Recently, I had a long chat with Amit Wadhwaney, the founder of Moerus Capital Management and the adviser to Moerus Worldwide Value Fund. He is a very thoughtful and seasoned investor. Here are some of his thoughts on his fund and his stock-picking style. I’ve presented a summary of my notes rather than an actual Q&A, but the flavor of their investing style will hopefully come through.

History and training:

Mr. Wadhwaney is broadly educated. He earned a Bachelor of Science in chemical engineering from Minnesota, then both a Bachelor of Arts and a Master’s in Economics from Concordia University, Montreal. He followed those with an M.B.A. from the University of Chicago.

His career began as a business analyst at Domtar, a Canadian forest products company, then at the Canadian brokerage Bunting Warburg, studying … well, the forest products industry. He earned a position as a securities analyst and then as Director of Research at M.J. Whitman LLC, a New York-based broker-dealer. Mr. Whitman founded Third Avenue Management, where Amit worked from 1990 – 2014. In his time at the firm, he was responsible for both hedge funds (Third Avenue Global Value Fund, LP and the Third Avenue Emerging Markets Fund, LP) and a US mutual fund (Third Avenue International Value). Amid what might be politely described as “considerable turmoil at Third Avenue,” Mr. Wadhwaney left to found Moerus Capital Management.

Mandate at Moerus:

The mandate is to run an unconstrained, global portfolio. That means US, developed international, and emerging market stocks. The goal is to be prudently opportunistic but with a low turnover. The portfolio changes every three to five years.

Moerus currently has about 34 holdings, with Tidewater being the biggest position. Wadhwaney recognizes the high mutual fund expenses ratio of 1.65%, but it’s a small fund, and he has expenses to pay. Wadhwaney says that Moerus is at one end of the value chain. A number of their peers have disappeared, and some have diminished. The business of value investing had to stretch very hard to justify its existence. Moerus are not great storytellers, but they know how to buy businesses that are able to fix themselves, and they buy these businesses at good prices. That’s their Edge.

Why Global? Why not just buy US companies for international exposure?

- Cheapness is hard to find in the USA.

- There are businesses – business models or monopolies – abroad that you will not find in the US.

How do you think about risk?

When they think of what can hurt the business of the stocks they buy, they look at:

- FX Asset-liability mismatch

- Nature of debt structure

- Sensitivity to inflation

Thus, they are macro-aware. But macro does not determine their stock picking. They are not sitting around trying to guess the level of interest rates, central bank policy, or commodity prices. They try to be in good neighborhoods and try to buy beaten up and depressed stocks. They understand that the time to fixing a beaten-up stock is quite variable. Unlike bonds, stocks have an indeterminate payoff date.

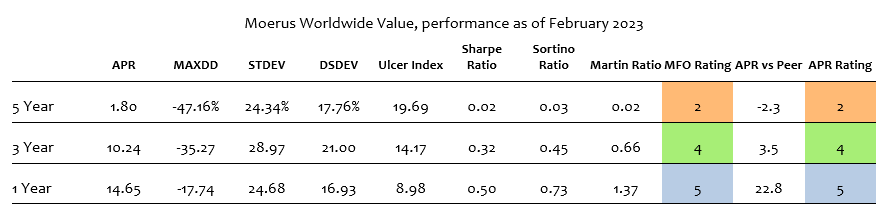

Recent performance

2020 was a bad year for the fund, down 10%. They bounced back in 2021, up a solid 18%. But they did even better in 2022. The fund was up 6% when the markets were down 15-20%.

What changed in 2021 and especially 2022, compared to 2020?

In what “we did,” nothing changed. Let’s take the case of three stocks in which we were invested.

Stock 1: Tidewater

Tidewater, an offshore oil exploration and drilling company, is one of their largest holdings, bought 3-4 years ago. They bought it when it emerged from bankruptcy with a clean balance sheet. Then in 2020, oil went to a negative price. Stock went from $20 to $4. The company was financially solid and well set up to deal with it. Because of its great balance sheet, it is a preferred counterparty to the biggies like Exxon and Amerada Hess, who want strong service providers in the North Sea. The stock came back in a very big way. Tidewater was not an oil bet. It was a bet on a financially strong company that was built to survive in a low oil price regime and thrived when oil prices went higher.

Stock 2: UniCredit

UniCredit, an Italian banking group, is another example. When interest rates were low, all kinds of financial companies – banks and insurance companies – were impacted. Moerus bought UniCredit because such low level of interest rates was unintuitive to them. UniCredit did a massive equity issuance and jettisoned a lot of bad debt. Internally, it continued to fix the business and balance sheet. The bank sold a unit to Amundi, a European asset manager. Improvements were happening and the company was all set to declare dividends and buybacks, when all of a sudden, the pandemic hit. Banks, UniCredit including, cratered. Moerus bought more of the stock. After the pandemic, UniCredit came out much stronger due to all of its internal fixing. Recently, the ECB has allowed UniCredit to conduct buybacks. Now, the stock is doing great.

Stock 3: Standard Chartered Bank

Standard Chartered Bank (Stanchart) is a very big bank operating in Asia. The previous CEO was involved in reckless lending. To win capital markets business from Indian promoters and Indian companies, the bank extended these promoters unsecured loans. This led to predictable disaster. Bill Winters was hired from JP Morgan and started cleaning up. While 2020 was a tough year for the bank, the capital internally was building up. Rising interest rates and internal self-help have gone a long way to help Stanchart’s stock price.

Bottom Line: learning from his embrace of Astoria, Queens

Wadhwaney came to New York, and in 1991 determined Manhattan real estate prices were too high. Once a value investor, always a value investor. He went to Astoria, liked what he saw, and still lives in that part of Queens. “I like the space and access to fresh produce, and the cost of living is much better.”

That tells an investor everything they want to know about Moerus. They are not chasing growth. They are looking for a margin of safety in investments, an art that is now lost in an age of Zero Day Trading Options. Don’t ask if Moerus is a good fund. Ask if you are the right investor to be invested in Moerus. If the frequency matches, it’s hard to not make money over a long period.