On October 14, 2024, Virtus Investment Partners launched Virtus KAR Mid-Cap ETF (KMID). It targets “U.S. mid-cap companies with durable competitive advantages, excellent management, lower financial risk, and strong growth trajectories” selling at “attractive” valuations. The fund is managed by Jon Christensen and Craig Stone who also manage the five-star, $2.9 billion Virtus KAR Mid-Cap Core Fund. The ETF, like its sibling, will hold 25-35 stocks with a low annual turnover.

The fund has two attractions.

First, mid-caps are interesting and underrepresented in most portfolios. (It’s the classic “middle child” problem.) Virtus notes:

Located in the equity sweet spot between faster-growing small caps and less-volatile large caps, mid-caps represent an attractive investment opportunity. Mid-sized companies are at a critical juncture in the business lifecycle, having successfully transitioned from the make-or-break small-cap phase. Though not as mature as large caps, mid-caps typically have established business models, access to capital, and experienced management teams—putting them in position for further growth.

Despite their attractive attributes, mid-caps are missing from many investor portfolios. Mid-caps make up 24% of the total U.S. market cap, yet account for just 11% of U.S. equity fund assets.

Over the long term, mid-caps have delivered strong returns relative to small caps and large caps, with lower volatility than small caps.

Mid-caps receive less attention from Wall Street analysts and trade at a lower volume than large-cap stocks. These market inefficiencies translate into an opportunity for an active manager like KAR to add value to the stock selection process by seeking out what they consider to be the highest quality mid-sized businesses with the strongest growth prospects.

By Virtus’s calculation, higher-quality midcaps outperform lower-quality ones through both higher total returns (12.2% APR versus 10.4%) and lower volatility (15.3% standard deviation versus 18.5%). The KAR managers have executed the strategy with considerable and consistent success since its launch.

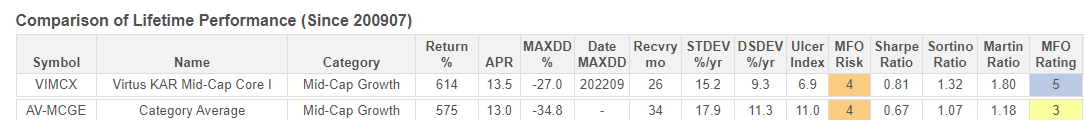

At base, they’ve generated higher total returns with smaller drawdowns and substantially lower volatility than their peers, giving them substantially higher risk-adjusted ratings across the board.

Second, this ETF gives you access to a successful strategy for a far lower price.

Mid-Cap Core Fund, four-star fund, “A” shares: 1.20% e.r.

Mid-Cap Core Fund, five-star fund, institutional: 0.95% e.r.

Mid-Cap ETF: 0.80% e.r.

It’s rare to be offered a one-third-off sale on access to a demonstrably successful strategy. Folks interested in moving a bit away from large-cap growth mania might want to consider this option.