Municipal Bond Fund closed to new investors on September 30, 2021.

Victory Sycamore Established Value Fund and Victory Sycamore Small Company Opportunity Fund have closed to new investors.

OLD WINE, NEW BOTTLES

On October 1, 2021, Aquila Three Peaks High Income Fund and Aquila Three Peaks Opportunity Growth Fund were renamed Aquila High Income Fund and Aquila Opportunity Growth Fund, respectively. That’s consequent to Three Peaks surrendering their sub-advisory role on the funds.

Effective on or about November 6, 2021, Aware Ultra-Short Duration Enhanced Income ETF will change names to become the National Investment Services Ultra-Short Duration Enhanced Income ETF.

Baird Small-Cap Value is giving up on … well, small caps and value to become Baird Equity Opportunity Fund as management switches to Greenhouse Funds LLLP (more L’s than I’m used to seeing) and becomes a focused, opportunistic SMID cap fund.

Following shareholder approval, BlackRock Long-Horizon Equity Fund will be renamed BlackRock Unconstrained Equity Fund.

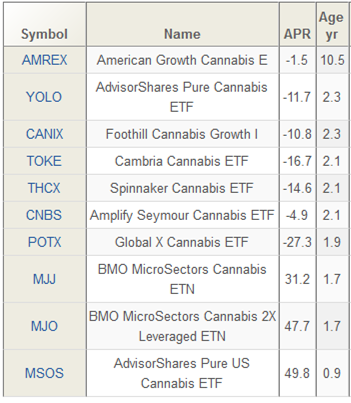

On September 24, 2021, the Cannabis Growth Fund became an exchange-traded fund, the Cannabis Growth ETF. For what interest it holds, here are the lifetime records of all 10 funds and ETFs whose name includes “cannabis.”

EEEEEEEEEEE! Aberdeen Standard Bloomberg All Commodity Strategy K-1 Free ETF, Aberdeen Standard Bloomberg All Commodity Longer Dated Strategy K-1 Free ETF, and Aberdeen Bloomberg Industrial Metals Strategy K-1 Free ETF have gotten virtually E-free as they transition from Aberdeen (which people both can say and which makes some sense) to abrdn (for which neither is true). The more pressing question, “why didn’t they also become the strategy TFs?” remains unanswered.

Effective November 1, 2021, Catalyst Multi-Strategy Fund becomes Catalyst Income and Multi-Strategy Fund and gains a heightened appreciation for income.

Effective September 30, 2021, the name of the Emerald Banking and Finance Fund has changed to the Emerald Finance & Banking Innovation Fund.

First Trust Strategic Income ETF intends to become a fund-of-funds. Following shareholder approval of the changes, the fund will be renamed First Trust High Income Strategic Focus ETF (HISF).

Effective September 1, Harbor Mid Cap Growth Fund was renamed Harbor Disruptive Innovation Fund.

Effective on or about October 28, 2021, Janus Henderson Short-Term Bond Fund will change its name to Janus Henderson Short Duration Flexible Bond Fund.

Effective as of December 29, 2021, the PGIM QMA funds become the PGIM Quant Solutions funds. Before they became obsessive with abbreviations, PGIM was just Prudential. The name changes will not result in any change in the investment objective or investment strategies.

| PGIM QMA US Broad Market Index | PGIM Quant Solutions US Broad Market Index |

| PGIM QMA Mid-Cap Core Equity | PGIM Quant Solutions Mid-Cap Core * |

| PGIM QMA International Developed Markets Index | PGIM Quant Solutions International Developed Markets Index |

| PGIM QMA Emerging Markets Equity | PGIM Quant Solutions Emerging Markets Equity |

| PGIM QMA Commodity Strategies | PGIM Quant Solutions Commodity Strategies |

| PGIM QMA Large-Cap Value | PGIM Quant Solutions Large-Cap Value |

| PGIM QMA Stock Index | PGIM Quant Solutions Stock Index |

| PGIM QMA Large-Cap Core Equity | PGIM Quant Solutions Large-Cap Core * |

| PGIM QMA Mid-Cap Value | PGIM Quant Solutions Mid-Cap Value |

| PGIM QMA International Equity | PGIM Quant Solutions International Equity |

| PGIM QMA Small-Cap Value | PGIM Quant Solutions Small-Cap Value |

| PGIM QMA Strategic Alpha International Equity ETF | PGIM Quant Solutions Strategic Alpha International Equity ETF |

| * Remove “equity” from fund name. |

Effective on December 10, 2021, VanEck Vectors ChinaAMC SME-ChiNext ETF will be renamed VanEck ChiNext ETF. (And here we thought ChiNext was just an upscale brand of paper plates!)

Effective September 1, 2021, the 35 VanEck Vectors ETFs will be re-named VanEck ETFs. Their lineup ranges from the eminently sensible (VanEck Morningstar Wide Moat ETF) to … well, the regrettable (VanEck Social Sentiment ETF, Gaming and eSports ETF).

Hope Allsprings eternal. Two items in the news which cynics suspect are related. Item #1, Wells Fargo has been found guilty of fraud for the … oh, who knows, 240th time? Wells Fargo has paid, or agreed to pay, $72.6 million for defrauding 771 small and medium-sized businesses. The lede from the Daily Mail (9/27/2021) captures the scam:

Wells Fargo will pay $37 million in fines after “routinely” lying to small and medium businesses about exchange rates and keeping a running tally of the overages they were willing to accept while their own workers made up to $1 million in bonuses.

The bank failed to disclose the fees it charged companies that dealt in foreign currency between 2010 and 2017, only letting them know about the ‘all in’ final rate rather than the market rate or the extra money it was charging … The bank has already paid $35 million in restitution to its customers, according to the settlement, the latest in a series of scandals that have damaged the bank’s reputation.

Forbes (9/28/2021) went into damning detail about the callous and calculated ways in which Wells Fargo employees executed the fraud.

Admittedly $72.6 million is chump change compared to the $3 billion they were forced … ummm, agreed to pay out last year, as a result of their vast fake accounts scam but it’s still not a good look.

Item #2, Wells Fargo Asset Management – which is completely blameless and has operated a clean business for decades – has announced that they and their funds’ names will be changing from Wells Fargo to Allspring on December 6, 2021.

OFF TO THE DUSTBIN OF HISTORY

AQR Risk Parity II MV Fund will be liquidated on November 5, 2021, having paid three distributions between the announcement of the liquidation and its occurrence.

Bridgeway Small-Cap Growth Fund (BRSGX) has been merged into Bridgeway Small Cap Value Fund.

The tiny, five-star Easterly Hedged High Income Fund was liquidated on September 30, 2021. Until six months ago it was the ALPs/Westport Resources Hedged High Income Fund.

Because the funds’ assets are “remaining quite small” and not anticipated to grow, Global X TargetIncome Plus 2 ETF, Global X MSCI China Large-Cap 50 ETF, and Global X TargetIncome 5 ETF will be liquidated (and terminated!) on October 15, 2021.

Having determined “that continuation of the fund is not in the best interests of the fund or its shareholders as a result of factors or events adversely affecting the fund’s ability to conduct its business and operations in an economically viable manner,” John Hancock Absolute Return Opportunities Fund will cease to be, on or about October 29, 2021

Morgan Stanley Institutional Intermediate Municipal Income Portfolio and Municipal Income Portfolio were liquidated, on seven days notice, on September 24, 2021.

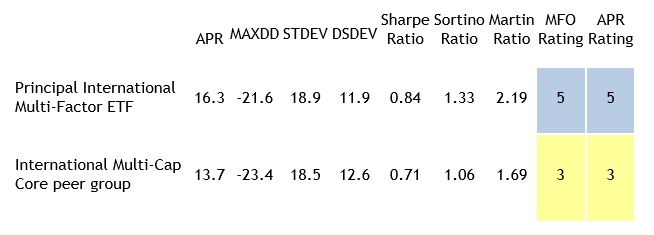

My former president, Tom Tredway, observed, “to ask the question is to ask the question.” That is, I would not ask “gee, I wonder if he’s a reality-challenged nutjob?” unless I thought there was a good reason to worry that he’s exactly that. And so, when the Principal Global Investors muses aloud “I wonder if it’s time to kill this fund?” you’ve got to assume there’s reason to kill the fund (and they probably will).

Here’s the unprompted public musing about a two-year-old fund:

Principal International Multi-Factor ETF

Principal Global Investors, LLC (“PGI”), the Fund’s investment advisor, is currently assessing potential strategic options for the Fund but has not yet made a final determination. Options being considered include a broad range of potential recommendations to the Fund’s Board of Trustees, including the possible continuance of the Fund, a combination or reorganization of the Fund, or liquidation of the Fund. PGI is expected to formulate a recommendation to the Board by the end of 2021.

And here’s the entirely admirable performance profile, since inception, for the $50 million fund from MFO Premium.

Higher returns, lower downside volatility, smaller drawdown higher risk-adjusted returns, two-tier MFO rating … yep, they’re pretty much toast.

PSI Tactical Growth Fund will be liquidated on October 8, 2021.

Rational Insider Buying VA Fund will reach its rational end on or about November 30, 2021. The fund is used as a funding vehicle for variable annuity contracts of several insurance companies.

RiverFront Dynamic Unconstrained Income ETF will be liquidated on October 22, 2021.

A minor stay of execution has been granted for Schroder Long Duration Investment-Grade Bond Fund. The fund’s liquidation, first scheduled for September 30, has been delayed to October 20, 2021.

Schwab Hedged Equity Fund will be liquidated on October 22, 2021. The fund has seen substantial outflows since the fourth quarter of 2018 and now has $67 million in AUM. This year’s peer-clobbering performance (its 17% returns through September 2021 are effectively double those of its peers) has not brought any renewed interest in the fund, which was likely fatal.

The Trend Aggregation Conservative ETF was liquidated on September 28, 2021. Apparently, the trend was not their friend.

VanEck Vectors Emerging Markets Aggregate Bond ETF and VanEck Vectors Unconventional Oil & Gas ETF will undergo “liquidation, winding down and termination” happen on or about Friday, October 22, 2021. Kudos to VanEck for introducing a new verb into the process!

On February 11, 2022, the 12 Vanguard Institutional Target Retirement Funds will each merge into the corresponding Vanguard Target Retirement Fund. Following each reorganization, the expense ratio for each Target Retirement Fund will be reduced to 0.08%.

VictoryShares Top Veteran Employers ETF and VictoryShares Protect America ETF will liquidate on or about October 15, 2021.

On July 26, 2021, the investment strategy for Virtus KAR International Small Cap Fund changed to an international small-mid cap strategy. In a singular display of flexibility and a remarkable act of contortion, on September 24, 2021, Virtus KAR International Small-Mid Cap Fund changed its name to Virtus KAR International Small-Mid Cap Fund II (for our purposes, VKISMF II). Then Virtus KAR International Small-Cap Fund will be renamed Virtus KAR International Small-Mid Cap Fund, the name formerly held by VKISMF II, and the former VKISMF (now WKISMF II, remember) will merge into the current VKISMF, and disappear. As previously disclosed.

On July 26, 2021, the investment strategy for Virtus KAR International Small Cap Fund changed to an international small-mid cap strategy. In a singular display of flexibility and a remarkable act of contortion, on September 24, 2021, Virtus KAR International Small-Mid Cap Fund changed its name to Virtus KAR International Small-Mid Cap Fund II (for our purposes, VKISMF II). Then Virtus KAR International Small-Cap Fund will be renamed Virtus KAR International Small-Mid Cap Fund, the name formerly held by VKISMF II, and the former VKISMF (now WKISMF II, remember) will merge into the current VKISMF, and disappear. As previously disclosed.

The merger of Wells Fargo Diversified Equity Fund into Wells Fargo Spectrum Aggressive Growth Fund is now expected to occur on or about February 4, 2022. At the same time, the 12 Wells Fargo Target (date) funds will merge into the corresponding Wells Fargo Dynamic Target (date) funds.