Our colleague Devesh Shah encouraged the incorporation of ETF Benchmarks into MFO Premium. Traditional benchmarks cannot be purchased. Similarly, category averages, which are the basis for much of the ratings on MFO Premium, also cannot be purchased. Establishing an ETF “benchmark,” Devesh argues, makes for a more relevant and practical comparison.

Furthermore, the exchange-traded funds ETFs selected for these benchmarks are all index-based and passively managed. Devesh remains skeptical of most actively managed funds and recommends they be viewed through the prism of a passively managed, index-based alternative.

[As a side note, like former MFO colleague Ed Studzinski, he asks when evaluating actively managed large-cap funds: What do they offer that Berkshire Hathaway BRKA does not?]

Since MFO’s inception in 2011, David Snowball has consistently employed comparisons with several “reference” funds in his fund profiles, which now tally 133. These comparisons are integral to our Risk Profile tool, which is freely available to the MFO community, along with QuickSearch, Great Owl, Three Alarm, and Dashboard of Profiled Funds tools.

The five venerable Vanguard reference funds: Total Bond Market Index (VBMFX), Balanced Index (VBINX), Vanguard STAR (VGSTX), Total Stock Market Index (VTSMX), and Vanguard Total International Stock Index (VGTSX). Each is further delineated in the table below.

David’s Reference Funds

Here is a link to the Risk Profile for Dodge & Cox Global Bond Fund (DODLX), which David profiled in 2014, to demonstrate comparative use of the reference funds. DODLX just passed its 10-year mark and is currently an MFO Great Owl. Risk Profiles can also be obtained by clicking on ticker symbols in almost any tool on the site.

The ETF Benchmarks expand this concept for 123 of the 174 rated categories, comprising more than 9,000 actively managed funds. (Yes, it’s true … there are nearly 12,000 US funds and the vast majority are actively managed.) Against these funds, 71 ETFs based solely on their target category have been assign, as summarized in table below. Generally, the ETFs are widely recognized (e.g., Vanguard or BlackRock), have lower ER, enjoy longevity, and retain larger AUM for better liquidity.

The ETF Benchmarks

In some cases, typically mixed asset, two broadly recognized ETFs are combined, like VTI and AGG, to form allocation ETFs, denoted VA6040, in this example, or VE5050 in the case of VWO and EMB.

Granted, this approach is subject to the same shortcomings as other benchmarking methodologies: category drift, survivorship bias, mis-categorization. But it keeps things simple and transparent. And presents the persistent challenge: What does this actively managed fund offer that a broadly used ETF does not?

Users can also pull-up these benchmarks in MultiSearch by selecting PreSet Screens/Benchmarks & Reference/ETF Benchmarks. Performance ratings based on them carry the designation APRBE. (Users can pull-up David’s Reference funds in same place.)

So, what can we do with the new benchmarks?

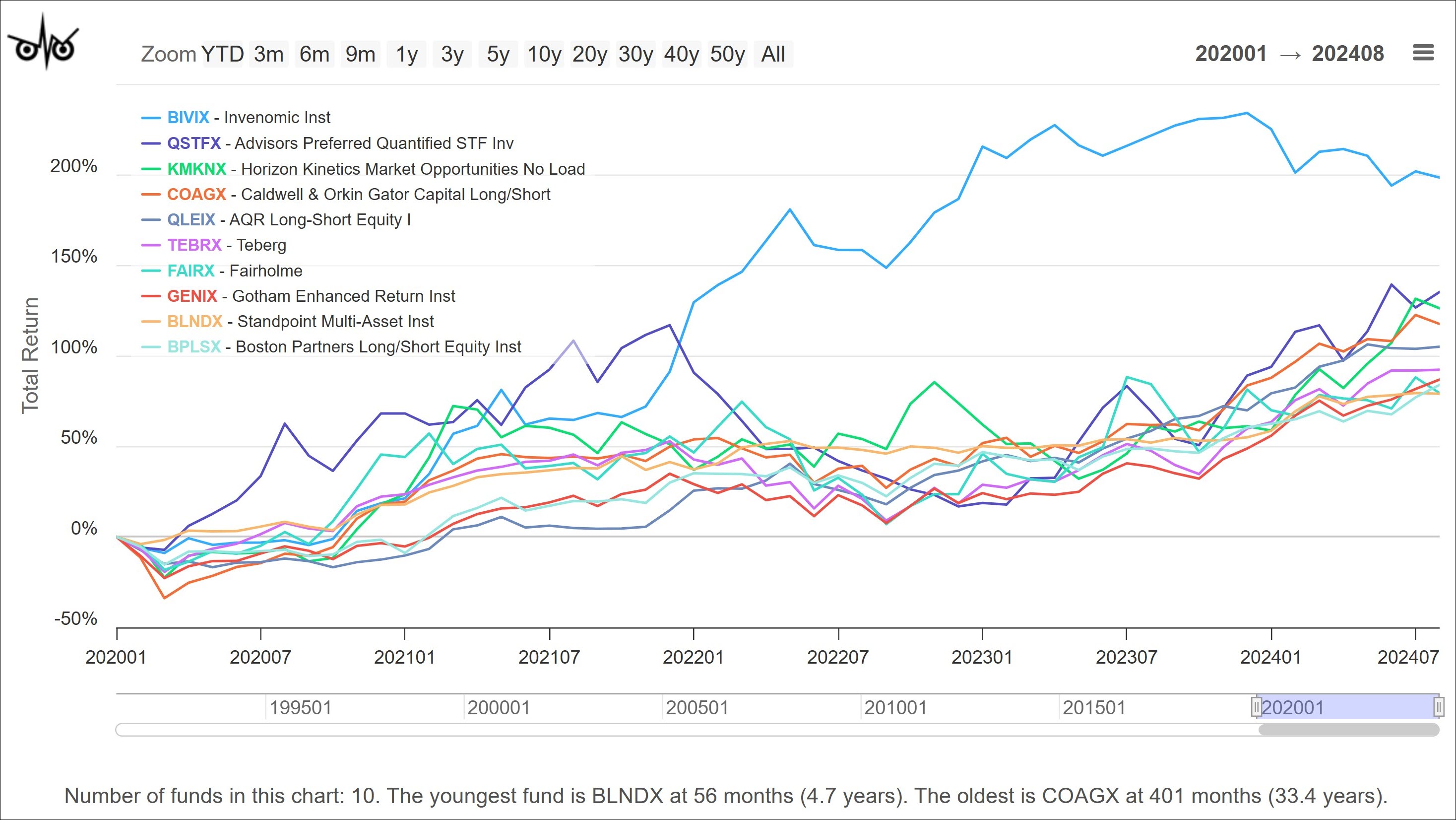

Below are the top performing mutual funds by absolute return since COVID, almost five years ago, when compared to their ETF Benchmark Mixed-Asset Target Alloc Moderate [VTI/AGG 40/60]:

Top Funds Since COVID with ETF Benchmark VA4060

They include Invenomic (BIVIX), AQR Long/Short (QLEIX), Fairholme (FAIRX … can you believe?), and Standpoint Multi-Asset (BLNDX). BIVIX was profiled by David in 2019. QLEIX profiled (by Sam Lee) in 2016. BLNDX profiled last January.

The ETF Benchmarks come with attendant ratings, called APRBE Rating, short for APR vs ETF Rating. (APR is Annualized Percent Return, typically.) All actively managed funds of a particular fund type, like Equity or Bond, are rated based on APR vs ETF return across a specified evaluation period. Those with highest decile performance are assigned a 10 (best).

In MultiSearch, users can screen for APRBE Rating by selecting desired decile or, alternatively, an absolute APR vs ETF percentage. Users can also examine category averages to see if some categories have consistently beat their ETF Benchmarks. Best to explore in MultiSearch, the site’s main search tool, specifically using Risk & Return selection criteria, plus other criteria like Asset Universe (e.g., Mutual Funds), Fund Type (e.g., Equity), and Display (or evaluation) Period.

MultiSearch Selection Criteria – Risk & Return Metrics

In addition to MultiSearch, where users would be well advised to compare a fund’s performance to its ETF Benchmark, we’ve included the APR vs ETF return metric in our Launches Dashboard and Dashboard of Profiled Funds, using the period since the launch alert or fund profile was last posted.

For users that desire a more fundamentals-based benchmark, MultiSearch also includes so-called “Best-Fit” Benchmarks. Currently, LSEG (formerly Refinitiv, formerly Lipper) assigns 163 indexes as “Best Fit” Benchmarks to most funds in the database, actively or passively managed. This benchmark is a market-recognized index that best correlates with the performance of the fund; therefore, it gives some idea of what role a given fund might play in an investor’s portfolio. Unlike benchmarks often defined by a fund’s manager, these indexes are broadly used and available. Like with our new ETF Benchmarks, the Best-Fit benchmarks have attendant metrics and ratings, like APRBF Rating, short for APR vs Best-Fit Rating. They can be accessed in MultiSearch in much the same way.

All the various types of benchmarks included on the site are described on the Definitions page. For what it’s worth, my impression is that benchmarking and indexing have become a big business in the fund industry, with almost as many indexes as funds themselves. A bit of an exaggeration perhaps, but not by much. In the meantime, I find the incorporation of Devesh’s ETF Benchmark idea to the site quite satisfying. I trust you will too.