On September 30, 2021, T. Rowe Price launched the T. Rowe Price Total Return ETF. The fund is a not-quite-clone of the successful T. Rowe Price Total Return Fund (PTTFX). The strategy behind the fund and ETF start with the same two assumptions:

- U.S. core fixed income allocations remain a building block of a diversified portfolio for many investors. Traditionally a low-to-negative correlation with the equity market made bonds an automatic volatility buffer, and they kick off a reliable stream of income that retired investors need.

- The Bloomberg U.S. Aggregate Bond Index is defective, and those defects then carry over into the $ 1.2 trillion of fund and ETF assets linked to it. Those linkages can be direct (an index fund that tracks The Agg) or indirect (an active bond fund that is benchmarked to The Agg).

What problems? The Agg, by design, tracks (1) investment grade, (2) taxable, (3) US, (4) fixed-rate bonds. This would be great … if this were 1964 because that collection of requirements defined a vibrant portfolio that broadly reflected the ancient fixed income universe. That’s no longer the case, with The Agg excluding huge swaths of assets (floating rate, asset-backed, non-IG, non-dollar denominated) that might be fundamentally more useful than an index trapped in the highest-quality (70% AAA-rated) but lowest yield (exposure to ultra-safe US Treasuries has doubled from 20% of the index before 2008 to 40% now, with yields of 1.45 – 1.8% for the 10- and 30-year bonds) corner of the market. Finally, only very large issues – generally a minimum issuance of $1 billion – is required for inclusion.

T. Rowe Price tries to address those problems by creating a strategy that consciously balances the virtues of a high-quality investment-grade portfolio with the opportunities offered by gaining access to smaller, more challenging but potentially more profitable fare.

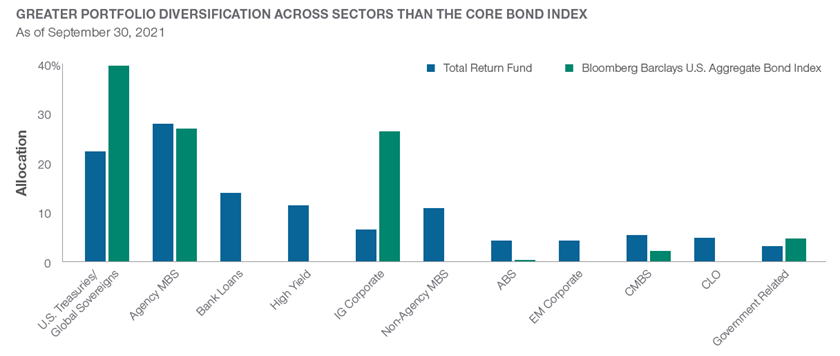

T. Rowe Price’s latest portfolio review gives a snapshot of where The Agg invests and where, contrarily, they’re finding opportunities.

So, far lower exposure to US Treasuries and investment-grade corporates, comparable exposure to mortgage-backed securities and significant exposure to bank loans, high yield bonds, mortgage-backed securities not issued by government bodies, EM corporations, and collateralized loan obligations.

That exposure is dynamic rather than static. Depending on market conditions, the managers could eliminate their substantial exposure to bank loans or double their EM corporate exposure. All investing involves risk, with unconstrained investing involving some risks that other strategies don’t entail. The two keys to judging whether the risks of the fund are acceptable, come down to understanding the managers and their records.

The fund is managed by Chris Brown and Anna Dreyer. He’s head of securitized product investing, she’s head of risk and portfolio construction research for Price. Between them, they have 33 years of experience, and they’re supported by nine other fixed-income managers on the fund’s advisory committee. In addition, they co-managed the T. Rowe Price Total Return Fund, the open-end fund from which this ETF was cloned.

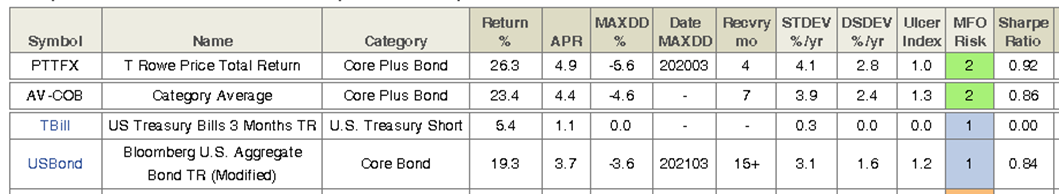

Their record is solid. Here’s a snip of the fund’s basic information since inception.

Higher total returns than its core-bond peers (0.5% per year higher) and substantially higher than its benchmark (1.2% per year higher). The decision to overweight risk assets is reflected in higher volatility (maximum drawdown, standard deviation, downside deviation, MFO Risk) but you’ve been compensated for that volatility. T. Rowe Price outperforms both its peers and its benchmark when you look at risk-return metrics such as the Sharpe ratio (where higher is better) and Ulcer Index (a measure of how far an investment falls and how long it takes to recover, where a lower score is better).

In short, bold-but-cautious management, first-rate adviser, decent income (2.4%), strong record. It’s especially reassuring that the fund’s strongest outperformance came in the two years, 2018 and 2021 YTD, when its benchmark and peer group posted losses while this fund posted gains.

Fund or ETF? The ETF is marginally less expensive than the fund – about 15 bps – though the ETF currently sells at a small premium to its NAV. The ETF might be more tax-efficient and allows you to skip the minimum initial investment. The differences are marginal but might favor the new T. Rowe Price Total Return ETF (TOTR).

The ETF’s homepage is understandably a bit thin on content, which the mutual fund is pretty rich.