Objective and strategy

The Appleseed Fund seeks long-term capital appreciation. They do that through a portfolio that combines a global, all-cap portfolio of undervalued equities with other diversifying, and sometimes defensive, assets. Its investable universe centers on companies that have “sustainable competitive positions, solid financials, and capable, shareholder-friendly management teams.” The “other assets” in the fund might include bonds (though it currently does not), convertible securities, ETFs, commodities, REITs, and other real estate entities, currencies, and cryptocurrencies. Finally, they use derivatives to hedge portfolio risks and for other purposes.

All investments are screened for ESG factor performance which the managers believe contributes materially to an understanding of their financial performance.

The fund is non-diversified.

Adviser

Pekin Hardy Strauss Wealth Management was founded in 1990 and is headquartered in Chicago, Illinois. They describe their investing approach as “a contrarian, patient, [and] value-oriented investment.” In 2015, Pekin Hardy became the first wealth management firm in Chicago certified as a B Corporation. B Corporations commit to balancing purpose and profit. “They are legally required to consider the impact of their decisions on their workers, customers, suppliers, community, and the environment,” according to the accreditor. Pekin Hardy manages approximately $950 million of investors’ capital in separately managed accounts and through Appleseed Fund.

Managers

Bill Pekin, Adam Strauss, Joshua Strauss with assistance from Shaun Roach. Mr. Pekin has been a portfolio manager at Pekin Hardy Strauss Wealth Management for nearly 20 years and has managed the fund since inception. Prior to joining the firm, Bill served with Credit Suisse, Donaldson Lufkin & Jenrette, and MetLife Investment Management. Because we believe that thinking broadly really does matter, we also celebrate his Bachelor of Arts in History from Haverford College as well as his professional degrees.

Adam Strauss has been a portfolio manager at Pekin Hardy Strauss since 2004, is their co-CEO, and has managed Appleseed Fund since inception. He has earned the CFA Charterholder designation, led the firm’s initiative to become a B Corp, and serves on the board of several socially responsible businesses. He earned a Bachelor of Arts in East Asian Studies with honors from Stanford University (still celebrating the breadth of perspective!), as well as an MBA, also from Stanford.

Joshua Strauss is the other co-CEO and has also managed Appleseed since its inception. He’s also earned the CFA Charterholder designation. His undergraduate degree is a Bachelor of Arts in Foreign Affairs from the University of Virginia, complemented by an MBA from Michigan.

Shaun Roach is an assistant portfolio manager, a CFA Charterholder who has earned degrees from the University of Illinois and the University of Chicago Booth School of Business.

Strategy capacity and closure

At its asset peak, the managers successfully handled $300 million; they estimate that the strategy and their investment infrastructure could easily handle a billion.

Management’s stake in the fund

Messrs Pekin, Strauss and Strauss have each invested in excess of $1 million in the fund; Mr. Roach, a relative newcomer, has invested between $100,000 and $500,000. The managers affirm that having their own money at risk “makes us more careful about our investment decisions, about what we purchase and at what price.” There is little to no investment by the fund’s trustees.

Opening date

December 6, 2006

Minimum investment

$2,500 for Investor shares, $100,000 for Institutional shares

Expense ratio

1.23% for Investor shares and 1.04% for Institutional shares, on assets of $72.4 million

Comments

The Appleseed Fund is defined and, in some ways, bedeviled by three characteristics:

- It is doggedly independent. In a category where large-growth rules ($70 billion average market cap, virtually no mid- or small-cap exposure, average P/E ratio of 17), Appleseed is all-cap and value-conscious ($11 billion market cap, 50% micro- to mid-cap, P/E of 15). Most dramatically, it holds no fixed income while its peers stash 30% of their portfolios there. In lieu of fixed income, it currently holds some convertible securities, some gold, and some cryptocurrency.

- It is focused. Appleseed holds 28 stocks and a handful of other securities. The average fund in its Lipper peer group holds 287.

- It is committed to investing in corporations that embody best practices in environmental, social, and governance issues. Only eight of the 169 funds in its Lipper category carry an ESG designation.

Why would any of this bedevil the fund’s managers? Simple: fund monitoring firms such as Morningstar and Lipper circulate portfolio metrics that are reliable if and only Appleseed looks like – and acts like – its nominal peers.

But it does not and, consequently, they are not.

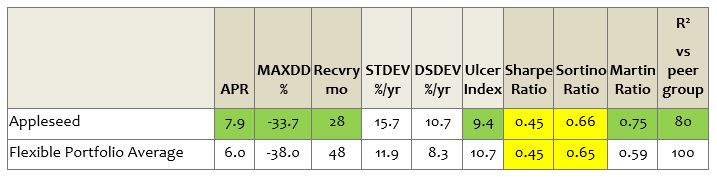

By way of illustration, here are the Lipper metrics for Appleseed since its inception, benchmarked against its “flexible portfolio” peers.

Comparison of Lifetime Performance (Since 200701)

How do you read that? Since its inception, Appleseed has substantially higher returns, a substantially smaller maximum drawdown, and a substantially faster recovery from that drawdown than its peers have. In consequence, the fund’s Ulcer Index (a measure of the depth and duration of drawdowns) is far better but its standard deviation and downside (aka “bad”) deviation are higher. As a result, the standard measures of risk-adjusted return (Sharpe and Sortino) are just average.

The key is that smaller stocks (which they vastly overweight) are more volatile than larger ones and stocks are more volatile than bonds (which they don’t currently hold). The proof of those differences is reflected in the last column: the correlation of Appleseed to its Morningstar peer group over the past five years is a pretty low 80. Among the 60 flexible portfolio funds that earned double-digit returns over the past five years, only eight have lower correlations – that is, greater independence – than Appleseed.

What’s might drive Appleseed over the next five years?

Unless conditions change: inflation. In a long interview in June 2021, folks from the fund expressed the concern that the economy is ripe for price inflation and that the Fed has decided that they need to let it happen. They are informed by the US experience in the 1960s, when then-President Lyndon Johnson pressured the Fed into monetary easing (“printing money”) so that he could pay simultaneously for his Great Society social programs and the war in Vietnam. The chair of the Fed reluctantly, and unwisely, caved under pressure.

In consequence, inflation rose during the last five years of the 1960s and spiked during the 1970s but President Johnson’s debt was kept manageable. A comparable pressure, they believe, exists today.

Debt to GDP level in the US is at a historic high. The only way out is to let inflation accelerate in a sustained way, capping yields under inflation for a negative real interest rate, which happened for 10 years after WW2. The net effect will be that debt is inflated away, though at the expense of bondholders.

Presumably, trillions of infrastructure spending, no matter how socially or environmentally desirable, would compound both the debt and the pressure for continuously low (or negative) real interest rates. How did various asset classes fare? They write:

- Stocks: Adjusted for inflation, the S&P 500 Index generated a total return of 0.3% per year … as is often the case when inflation increases, the P/E ratio of the S&P 500 Index contracted, from 18.8x to 15.8x, and the dividend yield increased from 2.9% to 3.5% between the beginning of 1965 and the beginning of 1970 …Increasing inflation generally results in a contraction of P/E ratios and an expanding dividend yield. In our view, the risk exists that accelerating inflation today could result in a significant downward rerating of U.S. stock prices.

- Bonds: In 1965, the yield-to-maturity on 10-year Treasury bonds was 4.2%; by the time the decade ended, the yield-to-maturity on that same bond, with five years remaining until maturity, was 8.2%. We estimate the total return of that Treasury bond from 1965-1969 to have been -33.1%, or -7.7% per annum, adjusted for inflation … The yield-to-maturity on 10-year Treasury bonds is currently 1.7%, which means that the downside risk of a rise in bond yields is greater today than it was in 1965.

- House prices: Housing performed better than bonds in the late 1960s but still did not keep up with inflation.

- Gold: During the Johnson administration, the dollar was pegged to gold at $35/ounce, and it was not yet legal for Americans to own physical gold during that period. However, demand for gold from Europe increased significantly; during the 1960s, U.S. gold reserves dropped by 38%, from 15,800 tonnes to 9,800 tonnes as undervalued U.S. gold was shipped to Europe. After the dollar/gold peg was removed in 1971, gold’s investment return was spectacular during the following decade as investors sought to sell dollars to invest in gold as a store of value. While not an investment option in the late 1960s, gold is an attractive asset class for investors in the current era and should serve as an excellent long-term store of value should inflation continue to accelerate.

All of which explains why – in a move doggedly independent of their peers – Appleseed has eliminated its fixed-income holdings, added substantial amounts of gold, and dabbled in cryptocurrency (“Crypto is very volatile but isn’t correlated with stocks so adding crypto actually reduces portfolio volatility”).

Bottom Line

The question is not, “does Morningstar (or Lipper or MFO) like Appleseed?” The legitimate questions are, “does Appleseed make sense to you, and does it strengthen your prospects of achieving your financial goals?” The former question is irrelevant because it does not play by its category’s rules: it is far more value-conscious, far more willing to invest in the opportunities presented by smaller stocks, far more skeptical of the mess that the fixed income market is in and, with just 28 stocks in the portfolio, far more willing to concentrate resources on high-confidence areas.

Appleseed embodies independence, has strong ESG credentials, and a stable management team. Its distinctiveness means that it is out-of-step with its Morningstar peer group, investing in places where few peers go and where conventional ESG metrics – designed to assess the behavior of large domestic corporations – have little heft.

The ideal investor here is someone balancing two sets of concerns: (1) the desire to invest in a sustainable strategy and (2) the desire to assert independence from the least rational parts of the market, currently large momentum stocks and investment-grade bonds. Both desires embody concern over the state of our physical and financial environment and favor a long-term perspective over the twitchy degree not to “miss out.”

If that describes you, or your clients, it would be prudent to add Appleseed to your due diligence list and, perhaps, reach out to the team during the relative summer lull.

Fund website

Appleseed Fund. Folks interested in the historic relation of Fed policy, asset class performance, and inflation should read their First Quarter 2021 Fund Commentary.