“It’s a sure sign of summer if the chair gets up when you do.” Walter Winchell

Walter who? O tempora! O mores!

At the height of his popularity, in the late 1930s, 50 million people—two-thirds of American adults—read Winchell’s syndicated column and listened to his 15-minute Sunday-night radio broadcast. He positioned himself as a champion of “Mr. and Mrs. America,” and was the most powerful – or, at least, most feared – person in American media. He remained a force through the 1950s. While he derided “presstitutes,” his fast-paced, gossip-driven, and politically charged style is the precursor to and model for the media madness that plagues us today.

On the upside, he got summer and rocked a mean fedora!

In the August issue of Mutual Fund Observer …

Each year MFO celebrates the insane heat of summer with its summer-light issue, which reflects the fact that both our readers and our contributors are scattered on beaches, benches, decks, and boats across the northern hemisphere. To which we say: good for you, guys!

Devesh peers over the rim of his pina colada to share “Summer Thoughts” on options-based funds (“just don’t”), asset allocation (“stay home”), good podcasts, and Berkshire Hathaway in the twilight of Buffett’s care (“stay the course”).

Lynn, who at 69 is about to roll into his prime, has decided to examine “The Wisdom of the Elders” – Warren, Chuck, Howard, and Gary – to see how they might help us prepare for 2025. Separately, he took a break from building houses for Habitat and traveling, to share “Bits and Pieces” of what he’s learned during his first year after leaving full-time work. Just a heads up, IRMAA is looking for you.

The Shadow went beyond his always excellent coverage of the industry’s twists and turns to highlight four new funds in the pipeline – Nordic bonds, anyone? – that likely deserves your attention.

And me? As I read Morningstar’s recent “best small cap funds” article, I had two strong reactions. (1) This is very non-Morningstar. Much more like Zacks and Yahoo. How weird. And (2) you can do hella better. In “Better than the Best,” we highlight 17 small cap funds that have beaten their peers at least 90% of the time over the past decade.

We also share three Launch Alerts for funds that have come online in the past few months: WPG Select Hedged (a long/short small-cap fund from Boston Partners), Otter Creek Focus ETF (a small- to mid-cap focused fund with an emphasis on quality businesses and a strong private record) and T. Rowe Price Intermediate Municipal Income ETF (an inexpensive way to access a very T. Rowe Price-y approach to tax-free investing, their first active ETF that doesn’t mimic an existing fund).

Things I’ve learned in summer …

“The first week of August hangs at the very top of summer, the top of the live-long year, like the highest seat of a Ferris wheel when it pauses in its turning. The weeks that come before are only a climb from balmy spring, and those that follow a drop to the chill of autumn, but the first week of August is motionless, and hot. It is curiously silent, too, with blank white dawns and glaring noons, and sunsets smeared with too much color.” Natalie Babbitt, the opening lines to “Tuck Everlasting” (2002)

-

The Upper Peninsula of Michigan is cool, but it makes Maine look urban in comparison. Chip and I spent 1o days there, sampling whitefish and fudge, listening to “The Wreck of the Edmund Fitzgerald” (it’s omnipresent), meditating on the fact that every family owned at least one ATV/UTV, traveling the Soo Locks and clambering about lighthouses.

Oh, right. Helicopter. Had I mentioned we went joyriding in a helicopter?

Thanks to Catch22 for his trip recommendations, and to Andrew and Michelle Foster for the lovely wine that made relaxing in Adirondack chairs all the sweeter!

-

Standpoint Multi-Asset Fund (REMIX/BLNDX) is on fire!

Charles Boccadoro, the maestro of MFO Premium, started the discussion as he tracked performance and asset flows, a relatively new function for our Premium site. We profiled this all-weather, long-short, managed futures fund in January 2024, concluding

Life is uncertain, and investing even more so. Standpoint is trying to offer an island of predictability that investors might use to complement and strengthen their core portfolios. With positive absolute returns each year, they have earned a place on any sensible investor’s due diligence list.

Since then Standpoint has climbed steadily toward $1 billion AUM and its fifth consecutive year of top-tier returns.

The MFO discussion board is all over the story. You should join them.

-

Morningstar has 17 new prospects for you

Morningstar maintains a sort of list of “Not Ready for Prime-Time” funds, and their Prospects. These are “up-and-coming or under-the-radar investment strategies” that they’re monitoring as candidates for analyst coverage. The newbies:

- Alpha Architect 1-3 Month Box ETF BOXX uses a novel options strategy to deliver Treasury yields with favorable tax treatment.

- American Century High Income’s AHIIX experienced and well-resourced team focuses its bottom-up approach on debt with strong financials.

- American Funds Multi-Sector Income’s RMDUX experienced team employs a thoughtful approach within the multisector bond Morningstar Category.

- Artisan International Explorer ARHBX brings the firm’s extensive international expertise to this concentrated foreign small-cap strategy.

- Ashmore Emerging Markets Equity’s EMFIX well-resourced team uses a thorough and reasonable approach to investing in emerging-markets equities.

- Capital Group Dividend Growers ETF CGDG actively picks dividend-paying, global market leaders.

- Capital Group International Equity ETF’s CGIE veteran managers look for non-US companies with strong management, solid balance sheets, and steady dividends.

- Dimensional Core Fixed Income ETF DFCF quantitatively selects bonds that tend to outperform according to Dimensional’s research.

- Fidelity Fund FFIDX sports a rising star at the firm and is one to watch.

- John Hancock Disciplined Value International Select ETF JDVI is a more concentrated version of distinguished John Hancock Disciplined Value International JDVIX.

- Lazard US Systematic Small Cap LUSIX employs a highly differentiated systematic process using artificial intelligence.

- Osterweis Opportunity’s OSTGX compact but experienced team takes a bold yet sensible approach to finding small-cap growth stocks.

- North Square Dynamic Small Cap ORSIX benefits from an experienced team and a repeatable systematic approach.

- Rowe Price Global Multi-Sector Bond’s PRSNX seasoned team has a unique approach to foreign currencies.

- Voya Target Retirement 2040 VTRKX has strong underlying holdings and below-average fees.

- WisdomTree US Value ETF WTV uses quality and shareholder yield to find sound businesses.

Two notes. First, Morningstar seems especially smitten with four of the funds: Artisan International Explorer, T. Rowe Price Global Multi-Sector Bond Fund, Voya Target Retirement Funds/Trusts, and WisdomTree US Value.

Second, MFO has already profiled two of the funds.

Artisan International Explorer, which invests in high-quality, undervalued businesses with the potential for superior risk/reward outcomes. The portfolio is typically 25-50 holdings. We concluded: Artisan International Value Strategy works. Demonstrably, repeatedly, over time, and across market cycles. Mr. Samra and his colleagues have demonstrated that at the huge, closed Artisan International Value Fund since 2002. In Artisan International Explorer, you get exposure to what International Value was in its first years: a small, agile portfolio that can benefit from positions in small, obscure, badly mispriced stocks.

Osterweis Opportunity, which pursues high quality, small- to mid-cap companies with the ability to generate rapid, sustainable revenue growth. The fund, formerly named Emerging Opportunity, is managed by Jim Callinan who began his career as an equity analyst in the mid-80s and was a small-cap growth portfolio manager by the mid-90s. He’s managed through four market crashes and two of the longest bull markets in American history. He’s managed both private partnerships and public funds and has handled as much as $6.8 billion in assets. We concluded that small growth companies “are risky, though potentially rewarding. Our first recommendation is to rely on a manager who’s succeeded through both the good times and the hard ones. Our second recommendation is to add Osterweis Opportunity to the due-diligence list for investors and advisers looking for sustained, risk-conscious excellence.”

-

Rich Guys Screwing Up, episode 1246: Bill Ackman’s “Fund for the masses”

Hedge fund billionaire … and, really, we could probably stop there, shake our heads, and move on … Bill Ackman wanted to launch a fund for regular investors. Which he decided needed to be a closed-end fund. With a 2% annual management fee for himself. And a 1.5% sales fee. And the very real prospect that the fund would sell at a discount to NAV, at 80% of what closed-end vehicles do, which means that he might buy $100 worth of stock but only be able to sell them at 95% of their face value. None of which turned out to be wildly attractive. The estimable Jason Zweig chronicles the story in “What Ackman Got Wrong with his Bungled IPO” (WSJ.com, 8/3/24, respect their paywall!).

As you might imagine, the folks on the MFO Discussion Board had a party.

-

The number of families owning mutual funds has spiked!

Working from Investment Company Institute data, the Financial Times reports that “the number of US households invested in mutual funds has grown, even as long-term mutual funds experienced outflows …In total, 68.7 million households, or just over half of US households, were invested in mutual funds in 2023, up from 58.7 million households in 2020” (“Number of US households that own mutual funds jumps,” 8/1/2024, and yes, they do know the difference between mutual funds and ETFs).

Younger investors, however, are increasingly drawn to crypto.

-

Ben Carlson has been wondering if you realize how rich you really are?

Mr. Carlson manages money for Ritholtz Wealth Management LLC and publishes the extraordinary A Wealth of Commonsense blog. Mr. Carlson recently shared “seven questions I’m pondering” (7/30/2024), which include reflections on the happiness of younger Americans and the underappreciated delight of fireplaces.

One fine question that he’s pondering is “Do Americans realize how rich they are?”

He looked at recent data from dozens of countries and dozens of states before observing that “Mississippi has higher average wages than Germany.” He admits to the complexity of the comparisons but does highlight the paradox of one of the richest countries in the world convincing itself that it is poor and faltering.

-

The S&P 500 has changed for the worse

Derek Horstmeyer, a finance professor at George Mason, and his research associates have spent time looking at the evolution of the S&P 500 over the past 50 years. For folks seeking a diversified portfolio, the news is not good. The index is more concentrated than ever in tech and financials, which have high interest rate sensitivity and has tripled its historic correlation with other developed market equities.

They conclude: “In all, the present-day S&P 500 is top-heavy on tech and highly correlated with other world indexes – with high sensitivity to rates and without the robust dividend of yore. This means that the 60-40 portfolio that worked in the 1970s to address diversification issues no longer works as well – and it will not long work to just add international stocks for diversification” (“The S&P 500 isn’t as diverse as it used to be. Here’s why that matters,” WSJ.com, 7/8/2024).

His conclusion: you’re going to need to range further afield – into private assets, commodities, and elsewhere – if your core is an S&P 500 index.

-

“Index fund” and “rational” aren’t the same thing

One risk, in particular, is that the Russell indexes are laden with junk. The WSJ’s Spencer Jakab warns that “companies gaming the system, or just being of low quality, create an imperceptible drag that has cost investors hundreds of percentage points of gains over the years.” He points out that the S&P 600 small cap index has outperformed the Russell 2000 by 700 basis points, largely because the S&P index is more careful about who they let in. (“The Surprise in Index Funds,” WSJ, 7/27/2024).

Go re-read “The Quality Anomaly” (MFO, 5/2024) before you invest. Both of these pieces support the argument we’ve been making: quality stocks are undervalued and overperform, year and year, decade after decade.

-

Climate change is going to drive infrastructure investing.

We’ve been toiling away, researching infrastructure investing, its drivers, and your options. One of our early suspicions was that we had delayed so long in trying to limit climate change that we’re now trapped spending trillions – often in unexpected places – trying to adapt to it. Research by the Wall Street Journal reaches the same sad conclusion:

Efforts to address the cause of climate change have fallen short so far. That is leading to a big push to treat the symptoms. Government and private money is pouring into plans to control flooding, address extreme heat and shore up infrastructure to withstand more severe weather caused by climate change.

“Adaptation has been the unpopular kid at the party for a long time. That is starting to change,” said Jay Koh, managing director at the Lightsmith Group, an investment firm with one of the few adaptation funds … The cost of adaptation is immense, particularly if mitigation efforts are delayed. The longer society waits to address climate change, the more it will spend to fend off the impact of hotter, wetter weather” (“Climate Cash Pivots to New Reality of a Hotter, Wetter Planet,” WSJ.com, 8/1/2024)

More in September!

-

Food at the Iowa State Fair is getting more … umm, wonderful every year.

Iowa’s annual end-of-summer ritual runs this year from August 8-18 in Des Moines. It’s a gathering that celebrates the state’s agricultural heritage and economy … and it gives Iowans an opportunity to taste an ever-wider array of food-on-a-stick and other culinary innovations.

Last’s years “People’s Choice Award” went to “Deep-Fried Bacon Brisket Mac-n-Cheese Grilled Cheese.”

Last’s years “People’s Choice Award” went to “Deep-Fried Bacon Brisket Mac-n-Cheese Grilled Cheese.”Yep: grilled cheese sandwich. Add mac & cheese. Add bacon brisket. Dip in batter. Deep-fry.

This year sees the debut of no fewer than 84 new delights, including the Bacon Cheeseburger Egg Roll, Barbie Era Funnel Cake, Beer Belly Fries, and BLT on a Stick (drooling yet?) as well as Butter Beer Ice Cream, Deep Fried Bubble Gum, Deep Fried PB&J and the Maple Bacon Bliss Sundae.

Tickers – and defibrillators – are still available!

Thanks, as ever …

To Frank from Delaware (it’s good to make your acquaintance, sir!) and our faithful monthly contributors Wilson, S&F Investment Advisors, Gregory, William, William, Stephen, Brian, David, and Doug.

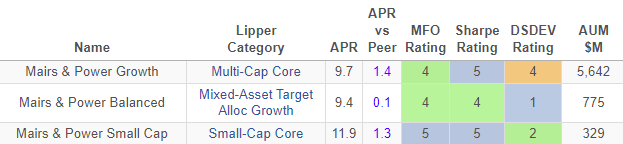

And to the good folks at Mairs & Power. I entered a raffle for their primo “Made in Minnesota” gift basket while I was at Morningstar… and won!

They’re kind of like the T. Rowe Price of Minnesota. Quietly, consistently excellent. I’ll try to drop by the next time I’m visiting my son Will in the Twin Cities.

Performance since inception, through 07/2024

We ended our fiscal year modestly in the red, which is not fatal but isn’t a great model for the long run. If you’d like to make a tax-free contribution (I know, changes in the tax code have made that less compelling but it still makes a difference), check out how to Support Us!

We wish you peace in the month and season ahead. It’s hard, I know. The simplest recommendation that, as a scholar, I can make is “disconnect.” Our brains cannot accommodate the flood of effluvia flowing through our phones. Very rich people know how to become richer: get you to obsess and doom-scroll while they sell your personal life to other rich folks. Books are much safer, gardens better still, and time working with those you love, best of all.

Beyond that, a psychologist appearing on the WBUR program “Here and Now,” points out a fascinating finding: the more you learn about politics, the more stressed you are … unless you become involved. That is, the one best way to protect yourself from feelings of doom is to do something about it. Political parties of all stripes need you, want you, and can empower you. From being a poll worker to stuffing envelopes, your heart will thank you for simply getting up and putting your beliefs into action. (“How to cope with political anxiety this election season,” 8/1/2024).

For September, we’ll be looking at some interesting bond fund options: Nordic, disciplined, multi-sector, and otherwise. Also, we’re hoping to share our long-incubating work on infrastructure investing!

As ever,