By David Snowball

The Securities and Exchange Commission, by law, gets between 60 and 75 days to review proposed new funds before they can be offered for sale to the public. Each month we survey actively managed funds and ETFs in the pipeline. This month brings 39 new products in the pipeline, most of which will launch by the end of December. Only Smead International Value overtly flags a 2022 launch.

The four most important words to keep in mind when you’re reviewing this month’s filings:

Show Me The Money.

More correctly, “show me that you have any audited record of making any money for clients with your Magic Wand Strategy.” Technically you’re asking for evidence of a GIPS-compliant separately managed account composite, which should appear in a prospectus under “Performance of related accounts.” But, this month, it mostly doesn’t. One fundamental tenet at MFO is “never trust your money to someone who still has training wheels on.” One place to get that training is on separately managed accounts using the same strategy. Some managers can bring a 10-year record with tens of millions of investor money to the table when they launch a new fund.

That is less important when an established advisor with a clear discipline and documented record adds a fund to their stable, as might be the case with Polen Global SMID Company Growth this month. There’s a Polan discipline that has been applied consistently across Polen’s slowly growing stable of funds. The record of those funds gives you some sense of what you’re getting in this one.

But if you’ve got nothing more than the manager’s boundless confidence that they’ve found The Secret of All Secrets when it comes to investing, perhaps you should give them a year or two to prove it … with someone else’s money.

Admirable Acts of Charity: the Simplify Health ETF and RN Volition America Patriot ETF are promising to contribute “all” and “the majority” of their management fees to worthy charities. The former supports the Susan G Komen Foundation and the latter, the Folds of Honor charity which provides scholarships for the children of soldiers wounded or killed in service.

Amazing how fast the bitcoin filings read like late-arriving wannabees. I could write the prospectus for them: “Hi, we’re going to invest in bitcoin futures and short-term fixed-income just like the last 12 guys!” I skipped a few filings for the sheer redundancy of them.

The two non-redundant filings: one to short bitcoin futures and the other the leverage them. The SEC has formally requested the withdrawal of that latter filing, but (at press time) the adviser has not

Think of it as “the trans moment for funds.” Five of this month’s filings are for conversions, including one hedge fund becoming a mutual fund and four mutual funds becoming ETFs.

ARK 21shares Bitcoin Futures Strategy ETF

Ark 21shares Bitcoin Futures Strategy ETF, an actively managed ETF, seeks long-term capital appreciation. The plan is to buy bitcoin futures while the rest of the portfolio is low-risk fixed-income stuff. The fund will be managed by an unnamed employee of 21Shares US who will provide recommendations to Brandon Koepke, who is “jointly and primarily responsive” for the fund. 21Shares is a Swiss firm with European crypto-ETPs. The ARK derives from the fact that ARK Investment Management provides “marketing support,” but not investment services, to the fund.

Avantis U.S. Small Cap Equity ETF

Avantis U.S. Small Cap Equity ETF, an actively managed ETF, seeks long-term capital appreciation. The plan is to build a diversified portfolio of “higher profitability or value companies.” The fund will be managed by an American Century team headed by Eduardo Repetto. Dr. Repetto is the Avantis CIO, a DFA alumnus and aeronautical engineer with his Ph.D. from CalTech. Its opening expense ratio has not been disclosed.

AXS Astoria Inflation Sensitive ETF

AXS Astoria Inflation Sensitive ETF, an actively managed ETF, seeks long-term capital appreciation in inflation-adjusted terms. The plan is to invest in firms in industries that benefit from sustained inflation in commodities and TIPs. (Jason Zweig expressed skepticism about the actual, as opposed to purported, performance of such assets. See “Deflating Your Inflation Fears,” Wall Street Journal, 10/29/2021.) The fund will be managed by John Davi of Astoria Portfolio Advisors. Its opening expense ratio has not been disclosed.

Baron Technology Fund

Baron Technology Fund will seek capital appreciation. The plan is to invest in tech companies Baron believes have significant opportunities for growth, sustainable competitive advantages, exceptional management, and an attractive valuation. The fund will be managed by Michael Lippert and Ashim Mehra. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $2,000, reduced to $500 for accounts with an automatic investing plan.

Barrow Hanley Emerging Markets Value Fund

Barrow Hanley Emerging Markets Value Fund will seek long-term capital appreciation and consistent income from dividends. The plan is to use quantitative valuation and business strength screens to reduce a 5,500-stock universe down to a 100-150 name guidance list. The team then does fundamental research to select the portfolio names. The fund will be managed by Randolph Wrighton, Sherry Zhang, and David Feygenson. Its opening expense ratio for “Y” shares is 1.14%, and the minimum initial investment will be $2,500.

Barrow Hanley International Value Fund

Barrow Hanley International Value Fund will seek to outperform the MSCI EAFE Index with lower risk. The plan is to invest in companies that are temporarily undervalued for reasons Barrow Hanley can identify, understand, and believe will improve over time. Quantitative screens winnow a 3,800-stock universe to 150-200 potential holdings, and analysts do fundamental research to identify the portfolio holdings. The fund will be managed by Randolph Wrighton and TJ Carter. Its opening expense ratio for “Y” shares is 1.01%, and the minimum initial investment will be $2,500.

BlackRock Global Equity Absolute Return Fund

BlackRock Global Equity Absolute Return Fund will seek total return over the long term. It’s going to be a global equity fund with a bunch of hedging opportunities, including shorts. The fund will be managed by James Bristow and Gareth Williams. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $1,000.

BlockFi Bitcoin Strategy ETF

BlockFi Bitcoin Strategy ETF, an actively managed ETF, seeks capital appreciation. The plan is to buy bitcoin futures and short-duration fixed income securities. The fund will be managed by Andrew Serowik, Todd Alberico, and Gabriel Tan. Its opening expense ratio has not been disclosed.

Clockwise Capital Innovation ETF

Clockwise Capital Innovation ETF, an actively managed ETF, seeks long-term growth of capital. The plan is to embrace “5G enabled opportunistic investing,” which “focuses on the meaning of time.” Nominally all-cap, 10-20 unevenly weighted names in the portfolio. The fund will be managed by Ryan J. Guttridge and Cengiz Mehmet Cakmak of Clockwise Capital LLC. Its opening expense ratio is 1.25%, but that number is reported in brackets which implies a degree of tentativeness.

Conductor Global Equity Value ETF

Conductor Global Equity Value ETF, an actively managed ETF, seeks to provide long-term risk-adjusted total return. The plan is to use one set of models to identify attractively valued stocks, a second set to find ones with momentum, and a third set dictates the extent to which the whole portfolio is hedged, with a final portfolio that’s 50-100% net long. This is the conversion to an ETF of the Conductor Global Value Equity Fund, whose five-year Sharpe ratio is about half that of its Lipper Global Small/Mid Cap peers. The fund will be managed by Charles Albert Cunningham, III, Chief Investment Officer of IronHorse Capital. Its opening expense ratio is 1.35% after waivers.

Convergence Long/Short Equity ETF

Convergence Long/Short Equity ETF, an actively managed ETF, seeks long-term capital growth. The plan is to invest 90-150% of the portfolio in “fundamentally sound companies” while having short positions equal to 20-70% against “fundamentally inferior” companies, with a net long position of 50-100%. This represents the fund-to-ETF conversion of the four-star Convergence Long/Short Fund. In the conversion, the minimum expense ratio goes away, and the expense ratio drops by 0.55%. The fund will be managed by David J. Abitz and. Justin Neuberg of Convergence Investment Partners. Its opening expense ratio is 1.84%.

Copeland International Small Cap Fund

Copeland International Small Cap Fund will seek long-term capital appreciation and income generation. The plan is to purchase small-cap equities (max cap of $11 billion) of international companies with a proven track record of consistent dividend growth. The fund will be managed by Erik B. Granade and Kenneth T. Lee. Its opening expense ratio for “A” shares is 1.22%, “I” shares is 0.97%, and the minimum initial investment for either class will be $5,000. They might be using the share class decision as a sort of IQ test for shareholders.

Cultivar ETF

Cultivar ETF, an actively managed ETF, seeks long-term capital appreciation. The plan is to invest in 50-100 undervalued (or under-appreciated, as so many of us are) securities. The fund will be managed by Thomas Muir and Keith Henderson of Cultivar Capital. Its opening expense ratio has not been disclosed.

Dimensional US Marketwide Value ETF

Dimensional US Marketwide Value ETF, an actively managed ETF, seeks long-term capital appreciation. The plan is to buy large-cap value stocks. This is the largest in DFA’s series of conversions of mutual funds into ETFs. The fund being converted is DFA Tax-Managed US Marketwide Value II which has above-average to high returns relative to its Morningstar large value peer group. The fund will be managed by Jed Fogdall and Joel Schneider. Its opening expense ratio is 0.23%.

Direxion Bitcoin Strategy Bear ETF

Direxion Bitcoin Strategy Bear ETF, an actively managed ETF, seeks capital appreciation. The plan is to short Bitcoin futures. The fund will be managed by Paul Brigandi and Tony Ng of Rafferty Asset Management. Its opening expense ratio has not been disclosed.

DoubleLine Shiller CAPE U.S. Equities ETF

DoubleLine Shiller CAPE U.S. Equities ETF, an actively managed non-transparent ETF, seeks to outperform the S&P 500. The plan is to invest primarily in four of the five most undervalued industry sectors in the S&P as measured by their CAPE Index values. The security selection within each sector is an active decision. The fund will be managed by two as-yet-unnamed DoubleLiners. Its opening expense ratio has not been disclosed.

Grandeur Peak Global Explorer Fund

Grandeur Peak Global Explorer Fund will seek long-term growth of capital. The plan is to build a typical Grandeur Peak portfolio. They can’t yet talk about the fund’s particular niche, and about the best I can discern is that the economic prospects of the region in which a company is located may play a greater-than-usual role in portfolio construction. Other than that, micro- to mid-cap, best-in-class companies, growth orientation. The fund will be managed by Juliette Douglas. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $1,000.

Green Alpha Growth & Income Fund

Green Alpha Growth & Income Fund will seek current income and long-term capital appreciation. The plan is to invest in “Next Economy” companies, those which “are creating or enabling solutions to major systemic risks including, but not limited to climate change, resource degradation and scarcity, and widening inequality and the resulting erosion of social cohesion.” (Social cohesion firms? Hmmm.) The fund will be managed by Jeremy Deems and Garvin Jabusch. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $2,500.

InfraCap Equity Income Fund ETF

InfraCap Equity Income Fund ETF, an actively managed ETF, seeks to maximize income and pursue total return opportunities. The plan is to invest in dividend-paying stocks, overlaid with put and call options and junk bonds, with the additional prospect of 33% leverage. The fund will be managed by Jay D. Hatfield of Infrastructure Capital Advisors. Its opening expense ratio is 0.80%.

LHA Market State Tactical Q ETF

LHA Market State Tactical Q ETF, an actively managed ETF, seeks long-term outperformance relative to the large-capitalization U.S. equity market. The plan is to use a bunch of derivatives, but only for good. The portfolio starts as the NASDAQ 100. If analysis of VIX trends shows rising volatility, they dial back exposure to the NASDAQ and add exposure to VIX futures and call options as hedges. The fund will be managed by Michael Thompson and D. Matthew Thompson of Little Harbor Advisors. Its opening expense ratio is 1.15%.

Madison Sustainable Equity Fund

Madison Sustainable Equity Fund will seek long-term capital appreciation. The plan is to buy 35-50 high-quality, large-cap companies that incorporate sustainability into their overall strategy. The fund will be managed by Maya Bittar and Dave Geisler. Its opening expense ratio for “Y” class shares is 0.90%, and the minimum initial investment will be $1,000.

Polen China Growth Fund

Polen China Growth Fund will seek long-term growth of capital. The plan is to invest in corporations from Hong Kong, the People’s Republic of China, and Taiwan. They’re looking for firms with (i) consistent and sustainable high return on capital; (ii) strong earnings growth and free cash flow generation; (iii) strong balance sheets, and (iv) competent and shareholder-oriented management teams. The fund will be managed by as-yet unnamed parties affiliated with Polen Capital Management. Its opening expense ratio will be 1.50%, and the minimum initial investment will be $3,000, reduced to $2,000 for IRAs and accounts with automatic investing provisions.

Polen Global SMID Company Growth Fund

Polen Global SMID Company Growth Fund will seek long-term growth of capital. The plan is to find companies with (i) consistent and sustainable high return on capital, (ii) strong earnings growth and free cash flow generation, (iii) strong balance sheets typically with low or no net debt to total capital, and (iv) competent and shareholder-oriented management teams. (I rather like the decision to target “competent teams,” presumably because they are few enough of them that it is a significant constraint.) The fund will be managed by Rob Forker, who has been on Polen’s Small Company Growth team since 2018. Its opening expense ratio will be 1.50%, and the minimum initial investment will be $3,000.

Rareview Inflation/Deflation ETF

Rareview Inflation/Deflation ETF, an actively managed ETF, will seek returns that exceed the rate of inflation over a business cycle. The plan is to invest in TIPs and derivatives linked to U.S. Treasury and interest-rate futures. The fund will be managed by Neil Azous of Rareview Capital. Its opening expense ratio will be 0.92%.

Rayliant Quantamental Emerging Market Equity ETF

Rayliant Quantamental Emerging Market Equity ETF, an actively managed ETF, seeks long-term capital appreciation. The plan is to put together a mid- to large-cap portfolio using the same “minds and machines” approach as the other Rayliant funds, also taking some account of ESG factors. The fund will be managed by a team led by Jason Hsu, the firm’s CIO. Its opening expense ratio will be 0.80%.

Rayliant Quantitative Developed Market Equity ETF

Rayliant Quantitative Developed Market Equity ETF, an actively managed ETF, seeks long-term capital appreciation. The plan is to use “a quantitative investment approach with human discretion” to find stocks with “the potential for higher future returns.” (Duh.) They also “take into account certain ESG criteria.” The fund will be managed by a team led by Mark Schlarbaum. Its opening expense ratio will be 0.80%.

RBC Global Equity Leaders Fund

RBC Global Equity Leaders Fund will seek long-term capital growth. The plan is to buy 20-40 companies that are, or have the potential to become, leaders in their industries. This assessment is based on the sustainability of a company’s competitive advantage, quality of management, and environmental, social, and governance stewardship. The fund will be managed by Habib Subjally. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $1,000.

RN Volition America Patriot ETF

RN Volition America Patriot ETF, an actively managed ETF, seeks capital growth. The plan is to invest in mid- to large-cap domestic stocks, with the sub-adviser donating “a majority of its sub-advisory fee” to Folds of Honor, a charity focused on providing scholarships to families of veterans who were disabled or killed in action. The fund will be managed by a team led by Patrick W. Galley of RiverNorth Capital. To unpack the name: RN is RiverNorth, Volition America is a charity that supports the Folds of Honor program and Patriot … well, sort of works with all the rest. Its opening expense ratio has not been disclosed.

RN Volition America Patriot ETF, an actively managed ETF, seeks capital growth. The plan is to invest in mid- to large-cap domestic stocks, with the sub-adviser donating “a majority of its sub-advisory fee” to Folds of Honor, a charity focused on providing scholarships to families of veterans who were disabled or killed in action. The fund will be managed by a team led by Patrick W. Galley of RiverNorth Capital. To unpack the name: RN is RiverNorth, Volition America is a charity that supports the Folds of Honor program and Patriot … well, sort of works with all the rest. Its opening expense ratio has not been disclosed.

RPAR Ultra Risk Parity ETF

RPAR Ultra Risk Parity ETF, an actively managed ETF, seeks to generate positive returns during periods of economic growth, preserve capital during periods of economic contraction, and preserve real rates of return during periods of heightened inflation. The plan is to provide “leveraged, risk balanced exposure across four major asset classes – Global Equities, Commodities (through commodity producer equities and gold), U.S. Treasury Inflation Protected Securities, and U.S. Treasuries.” They target leverage at 160-180% of the fund’s net assets. The fund will be managed by Michael Venuto and Charles A. Ragauss of Toroso Investments. Its opening expense ratio has not been disclosed.

SilverPepper Long/Short Emerging Markets Currency Fund

SilverPepper Long/Short Emerging Markets Currency Fund will seek positive absolute returns from sources uncorrelated with the stock and bond markets. The plan is to take long and short positions in a select number of emerging market currencies. The fund will be managed by John Dean and Ian Ross Taylor of Absolute Returns Strategies. Its opening expense ratio is 1.85%, and the minimum initial investment will be $5,000.

Smead International Value Fund

Smead International Value Fund will seek long-term capital appreciation. The plan is to invest in 25-30 large-cap value stocks in developed and emerging markets. Their standard for “large-cap” is above $5 billion, which other funds place in the lower end of the mid-cap spectrum. The screening criteria for holdings seems to match their domestic funds’. This represents the conversion of their hedge fund, Smead International Value Fund LP. The fund will be managed by Cole Smead, backed up by his dad, Bill. Its opening expense ratio on its six share shares has not been disclosed, and the minimum initial investment will be $3,000 for Investor shares.

State Street Diversified Income Fund

State Street Diversified Income Fund will seek a high level of income. The plan is to invest across higher income-generating sectors while adjusting the portfolio to manage risk through different credit cycles. The fund will invest up to 10% convertibles, 10% preferreds, up to 75% in emerging markets but no more than 50% in non-US dollar-denominated securities. The fund will be managed by Matthew Nest and Orhan Imer. Its opening expense ratio has not been disclosed, and there is no minimum initial investment requirement.

Subversive Cannabis ETF

Subversive Cannabis ETF, an actively managed ETF, seeks long-term capital appreciation. The plan is to invest in legal THC-related businesses in the United States, including REITs, biotechs, financial services and such. The “subversive” part appears to be marketing, given that the strategy is about as subversive as my Aunt Jean’s decision to sneak a little parsley into her green bean casserole. The fund will be managed by a team from Subversive Capital. Its opening expense ratio is 0.75%.

Subversive Metaverse ETF

Subversive Metaerse ETF, an actively managed ETF, seeks long-term capital appreciation. The plan is to invest in tech companies. I suppose there is some tech company that wouldn’t qualify as having any involvement in The Next Big Thing, but not many. The fund will be managed by a team from Subversive Capital. Its opening expense ratio is 0.75%.

The Acquirers Fund

The Acquirers Fund, an actively managed ETF, seeks capital appreciation. The plan is to invest in 30 stocks considered to be undervalued but fundamentally strong. Nothing about the portfolio discipline involves firms that are about to be acquired or any stuff. It’s just the name of the adviser. This represents a conversion of the adviser’s passive ETF (which has a pretty horrible record – negative 5% since inception in 2019, against a 21% S&P 500 gain) into an active fund. The fund will be managed by Charles A. Ragauss and Qiao Duan of Toroso Investments. Its opening expense ratio is 0.89%.

The Character Based Investing ETF

The Character Based Investing ETF, an actively managed ETF, seeks capital appreciation. The plan is to invest in the 75-100 corporations whose CEOs have the highest Composite Character. At base, they want to invest in corporations led by Great Leaders, people of exceptional integrity who, by nature, tend to stay with their company for long periods. The fund will be managed by Daniel Cooper of Character Based Investing LLC. Its opening expense ratio will be 0.49%.

The Future Fund Long/Short ETF

The Future Fund Long/Short ETF, an actively managed ETF, seeks to provide capital appreciation. The plan is to have a thematic long portfolio: companies that benefit from “emerging technological or social trends or developments” and will short “thematic losers.” In general, the portfolio will be 50-80% net long. The fund will be managed by Gary Black and David Kalis. Mr. Black is in equal measure famous and infamous: ex-CIO for Goldman Sachs Global Equities, ex-CEO of Janus, ex-CIO of Calamos. Its opening expense ratio has not been disclosed.

Valkyrie XBTO Levered BTC Futures ETF

Valkyrie XBTO Levered BTC Futures ETF, a leveraged ETF, seeks to generate 1.25 times the daily movement of the price of Bitcoin. So October 26, 2019: 40% jump in 24 hours = 50% rise in your holdings. February 23, 2021, 20% drop in 19 hours = 25% loss for you, bubba. The prospectus helpfully warns that if you hold the fund for more than a day, returns “will very likely differ in amount and possibly even direction” from the fund’s target. Translation: if you hold the fund for a week and bitcoin rises three days, falls two days, and ends the week flat, you could be a major loser. The fund will be managed by a team from Valkyrie, which had the first bitcoin ETF. Its opening expense ratio has not been disclosed.

WisdomTree Managed Futures Strategy Fund

WisdomTree Managed Futures Strategy Fund, an actively managed ETF, seeks to provide investors with positive total returns in rising or falling markets. The plan is to invest in some combination of 21 commodities futures (unrefined sugar?) and bitcoin futures (up to 5%). Hmmm … maybe currency futures. This seems to be the relaunch of a Wisdom Tree fund that might be on its third strategy refinement? The fund will be managed by a team from Newton Investment Management North America. Its opening expense ratio is 0.65%.

A series of studies published in Social Psychological and Personality Science found that people of higher socioeconomic status (SES) score consistently lower on tests of emotional intelligence, especially when they perceive high levels of inequality in their community. The researchers suggest that high SES and high subjective inequality promote increased self-focus and less motivation to attend to others’ emotions.

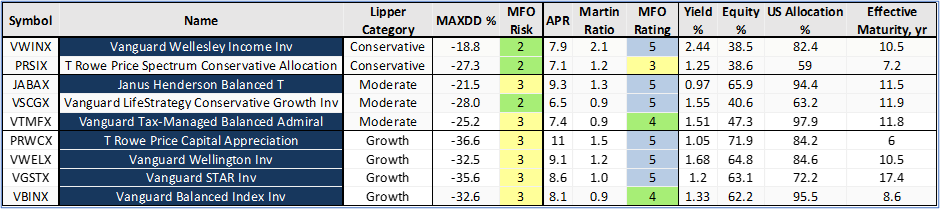

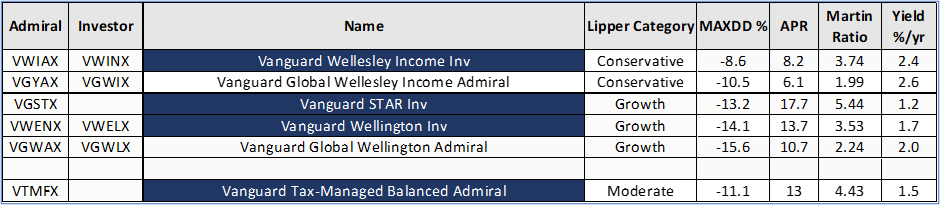

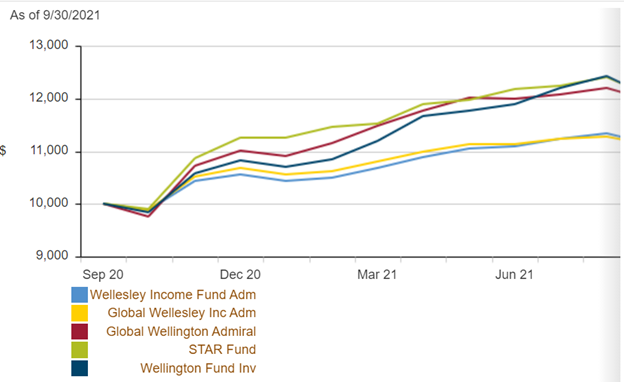

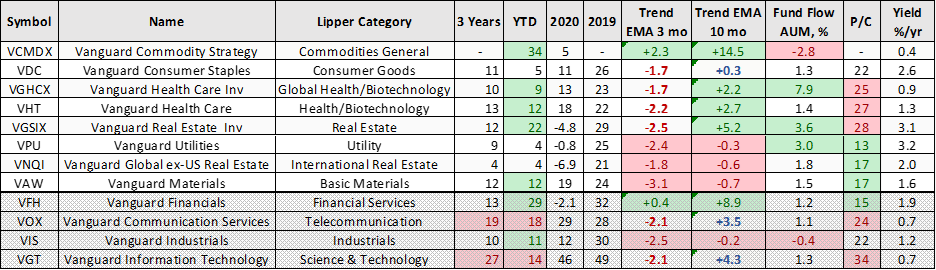

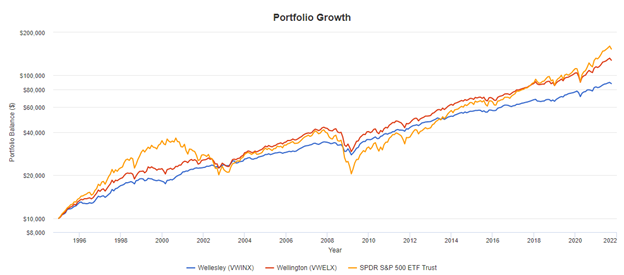

A series of studies published in Social Psychological and Personality Science found that people of higher socioeconomic status (SES) score consistently lower on tests of emotional intelligence, especially when they perceive high levels of inequality in their community. The researchers suggest that high SES and high subjective inequality promote increased self-focus and less motivation to attend to others’ emotions. The Bank of America has now joined the “dead for the long term” party. They now project that the S&P 500 will return somewhere between zero and a bit below zero annually for the next ten years. That’s perfectly in line with Research Affiliates’ projection of a negative 0.5% annual return for the broad US stock market and wildly more optimistic than GMO’s regression-driven estimate of negative 7% annual returns for the next seven years.

The Bank of America has now joined the “dead for the long term” party. They now project that the S&P 500 will return somewhere between zero and a bit below zero annually for the next ten years. That’s perfectly in line with Research Affiliates’ projection of a negative 0.5% annual return for the broad US stock market and wildly more optimistic than GMO’s regression-driven estimate of negative 7% annual returns for the next seven years.

And those are paired with investment vehicles that make all the difference:

And those are paired with investment vehicles that make all the difference:

managers – navigate the quickly evolving rules concerning green disclosure.

managers – navigate the quickly evolving rules concerning green disclosure. Jennifer L. Klass serves as the other co-chair of Baker McKenzie’s Financial Regulation and Enforcement Practice in North America. She is an experienced investment management lawyer with a particular focus on investment adviser regulation and regularly represents clients before the SEC. She provides practical advice that is informed by her experience as Vice President and Associate Counsel at Goldman, Sachs & Co., where she represented the asset management and private wealth management businesses. She’s also worked with SEI, which manages, administers, or advises on about $1.2 trillion in assets.

Jennifer L. Klass serves as the other co-chair of Baker McKenzie’s Financial Regulation and Enforcement Practice in North America. She is an experienced investment management lawyer with a particular focus on investment adviser regulation and regularly represents clients before the SEC. She provides practical advice that is informed by her experience as Vice President and Associate Counsel at Goldman, Sachs & Co., where she represented the asset management and private wealth management businesses. She’s also worked with SEI, which manages, administers, or advises on about $1.2 trillion in assets.