What kind of investor are you? Do you want yield, safety, yield with a reasonable risk, or total return? I created a ranking system to combine Risk, Yield, Return, Quality, Trend, and Tax-Efficiency factors into an overall rating. I used yield divided by Ulcer Index which measures the depth and duration of drawdowns to limit the number of categories that I evaluate.

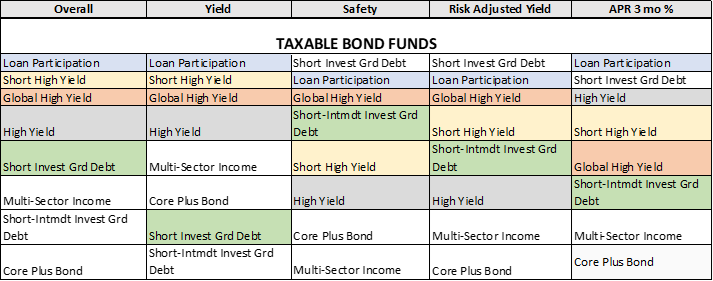

My favorites may not be the same as yours. Table #1 shows how I rank the categories. I will be discussing each Lipper Category in the order of the “Overall” column. Approximately 10% of my bond investments are in six of the eight categories but the bulk of my bond investments are in bond ladders and core bonds along with diversification into global and international income categories.

Table #1: Performance of Lipper Categories with High Yields

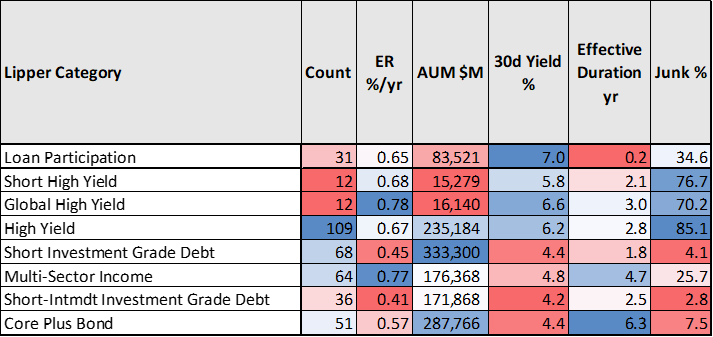

I extracted all mutual funds and exchanged traded funds using the MFO Premium Fund Screener and Lipper global dataset. What Table #2 tells us is that global high-yield and short high-yield categories don’t have as many funds or assets under management, and investors should invest with caution. Loan participation funds are interesting because they have a lower percentage of assets rated below investment grade, a small effective duration, and a high yield. High-yield categories have the highest 30d yields and the lowest-rated quality assets. Core plus bond funds have a longer duration and have performed poorly with rising rates.

Table #2: Metrics for Lipper Categories with High Yields

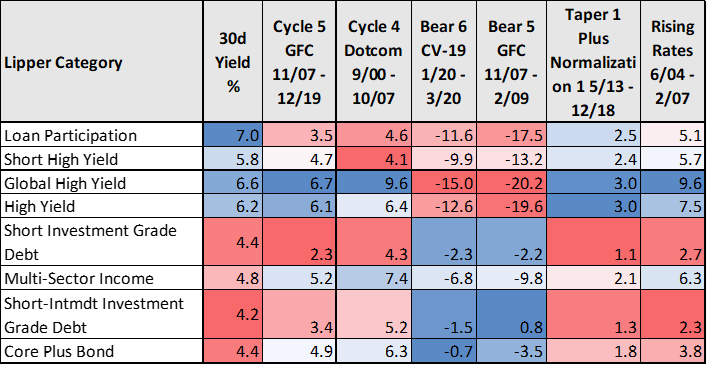

Table #3 is based on the history of nearly 400 mutual funds and exchange-traded funds. The top four categories have current yields of about 6% or more, full cycle returns of 4% to 7%, and drawdowns during severe market downturns of 13% to 20%. If investing in these categories go in with eyes wide open. By comparison, during the Dotcom Full Cycle from September 2000 to October 2007, the S&P 500 had an annualized return of around 2.0% The bottom four categories have lower yields and lower risk. Core plus bond funds performed relatively well during the financial crisis. I have invested in multi-sector funds as a middle-of-the-road option.

Table #3: Performance of Lipper Categories with High Yields

The Chosen Few

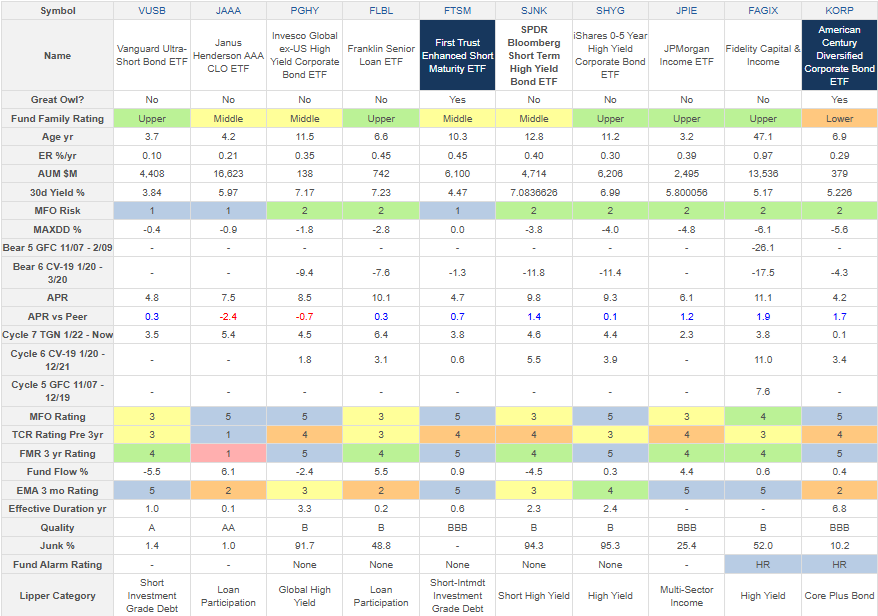

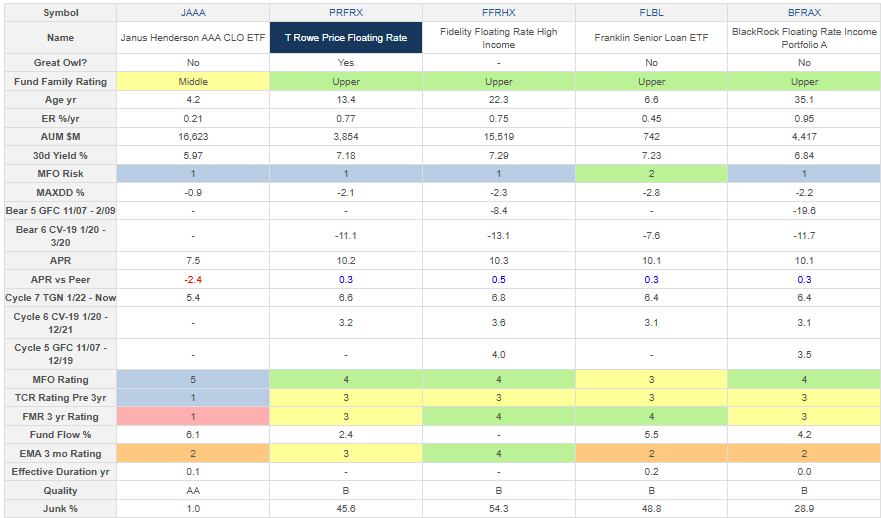

I selected one fund, most interesting to me as a moderately conservative investor, from each of the eight Lipper Categories covered in the article. Table #4 is packed with useful information about risk (MFO Risk, MaxDD %, Bear Markets), risk-adjusted return (MFO Rating), returns (APR, Full Cycle), trends (Fund Flow, EMA), quality (Quality, Junk), and expenses (ER, FMR), and yield.

Last month, I bought Janus Henderson AAA CLO ETF (JAAA) as a lower-risk fund with a 30d yield of 6.0% and Franklin Senior Loan Fund ETF (FLBL) with a 30d yield of 7.2% but a little more risk. I bought Fidelity Capital & Income (FAGIX) with a 30d yield of 5.2%. It has about 21% in equity and is higher risk and higher potential reward. The funds are loosely sorted with the safest to the left and riskier to the right in Table #4. For a future article, I have screened high-yielding funds rated with an MFO Risk of “Very Conservative” and Great Owl First Trust Enhanced Short Maturity ETF (FTSM), Vanguard Ultra-Short Bond ETF (VUSB), and Janus Henderson AAA CLO ETF (AAA) are among the fourteen on the list.

Table #4: Author’s Select High Performing Funds Per Lipper Category (2.5 Year Metrics)

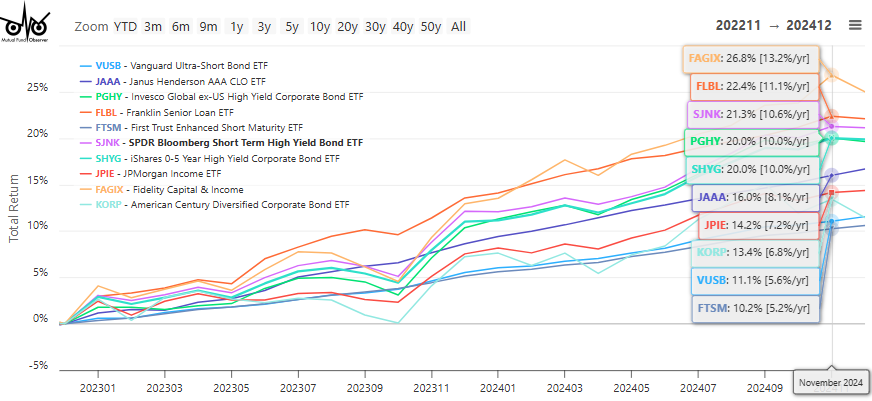

The steady profile and low volatility can be observed in Figure #2 below for First Trust Enhanced Short Maturity ETF (FTSM), Vanguard Ultra-Short Bond ETF (VUSB), Janus Henderson AAA CLO ETF (JAAA), and to a lesser extent Franklin Senior Loan Fund ETF (FLBL). As longer-term yields start to stabilize, I expect JPMorgan Income ETF (JPIE), Fidelity Capital & Income (FAGIX), and American Century Diversified Corporate Bond ETF (KORP) to start to perform better. Note that some of these funds have averaged a respectable return of 7% to 13% over the past two years.

Figure #2: Author’s Select High Performing Funds Per Lipper Category

Loan Participation Funds

Lipper U.S. Mutual Fund Classification Loan Participation Funds: Funds that invest primarily in participation interests in collateralized senior corporate loans that have floating or variable rates.

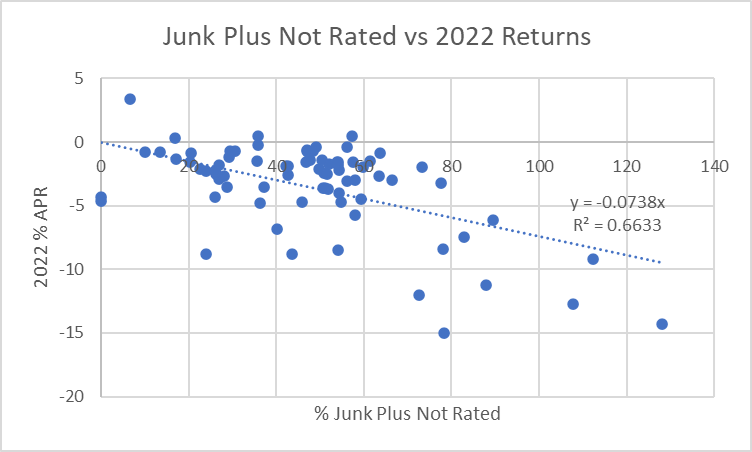

Loan participation funds are a diverse group that can make returns of 5% to 8% during rising or falling rates. They can have positive returns during a mild recession, but some may lose 20% or much more during a severe financial crisis. Percent Junk Plus Not Rated is a fairly good indicator of performance during a severe downturn in bond prices as shown in Figure #3. For this reason, I bought more of Janus Henderson AAA CLO ETF (JAAA) than I did of Franklin Senior Loan ETF (FLBL).

Figure #3: 2022 Returns Versus Percent Junk Plus Not Rated

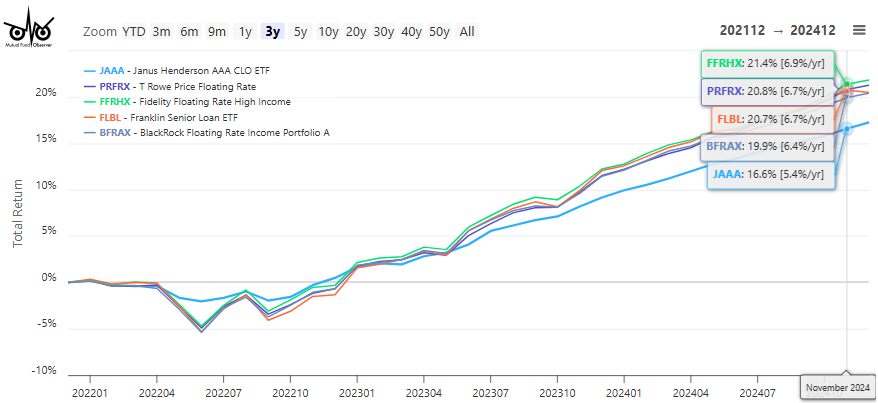

Most of the loan participation funds that I selected for Table #5 have lower risk and volatility; however, BlackRock Floating Rate Income Portfolio (BFRAX) had a drawdown of 19.6% during the financial crisis compared to Fidelity Floating Rate High Income (FFRHX) which had a drawdown of 8.4%.

Table #5: High Performing Loan Participations Funds (2.5 Year Metrics)

Janus Henderson AAA CLO ETF (JAAA) is one of my favorites because of its low drawdown and volatility which can be observed in Figure #4. It invests in higher-quality assets.

Janus Henderson AAA CLO ETF (JAAA) is one of my favorites because of its low drawdown and volatility which can be observed in Figure #4. It invests in higher-quality assets.

Figure #4: High Performing Loan Participations Funds

Short High Yield

Lipper U.S. Mutual Fund Classification Short High Yield: Funds that aim at high (relative) current yield from domestic fixed-income securities, with dollar-weighted average maturities of less than three years, and tend to invest in lower-grade debt issues.

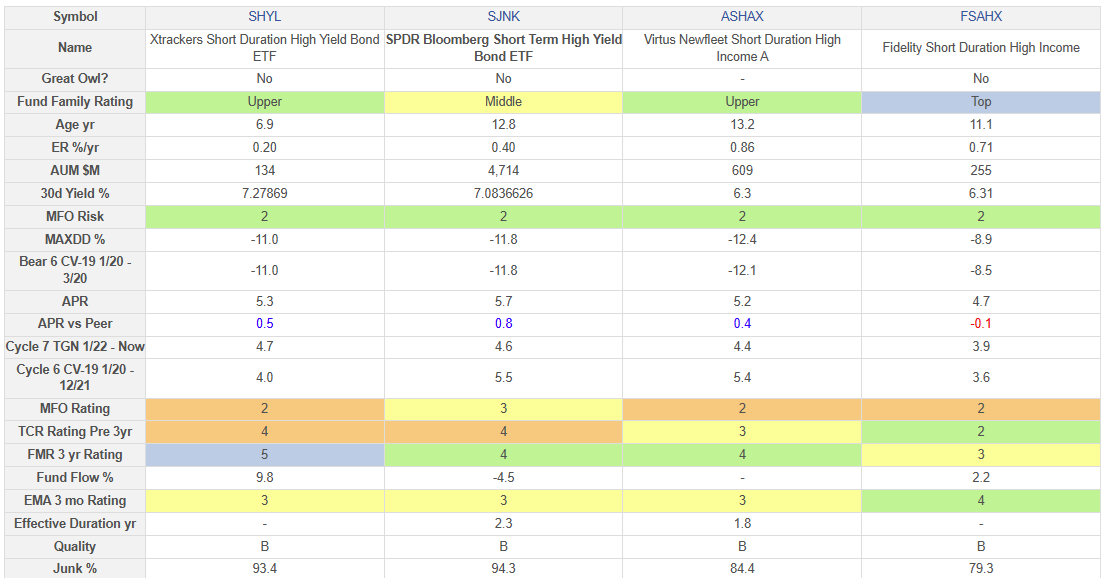

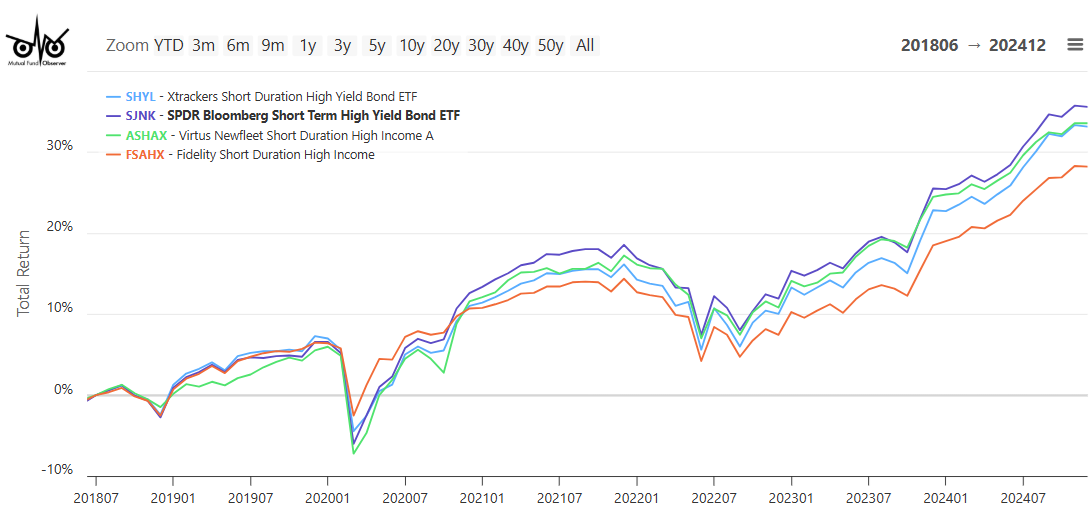

Short high-yield funds have a lower risk compared to most other categories in this article with decent returns compared to other short-term bond funds. I bought Fidelity Short Duration High Income (FSAHX) because it has a lower percentage of “Junk” rated bonds and a lower drawdown. Of the ETFs, I favor Xtrackers Short Duration High Yield Bond ETF (SHYL).

Table #6: High Performing Short High Yield Funds (2.5 Year Metrics)

I focus on performance over the last year or two because the Federal Reserve has stopped raising rates, but check how the fund performed during the latest downturn. While Fidelity Short Duration High Income (FSAHX) has underperformed recently, it had a lower drawdown during the COVID recession.

Figure #5: High Performing Short High Yield Funds

Global High Yield

Lipper U.S. Mutual Fund Classification Global High Yield: Funds that aim at high (relative) current yield from both domestic and foreign fixed-income securities, have no quality or maturity restrictions, and tend to invest in lower-grade debt issues.

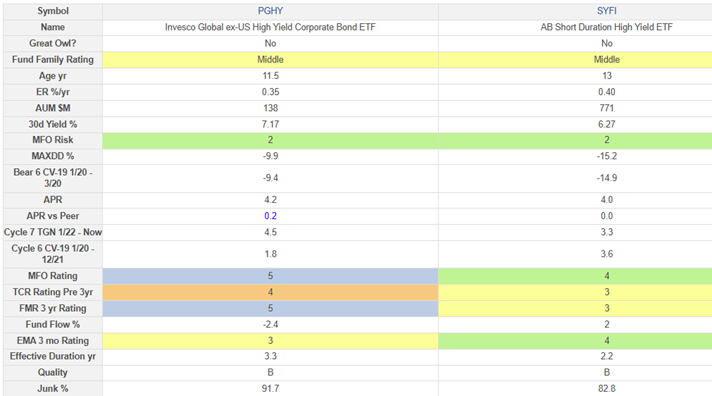

The global high-yield category does not have many quality funds, but I identify Invesco Global ex-US High Yield Corporate Bond ETF (PGHY) and AB Short Duration High Yield ETF (SYFI) as high performers with respectable yields, but moderately large drawdowns.

Table #7: High Performing Global High Yield Funds (2.5 Year Metrics)

Of the two funds, I favor Invesco Global ex-US High Yield Corporate Bond ETF (PGHY) for its risk-adjusted performance.

Figure #6: High Performing Global High Yield Funds

High Yield

Lipper U.S. Mutual Fund Classification High Yield: Funds that aim at high (relative) current yield from domestic fixed-income securities, have no quality or maturity restrictions, and tend to invest in lower-grade debt issues.

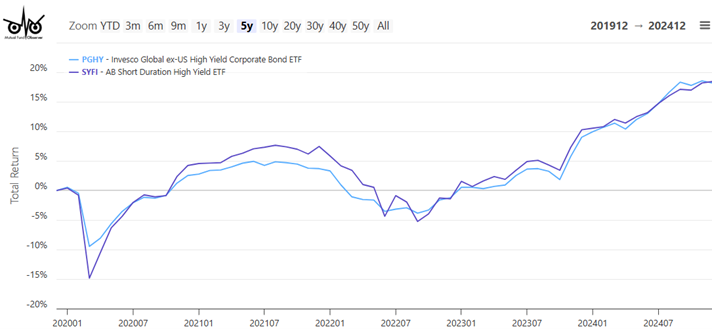

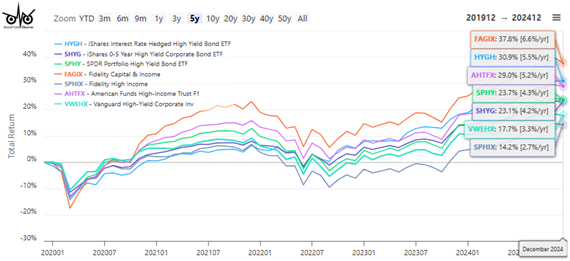

Of the ETFs, I like iShares 0-5 Year High Yield Corporate Bond ETF (SHYG) and expect it to perform better during falling rates or a market downturn with less volatility. I bought modest amounts of Fidelity Capital & Income (FAGIX) and Fidelity High Income (SPHIX) for diversification within the high-yield category.

Table #8: High Performing High Yield Funds (2.5 Year Metrics)

Figure #7 shows the diverse range of performance of high-yield funds due in part to hedging, duration, percent junk, and owning equity.

Figure #7: High Performing High Yield Funds

Short Investment Grade Debt

Lipper U.S. Mutual Fund Classification Short Investment Grade Debt: Funds that invest primarily in investment-grade debt issues (rated in the top four grades) with dollar-weighted average maturities of less than three years.

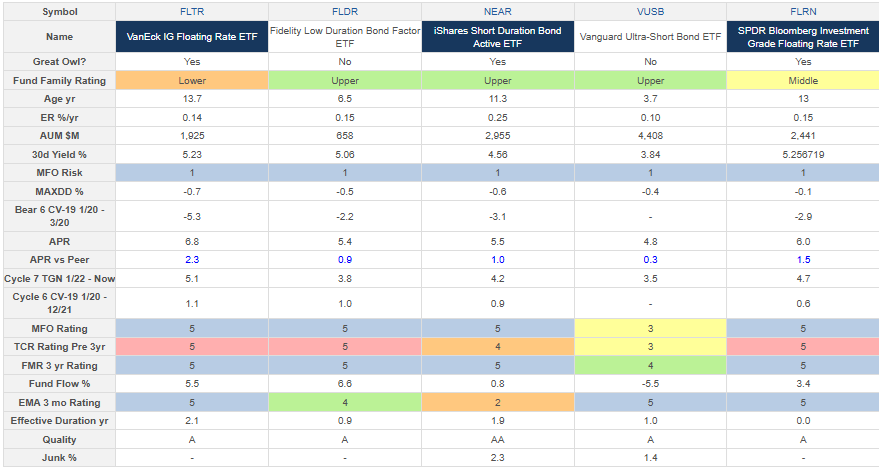

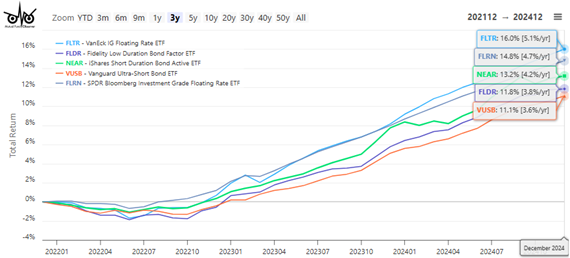

Columbia Threadneedle Investments wrote As Interest Rates Rise, Investors May Look To Floating-Rate Funds explaining that while floating-rate bonds do well when rates are stable or rising, they tend to underperform when rates are falling. I favor Fidelity Low Duration Bond Factor ETF (FLDR) for its high yield and low volatility.

Table #9: High Performing Short Investment Grade Debt Funds (2.5 Year Metrics)

Figure #8: High Performing Short Investment Grade Debt Funds

Multi-Sector Income

Lipper U.S. Mutual Fund Classification Multi-Sector Income: Funds that seek current income by allocating assets among several different fixed-income securities sectors (with no more than 65% in any one sector except for defensive purposes), including U.S. government and foreign governments, with a significant portion of assets in securities rated below investment-grade.

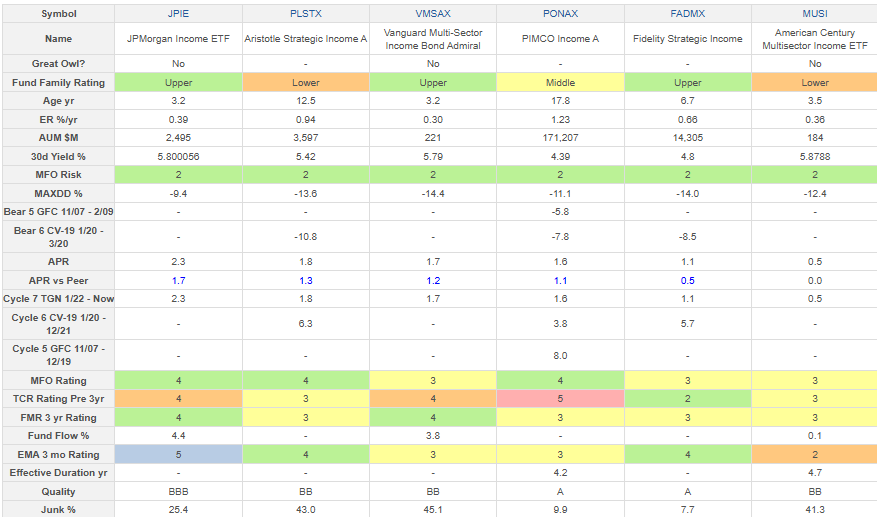

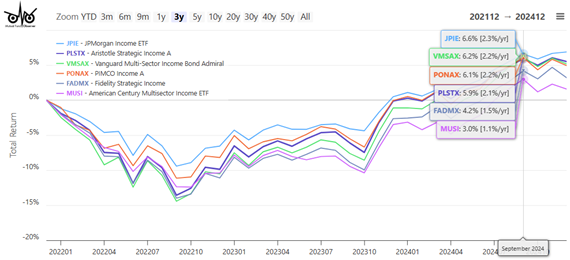

Exchange-traded funds are relatively new to the Multi-Sector Income category and of the two, I prefer JP Morgan Income ETF (JPIE). I purchased modest amounts of both the Vanguard Multi-Sector Income Bond (VMSAX) and Fidelity Strategic Income (FADMX) for Traditional IRAs.

Table #10: High Performing Multi-Sector Income Funds (2.5 Year Metrics)

Figure #9: High Performing Multi-Sector Income Funds

Short-Intermediate Investment Grade Debt

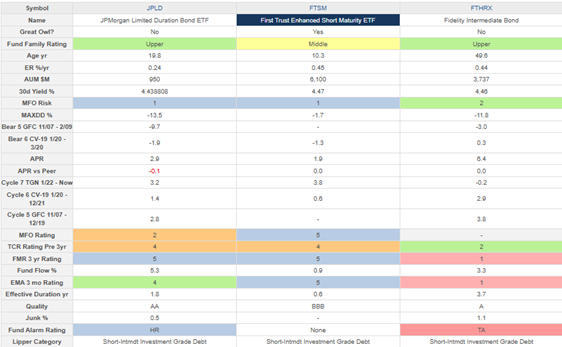

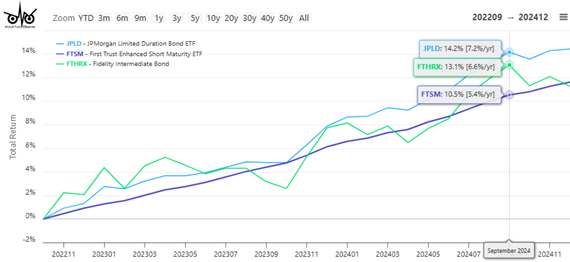

Lipper U.S. Mutual Fund Classification Short-Intermediate Investment Grade Debt: Funds that invest primarily in investment-grade debt issues (rated in the top four grades) with dollar-weighted average maturities of one to five years.

I favor Great Owl First Trust Short Maturity ETF (FTSM) for its low volatility and drawdown. I own Fidelity Intermediate Bond (FTHRX) but traded a modest portion for other bond funds discussed in this article.

Table #11: High Performing Short-Intermediate Investment Grade Debt (2.5 Year Metrics)

Figure #10: High Performing Short-Intermediate Investment Grade Debt Funds

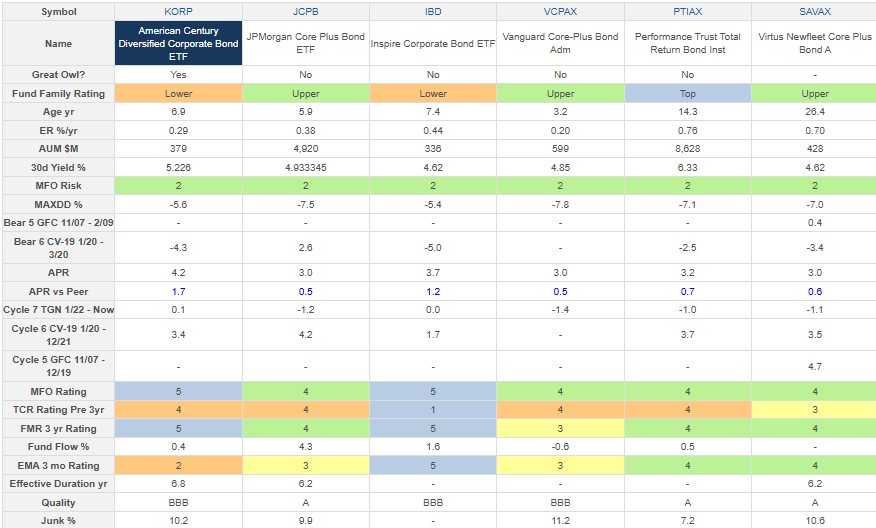

Core Plus Bond

Lipper U.S. Mutual Fund Classification Core Plus Bond Funds: Funds that invest at least 65% in domestic investment-grade debt issues (rated in the top four grades) with any remaining investment in non-benchmark sectors such as high-yield, global, and emerging market debt. These funds maintain dollar-weighted average maturities of five to ten years.

This is my least favorite category as its total return has been hampered as rates rose because of its longer duration, but I will continue to monitor it throughout the year. It is a category that I may want to own in the future as longer-term rates stabilize. The standout core plus bond fund is the Great Owl American Century Diversified Corporate Bond ETF (KORP).

Table #12: High Performing Core Plus Bond Funds (2.5 Year Metrics)

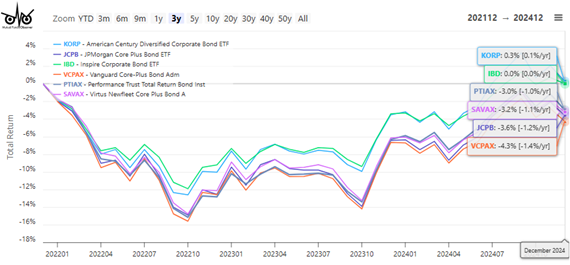

Figure #11 shows the one-year trends on core plus funds have been strong but the recent three-month trends are waving red flags. I will continue to monitor.

Figure #11: High Performing Core Plus Bond Funds

Closing

To prepare for 2025, I invested in high-yielding funds with low to moderate risk. These are the low-hanging fruit. There is plenty of opportunity to increase yields along with higher risk by investing in different funds within the same categories.

It is possible to find funds with higher yields in other Lipper Categories. They usually have an Aggressive or Very Aggressive MFO Risk Rank, usually accompanied by below-average risk-adjusted performance as measured by MFO Rank, and often with very high expenses. No, thank you!