Jamie Cuellar, CFA, passed away unexpectedly and tragically on May 8. He was the co-portfolio manager of the Buffalo Small Cap Fund from 2015 and of the Buffalo Discovery Fund from April 2020. Our condolences to his family, friends, and co-workers.

Capital Group, parent of the American Funds and, with $2.6 trillion AUM, one of the world’s largest investment managers, has registered two exchange-traded funds, Capital Group Core Bond ETF and Capital Group Short Duration Municipal Income ETF. Management and operating expenses have not been stated in the registration filing.

Fiera Capital has sold its investment advisory business relating to International Equity, Capital Global Equity, and U.S. Equity Long-Term Quality Funds to New York Life Investment Management. A shareholder meeting will be held in August 2023 to consider the reorganizations.

Franklin Templeton is acquiring Putnam Investments for about $925 million in a cash plus equity deal. Putnam began life during the Great Depression as the adviser to the George Putnam Fund of Boston, the first balanced or hybrid mutual fund. $136bn asset manager Putnam Investments. The firm was entangled in a series of scandals from 2003 – 06, which led it to be bought by the insurer Great-West LifeCo and its parent Power Corporation of Canada. Since then, it has mostly been staggering about with undistinguished mainstream funds, adding alt funds, then dropping alt funds, adding absolute return funds, then dropping absolute return funds, and belatedly adding ETFs, mostly in support of their retirement-oriented funds.

Manning & Napier is converting the Callodine Equity Income Fund, LP, into a mutual fund with painfully high expenses (1.70 – 2.10%). The goal is “to provide strong risk-adjusted total returns with low market correlation and preservation of capital.” The hedge fund returned 1.47% in 2022, a year in which its benchmark S&P 500 High Dividend Index dropped 1.11%.

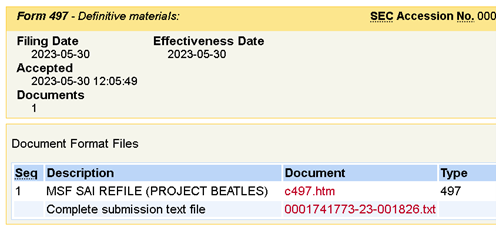

MainStay Funds is up to something. It probably involved ChatGPT or AI or something, but according to an SEC filing, they’ve launched “Project Beatles.”

The ETF Conversion Beat: Matthews Korea Fund will be reorganized into an exchange-traded fund. On or around June 20, the investor class shares will be converted into institutional class shares. Subsequently, on or around June 23, the institutional shares will undergo a reverse stock split.

The ETF Conversion Two-Step: Neuberger Berman Greater China Equity and Neuberger Berman Global Real Estate Funds will be converted into exchange-traded funds. Prior to the conversion, Class A and Class C shares will be converted into Institutional Class shares, then the funds, with only institutional class shares, will become ETFs sometime in the third quarter of 2023.

Pimco Active Multisector Exchange Traded Fund registration filing has been filed. The ETF seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in a multi-sector portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts, or swap agreements. Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement will be 0.55%.

Small Wins for Investors

Effective June 1, 2023, the four-star Guinness Atkinson Alternative Energy Fund (GAAEX) has dropped its management fee from 1.00% to 0.80%. It’s one of the oldest alt energy funds, a passion of founder Edward Guinness. Admittedly the fund is tiny and streaky, but surely that still crosses the “small wins” threshold.

Old Wine, New Bottles

Greenspring Fund is becoming the Cromwell Greenspring Mid Cap Fund on or about July 28.

The Victory INCORE Fund for Income and Victory INCORE Investment Grade Convertible names will be rechristened Victory Fund for Income and the Victory Investment Grade Convertible Fund effective September 1.

The Miller Transition rolls on. Bill Miller, founding inductee of The Overhyped Manager Hall of Fame for his long run of beating the S&P 500 with his Legg Mason Value Fund (a streak dependent on being very careful about looking only at year-end values and ignoring volatility), was sort of bequeathed several of his funds as retirement presents when he left Legg Mason. In December 2022, he retired from management. On May 26, 2023, his $1.2 billion Opportunity Trust, successor to the Legg Mason Opportunity Fund, has now been assigned to Patient Capital Management. Patient Capital is owned by Miller’s long-time comanager, Sarah McLemore. The one-star Opportunity Trust is incredibly streaky, frequently occupying either the top 1% or bottom 1% of its peer group but rarely anything in-between.

Mr. Miller’s son, Bill Miller IV, has now taken over Miller Value Partners, the family’s $2.5 billion firm. He’s the CIO and manager of the $146m Miller Income fund, which has posted more years in the red than in the black since launch.

Effective on or about July 24, 2023, the name of the Sound Equity Income ETF will be changed to the Sound Equity Dividend Income ETF.

Touchstone Funds has booted Rockefeller & Co. from Touchstone International ESG Equity Fund, replacing them with Sands Capital. As a result, the fund will be renamed Touchstone Sands Capital International Growth Equity Fund. Sands Capital also sub-advises Touchstone Sands Capital Select Growth Fund and Touchstone Sands Capital Emerging Markets Growth Fund, neither of which has been excellent. As of March 31, 2023, Sands Capital managed approximately $48.4 billion in assets.

Off to the Dustbin of History …

AAAMCO Ultrashort Financing Fund will be liquidated on or about May 31.

American Beacon Zebra Small Cap Equity Fund will be liquidated on or about July 14.

AXS All Terrain Opportunity Fund goes off-road for the last time on or about June 26, 2023.

BlackRock is liquidating BlackRock U.S. Impact Fund and BlackRock International Impact Fund on or about August 31, 2023, then BlackRock Total Factor Fund on September 29, 2023

A short rant about single-stock ETFs.

These strike me as incredibly stupid. They are, at the base, tools that allow individual investors to easily make high-risk bets for or against individual stocks. Rather than going to the bother of figuring out how to short Tesla, you can just buy a single-stock ETF that does the job for you.

The key, of course, is that these are trading funds that are meant to have holding periods of hours. Not days, not weeks, and, god knows, not for the long term. The issuers endlessly warn that buying these things and letting your attention wander is an awfully good way to learn about bankruptcy.

Rant over.

AXS has announced the liquidation of a series of single-stock ETFs: AXS 2X NKE Bear Daily ETF, AXS 2X NKE Bull Daily ETF, AXS 2X PFE Bear Daily ETF, AXS 2X PFE Bull Daily ETF, AXS 1.5X PYPL Bear Daily ETF, AXS Short China Internet ETF, and AXS Short De-SPAC Daily ETF. At about the same time, GraniteShares decided to liquidate its GraniteShares 1x Short TSLA Daily ETF, which is down 46% YTD.

An emerging sign of sanity in the markets? No, silly reader. GraniteShares replaced its simple “short Tesla” ETF with leveraged short (and long) single-stock ETFs.

- GraniteShares 1.5x Long AAL Daily ETF

- GraniteShares 1x Short AAL Daily ETF

- GraniteShares 1.5x Short AAL Daily ETF

- GraniteShares 1x Short AAPL Daily ETF

- GraniteShares 1.5x Short AAPL Daily ETF

- GraniteShares 1.75x Short AAPL Daily ETF

- GraniteShares 1x Short AMD Daily ETF

- GraniteShares 1.25x Short AMD Daily ETF

- GraniteShares 1x Short COIN Daily ETF

- GraniteShares 1.5x Short COIN Daily ETF

- GraniteShares 1.5x Long JPM Daily ETF

- GraniteShares 1x Short JPM Daily ETF

- GraniteShares 1.5x Short JPM Daily ETF

- GraniteShares 1.5x Long LCID Daily ETF

- GraniteShares 1x Short LCID Daily ETF

- GraniteShares 1.5x Short LCID Daily ETF

- GraniteShares 1x Short META Daily ETF

- GraniteShares 1.5x Short META Daily ETF

- GraniteShares 1x Short NIO Daily ETF

- GraniteShares 1x Short NVDA Daily ETF

- GraniteShares 1.5x Short NVDA Daily ETF

- GraniteShares 1.5x Long RIVN Daily ETF

- GraniteShares 1x Short RIVN Daily ETF

- GraniteShares 1.5x Short RIVN Daily ETF

- GraniteShares 1.75x Long TSLA Daily ETF

- GraniteShares 1.5x Long TSLA Daily ETF

- GraniteShares 1.25x Short TSLA Daily ETF

- GraniteShares 1.5x Short TSLA Daily ETF

- GraniteShares 1.75x Short TSLA Daily ETF

- GraniteShares 1.5x Long XOM Daily ETF

- GraniteShares 1x Short XOM Daily ETF

- GraniteShares 1.5x Short XOM Daily ETF

One of their competitors, eyeing the limited bankruptcy opportunities provided by 1.5x and 1.75x leverage, said “Hold my beer” and filed to launch a series of double-down ETFs:

- T-Rex 2x Long Tesla Daily Target ETF

- T-Rex 2x Inverse Tesla Daily Target ETF

- T-Rex 2x Long Nvidia Daily Target ETF

- T-Rex 2x Inverse Nvidia Daily Target ETF

Brown Advisory Total Return Fund will merge into Brown Advisory Sustainable Bond Fund on or about June 23, 2023.

Harbor Global Leaders Fund, subadvised by Sands Capital, will be liquidated on August 23.

Hussman Strategic International Fund will be liquidated on or about June 27.

James Alpha Funds Trust d/b/a Easterly Total Hedge Portfolio will be liquidated on or about June 12.

PSI Strategic Growth Fund will be liquidated on or about June 27.

Segall Bryant & Hamill Fundamental International Small Cap Fund will be liquidated on or about June 26.

Segall Bryant & Hamill Workplace Equality Fund will be liquidated on or about June 26.

UVA Dividend Value ETF will undergo liquidation and dissolution on or about June 26, 2023.

Virtus FORT Trend Fund will be liquidated on or about July 12.

Finally, Ziegler Senior Floating Rate Fund will be liquidated on or about July 16.

Manager changes

The Board of Trustees of Vanguard Quantitative Funds, on behalf of Vanguard Growth and Income Fund, has approved firing Vanguard’s Quantitative Equity Group, then adding Wellington Management to existing subadvisors D. E. Shaw Investment Management and Los Angeles Capital Management. An odd disclosure: “With the addition of Wellington Management, which will employ a fundamental approach, the Fund’s principal investment strategy will change, as it will no longer use solely quantitative approaches to security selection.” This Leaves it unclear whether Shaw & LA are switching from quant strategies or if they were simply too minor to drive the fund’s “principal” strategy.

Vanguard’s QEG suffers the same fate with regard to Vanguard U.S. Growth Fund; they get booted while Baillie Gifford, Jennison Associates, and Wellington Management Company remain. Despite the disappearance of a quant manager, “The Fund’s investment objective, principal investment strategies, and policies remain unchanged.”