Exchange-traded funds (ETFs) that are designed to be used in bond ladders with target maturities have been around for over a decade. They come in Corporate Debt BBB-Rated, High Yield, Inflation-Protected, U.S. Treasury General, and Municipal Bond Lipper Categories. They have the advantages of simplicity, diversification, liquidity, flexibility, and low expense ratios. The disadvantages are that an active investor may be able to selectively pick higher-yielding bonds, some of the bonds held in the ETF may be callable, the dividends are not as predictable as individual bonds, and in the final year the bonds that have matured are invested in Treasury bills.

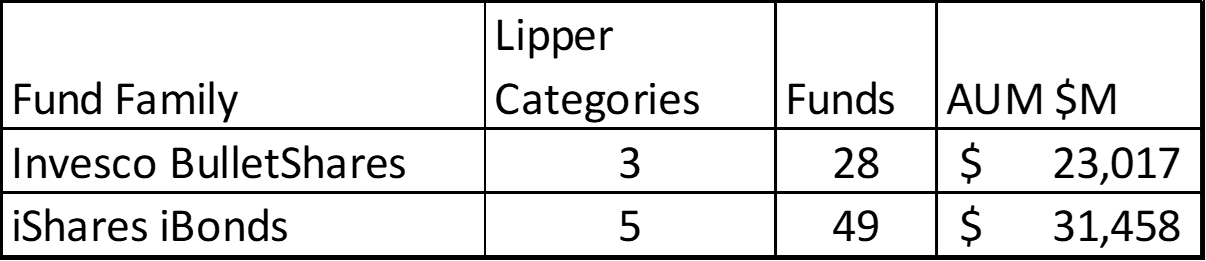

Invesco manages Bulletshares bond funds and BlackRock manages iShares iBonds. A summary is shown in Table #1. Included in the iShares iBond ETFs totals are ready-built bond ladders (LDRH, LDRI, LDRC, and LDRT) which are beyond the scope of this article as well as the inflation-protected bonds which are less than two years old.

Table #1: ETF Bond Ladder Funds

Overview

For a great article on Bond Ladder ETFs, I refer you to Bond Ladder ETFs Can Help Investors Climb Higher at Morningstar by Saraja Samant. Defined-maturity ETFs buy bonds that mature in the year the ETF terminates, returning its proceeds to investors. Ms. Samant shows an example of how ladders built with iShares iBond and Invesco BulletShares would have performed against an aggregate bond fund.

The BlackRock iShares iBonds ETFs website describes their bond ETFs as:

“iBonds exchange-traded funds (“ETFs”) are an innovative suite of bond funds that hold a diversified portfolio of bonds with similar maturity dates. Each ETF provides regular interest payments and distributes a final payout in its stated maturity year, similar to traditional bond laddering strategies. However, the funds’ unique structure is designed to help investors easily build bond ladders with only a handful of funds.”

The net acquisition yield provides a yield estimate, net of fees, and market price impact if held to maturity. They do not seek to return any predetermined amount at maturity or in periodic distributions. The prospectus states that they expect that an investment in the funds, if held through maturity, will produce aggregate returns comparable to a direct investment in a group of bonds of similar credit quality and maturity.

ETF Bond Ladder Performance by Lipper Category

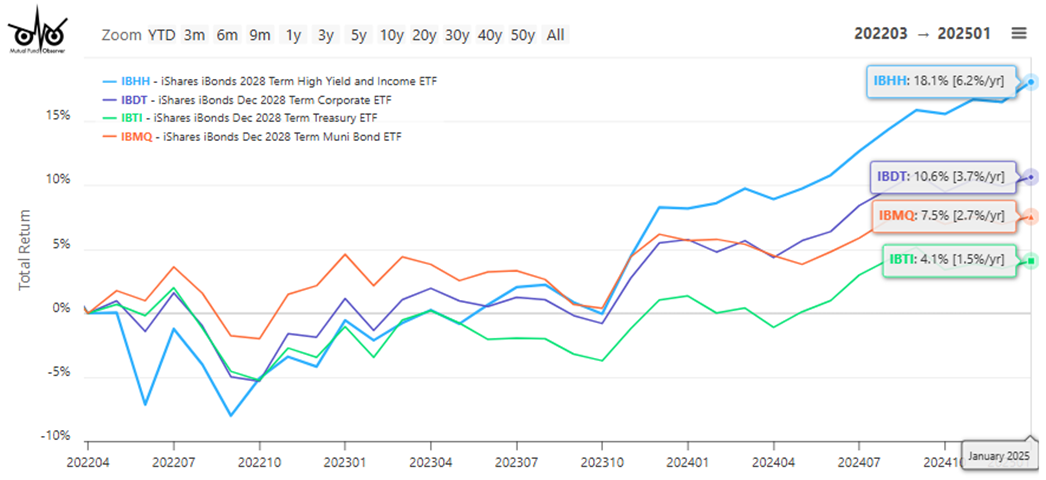

This section compares the total return performance of iShares iBonds maturing in 2028 for high yield, corporate BBB-Rated, U.S. Treasuries, and municipals bond categories. It shows the benefits of diversification. Municipal Bond Ladder ETFs have outperformed Treasuries over the past three years.

Figure #1: iShares iBonds Performance for ETFs Maturing in 2028

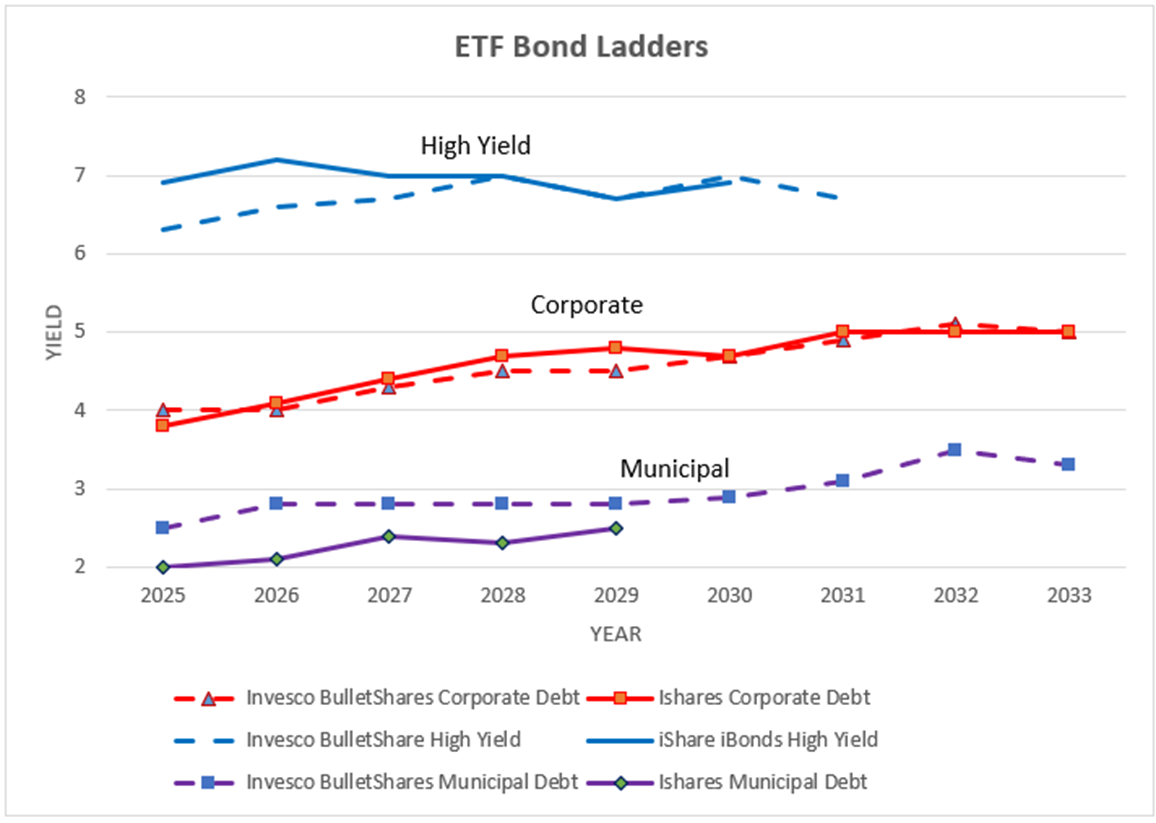

Figure #2 compares the yields of Invesco BulletShares and iShares iBond ETFs for the Corporate, Municipal and High Yield Lipper Categories.

Figure #2: Comparing Yields of ETF Bond Ladders for Various Lipper Categories

Corporate BBB Rated Yield Changes Over Time

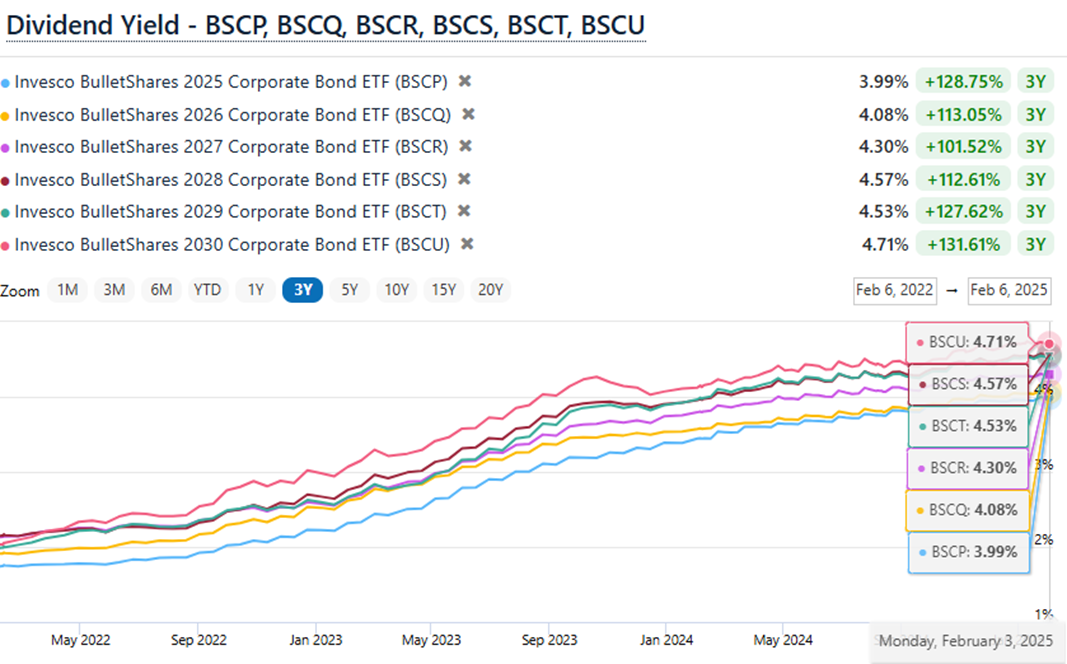

Figure #3 shows the dividend yield for the past three years from FinanceCharts for the Invesco Corporate Bond BulletShares with maturities from 2025 through 2030. Now is probably a good time to begin locking in higher yields.

Figure #3: Dividend Yield Over Time for Invesco BulletShares Corporate BBB-Rated Debt

Financial Goals

We have established relationships with Financial Advisors at Fidelity and Vanguard. If I were to pass away before my wife, I want her to turn over the rest of the accounts to them to manage for income. I want to keep things as simple as possible but no simpler.

Whether bond ladders or ETF Bond Ladders are right for an investor depends upon their financial goals. I view my Bucket #2 conservative Traditional IRAs as a place to withdraw funds if and only if the stock market is not doing well enough to withdraw from other sources. I want to maintain enough in this investment bucket to last a lifetime by replenishing it when stocks are high or withdrawing at a sustainable rate taking into consideration inflation.

Over full cycles, core bond, investment grade debt, high yield, and multi-sector debt have had the highest returns, yields, and drawdowns. These are the categories that I want to use to build bond ladders where the funds are not needed for several years, and they get more conservative over time. I want to own Corporate Debt BBB-rated bonds without doing the research to pick individual bonds.

I collect the dividends in money markets and make withdrawals as needed. That the dividends of bond ladder ETFs are not as predictable as individual bonds does not concern me. Finally, that bond ETFs invest the funds from bonds that matured in Treasury bills in the final year is a plus for me because I want them to get more conservative as they mature, especially in the year that I choose to withdraw them. I also like the liquidity.

Corporate Debt BBB-Rated Bond Ladder ETFs

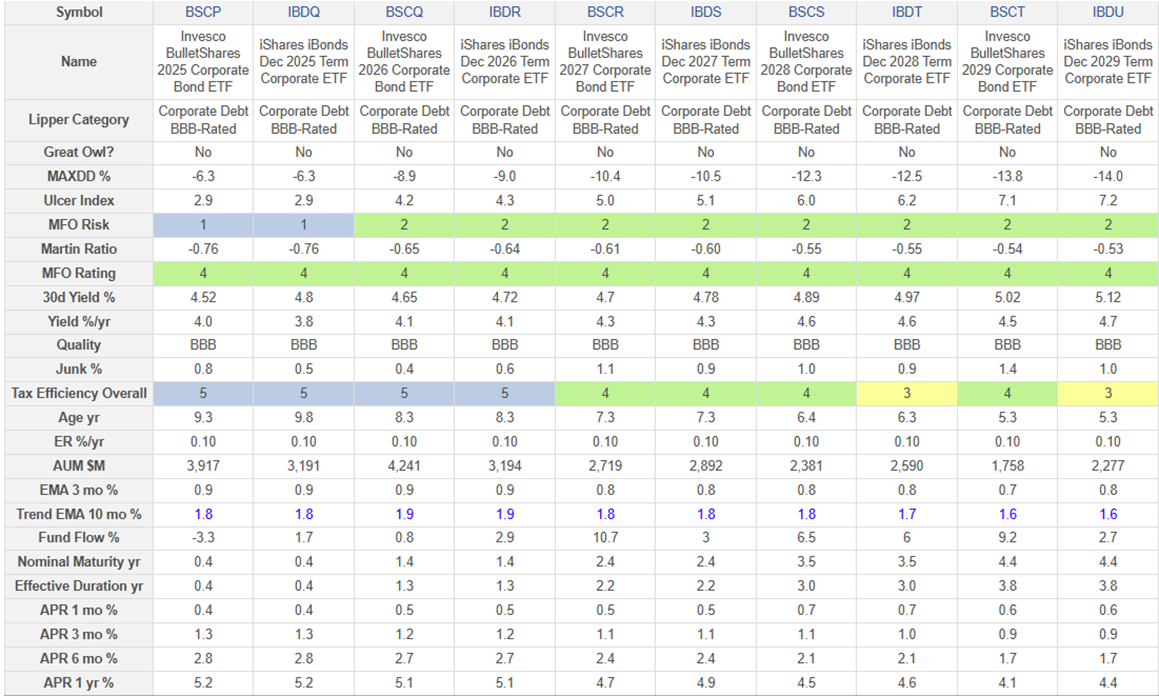

Table #2 provides a summary table comparing Invesco Bulletshares and iShares iBonds in the Corporate Debt BBB-Rated Lipper Bond Category. It is remarkable how similarly the Bulletshares and iBonds perform. I would be comfortable with either. During the past year, these funds have returned 4.1% to 5.2% and currently yield between 4.5% and 5.3%.

Table #2: Corporate Debt BBB-Rated Bond Ladder ETFs – (3-Year Metrics)

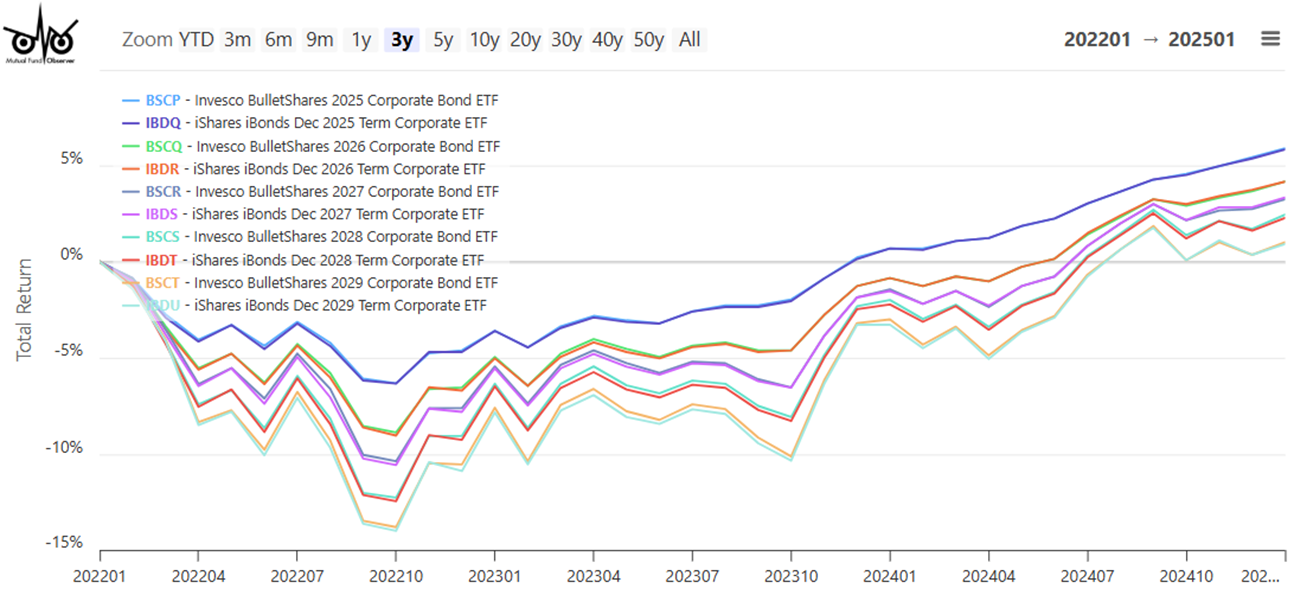

Figure #4 shows the total return performance of the corporate debt BBB-rated Bond Ladder ETFs over the past three years. Stocks and bonds did poorly in 2022. Bond ETFs maturing in two years had a drawdown of about 6% while bond ETFs maturing in six years had a drawdown of about 14%.

Figure #4: Corporate Debt BBB-Rated Bond Ladder ETFs (3 Years)

High Yield Bond Ladder ETFs

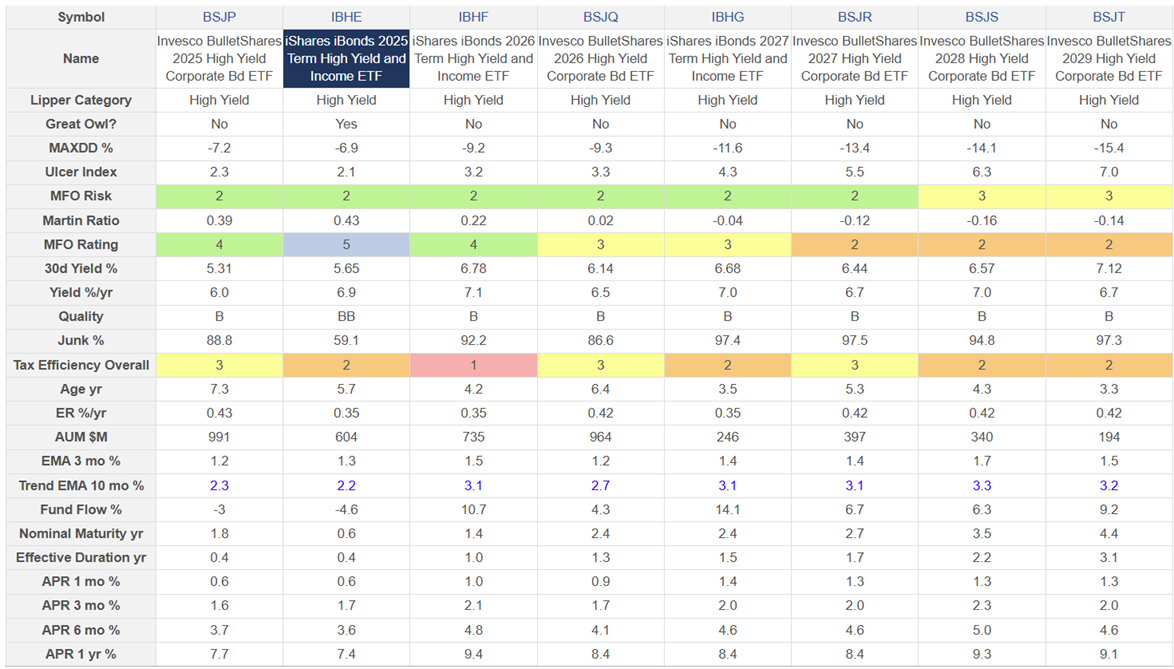

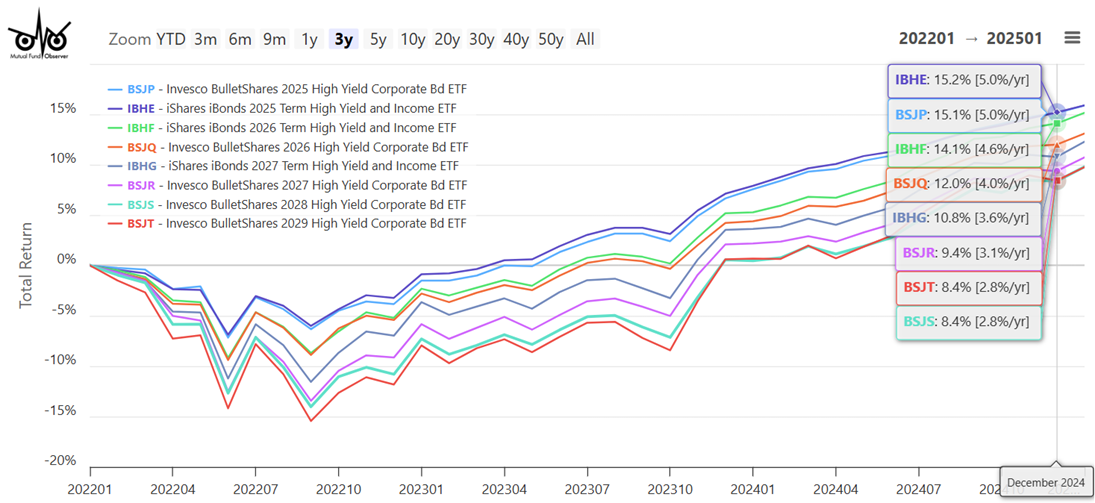

High-yield bonds can have large drawdowns during recessions. I favor shorter duration high yield bonds. Over the past three years, these bond ETFs had drawdowns between 7% and 15%. During the past year, they have returned 7.4% to 9.3% and currently yield 5.3% to 7.1%.

Table #3: High Yield Bond Ladder ETFs – (3-Year Metrics)

Figure #5 shows that these short-duration high-yield bonds have had higher returns than corporate BBB-rated bond ETFs and with roughly comparable drawdowns.

Figure #5: High Yield Debt Bond Ladder ETFs (3 Years)

U.S. Treasury Bond Ladder ETFs

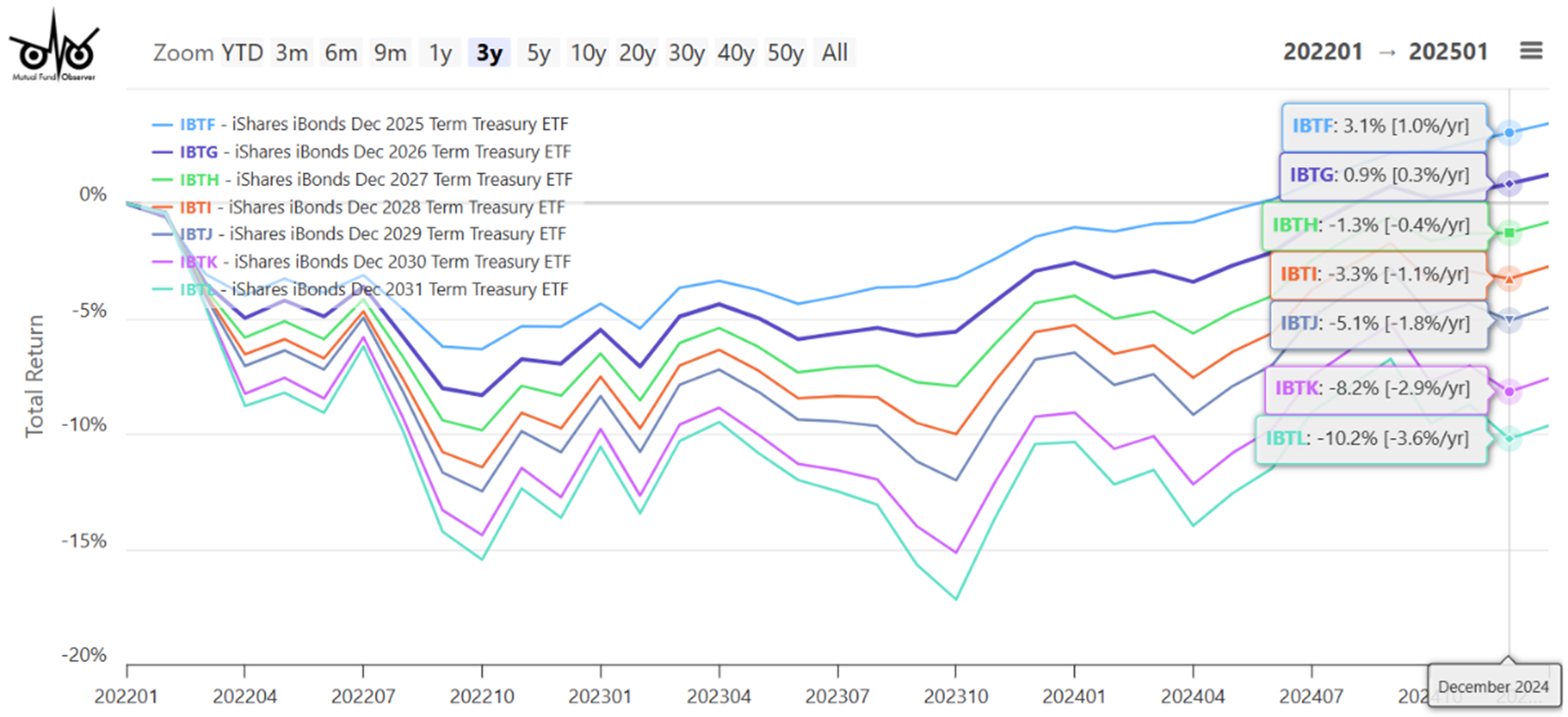

For comparable maturities, U.S. Treasuries have not had a much lower drawdown than investment-grade bonds, or even high-yield bonds. They have been slower to recover from 2022.

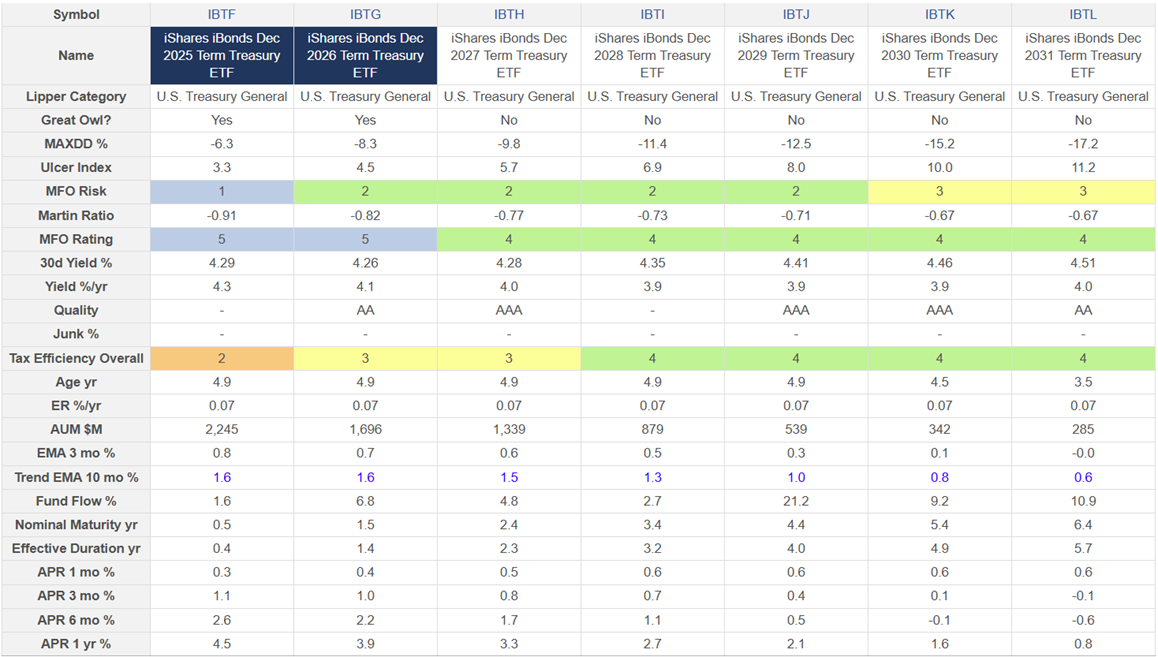

Table #4: Treasury Bond Ladder ETFs – (3-Year Metrics)

Figure #6: Treasury Bond Ladder ETFs (3 Years)

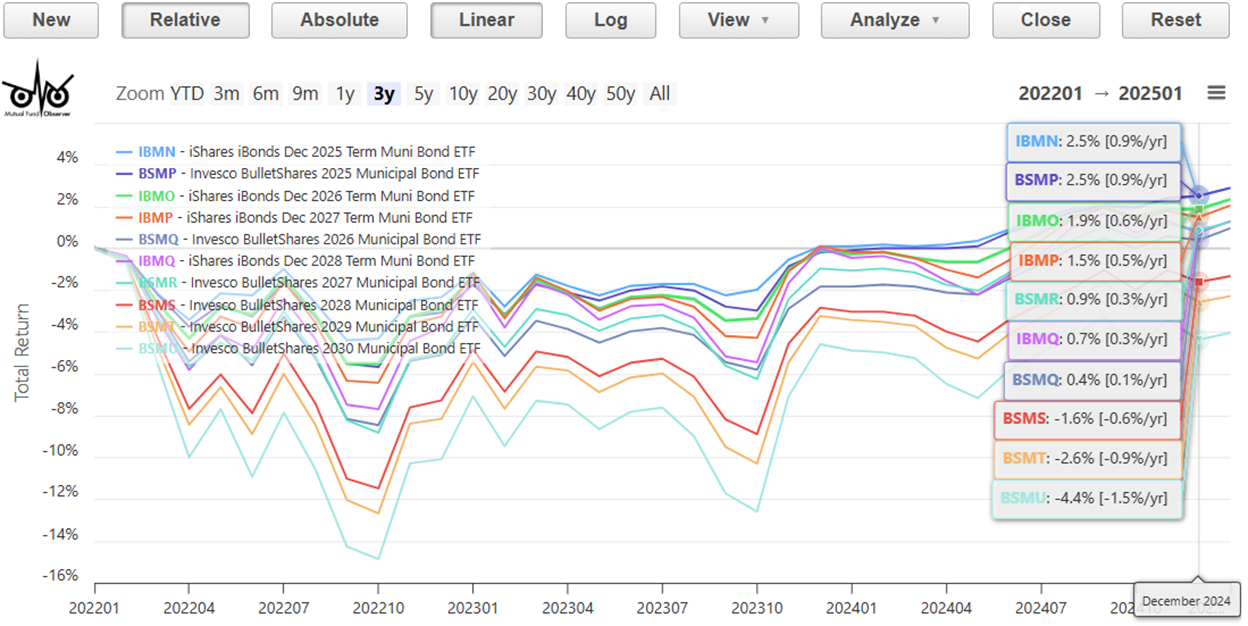

Municipal Bond Ladder ETFs

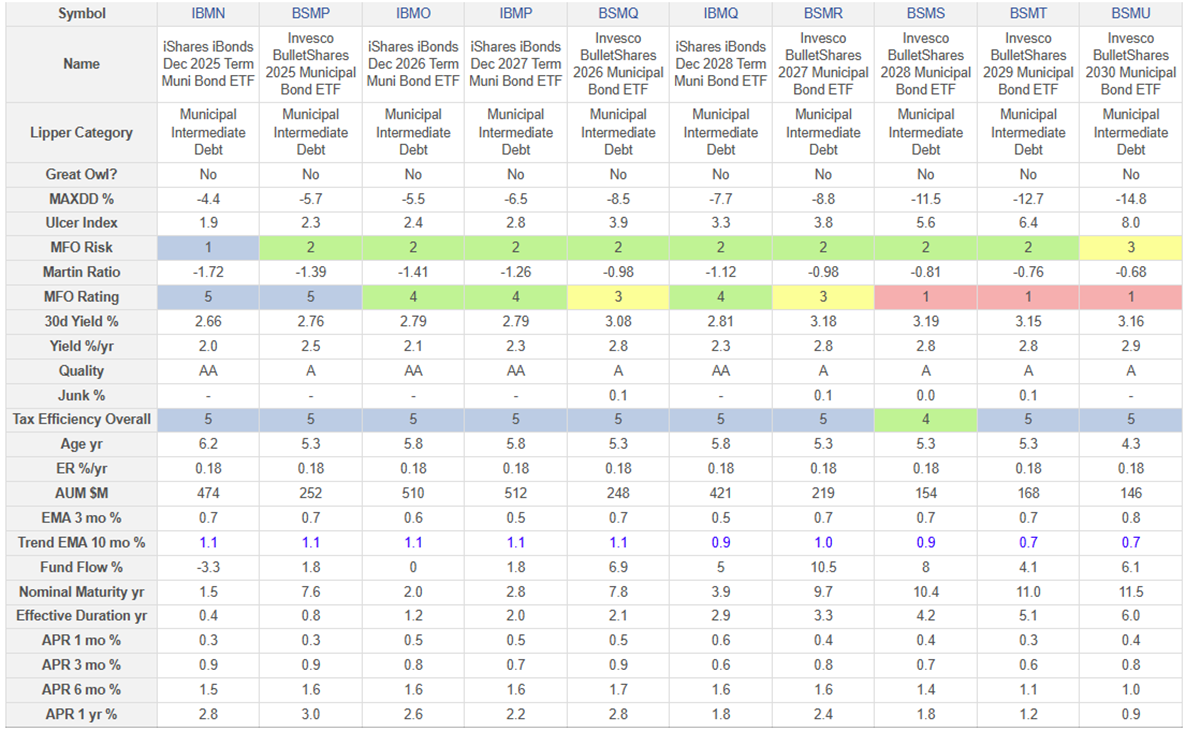

Municipal bond funds have done well considering their low yield. Fidelity has a Calculator for Fixed Income Taxable-Equivalent Yields for Individual Bonds, CDs, & SPDAs. The link is provided here. I use municipal bonds as long-term accounts where I want to keep taxes low. I am considering if there is a home for municipal Bond Ladder ETFs in my portfolio.

Table #5: Municipal Bond Ladder ETFs – (3 Year Metrics)

Figure #7: Municipal Bond Ladder ETFs (3 Years)

Closing

This research has helped me to decide when the next rungs on my bond ladder mature that I will be investing in bond ladder ETFs. Which ones? Corporate BBB-rated Bond Ladders will be the mainstay. I am considering a rung of high yield in the couple of years since the economy is strong and default risk is relatively low. I can see where a bond ladder of municipal bond ETFs can fit into a long-term tax efficient account as well.