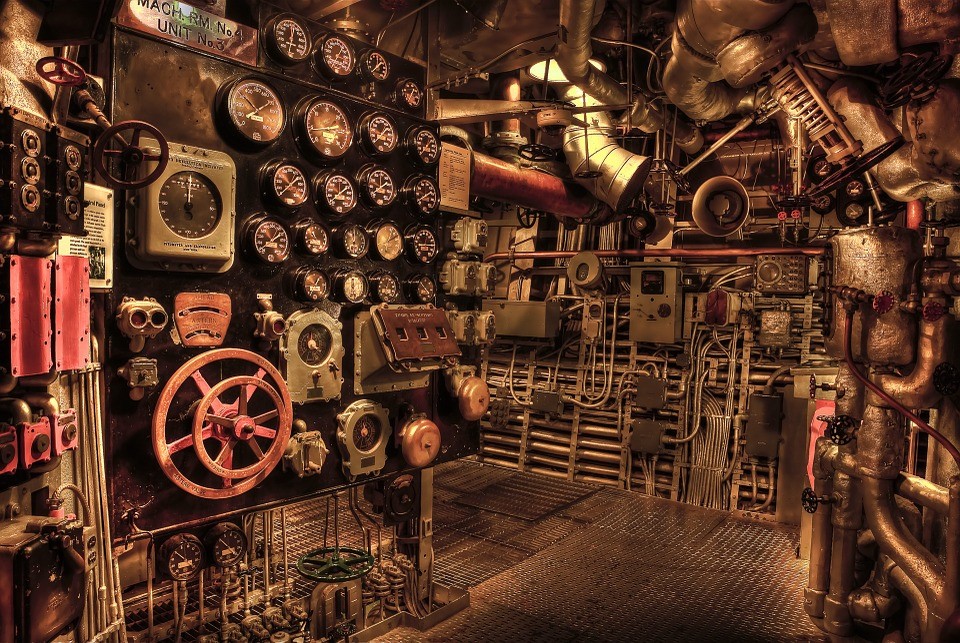

Charles sends his regrets for being unable to join us this issue, but he’s retreated deep underground to the MFO Premium command center.

At Charles’s request, the good folks at Thomson Reuters have substantially (vastly, enormously) expanded the amount of data they provide each month. The new datafeed will not only allow MFO Premium users to access a new level of detail about the composition and performance of mutual funds and ETFs, but it will also allow us to expand our coverage to closed-end funds and insurance products. At the end of the conversion, you’ll be able to screen for and analyze something like 36,000 investment products.

Charles describes the new monthly data drop this way:

35575 total entries

27042 mutual funds (all share classes)

4023 insurance funds

2188 ETFs

1515 indices

614 CEFs

168 categories (averages)

Delivered in …

14,383 data XML files for the performance data

comprising

6,769,238,777 bytes (6.8 gigabytes)

plus

14,117 data XML files for the holdings data

comprising

99,313,147,272 bytes (99.3 gigabytes).

All that takes hours upon hours of time just to download, distill, crunch even with multiple 8th gen Intel core i7 processors.

That is not, as it turns out, a plug-and-play operation and Charles has sunk hundreds of hours in May to making the conversion. We’re really, really close; Charles can generate ratings using  the new data but he’s not yet satisfied about its complete integrity. He grabbed a handful of MREs and headed underground, intent on discovering whether he can break the system, so that it won’t happen to you!

the new data but he’s not yet satisfied about its complete integrity. He grabbed a handful of MREs and headed underground, intent on discovering whether he can break the system, so that it won’t happen to you!

Charles will resurface next month, bright-eyed and happy to share tales from the conference, word on the new database and analyses of the two funds he’s been profiling.

Until then, you might consider joining MFO Premium. It’s a phenomenal resource for tax-deductible $100. We’re perpetually amazed that the number of subscribers is low in the hundreds rather than high in the thousands. You can change that, and should!