On September 29, 2023, Mr. Pabrai started the Pabrai Wagons Fund (WAGNX/WGNIX), a ‘40 Act mutual fund, offering retail investors a vehicle to invest in his stock ideas.

Mohnish Pabrai, quoting ChatGPT, is a value investor heavily inspired by Warren Buffett and Charlie Munger, with a focus on long-term, concentrated bets on undervalued companies. He founded Pabrai Investment Funds, where he manages private partnerships that mirror Buffett’s approach, often emphasizing the importance of patience and low-risk, high-return opportunities.

He has written two notable books:

- The Dhandho Investor: The Low-Risk Value Method to High Returns (2007)

This book outlines his investment philosophy. The term “Dhandho” refers to the concept of business in Gujarati, and Pabrai presents a simple, low-risk method to achieving high returns through value investing. - Mosaic: Perspectives on Investing (2004, out-of-print)

This book is a collection of Pabrai’s writings, where he shares his thoughts on investing, including lessons learned from successful investors like Warren Buffett and Charlie Munger. It offers insights into his personal investment philosophy and strategies.

I had read one of his books, The Dhando Investor, and was aware of his friendship with Charlie Munger. I had heard him on value investing podcasts, listened to some of his stock investments, and admired his philanthropy work in India.

Mr. Pabrai has quite a following in the investment community and his Pabraisms are often quoted. One I heard recently was “Always invest when the market is closed”, followed by “Take a nap every day”.

I first learnt about the Wagon fund through Twitter, where a targeted advertisement told me:

- The S&P 500 Index of US equities presently trades at a trailing P/E of about 27.5x earnings, identical to 2000 and significantly about the S&P’s 16x long-term average earnings multiple.

- When the P/E was this high in 2000, for the next 11+ years, dividends included, investors made no money in the S&P 500. The current valuations could be a problem going forward.

- In juxtaposition, the Wagon Fund carries a portfolio of exceptional global businesses, which currently trade at an average P/E of 7.5x

- Thus, the Wagon Fund is well-suited to outperform the S&P 500 going forward.

Intrigued by the pitch, I researched the fund’s website, following which, I reached out to Mr. Pabrai. David Snowball and I met with Mr. Pabrai over Zoom in the middle of September 2024 to learn more about the Wagon Fund. What follows is part analysis, part Q&A, paraphrased for print.

In this article, we will first hear from Mr. Pabrai about his reasons for starting a mutual fund, and we will dive into the stock portfolio of the fund. Next, we will look at the fund structure and some of the challenges in this situation. I conclude with my take on the fund’s merit for potential investors.

A “Devesh Q and Mohnish A” exchange

Q: Why did you start the Wagon Fund?

MP: I operate multiple private investment partnerships, but the maximum number of investors that we can have in these partnerships is between one hundred to five hundred. Many individual retail investors have reached out to invest in my strategies. The private funds have a high minimum investment in the millions of dollars. To meet the lower minimums suitable for small investors, I started the Wagon Fund, a democratic product.

Q: What are the assets under management?

The private funds have over one billion in assets managed by me. The Wagon fund is just getting started and has around 39 million dollars in Assets (as of Sep ’24, 2024).

Q: Are the returns of the Private funds available to investors so we can learn more about your investing history?

(Mr. Pabrai did not offer specific numbers since the funds are private but let on that the funds have outperformed the S&P 500 over the long run, albeit with higher volatility).

Q: What comparisons can you draw between the Private funds and the Wagon fund?

MP: The private funds are highly concentrated holding 10 positions. The Wagon Fund holds about 27-28 positions. Mutual Fund regulations about diversification require us to run it differently than the privates. I have a limited number of good ideas and thus many of the stocks overlap between the funds.

Q: How have you applied Buffett-Munger learnings to stock concentrations in your own investing?

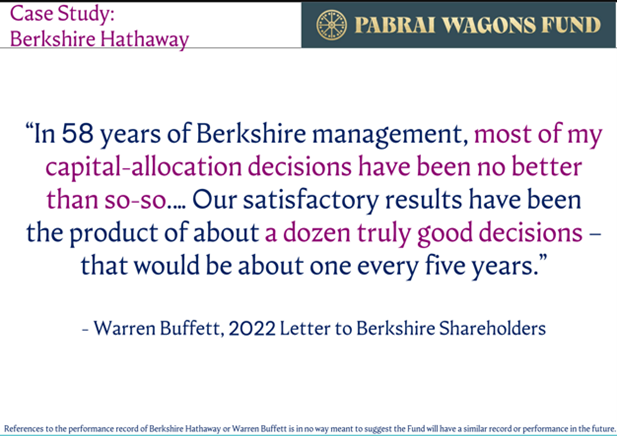

MP: We did a deep dive on every decision made by Berkshire Hathaway since 1965. If we count Buffett’s private investments, the public company stocks he bought, and important personnel hires, Berkshire Hathaway has made about 300 significant decisions over six decades. In his 2022 Annual Letter, Mr. Buffett wrote that only about a dozen decisions have been responsible for almost all the returns of Berkshire.

We are talking about a dozen great decisions out of three hundred significant investments. That is a 4% hit rate.

And we are talking about GOD here (referring to Mr. Buffett).

What chance do we mortals have to outperform the market? It’s tough. The important lesson is when opportunity knocks, we want to have high conviction, bet big, and then hold the investment forever.

Q: Looking at the allocation of the stock portfolio in the Wagon Fund, it appears that the fund holds 35% Turkish stocks and 60% US stocks. Is your mandate to be (1) a Global Fund (like Moerus Global MOWIX) (2) an EM fund with US exposure (like Artisan Developing APDYX) or (3) a deep value fund?

MP: None of the above. Our only mandate in the Wagon Fund is to make money.

(On the topic of Turkey), the fund has investments in certain stocks. They happen to be in Turkey. But I didn’t start with the idea of buying something in Turkey.

Q: How would you best categorize the Wagon fund?

Think of the Wagon fund (and the private partnerships) as an Anomalies Fund – my strongest views on where Mr. Market is wrong and created a big anomaly, allowing me to invest.

Broadly speaking, the Wagon fund’s investments consist of 6 buckets:

-

- Coal stocks (Arch Resources, Alpha Metallurgical Resource, CONSOL Energy, Warrior Met Coal), represent about 20% of the portfolio.

- US Homebuilders (Pulte, Toll Brothers, Tri Point homes) about 10% of the portfolio

- US Car Dealers (including Asbury Automotive, Penske, Lithia) are about 19% of the portfolio. Here’s the rationale for our investment in this bucket:

- Markets expected Electric Vehicles (EVs) to become a large portion of the car fleet, that these EVs would be sold directly, and these cars would not require servicing.

- We are not seeing that level of migration to EVs. The OEMs (the car manufacturers) are not going to bypass the dealer network and many of them are locked into those contracts. In any case, dealers don’t make that much on car sales.

- What the market got wrong is that the lifetime servicing of an EV is similar to Internal Combustion Engine (ICE) vehicles.

- We concluded that Car dealers, which were trading at 5-7x Earnings were too cheap. We built a position in the best names we could find.

- Car dealerships are an example of a contrarian, deep-value bet.

- Our 4th bucket is TAV Havalimanlari Holding: This is the Turkey Airport Holdings Company, a 12% holding for the Wagon Fund. Thesis:

- Start with just one airport.

- During COVID, TAV bought the Almaty airport in Kazakhstan when the passenger traffic was zero for $400mm. They put in another $250mm to build a new terminal. The $650mm investment was financed at 4% for 30 years and with a $150mm Equity investment.

- 95% of the airports around the world are owned and operated by Governments.

- Even when airports are private, they operate on BOT (Build, Operate, Transfer), that is, the airport goes back to the Government after 20-30 years.

- In contrast, the Almaty airport license is permanent (he said, 10,000 years).

- Fast forward to 2024: Cash Flow from Almaty will be $150-200 mm growing at 15-20% per year.

- TAV operates 15 airports across 8 countries. It provides a wide range of services in addition to airport management, including duty-free operations, ground handling, and other aviation-related services.

- The stock’s Equity Market Cap was $800mm when we invested and is $2.8Bn currently.

- Why would I ever want to sell TAV Holdings when it pays for itself many times over? I can’t find businesses like these on the NYSE.

- Bucket number 5 is the Turkish Coca Cola Bottling Company, Coca Cola Icecek. We own stock in Icecek (the bottling company), in Anadolu Grubu Holding (the parent company), and Anadolu Efes Biracilik ve Malt Sanayii AS ORD (the holding company) for a total allocation of 25%. Through the parent and holding company, the fund also has exposure to various businesses in that region. The exposure gives us ownership of the largest beverage and beer distributor in Ukraine and Russia. The business trades at a very reasonable valuation.

- Mongolian Mining (which Pabrai talked about in depth) represents a high cash flow business trading at low Free Cash Flow multiples. Along with Occidental Petroleum, and a smidgen of Amazon and Microsoft, the portfolio is mostly spoken for.

These are my great ideas for now. My two analysts and I will spend months diving deep into each company before investing.

Q: Do you expect the Wagon Fund to beat the S&P 500? What about Berkshire Hathaway?

MP: First, let’s talk about why the S&P 500 Index is unbeatable.

The index is a thing of beauty because it is so DUMB.

Take, for example, NVIDIA. The Index has been long NVIDIA since 2001 and luckily by design is too dumb to have sold the stock. Meanwhile, active managers have bought and sold NVIDIA from their portfolio numerous times.

Remember the lesson from Berkshire is not the buying of great companies which creates investment greatness. It is the part one remains invested in that allows for compounding.

Both Buffett and Munger have publicly disclosed they do not expect Berkshire to outperform the S&P 500. The size of the balance sheet is simply too large to invest and gain an edge versus the S&P.

For the Wagon fund, I like to underpromise and overdeliver. I hope the fund will beat the S&P by 1% to 3% over the long run. And since I don’t think Berkshire can outperform the S&P anymore, it follows I expect the fund to outperform Berkshire too.

At the end of the call …

In the ninety-minute Zoom call, Mr. Pabrai delved deep into his analysis of Mongolian Mining and some of his Canadian Steel investments around 2005. He was making the point that he has a history of finding stocks that Mr. Market has mispriced. He finds them, invests big, and sits on those companies.

I believe Mr. Pabrai is a high-quality investor, has a knack for finding areas where Mr. Market offers anomalies, and can identify solid businesses. The Wagon fund looks promising.

But this fund is not for everybody.

There are several challenges on the Business side.

Issues/Challenges for Wagon Fund investors:

-

-

-

Key man risk. This is the Pabrai Wagon Fund.

If Mr. Pabrai gets hit by the proverbial bus, the fund has no future. There are two analysts, but this is not a team, where another Portfolio Manager with Mr. Pabrai’s gravitas can take over.

-

Trading priority between privates and Wagon Fund.

Q. Since Mr. Pabrai operates private funds and this mutual fund, which funds get priority to trade? Is there a conflict of interest?

MP:

- We have worked on a solution whereby each fund gets a priority one day a week. Monday would be Private Fund 1, Tuesday Private Fund 2, Wednesday Wagon Fund, and so on and so forth. The idea is that each day one fund gets first dibs to invest in the market.

- There isn’t much trading going on day to day. We invest and sit on stocks for a long time.

- The Private fund investors can only redeem once a year at the end of the year. Whereas Public funds provide daily liquidity by regulation. By design, the public funds win in liquidity on the exit.

- It takes 6-9 months to invest slowly in some business. Remember it took Berkshire eighteen months to invest in the Japanese trading houses.

Analysis: The idea of rotating liquidity first dibs is pragmatic, but I don’t know how comfortable many investors will be with such a mechanism.

-

Size limits to investments?

-

Suppose the Wagon fund would become a Billion-dollar fund. Do Turkish stocks have that kind of daily trading volume and liquidity? Suppose there is a market crash and there are redemptions in the Wagon Fund, will you be able to sell these same stocks to match outflows (if it took 6-9 months to get into these stocks).

MP: Firstly, this is a theoretical, not a real problem. The Wagon Fund only has $39 million in assets. Second, can establish Lines of Credit with Banks, so we could use that liquidity to meet Outflows if needed. Third, we own other stocks in the US. We can sell those first to raise the money to meet outflows.

Analysis: Neither Berkshire Hathaway nor the private funds are forced to sell stocks in a crash. Their capital is permanent and locked respectively.

On the other hand, the Wagon Fund is a daily liquidity product. concentrated investing is a dual-edged sword. When the market is going in your favor, the fund will mint money and compound at extraordinary rates. When the market goes against you, the bottom falls out. The Wagon Fund will suffer from illiquidity as a nature of its bets.

As a case in point, Mr. Pabrai mentioned that Private funds were down as much as 60-70% in the Great Financial Crisis of 2008-2009. They did bounce back and were up approximately 20% by the end of 2009. Ergo, investors should be buckled up when investing in this fund when the market is in rough waters.

-

Potential risk of sharper drawdowns than the market

Said Mr. Pabrai, “When you hold 10 stocks in the Private funds’ portfolio, it is bound to be more volatile than the S&P 500, which has 500 stocks. One of our funds in 2008 was a sub-prime investment, which went to zero. When that’s 10% of the portfolio, you get hit.”

Mr. Pabrai added, “Ted Weschler (one of the two Berkshire Teds) was also down 70% in the GFC and Buffett still hired him.”

-

For retail investors considering the Wagon fund, it’s important to keep in mind that even the great investors have large drawdowns and have stocks that go to zero. Their greatness is not because they are good at controlling drawdowns. Rather, it’s because they find businesses that will survive the economic cycles, and they buy such businesses at great valuations (and hold them forever).

Striking the Balance between Reasons to Buy and Reasons to Avoid

Investors are being presented with access to a high-quality, deep-value, storied investor, in the form of Mr. Pabrai. The fund’s portfolio is different than the Mag 7, not ridiculously diversified like some index funds, and not invested for the sake of filling buckets. It’s constructed meticulously.

But this access comes with caveats on the business side.

Pabrai hasn’t run a mutual fund before. He is the Keyman for the fund. Conflicts between private and public funds, liquidity in international markets, and the correlation between concentrated portfolios and drawdown measures are all on the table.

Mr. Pabrai would argue my concerns are theoretical. I agree. But it’s my duty to point out concerns for potential investors.

I am going to invest in the Wagon fund because I like a differentiated portfolio, and I think Mr. Pabrai has tremendous investment acumen.

But it cannot be a big position.

I would like the fund to season and fine-tune on the business side – build a bigger team with a seasoned number two. I want to see how the fund performs in a market correction – how it handles outflows and manages liquidity in Turkish stocks. And I’d like to see if the public vs private funds create conflicts.

It’s not a fund for everyone, but for those with extra investment capacity, and a desire to overlook the teething problems of the mutual fund, it might be a good idea to circle the wagons.

-