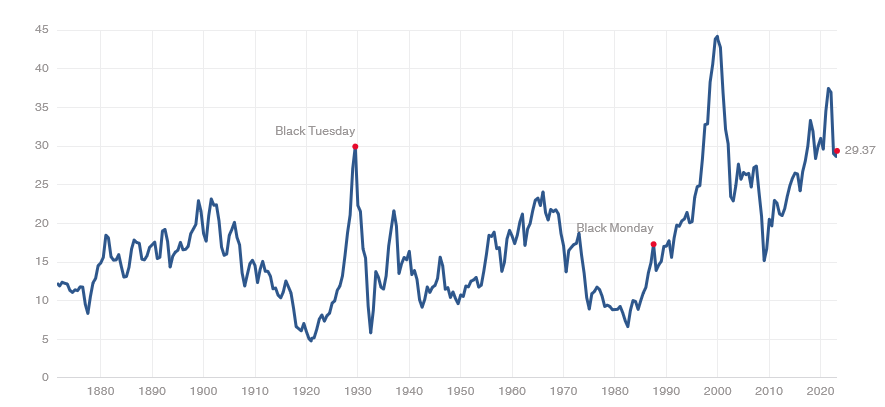

The US stock market remains among the most extreme valuation of the past 150 years, at least as measured by the Schiller 10-year PE ratio.

Traditionally bear markets bottom out with a price/earnings ratio in the single digits … not at 29. Leuthold ruefully observes:

If the October S&P 500 low holds, the normalized P/E ratio of 22.7x on that date will signify the priciest bear market bottom in history; in fact, it is exactly the same level reached as at the August-1987 bull market high. Since October, the normalized P/E multiple has grown to 25.5x—higher than all but three previous bull market peaks. (Green Book, February 2023)

On the whole, they conclude, “The hostile monetary backdrop makes recent stock market exuberance even more irrational than in early 2021” (February 2023). James Mackintosh, senior markets columnist at the Wall Street Journal, has been buying “storm warning” flags in bulk: “this is no more than a brief interruption to the bear market” (2/22/2023), buy bonds now because they “provide some protection against the risk that stocks aren’t merely highly valued, but still overpriced” (2/23/2023), the recent rally in speculative stocks and CCC-rated bonds is just “a wild race to load up on risk” (2/8/2023) and “Investing is all about risk and reward, but at the moment it’s mostly about risk” (2/2/2023). Much of the euphoria is driven by the fantasy that “this time is different, inflation will vanish (it hasn’t; it clocked in at nearly 300% of the fed target rate and unemployment remains at a 50-year low), the Fed will lower rates (they won’t), and we can bet on “no landing” as easily as a “soft landing” (you shouldn’t since the Fed has managed that feat precisely once in 35 years).

On March 2nd, Christopher Waller, a member of the Fed’s board of governors, warned business leaders; “Recent data suggest that consumer spending isn’t slowing that much, that the labor market continues to run unsustainably hot and that inflation is not coming down as fast as I had thought.” In a carefully orchestrated show, three other Fed governors made separate comments, including “we need to go higher,” the Fed “needs to do a little more” to raise rates, and “I lean towards continuing to raise further.”

They are not trying to be subtle. They are saying, as clearly as Fed officials ever do: “read our lips: we will continue tightening the vise until we break the back of inflation.”

In general, we do not suggest that you run and hide. Having “strategic cash” that’s earmarked for opportunistic buying is good as long as you know what you’re going to buy and when you’re going to buy it … and you have the fortitude to do so. Most investors are better off giving up the illusion that they’re Warren Buffett.

The alternative is to invest regularly, through thick and thin, with people who are good at managing uncertain markets on your behalf. They are generally obsessive and apt to wake at 3:00 a.m. wondering about the state of the Euro/dollar exchange rate. Our motto: let them get ulcers, so you don’t have to.

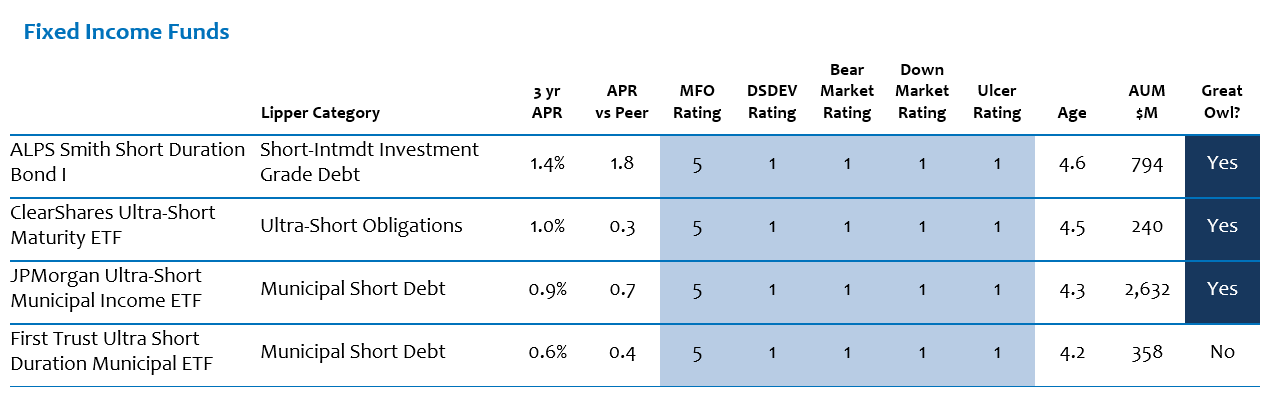

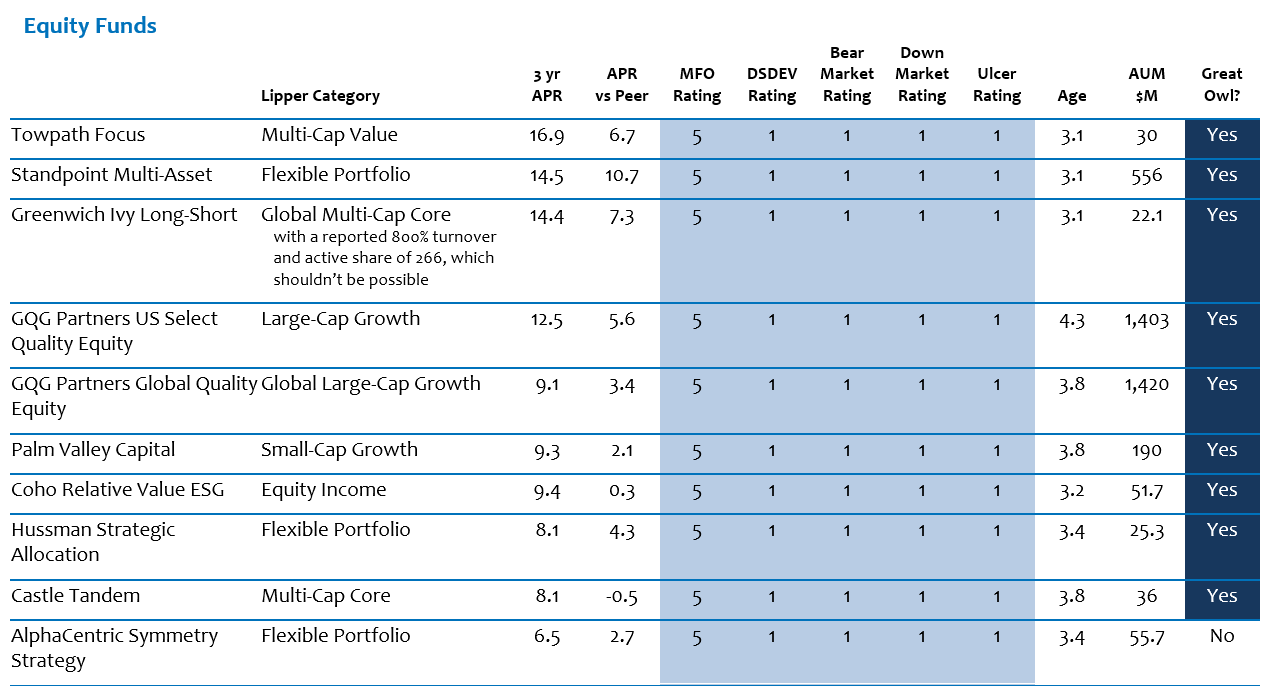

We will offer you two sets of leads. The first set, The Young Defenders, focused on funds that are less than five years old but that have posted utterly impeccable risk and return metrics. This crowd has been, since inception, top-tier across all measures. The second set, The Wizards, focuses on funds that have managed to combine high degrees of flexibility with top-tier returns and below- to much-below-average volatility for decades.

The Young Defenders

A handful of young funds, by luck or design, have managed the rare feat of peer-beating returns since inception with risk-rated, risk-adjusted returns (MFO rating, Ulcer rating) and risk metrics (downside deviation, bear market deviation, down market deviation).

Investors leery of the state of the market might cast an eye in their direction.

Cells marked in blue represent the top 20% of performance.

Columns 3 & 4 measure a fund’s raw returns. Column 5, MFO Rating, is a risk-return balance. We then report relative performance based on downside deviation (a measure of day-to-day downtime volatility), bear market deviation (performance when markets are very ugly), down market deviation (performances when markets are merely ugly), and Ulcer Index (which combined the length and depth of a fund’s maximum drawdown; the idea is that funds that don’t fall much – or fall but recover quickly – are much less likely to give you ulcers than funds than fall hard and stay down.)

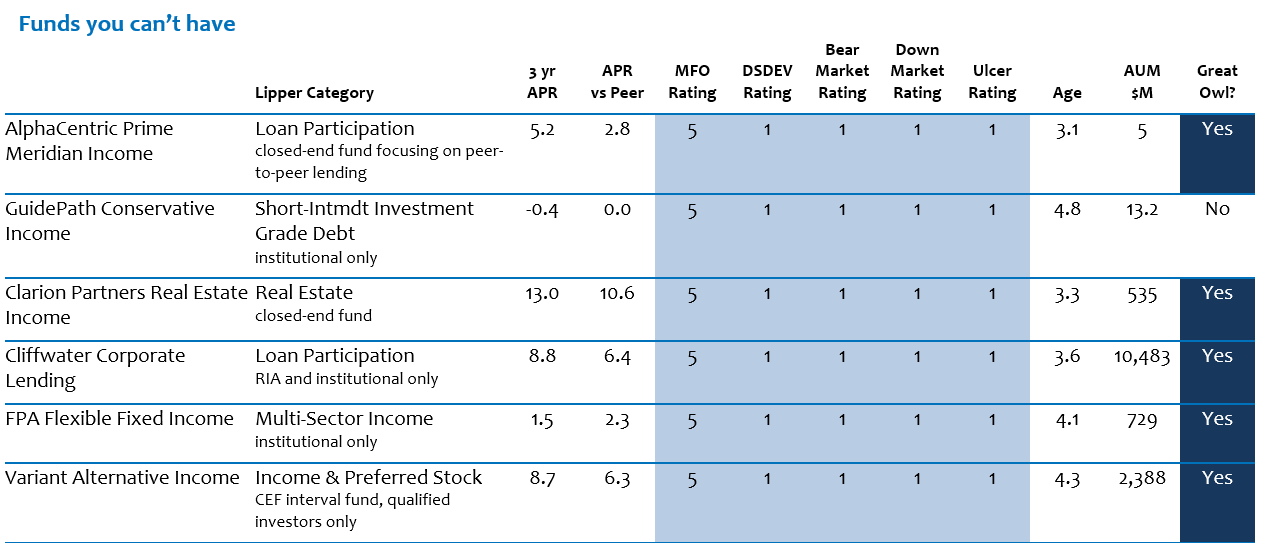

A handful of other funds also made the cut but appear to be unavailable to mere mortals, normal investors, and the folks I know. For the sake of the richly resourced, we wanted to include the restricted funds with some notes about their distinction.

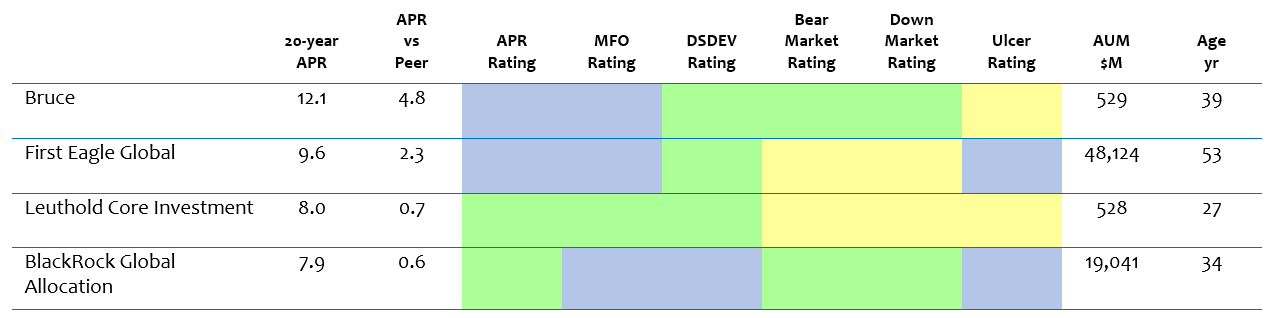

The Wizards

At the other end of the extreme are an even smaller handful of funds that have two virtues. First is the freedom of maneuver. Their managers, by prospectus and discipline, have the ability to change the shape of their portfolios, possibly moving from 90% European equities in one market to a split between short-term bonds and real estate in another. Second is a demonstrable record of getting it right. While a fund’s returns profile changes unpredictably (it’s about impossible to “beat the market” year in and year on), a manager’s risk profile is really consistent. Managers who have a discipline that values absolute returns over relative ones and a willingness to shy away from overpriced assets tend to demonstrate that perspective consistently over time.

At the other end of the extreme are an even smaller handful of funds that have two virtues. First is the freedom of maneuver. Their managers, by prospectus and discipline, have the ability to change the shape of their portfolios, possibly moving from 90% European equities in one market to a split between short-term bonds and real estate in another. Second is a demonstrable record of getting it right. While a fund’s returns profile changes unpredictably (it’s about impossible to “beat the market” year in and year on), a manager’s risk profile is really consistent. Managers who have a discipline that values absolute returns over relative ones and a willingness to shy away from overpriced assets tend to demonstrate that perspective consistently over time.

Performance is only skin-deep; risk management goes right to the bone.

We searched for “flexible portfolio” funds with a track record of 25 or more years and a combination of above-average returns and lower – sometimes dramatically lower – volatility than their peers. Only four funds make the cut.

Cells marked in blue represent the top 20% performance, while green is the next highest 20%, and yellow is in the group’s mid-range. These are the same metrics we described above under the “young defenders” table.

Who are these wily creatures? First, they all appeared as our “best-of-class flexible allocation fund” based on their 25-year Sharpe ratios. That was in our January 2023 article, “The Investor’s Guide to 2023: Three Opportunities to Move Toward.”

Bruce Fund will invest as heavily in stocks as the market warrants, which might be 40% and it might be near 80%. The equity portfolio is not constrained by market capitalization, but the managers prefer small-cap stocks. The bond portfolio is primarily convertible and long-dated “zero coupon” corporate bonds. The managers might invest in distressed securities, both in equity and fixed-income portfolios. They may be “a large cash position for a transitional period of time.”

First Eagle Global is an absolute return fund managed on a sort of Benjamin Graham / Warren Buffett model. It has “the ability to invest across asset classes, regions, sectors/industries, market-capitalization ranges, and without regard to a benchmark.” Turnover is low, and active share is high. Investors with a long memory will recall its early days as Jean-Marie Eviellard’s SoGen International Fund; a new millennium brought a new name. As you can tell from its sheer size, this is not a “star in the shadows” fund.

Leuthold Core Investment is a purely quant fund managed by a team from The Leuthold Group led by Doug Ramsey (who has the distinction of being the finest fund manager ever to graduate from Coe College in nearby Cedar Rapids, Iowa). Leuthold’s core business is rigorous market research driven by an irreproducibly deep database provided to institutional investors. Their analysis was so good that they were urged to produce an investment vehicle based on it. That’s this fund. They start with “proper asset class selection and a highly disciplined, unemotional method of evaluating risk/reward potential across investment choices. We adjust the exposure to each asset class to reflect our view of the potential opportunity and risk offered within that category. Flexibility is central to the creation of an asset allocation portfolio that is effective in a variety of market conditions. We possess the flexibility and discipline to invest where there is value and to sell when there is an undue risk.” They don’t pretend to be stock selectors and tend to buy baskets of stocks to execute their asset allocations.

BlackRock Global Allocation has a go-anywhere discipline. A sense of how not “60/40” they are comes from looking at their custom benchmark index: 36% US equities, 24% international equities, 24% 5-year Treasuries, and 16% global bonds. It comes with both global overlays and individual security selection with a bunch of unconventional data sources (e.g., internet search frequency, credit card charges). The allocation can change a lot depending on their reading of conditions and trends. The team is deep, richly resourced, and has, since 2019, been getting stronger (per Morningstar). It must be nice to have a “parent” with $10 trillion in assets behind you.

Bottom line:

Our recommendation is stick with your discipline. Stay in the market. Invest consistently; most especially, invest when you’re feeling most panicked. And simply your life by choosing a manager who has the skills, fortitude and authority to make the decisions in bad times that most benefit you in good ones.