Investors waited impatiently as the Federal Reserve considered cutting interest rates. Will it be 0.25% or 0.5%? They finally cut rates by 0.5% on September 18th. The S&P 500 is up 20% year to date as investors contemplated whether we would have a recession or manage the elusive soft landing. There have been three periods this year where the market fell 5% or more. The S&P 500 has been relatively flat for the past three months but spiked over 1% after the Fed made the cut.

My survival instinct tells me to sell stocks and buy bonds, but my self-control tells me to stick to the plan worked out over the past three years with the assistance of financial advisors. The economy is strong, and I hope for a soft landing. It’s 4 am in the morning so I will get another cup of coffee and chill. I prepared for the rate cuts by evaluating if I had enough in safe bonds, certificates of deposit, and money markets to cover three years of expenses. I sold a small amount of my more volatile funds and bought bond funds.

We are at an inflection point with short-term interest rates falling and the yield curve uninverting. I hope to gain some insight into the next six to twelve months by looking at short-term trends in this article. I track over eight hundred mutual and exchange-traded funds from approximately 125 Lipper Categories available at Fidelity and/or Vanguard without transaction fees or loads. For this article, I downloaded the latest data as of September 21st using the Mutual Fund Observer MultiScreen tool. I created a momentum indicator based on an equal weight of 1) August and September returns, 2) three-month exponential moving averages, and 3) fund flows.

This article is divided into the following sections:

- Section 1, Trending Lipper Categories

- Section 2, Trending Great Owl Funds

- Section 3, Trending Funds from the Trending Lipper Categories

- Section 4, Trending Bond Funds

TRENDING LIPPER CATERGORIES

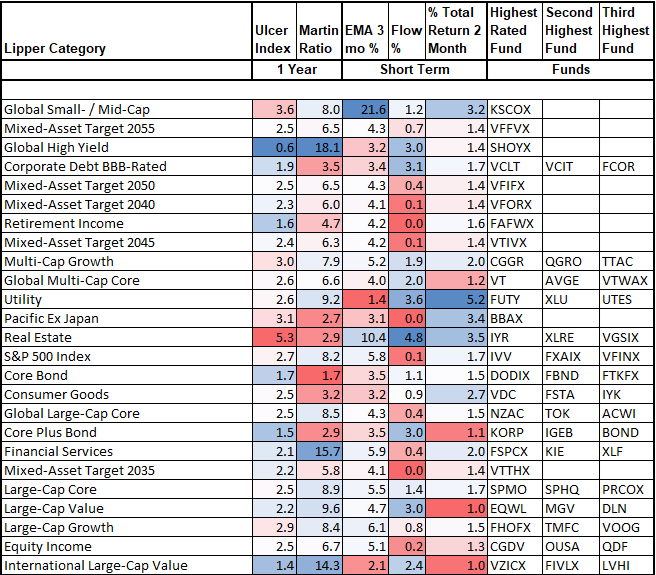

I calculated the trending Lipper Categories from the average of the momentum indicator for individual funds. As a casual observation, there are six Mixed Assets, six Global, six Equity, four Bond Categories, and four Sector categories trending the most now. A globally diversified stock and bond portfolio is trending upwards very well. Bond funds have performed well because bond values rise as interest rates fall. As bonds in my bond ladders mature, this table contains the Lipper categories and funds that I may be interested in buying.

Table #1: Top Funds from Trending Lipper Categories (One-Year Metrics)

DEFINITIONS:

- Ulcer Index measures both the magnitude and duration of drawdowns in value.

- Martin Ratio is a measure of excess return above a risk-free investment divided by the risk. It is calculated as (Total return – Risk-free return) / Ulcer Index.

- return, but relative to its typical drawdown.

- Great Owl funds have “delivered top quintile risk-adjusted returns, based on Martin Ratio, in its category for evaluation periods of 3, 5, 10, and 20 years as applicable”.

TRENDING GREAT OWL FUNDS

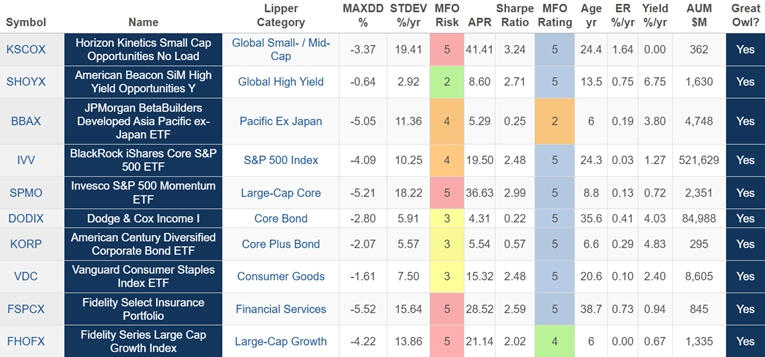

Table #2 contains Great Owl Funds that are trending strongly within the trending Lipper Categories in Table #1. I own a diversified global portfolio resembling a traditional 60% stock /40% bond balanced allocation. When the yield curve uninverts, a recession usually begins within a few months, but the economy currently looks resilient. I prefer to underweight growth funds that have done so well over the past year.

On the equity side, Vanguard Consumer Staples (VDC) has some appeal as valuations of the S&P 500 remain high. With interest rates likely to fall over the twelve months or so, American Beacon SiM High Yield Opportunities (SHOYX), Dodge & Cox Income (DODIX), and American Century Diversified Corporate Income (Korp) also interest me. I look at these further in Section #4.

Table #2: Trending Great Owl Funds (One-Year Metrics)

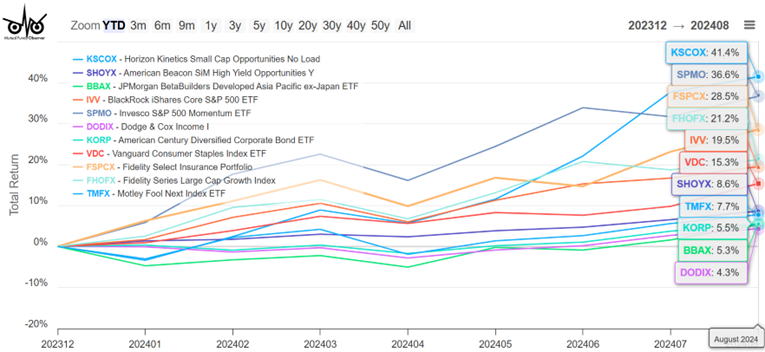

Figure #1 reveals that Vanguard Consumer Staples (VDC) and American Beacon SiM High Yield Opportunities (SHOYX) have had relatively steady returns over the past several months. In a market downturn, they may perform better than diversified equity funds.

Figure #1: Trending Great Owl Funds

TOP FUNDS FROM THE TRENDING LIPPER CATEGORIES

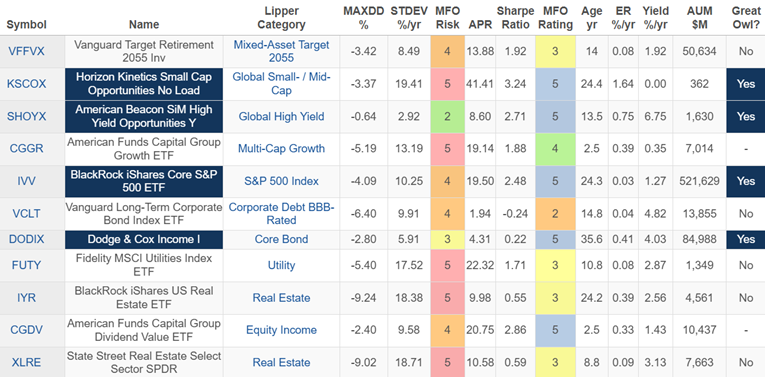

The funds in Table #3 are trending in Lipper Categories where the majority of the funds are trending regardless of whether they are Great Owl Funds. It includes some Mixed Assets, utility, and sector funds.

Table #3: Top Combined Funds from Trending Lipper Categories (One-Year Metrics)

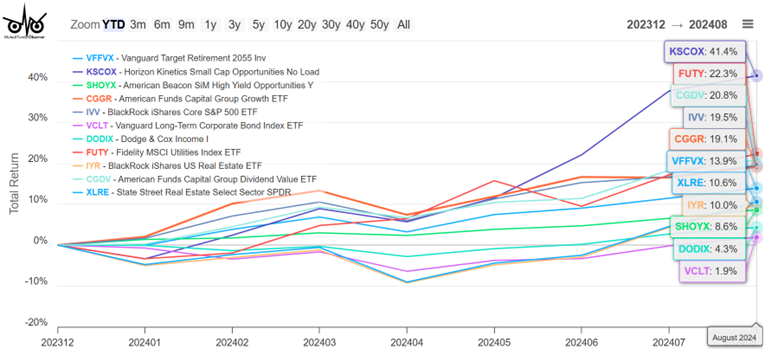

Among equity, American Funds Capital Group Dividend Value (CGDV) stands out for consistent performance. For those who want a one-stop fund, the Vanguard Target Retirement 2055 (VFFVX) fund has done well, but interested investors should look at the appropriate target date. Finally, State Street Real Estate Select Sector (XLRE) responded strongly to the rate cut.

Figure #2: Top Combined Funds from Trending Lipper Categories

TRENDING BOND FUNDS

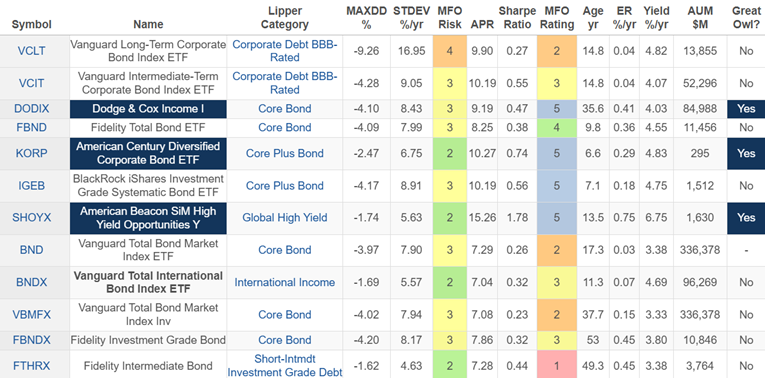

In a falling rate environment, I favor being overweight in bonds. The first seven funds in Table #4 were identified as top-performing funds in the trending Lipper Categories. The remaining five are included for comparison purposes.

Table #4: Top Bond Funds from Trending Lipper Categories (One-Year Metrics)

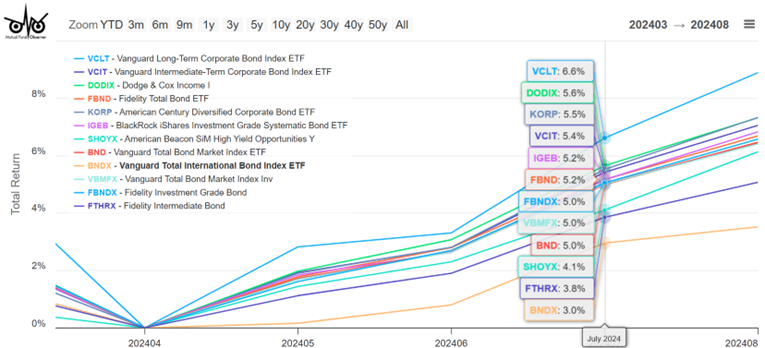

Figure #3 shows that long-term corporate bonds have increased the most in value as the interest rates fall. Fidelity Intermediate Bond (FTHRX) contains more treasuries and has not climbed at much as the others. Dodge & Cox Income has been a top performer in the pack of other bond funds. One last observation is that low-cost bond ETF funds are also at the top of the pack for performance.

Figure #3: Top Bond Funds from Trending Lipper Categories

CLOSING THOUGHTS

I maintain a list of over a thousand funds that I have previously vetted. Which fund is best for an investor depends mostly on their current and desired portfolio. I was not surprised that bond funds are trending favorably. I will be making small changes next year taking into account the impact of taxes and the economy. Tax efficiency was not a consideration in identifying these trending funds. Less tax-efficient equity funds should be held in Roth IRAs and less efficient bond funds like the ones in this article should be held in Traditional IRAs if possible.