By Morningstar’s calculation, there are 486 “socially-conscious” funds. While bond and mixed-asset funds can be “socially-conscious,” Morningstar does not rate the sustainability of their portfolios. If you subtract the 183 funds in those categories, you’re left with 303 “socially-conscious” equity funds. Only 93 (or 31%) have portfolios that score “high” on Morningstar’s sustainability ratings while 101 more are “above average,” so about two-thirds of ESG funds earn good-to-great sustainability scores.

At the other end of the spectrum, 18 (about 6%, including one with “environmental” in the name) have the lowest-possible sustainability rating.

MFO, which draws its data from Refinitiv (formerly Thomsen-Reuters, formerly Lipper), can identify 339 “socially-conscious” funds and ETFs, combined. In either case, ESG-conscious investors have a wealth – and possibly a welter – of choices to contend with.

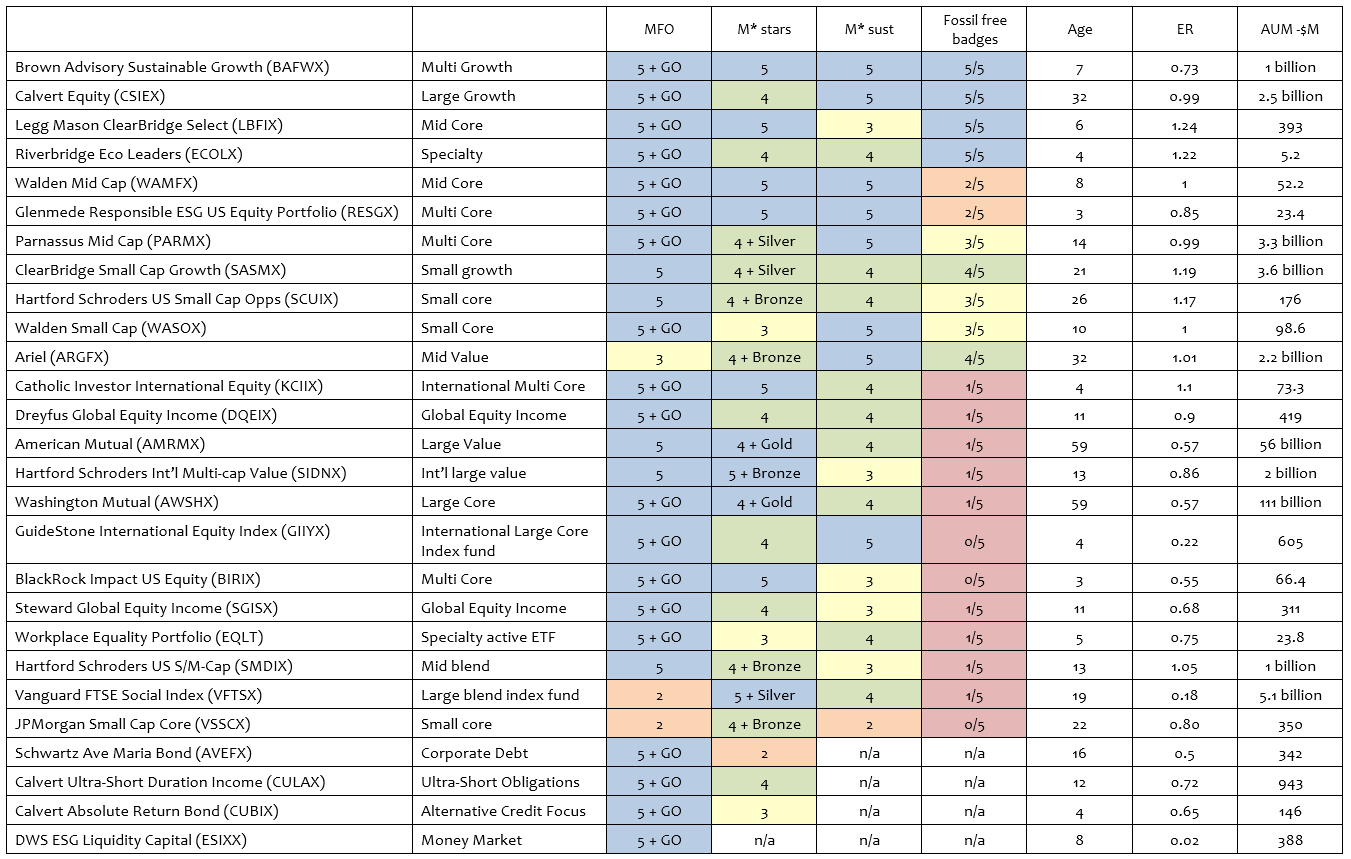

To help create a more manageable short list of ESG funds that might be worth consideration, we combined three datasets and two sets of measurements to identify 27 first-tier options for you.

Screen one: we looked for “socially conscious” funds in both the Morningstar and MFO datasets.

Screen two: we selected funds with strong risk-adjusted returns. Those were defined as funds that have an MFO rating of 5 for risk-adjusted performance (and noted the Great Owl funds, GO on the table, which have been incredibly persistent outperformers) or a Morningstar rating of four- or five-stars (and noted the presence of a positive analyst rating).

Screen three: we selected funds with the most promising records of environmentally sustainable investments by looking at their Morningstar sustainability ratings and the Fossil Free Funds badges.

Then we added three bits of important information: age (since excellence over long periods is especially notable), expenses and fund size. To make it easy to scan, we color-coded each cell with blue for the highest score, green for second and so on. Finally, we sorted the table by score. Brown Advisory ranks first with 20 of a possible 20 points, Calvert is second with 19 of 20 and so on.

Remember: these are all really solid performers, whether at the top of the table or at the bottom of it. Our basic starting point for inclusion was outstanding risk-adjusted returns.

Three important notes to help you interpret the table:

- The ranking is most sensitive to the “E” in “ESG.” That might not align with your interests if, for example, you’re intensely motivated to find firms that treat their employees with respect.

- Environmentally sensitive funds without an explicit ESG mandate are missing. If we keyed off the fund’s Morningstar sustainability rating, which is based on a portfolio analysis rather than on the prospectus language, interesting opportunities are added. The funds below don’t invoke “the trigger words” but act responsibly and perform splendidly.

| MFO | M* stars | M* sust | Age | ER | AUM -$M | ||

| Champlain Mid Cap (CIPMX) | Mid growth | 5 + GO | 5 + Gold | 5 | 11 | 1.05 | 3.1 billion |

| Buffalo International (BUFIX) | Int’l multi growth | 5 + GO | 5 | 5 | 11 | 1.05 | 325 |

| Monongahela All Cap Value (MCMVX) | Multi value | 5 | 5 | 5 | 6 | 0.87 | 12 |

| FAM Equity-income (FAMEX) | Mid growth | 5 + GO | 5 | 4 | 23 | 1.26 | 283 |

| Harding Loevner EM (HLMEX) | EM | 5 | 4 + Silver | 5 | 20 | 1.40 | 3.8 billion |

| Crawford Dividend Opp (CDOFX) | Small core, dividend focused | 4 | 5 | 5 | 6 | 1.05 | 214 |

| Seafarer Overseas Gr & Income (SIGIX) | EM | 5 | 3 + Silver | 5 | 7 | 0.87 | 1.5 billion |

| Dreyfus Total EM (DTEIX) | EM balanced | 4 | 5 | 4 | 8 | 1.30 | 28 |

Dreyfus just announced plans to liquidate DTEIX on May 20, 2019, because producing twice your peers’ returns with 80% of their volatility just isn’t sexy enough for investors.

- Many fine socially-conscious funds fall just outside of our performance metrics. Remember, we targeted funds with a “5” from MFO (top 20% risk-adjusted returns since inception) and a “4” or “5” from Morningstar. Of necessity, some entirely credible ESG funds live just outside that fence. Here are two examples.

| MFO | M* stars | M* sust | Age | ER | AUM -$M | ||

| Trillium P21 Global Equity (PORTX) | Global large | 4 | 4 | 5 | 20 | 1.29 | 511 |

| Northern Global Sustainability Index (NSRIX) | Int’l large | 4 | 3 | 4 | 11 | 0.30 | 640 |

Bottom line: there’s a good chance that ESG investors will stumble when they first encounter the number and diversity of ESG funds and ETFs. That problem is deepened by the short track record for many of these funds (51 have launched in just the past two years) and the apparent differences in their goals and methods (do you even know whether you’d want a fund with the word “impact” in the name?). That leads to a decision phenomenon (perhaps an indecision phenomenon) known as choice overload. Having too many approximately equally good options is mentally draining, especially when the choices feel significant and time is limited. In such cases, we tend to freeze or make impulsive “let’s pick any one and get it over” choices.

It doesn’t have to be hard. Remember that, first and foremost, you want an investment that produces reasonable returns while creating risks you can live with. After that, you want funds that either broadly address ESG issues or that (as with the Workplace Equality or Eco Leaders fund) specialize in an set of issues which are particularly important to you. After that, it’s just a matter of starting small, investing regularly and keeping, so to speak, the faith.