Jimmy and Rosalynn Carter – Habitat For Humanity. Source: Encyclopædia Britannica

In November, I began volunteering at the Loveland Habitat For Humanity, helping to build houses for those who might not be able to afford them without a hand up. Former President Jimmy Carter and First Lady Rosalynn have volunteered or worked with Habitat For Humanity since the 1980s. Housing prices have roughly doubled in the past ten years putting home ownership out of the reach of many potential buyers. I also volunteer at Neighbor To Neighbor, which helps those on the fringe of homelessness stay sheltered. Pandemic-era savings are expected to be depleted during the first half of 2024, but for many, losing work, even temporarily, can mean eviction, losing utilities, and going hungry. This puts a human perspective on financial metrics.

My target allocation to stock is 50% within a range of 35% to 65% based on my investment model, which loosely follows the guidelines of Warren Buffet’s mentor, Benjamin Graham. Warren Buffet is usually sitting on a pile of cash prior to recessions because he tends to reduce his exposure to stocks when valuations are high. The Motley Fool reported that Warren Buffet was a net seller of stocks during the third quarter, and “Buffett added $29 billion to his position in short-term U.S. Treasury bills last quarter, bringing his total investment to more than $126 billion.” With the recent run up in stocks and my Roth Conversion, my equity allocation has crept up to 40%. I remain overweight in short-term Treasuries and Certificates of Deposit. I have no plans to make any changes until next year when ladders of bonds and certificates of deposit mature.

In this article, I look at the economy, the labor market, and two metrics that highlight inflection points to look for early signs of changes in the markets. I use the Mutual Fund Observer MultiSearch tool to identify funds that are trending now. I am interested in global bond funds and long-duration bond funds as possible additions over the next six months. US equities have done much better than international equities over the past decade in part due to an increase in valuations, stronger dollar, and high monetary stimulus (Quantitative Easing). I look for this to normalize over the coming decade. One fund that caught my attention this month is the emerging markets mixed-asset Fidelity Total Emerging Markets Fund (FTEMX), which is roughly 40% in bonds.

This article is divided into the following sections:

- Section 1, Economy and Recession Watch

- Section 2, Post Pandemic Consumers

- Section 3, Inflection Points

- Section 4, Review of Author’s Funds

- Section 5, Trending Lipper Categories

- Section 6, Fidelity Total Emerging Markets Fund (FTEMX)

Economy And Recession Watch

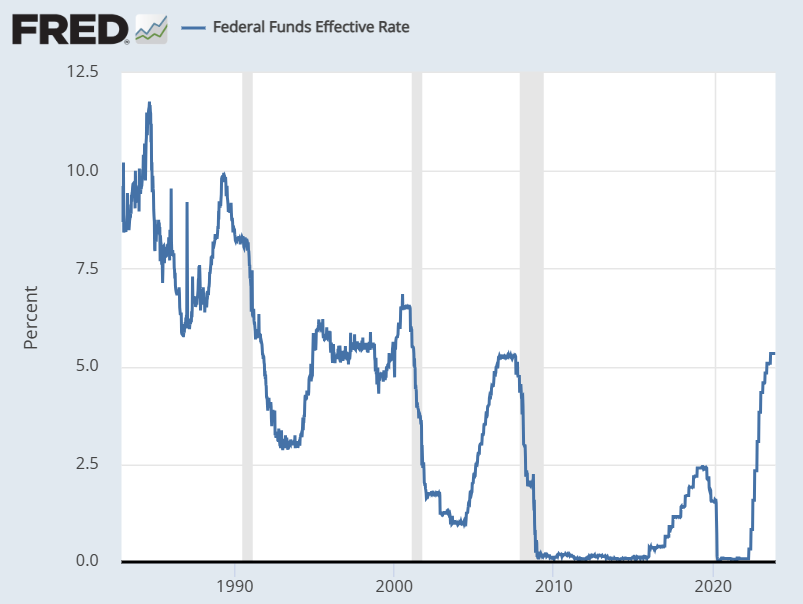

Credit keeps the economy going as businesses borrow to expand and consumers borrow to keep spending. The Federal Reserve raises the interest rate that banks charge each other to borrow or lend excess reserves overnight, known as the Federal Funds rate, in order to make borrowing more expensive, thereby slowing down the economy and reducing inflationary pressures. Figure #1 shows that by the time the Federal Reserve starts to lower the Federal Funds rate, a recession often follows.

Figure #1: Federal Funds Rate with Recession Shading

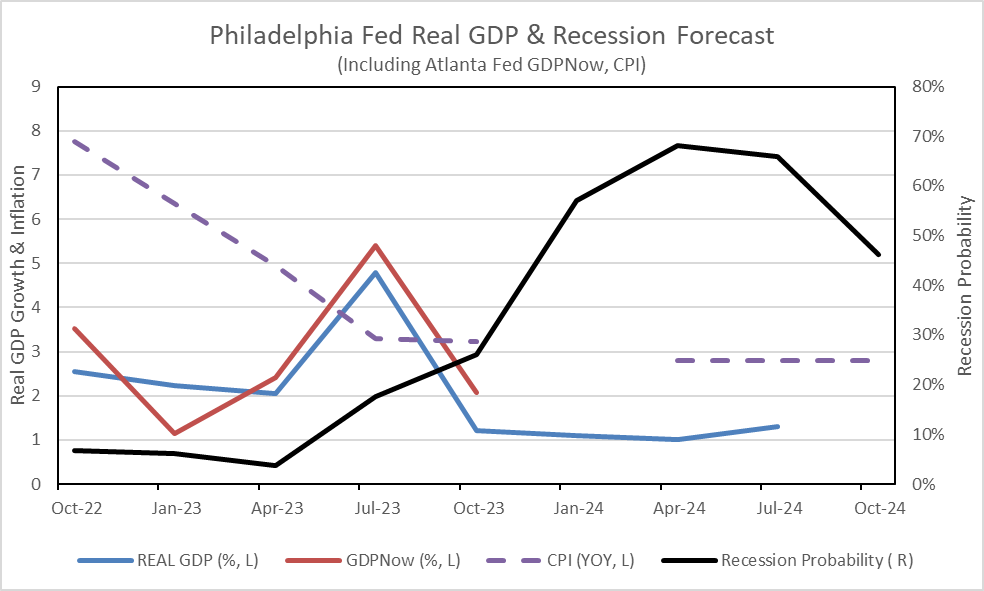

Figure #2 contains the Philadelphia Federal Reserve Survey of Professional Forecasters estimates for real gross domestic product growth (solid blue line) to be around 0.8% to 1.5% in the first half of next year, and the Reserve Bank of New York estimates for the probability of a recession (solid black line) to be 57% to 68%. The Consumer Price Index (dashed purple line) is currently 3.2%, and the one-year expected inflation rate is 2.8%. Inflation is expected to be “sticky,” and rates will remain “higher for longer.” The chart shows that economic growth will be low and the probability of a recession relatively high. It should be clear by the end of the second quarter of 2024 whether there will be a recession or a “soft landing.”

Figure #2: Real GDP Growth Forecast and Recession Probabilities

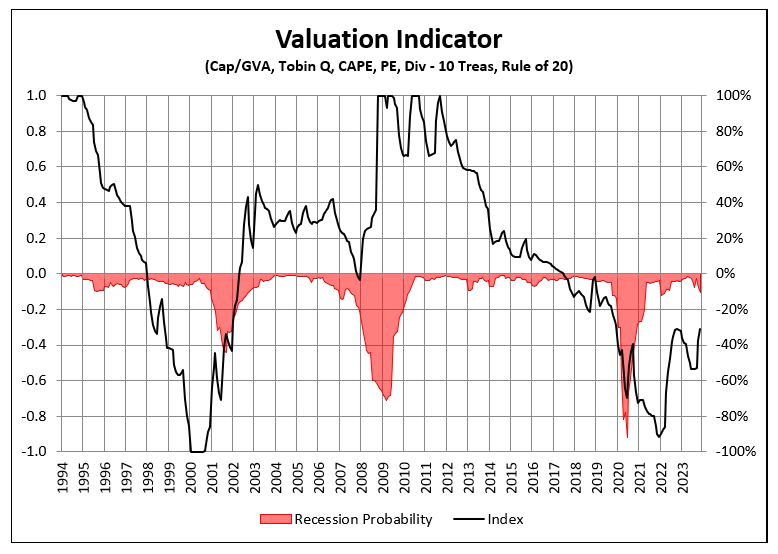

Figure #3 is my composite of six valuation methods, with +1 being favorable (low valuations) and -1 being unfavorable (high valuations). In my perspective, current high valuations are not justified in a slow growth environment with high bond yields and with the Federal Reserve likely to lower the Federal Funds rate in the second or third quarter of next year.

Figure #3: Author’s Valuation Indicator

Post Pandemic Consumers

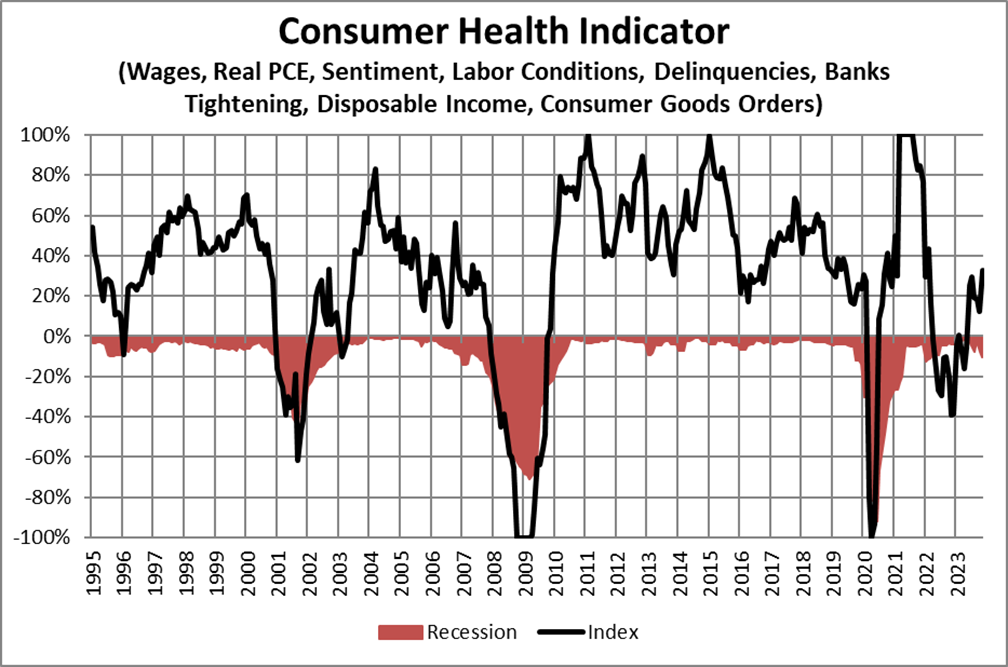

The Federal Reserve Bank of San Francisco, using the Bureau of Economic Analysis, estimates that pandemic-era savings have declined from a high of $2.1T in August 2021 to $430B in September 2023. However, analysis suggests that the bottom 80% of households by income have depleted their pandemic-era savings. Figure #4 is my Consumer Health Indicator which is a composite of ten indicators that suggest how well consumers may be able to continue their current spending habits. The strength of the consumer is not high but has been improving since mid-year.

Figure #4: Author’s Consumer Health Indicator

Paxtyn Merten listed a detailed description of industries laying off employees in “The 19 Industries Laying Off the Most Workers Right Now” for Stacker. The following industries laid off more than 100,000 employees each in August: 1) Professional and business services, 2) Accommodation and food services, 3) Retail Trade, 4) Health care and social assistance, and 5) Construction, and 6) Transportation, warehousing, and utilities. According to Business Insider, here is a list of some of the companies reducing staff this year: Amazon, Charles Schwab, Roku, Farmers Insurance, T-Mobile, CVS, Binance, Robinhood, Ford, JP Morgan, Morgan Stanley, Spotify, Gap, Jenny Craig, 3M, Lyft, Deloitte, Whole Foods, Ernst & Young, McKinsey, Electronic Arts, Walmart, Sirius, Accenture, Citigroup, General Motors, Yahoo, Twitter, Disney, Zoom, Docusign, eBay, Dell, Rivian, Intel, FedEx, PayPal, IBM, Google, Capital One, Microsoft, Blackrock, Goldman Sachs, BNY Mellon, and Direct TV.

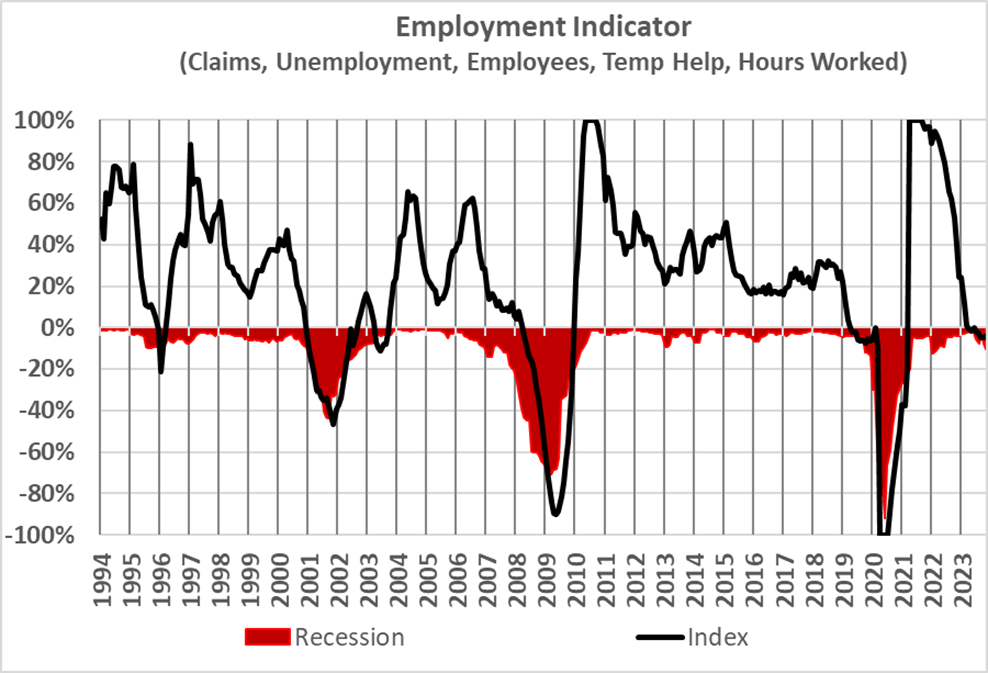

Figure #5 is my composite employment indicator that points to clouds on the horizon for labor. Businesses usually reduce Temporary Help Services and Hours Worked before laying off full-time employees, and these are falling. Growth in persons employed has slowed.

Figure #5: Author’s Employment Indicator

Inflection Points

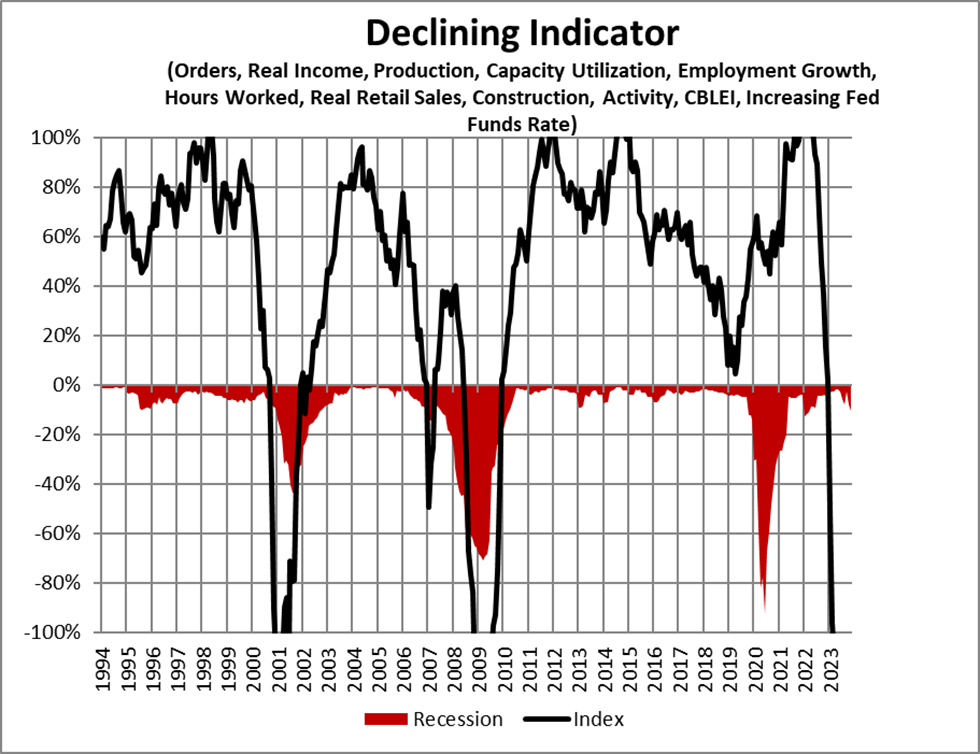

I built the Declining Indicator (Figure #6) to measure the percent of months that indicators are negative. It is highly negative, showing that key indicators are either declining or have peaked.

Figure #6: Author’s Declining Indicator

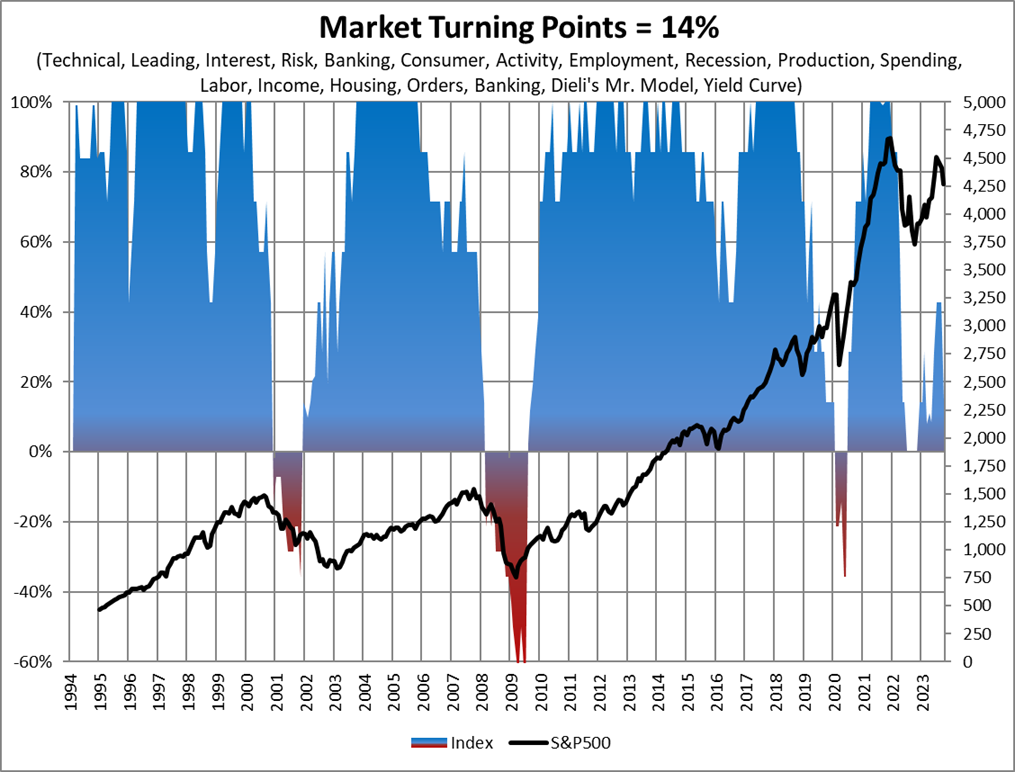

Figure #7 is my Market Turning Points indicator which composites the values of leading and coincident indicators to give an estimate of major inflection points. While the level is low, it is not negative, suggesting that conditions for a market downturn are not yet fully developed.

Figure #7: Author’s Market Turning Points Indicator

Review Of Author’s Funds

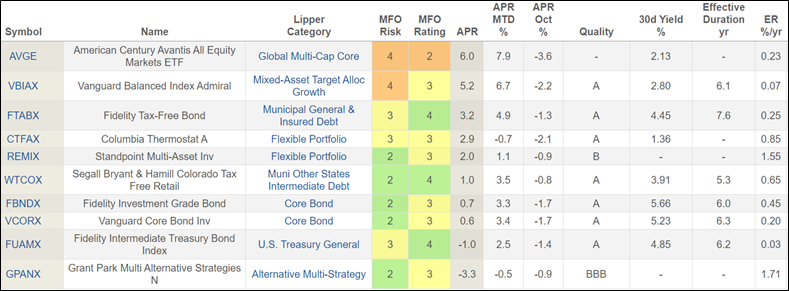

The funds in Table #1 are those that I currently own in Bucket #1 (Living Expenses) and Bucket #2 (Expected Withdrawal in 3 to 10 years held in multiple accounts), along with fixed income ladders. Vanguard Balanced Index Fund (VBIAX) is included as a baseline. My strategy has been to lock in higher yields in longer-duration bond funds as the Federal Reserve pauses rate hikes. What I would like to add during the next six months is Global/International bond funds and longer-duration bond funds, but the time is not right. I use management services at Fidelity and Vanguard for Bucket #3 (longer-term) funds.

Table #1: Review of Author’s Funds – Metrics for One Year

Grant Park Multi Alternative Strategies (GPANX) has not performed well this year, but it is a good fund with a long-term performance record, so I will keep it. Upon dips, I will add to American Century Avantis All Equity Markets ETF (AVGE), and Columbia Thermostat (COTZX/CTFAX) will increase its allocation to equities.

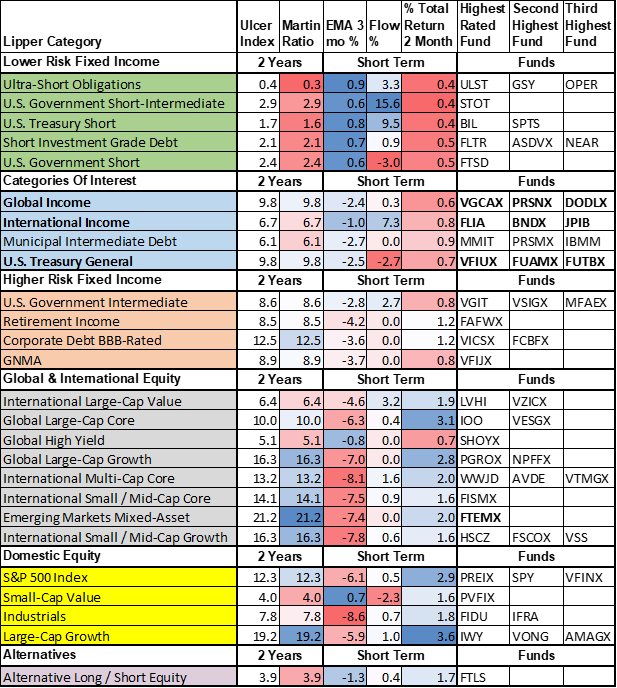

Trending Lipper Categories

Table #2 contains the top-performing Lipper Categories for the 635 funds that I currently track. The first group of funds is short-term, quality fixed income. The Ulcer Index measures the depth and duration of drawdowns over the past two years, while the Martin Ratio measures the risk-adjusted performance over the past two years. The next group of categories (International bond funds and long-duration Treasuries) are not trending favorably, but I include them to fill gaps in my portfolio. Next are intermediate government and corporate bond funds which have higher duration or quality risk than the first category. Global and international equities have recently tended to perform better than domestic equities.

Table #2: Trending Lipper Categories – Ulcer & Martin Stats – Two Years

Fidelity Total Emerging Markets Fund (FTEMX)

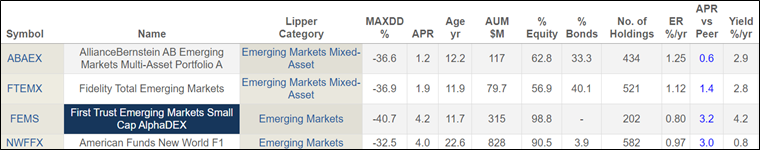

Only a handful of emerging market mixed-asset funds are available to individual investors. One of my criteria for selecting an emerging market fund is to have low exposure to China. Fidelity Total Emerging Markets Fund (FTEMX) has 14% allocated to China, which is below the 22% that most EM funds have. In Table #3, I show two emerging market mixed-asset funds compared to two emerging market equity funds for the past ten years. I am not concerned about the low annualized returns because I expect emerging markets to outperform over the coming decade.

Table #3: Emerging Market Mixed Asset Funds and Selected Equity Funds (10 Years)

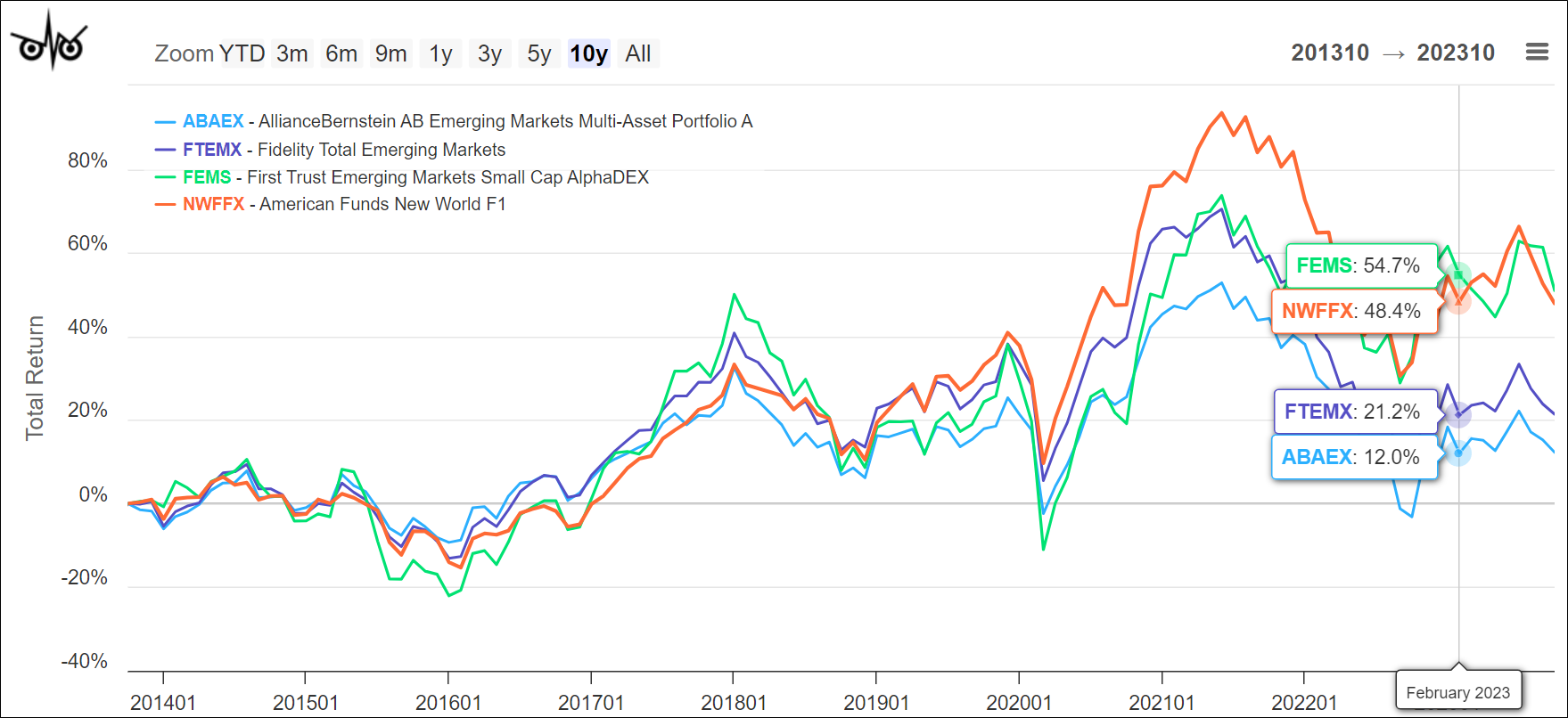

Figure #8 is a graphical representation of the above funds. Emerging market mixed-asset funds have performed well over the past decade until interest rates went up. I will monitor FTEMX with interest but have no plans to purchase it in the near term.

Figure #8: Emerging Market Mixed Asset Funds and Selected Equity Funds

Closing Thoughts

I like the prospects for bonds relative to stocks in the intermediate time horizon. In November, I sold Allianz PIMCO TRENDS Managed Futures Strategy (PQTAX) and bought Fidelity Investment Grade (FBNDX), which is an intermediate duration fund with 39% Treasuries and 31% corporate bonds. Over the next six months, I expect to add Global/International bond funds and/or a quality long-term bond fund.

I created a long-term financial plan that includes Roth Conversions and accelerated withdrawals to minimize long-term taxes and increase the tax efficiency of estate plans. In July, I set up an appointment to do a Roth Conversion on October 27th, expecting the markets to go down. I was fortunate that the S&P 500 fell roughly ten percent, allowing me to convert more shares for the same conversion amount. The market then recovered. I plan to do another Roth Conversion in mid-2024 if the market dips as I expect.

Hiring Fidelity and Vanguard to manage my long-term investment bucket(s) freed up my time to pursue other interests. I enjoy volunteering and giving back to the community. I am learning a lot and meeting a lot of interesting volunteers.