On September 10, 2024, Research Affiliates will launch its first ETF. Research Affiliates was founded in 2002 by Rob Arnott to provide professional and institutional investors with innovative research and product development. Mr. Arnott is iconic, having published 150 or so research articles that received both attention and rewards. His most extensive work is The Fundamental Index: A Better Way to Invest (2008). Most traditional indexes are capitalization-weighted, so they lock in a large/growth/momentum bias. Arnott notes that the bias may contaminate performance and argues for “fundamental” indexes that give preference to firms that are, oh, I don’t know, consistently profitable and efficient. That insight eventually gets incorporated into what are called “smart beta” products.

On September 10, 2024, Research Affiliates will launch its first ETF. Research Affiliates was founded in 2002 by Rob Arnott to provide professional and institutional investors with innovative research and product development. Mr. Arnott is iconic, having published 150 or so research articles that received both attention and rewards. His most extensive work is The Fundamental Index: A Better Way to Invest (2008). Most traditional indexes are capitalization-weighted, so they lock in a large/growth/momentum bias. Arnott notes that the bias may contaminate performance and argues for “fundamental” indexes that give preference to firms that are, oh, I don’t know, consistently profitable and efficient. That insight eventually gets incorporated into what are called “smart beta” products.

RAFI’s focus is on “smart beta and enhanced indexing, quantitative active equity, and multi-asset products” and is driven by the idea that markets are not efficient and their inefficiencies are predictable and exploitable. Like Leuthold before, their research business generated calls for them to offer products driven by research (rather than, more commonly, by marketing). Up until now, most investors are exposed to Research Affiliates through their RAFI collaborations with Invesco (for instance, Invesco RAFI Strategic US ETF) and PIMCO (as in PIMCO RAFI ESG US ETF, the only fund that has to be rendered entirely in capital letters). As of June 30, 2024, the firm has over $147 billion in assets using strategies developed by Research Affiliates.

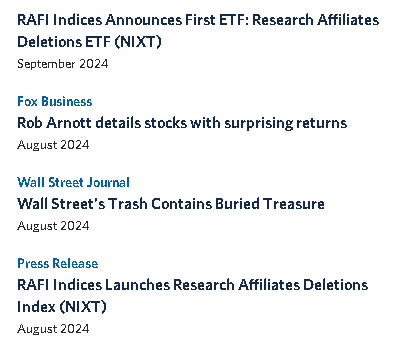

Research Affiliates is about to launch its first directly branded ETF, the Research Affiliates Deletions ETF (NIXT). NIXT will buy the companies ejected from large cap (“the 500”) and mid-cap (“the 1000”) indexes. They will hold those companies in an equal-weight portfolio for five years, rebalancing annually.

Why? Investors have long known that the companies dropped from the S&P 500 tend to outperform the S&P 500 (and, in particular, outperform the companies that replaced them). RAFI systematized that observation in a recent research piece, “Nixed: The Upside of Getting Dumped” (August 2024). They found that “stocks deleted from market-cap weighted indices have soundly beaten the small cap value benchmark over the past 30 years, including during this last difficult decade for small-cap value companies.” In particular, they outperform for about five years, hence the fund’s holding period.

Why? Investors have long known that the companies dropped from the S&P 500 tend to outperform the S&P 500 (and, in particular, outperform the companies that replaced them). RAFI systematized that observation in a recent research piece, “Nixed: The Upside of Getting Dumped” (August 2024). They found that “stocks deleted from market-cap weighted indices have soundly beaten the small cap value benchmark over the past 30 years, including during this last difficult decade for small-cap value companies.” In particular, they outperform for about five years, hence the fund’s holding period.

Why might you be interested? First, it provides a small cap value fund that’s going to be very different from its peers. Second, it provides return drivers that are structural and uncorrelated with the market. Cap-weighted strategies rise when, if, and to the extent that, the market rises. Strategies with uncorrelated alpha (some long/short and arbitrage strategies, as examples) have the prospect of prospering in flat or falling markets, while still participating in rising ones.

The fund has its own website and advertises an expense ratio of 0.09%.