On October 15, 2024, Bridgeway Capital launched Bridgeway Global Opportunities Fund (BRGOX), a long/short equity fund that will pursue long-term positive absolute returns while limiting exposure to general stock market risk. Using advanced quantitative modeling, the fund will hold 250-300 long positions and 250-300 short positions. The portfolio is designed with a bias toward quality, value, and sentiment. It will otherwise be neutral as to country, size, sector, and beta. That is, it will shoot for a beta of zero, a net China exposure of zero, and so on.

The fund will be managed by a Bridgeway team led by Co-Chief Investment Officer Jacob Pozharny, PhD. He joined Bridgeway in 2018 and leads the firm’s international and alternative equity investing efforts. Jacob was formerly head of international equity research and portfolio management at QMA, a Prudential Global Investment Management (PGIM) company where he successfully managed $15 billion, and head of international quantitative equity at TIAA-CREF where he was responsible for about $10 billion. Reportedly his QMA team consistently outperformed global, EAFE, EM, EAFE small-cap, and EM small-cap benchmarks. The fact that he grew QMA assets from $2.5 billion to $15 billion in seven years implies some considerable satisfaction with his performance.

The key will be intangible capital intensity

The world, and the world economy, have changed dramatically in the past quarter century. Accounting standards and valuation metrics have not; they remain largely rooted in the 20th-century economic model. A half-century ago, a company’s most valuable assets – those that weighed most heavily on balance sheets and in stock valuation metrics – were physical objects: factories, machines, raw material reserves, and so on. In the 21st century, the dominant assets are mostly intangible: patents, research programs, intellectual property, network effects, etc. Based on old rules, intangible assets were not measurable goods while expenditures on creating intangibles were marked as negative. That is, a research and development program was seen as a drag on the balance sheet which contributed nothing.

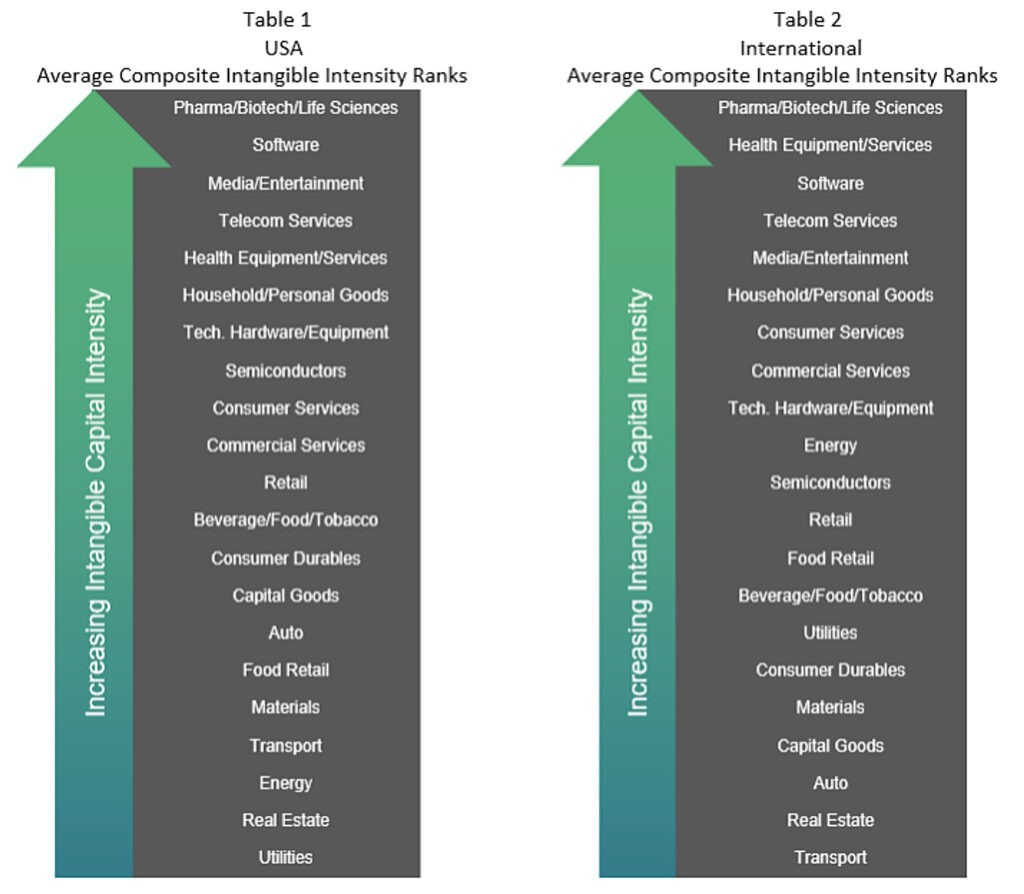

Dr. Pozharny has published a lot of research on the nature and significance of intangible capital on a firm’s prospects and has identified the industries in which intangible capital is the most important driver of success. That led to the formulation of Bridgeway’s Intangible Capital Intensity metric. The notion is that by factoring in intangible capital, Bridgeway can better identify attractive growth opportunities and better assess the firm’s actual stock valuation.

Bridgeway is not the first investor to pursue intangible capital with focus and discipline. Guinness Atkinson Global Innovators has used it to create a high-performance (top 5% of global growth funds over the past 15 years), low turnover (8%) portfolio that has drawn less attention than its merits warrant.

Bridgeway, unlike Global Innovators, will actively short stocks. Founder John Montgomery’s assessment is that a well-devised short book might add even more value than the long book alone.

Why not run this as an ETF? Two reasons. Shorting in an ETF is hard. And ETFs cannot close to new investors. Bridgeway intends to close this fund to new investors at between $100-150 million. Once the fund closes the strategy will only be available through larger separately managed accounts and a Bridgeway hedge fund. Both will charge more than the 1.5% e.r. on the mutual fund.

Website: Bridgeway Global Opportunities Fund. The fund is available at Schwab for a $2500 minimum and at Fidelity.