Younger funds often excel due to technical advantages, innovation, and/or management. For this article, I sifted through over a thousand actively managed Exchange Traded Funds to find thirty-three funds that are less than five years old and have performed better than their peers over their respective lives. Are these the success stories of the future?

One of my favorite Lipper Categories is the Flexible Portfolio because managers have the ability to invest across asset classes according to market conditions. Of these young funds, Leuthold Core ETF (LCR) in the Flexible Portfolio Category stands out for early performance in this turbulent market. I included Fidelity New Millennium ETF (FMIL) and American Century Avantis All Equity Markets ETF (AVGE), which I have written about in order to monitor their performance.

This article is divided into the following sections:

- Section 1, Young ETF Universe

- Section 2, Four-Year-Old Funds

- Section 3, Three-Year-Old Funds

- Section 4, One and a Half Year Old Funds

- Section 5, Funds Still in Their Infancy

- Section 6, Best Year-to-Date Performance

- Section 7, Young Fund Shortlist

- Section 8, Spotlight on Leuthold Core ETF (LCR)

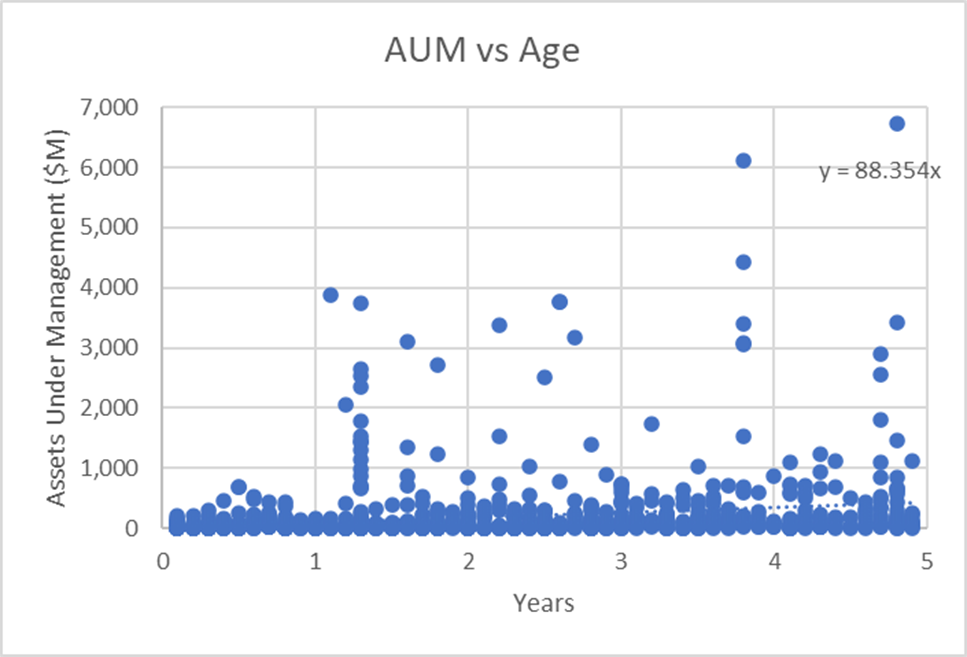

There are over a thousand actively managed exchange-traded funds that are less than five years old as shown in Assets Under Management versus Age in Years (Figure #1). The difficulty in identifying the best-performing funds lies in the lack of historical performance data of the youngest funds. I used the growth of Assets Under Management to reflect investor sentiment and Fund Family Rating initially to help pare down the list. I then used return relative to peers by age group to further reduce the list. As a final check, I used the Morningstar Analyst Rating about Process, People, and Parent.

Figure #1: Young Funds Assets Under Management vs Age

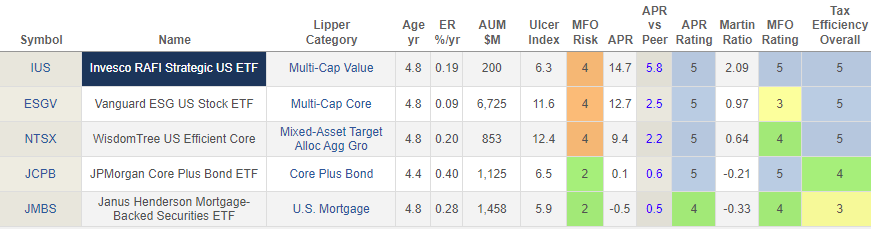

Four-Year-Old Funds

Fund Spotlight: Vanguard ESG US Stock ETF (ESGV)

ESGV only gets two stars from Morningstar but a Silver Analyst Rating based on a high conviction that it will outperform over a market cycle. ESGV and NTSX have over 30% allocated to the technology sector while IUS has 23%.

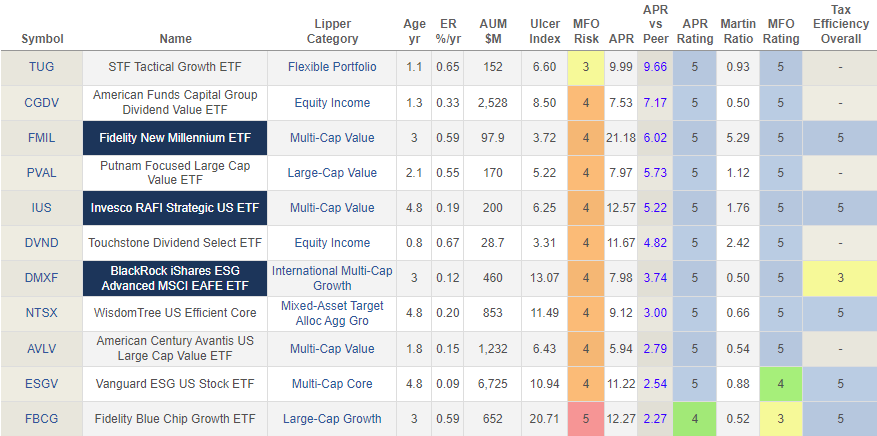

Table #1: Four-Year-Old Actively Managed ETFs (July 2023)

Figure #2: Four-Year-Old Actively Managed ETFs

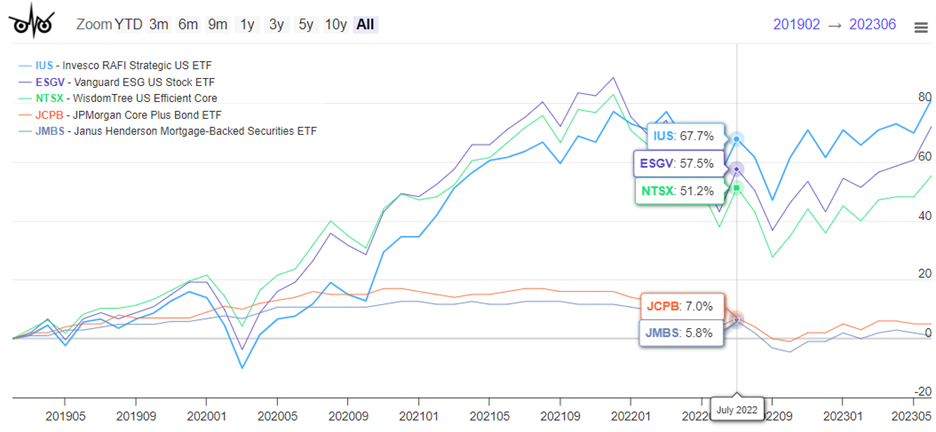

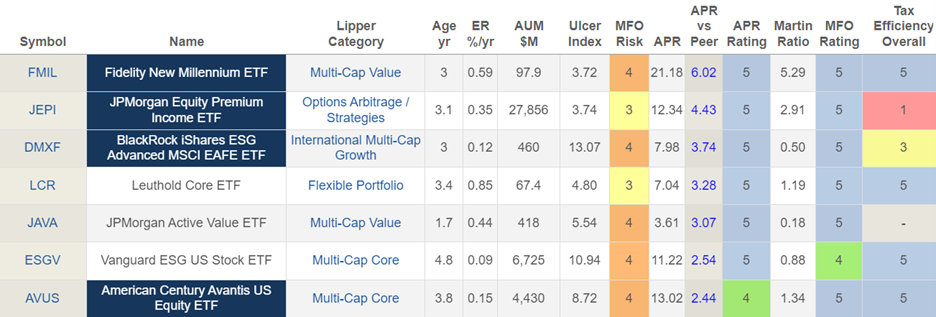

Three-Year-Old Funds

Fund Spotlight: Fidelity New Millennium ETF (FMIL)

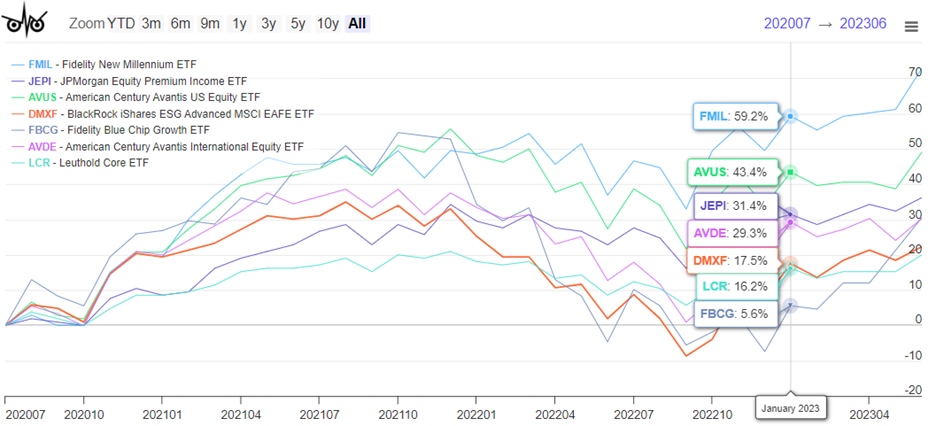

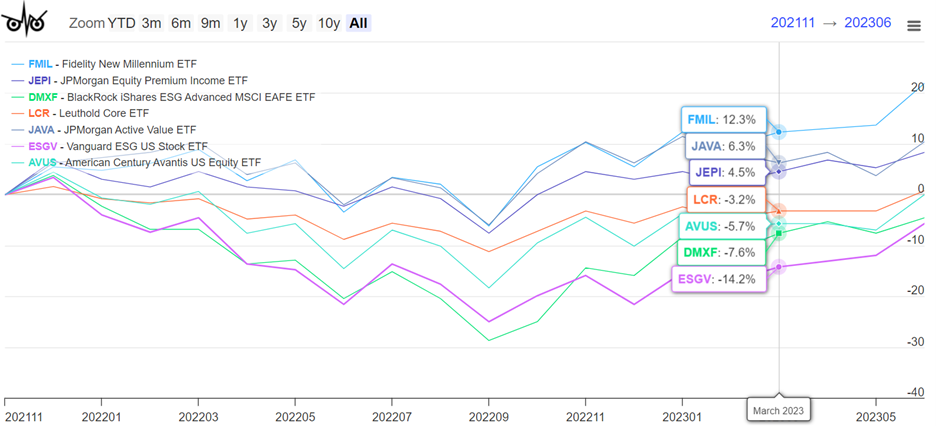

FMIL gets five stars from Morningstar but only a Neutral Analyst Rating. JPMorgan Equity Premium ETF (JEPI) gets four stars from Morningstar. Leuthold Core ETF (LCR) is the Fund Spotlight later in this article. LCR gets four stars from Morningstar and a Gold Analyst Rating. Morningstar gives AVUS five stars and an Analyst Rating of Silver.

I wrote Fidelity New Millennium ETF (FMIL) in the MFO September 2022 newsletter. The fund is still an outstanding performer but has not yet attracted much attention from investors. JPMorgan Equity Premium ETF (JEPI) is an outlier in that it has attracted the most assets under management. Leuthold Core ETF (LCR) deserves consideration for its above-average returns and risk-adjusted returns as measured by the Martin Ratio for the Flexible Portfolio Category. FMIL has 29% allocated to the technology sector, while FBCG has about 50%, and AVUS has 23%. The international funds (AVDE and DMXF) have low allocations to technology.

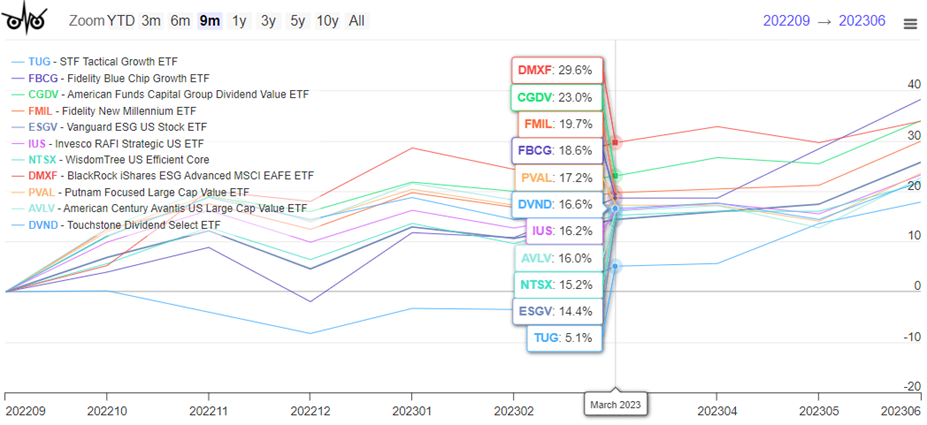

Table #2: Three-Year-Old Actively Managed ETFs (July 2023)

Figure #3: Three-Year-Old Actively Managed ETFs (July 2023)

One and Half-Year-Old Funds

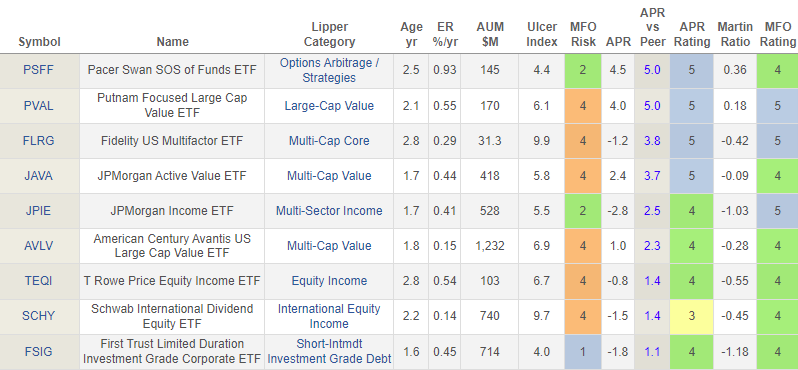

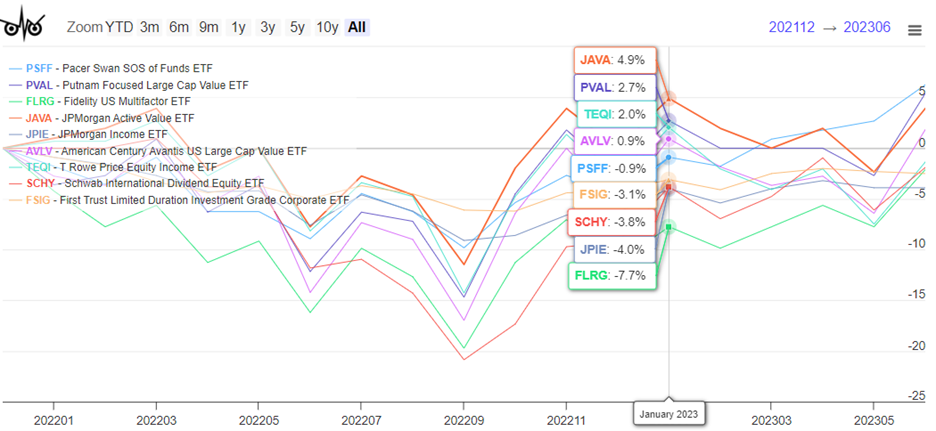

Fund Spotlight: JPMorgan Active Value ETF (JAVA)

JAVA is too young to get a Morningstar star rating but gets an Analyst Rating of Gold. It has a low allocation to the technology sector.

Table #3: One and a Half Old Actively Managed ETFs (July 2023)

Figure #4: One and a Half Old Actively Managed ETFs (July 2023)

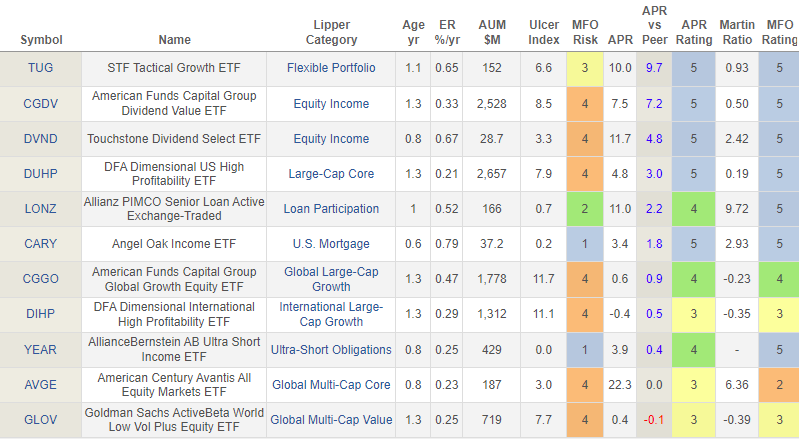

Funds Still in Their Infancy (< 1.5 Years Old)

Fund Spotlight: Capital Group Global Growth Equity ETF (CGGO)

CGGO gets an Analyst Rating of Gold from Morningstar. I wrote American Century Avantis All Equity Markets ETF (AVGE) in the MFO February 2023 newsletter. It is an actively managed fund of funds that I own and will buy more if the performance continues as I expect it will. AVGE does not have a high concentration in the technology sector.

Table #4: Infant (<1.5 Years Old) Actively Managed ETFs (Stats: Life of Fund)

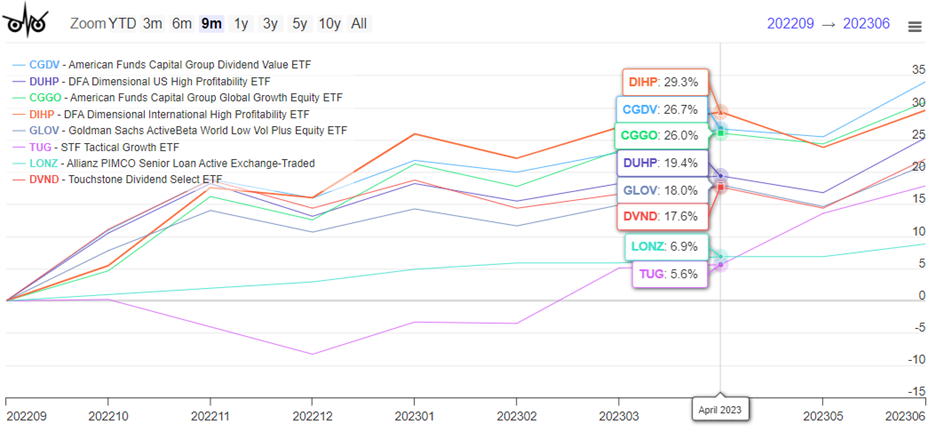

Figure #5: Infant (<1.5 Years Old) Actively Managed ETFs

Best Year-to-Date Performance

The best-performing funds year-to-date, as measured by APR vs. Peer, are shown in this section. Metrics are for the life of the fund.

Table #5: Best Performing Actively Managed ETFs Year-To-Date (Stats: Life of Fund)

Figure #6: Best Performing Actively Managed ETFs Year-To-Date as of June 2023

Young Fund Shortlist

In reviewing the performance of the funds and Morningstar Analyst Ratings, I show the funds that make my short list of best performing actively managed young exchange-traded funds. These are on my Watchlist.

Table #6: Author’s Shortlist of Actively Managed ETFs (Stats: Life of Fund)

Figure #7: Author’s Shortlist of Actively Managed ETFs

Fund Spotlight: Leuthold Core ETF (LCR)

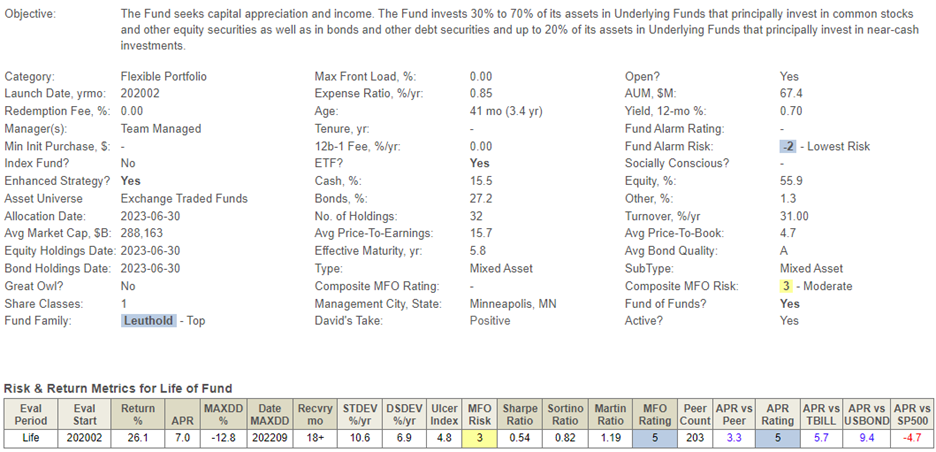

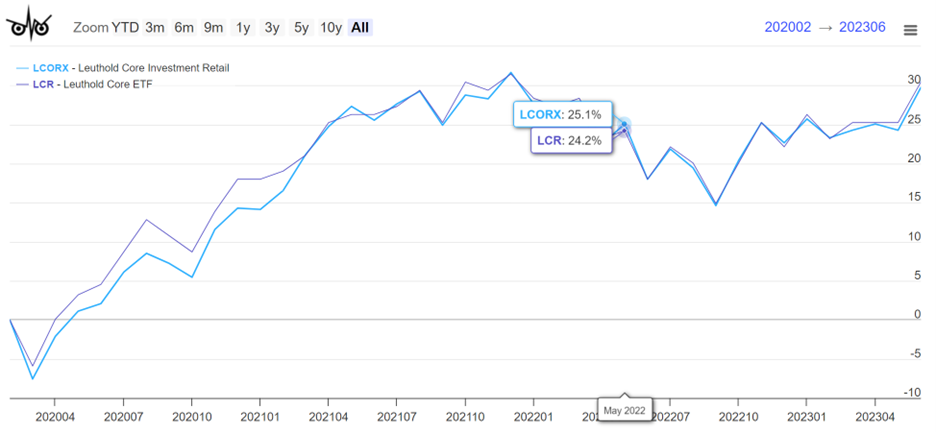

I chose to profile Leuthold Core ETF (LCR) because it is a high-performing young fund in the Flexible Portfolio Lipper Category, and Morningstar gives it four stars with an Analyst Rating of Gold. Leuthold Core Investment Retail (LCORX) is a twenty-seven-year-old Flexible Portfolio fund with an MFO Rating of “4” over its life. David Snowball wrote Leuthold Core Investment (LCORX/LCRIX) in the MFO June 2023 newsletter for those who want more information. Professor Snowball gives LCR a “David’s Take” of positive. LCORX has returned 7.9% over the past twenty-seven years and beaten peers by 0.7%. LCR tracks LCORX closely, as shown in Figure #8.

The principal investment strategies of the fund (LCR) are found in the prospectus:

The Fund is an actively-managed “exchange-traded fund of funds” and seeks to achieve its objective by investing primarily in other registered investment companies, including other actively-managed exchange-traded funds (“ETFs”) and index-based ETFs (collectively, “Underlying Funds”), that provide exposure to a broad range of asset classes. The Fund will not invest more than 25% in any Underlying Fund. The Underlying Funds may invest in equity securities of U.S. or foreign companies; debt obligations of U.S. or foreign companies or governments; or investments such as volatility indexes and managed futures. The Fund allocates its assets across asset classes, geographic regions, and industries, subject to certain diversification and liquidity considerations. The Fund’s investments in foreign countries may include exposure to emerging markets…

Table #7: Leuthold Core ETF (LCR)

Figure #8: Leuthold Core ETF (LCR) and LCORX

Closing Thoughts

My investment strategy has changed this year due to the availability of high yields on quality fixed income. I have created ladders of Treasuries, agency bonds, and certificates of deposits to lock in returns for low-risk investments. I began using Vanguard’s Personal Advisory Service in addition to Fidelity’s Wealth Management Service to manage longer-term portions of my investments. These changes in strategy shifted my focus from mixed-asset funds to well-managed equity funds in order to maintain a target stock-to-bond allocation of 50% within a range of 35% to 65%. I am currently near the 40% allocated to stocks.

At the moment, as fixed income in ladders mature, I look to extend the duration. In the future, I will monitor the following funds for when I want to increase allocations to equity: American Century Avantis All Equity Markets ETF (AVGE), Fidelity New Millennium ETF (FMIL), American Century Avantis US Equity ETF (AVUS), and JPMorgan Active Value ETF (JAVA).