Dear friends,

Winter is coming.

I’m so thankful.

And welcome to the modestly delayed December issue of the Mutual Fund Observer.

Traditionally, year’s end has been a slower time. The growing season has ended, and both the farm fields and the sports fields lie mostly empty in this part of the country. Going out at night is just a touch less attractive when “night” settles in at about 4:30. New projects and wild ambitions are set aside for the new year. Traditionally, it’s a season for festivals and celebrations, only occasionally draped in religious garb.

Augustana’s Sankta Lucia service, in this case. I thought I’d share a bit of Christmas on campus with you!

In the northern hemisphere, every religion and every culture seems to have reached the same conclusion: it’s cold, it’s dark, it’s time to get together!

Too, it’s time to reflect on the year just past and all the things we have to be thankful for. (Yes, I was awake pretty much all year in 2024, but that doesn’t change my sense of gratitude for all the good the year bequeathed.)

What do I have to be grateful for?

-

The elections are over. You know, we could pretty much stop right there. Some pundits have taken to humming “Send in the Clowns,” but we have a government chosen by the majority of voters in a free, open, and contested election. They voted for the incoming government based on some combination of hopes and fears. If their hopes are fulfilled and their fears diminished two years hence, they’ll have the opportunity to reaffirm their decision. Otherwise, they’ll have a chance to reverse it in state and congressional elections.

-

By most metrics, America is better off than it has been in years.

- Somehow the feverish claims about rigged elections have fallen silent.

- Crime rates have fallen dramatically in the past four years, continuing a half-century decline. (Stories about immigrant crime rates, which is well less than half the rate for US citizens, and rampant retail theft appear to have been slightly fevered inventions.)

- Health insurance coverage is at its highest rate ever, with about 95% of Americans holding some kind of insurance.

- Job growth has been ridiculously strong, with about 15 million new jobs in under four years, though wage growth has just sort of treaded water.

- Interest rates have sort of normalized at around 5%, a century-long average, after years of disastrously low rates and months of painfully high ones.

- Household wealth is at a record high and household debt, as a percentage of income, has fallen to its lowest level since 2001. Income inequality has declined at least a bit.

- The US reindustrialization, after years of offshoring, is well underway supported by over a trillion in “green” spending spurred by the Inflation Reduction Act and by the CHIPS Act. By some estimates, the effects of these changes will be vastly greater in five or ten years than they are today.

- American soldiers are not fighting on foreign soil.

(For those of you geeky enough to want the data, see “What Have Biden and Harris Accomplished? Look at These 10 Metrics,” Bloomberg, 09/10/24; “Is Biden’s legacy dependent on a Trump defeat?” Financial Times, 11/1/24; “Bidenomics Is Starting to Transform America,” New Yorker, 10/28/24).

Much could be undone, and much remains to be done (ummm … climate change, the emerging challenge of AI, and rational immigration policies), but there is more going well than we admit.

-

We’ve been through this before. From the collapse of Reconstruction and virtual reinstitution of slavery in the late 19th century to the attempted coup against Franklin Roosevelt in the early 20th century and the riots of the 1960s (do you remember George Wallace’s rallying cry, “segregation now, segregation tomorrow, segregation forever”), we’ve worked our way through and out of rather a lot of discord. We will again if we choose to.

The challenge is that we’re becoming exceptionally good at demonizing one another, which makes the task of finding common ground exceptionally difficult. Much of that is attributable to our constant connection to an unreal world. My students’ most common response to the question, “When do you put your phone away?” is “never.” (The most reflective answer is “never, except when I’m on the floor in competition” or “never, which I’m embarrassed to say.”) We’ve always been drawn to figures in the media; the difference now seems to be that we have fewer and fewer counterbalances from real life to engage. Consider a series of questions that begin with the phrase “When was the last time you …”

- Had a conversation with your next-door neighbor?

- Invited friends over for dinner at your place?

- Spent time at your public library?

- Volunteered time to work with a local group?

- Helped out with Little League?

- Joined a bowling league?

- Sat and talked with a stranger?

You’re welcome to mumble about Covid if you like. The excuse “my life is too busy” is often a dodge that comes down to “by phone doesn’t permit me such distractions.” The research is pretty clear that social engagement in the US is in decline (Kannan and Veazie, “US trends in social isolation, social engagement, and companionship,” 2023) and that the resulting isolation contributes to paranoia (Langenkamp & Sstepanova, “Loneliness, Societal Preferences and Political Attitudes,” 2024) dementia, and physical decline (Holt-Lunstad, “Social connection as a critical factor for mental and physical health,” 2024).

-

I’ve got friends. Admittedly, rather more in low places than high, but that’s okay. My colleagues at work are amazing, though crazy. Chip is simply amazing. My son Will is simply crazy but that’s okay because he’s training to be a counseling psychologist … and is my son. Lynn and Shadow and Charles, Wendy and Lucy and Raychelle, make a world of difference.

We have also linked this part of our lives with tens of thousands of you. It was your letters, long ago, that convinced us to launch MFO as FundAlarm reached its last chapter. It’s your notes, in email and sometimes on Twitter, that monthly help allay self-doubt and answer the question, “is this still worth doing? Are we making a difference?”

No one thrives when they’re alone and each day brings 14 to 18 hours of darkness. And so, we’ve chosen, from time immemorial, to open our hearts and our homes, our arms and our pantries, to friends and strangers alike.

Don’t talk yourself out of that impulse. Don’t worry about whether your gift is glittery, or your meal is perfect. People most appreciate gifts that make them think of you; give a part of yourself. Follow The Grinch. Take advice from Scrooged. Tell someone they make you smile, hug them if you dare, smile and go.

In This month’s Observer …

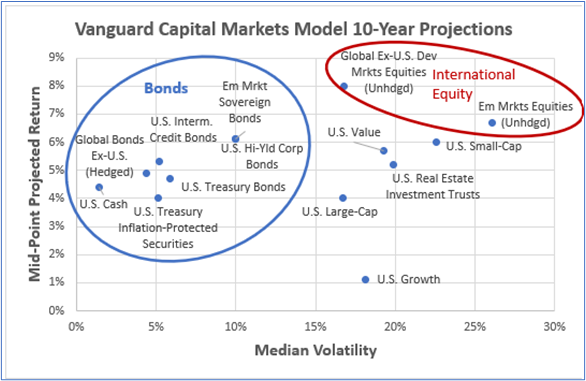

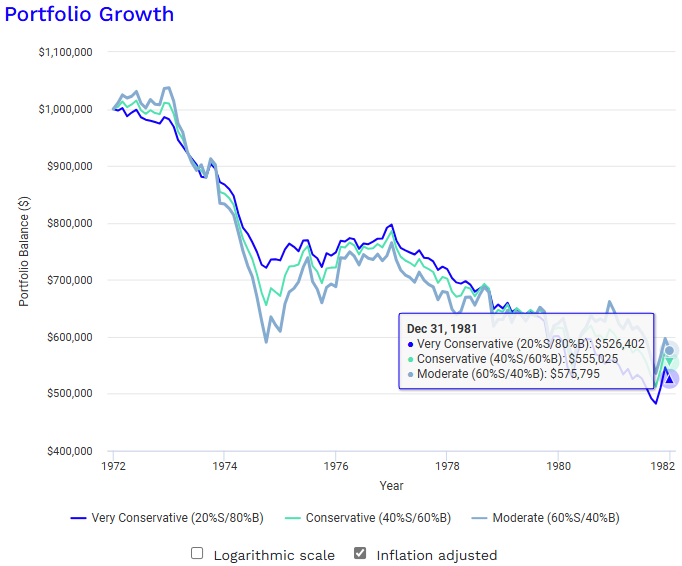

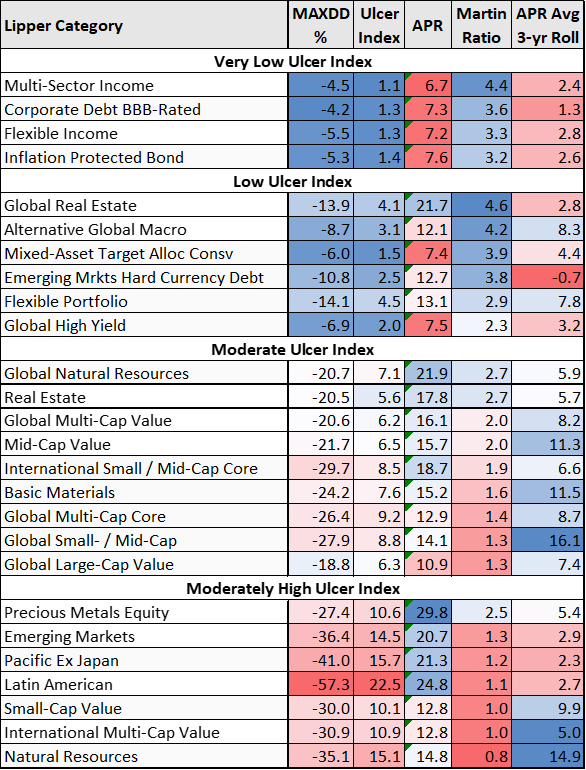

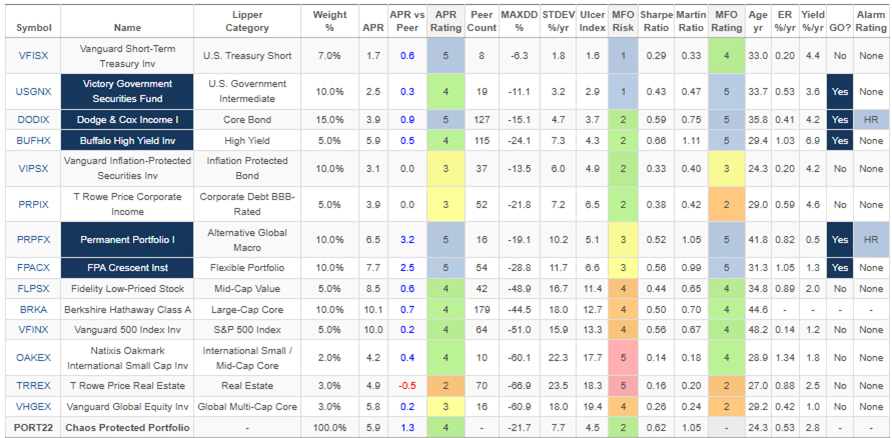

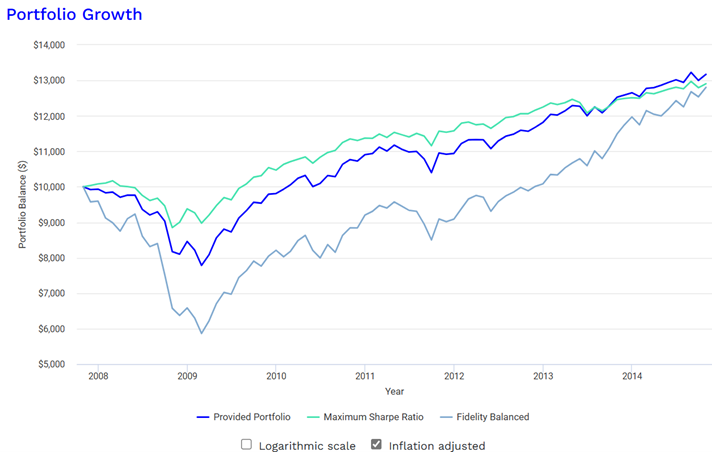

Financial markets are, in a technical sense, structurally chaotic. That is highly complex, interlinked systems that are so sensitive to tiny, often invisible, changes that their short-term movements cannot be predicted. Rather beyond that structural chaos, there’s a prospect of political chaos that plays out over the weeks and months ahead. Chaos is not good for your portfolios or your sanity. Lynn Bolin and I, separately but with knowledge of what each was doing, have offered advice on crafting “a chaos-protected portfolio” (Lynn) and “a chaos-resistant portfolio” (me). Lynn suggests favoring bonds over stocks, maintaining diversification, and matching withdrawals with time horizons. My argument would be to hire other people to worry on your behalf, increase the quality of your holdings, add short-term high-yield bonds, and insulate yourself from your own worst impulses. Book recommendations follow!

Lynn also offers up advice for investing in 2025. He identifies key challenges for investors in the coming years:

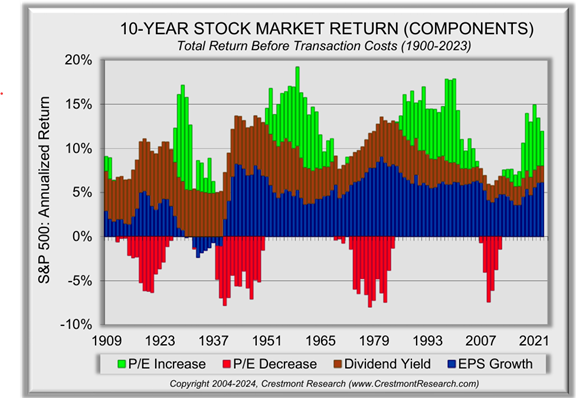

- High stock valuations and interest rates, suggesting lower returns in the intermediate-term

- Slow economic growth due to slowing population growth, potential federal spending cuts, inflationary tariffs, and higher interest rates to finance national debt

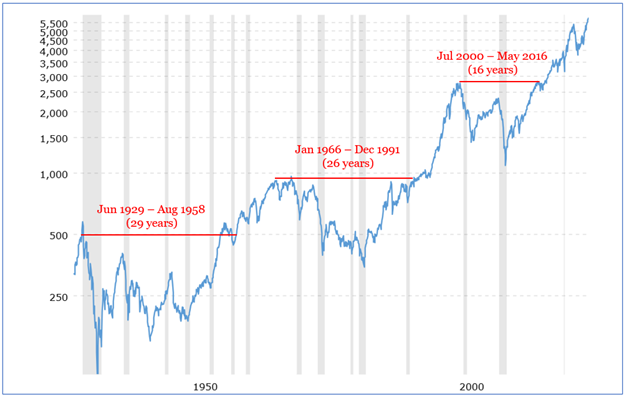

- Risk of another secular bear market starting during this decade

- High inflation potentially leading to falling stock valuations

- Increasing national debt and budget deficits, especially if tax cuts are extended

That is somewhat at odds with the “Where to Invest in 2025” recommendations from the good folks at Kiplinger’s, which starts with the assumption of six or seven interest rate cuts (which only works if the economy is slowing and inflation falling or if the Fed has been coopted by the executive branch). Lynn’s prudent recs: anticipate lower long-term returns, trust active investment management during potential secular bear markets, and maybe ease back on equities if you’re of a certain age.

John Rekenthaler retired from Morningstar in mid-November. He and the other founders of Morningstar have helped guide a nearly unimaginable evolution of the power of individual investors, from a world where fund companies did not even deign to disclose the names of the people managing their funds to one where, for better and worse, investors have nearly unlimited choice and unlimited information. (Morningstar tracks 175,000 investment vehicles and will, for a price, inundate you with information about them. MFO Premium does much the same for … well, $120 / year.) I wrote a short encomium to JR.

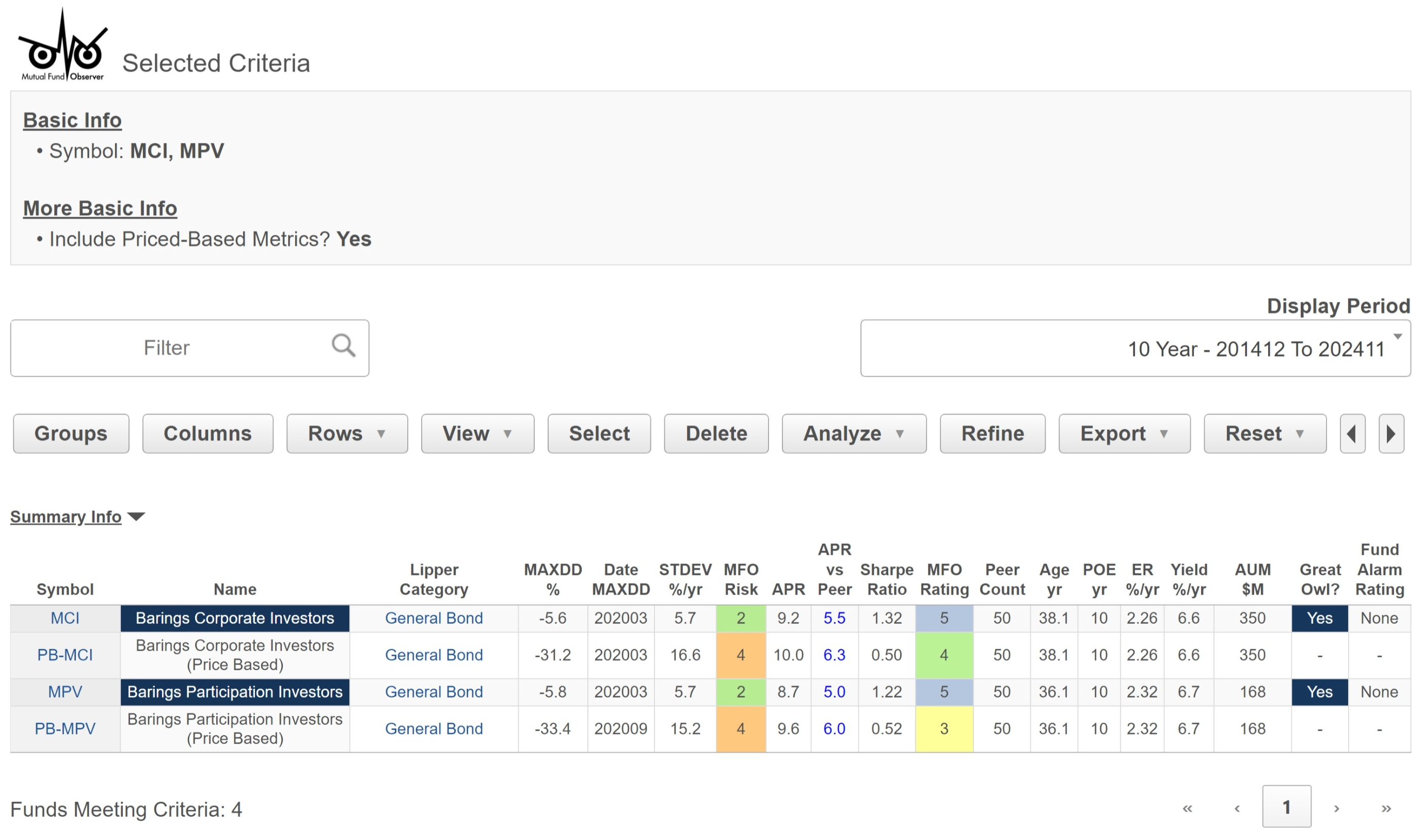

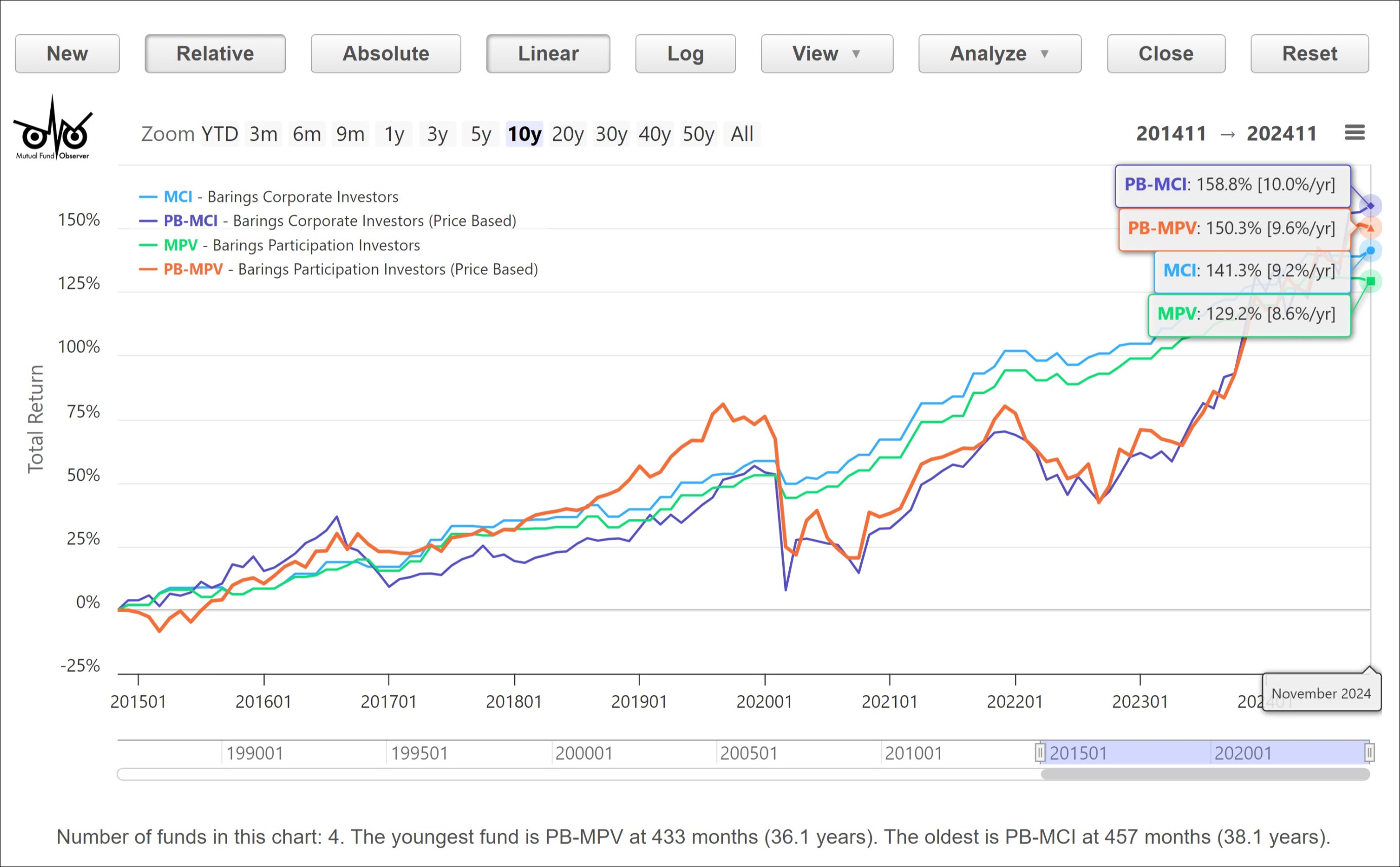

Speaking of which, our colleague Charles offers useful new capabilities at MFO Premium (for the inflation-resistant price of $120, virtually unchanged in its decade of operation).

The Shadow keeps it real and keeps us grounded by reviewing the industry’s news, innovations and twists in “Briefly Noted.”

Thanks, as ever …

To our faithful “subscribers,” Wilson, S&F Investment Advisors, Gregory, William, William, Stephen, Brian, David, and Doug, thanks!

And to Thomas from Williamsburg and Binod from Houston, for their kind gifts of support!

From Chip, me, and all the folks at the Observer, wishes for a joyful end to the year. We’ll see you on (or about) New Year’s!