On May 4, 2021, Fred Alger Management launched the Alger 35 ETF (ATFV), their second active/nontransparent ETF (known colloquially as an ANT). The fund will invest in 35 stocks, typically US, typically mid- to large-cap (98% of the portfolio), and uniformly high growth.

Alger was founded in 1964 as a growth investor with all of its strategies using the same underlying discipline that focused on original, bottom-up research, stress testing of their investment assumptions, high levels of collaboration between analysts and managers, and a focused/high conviction approach.

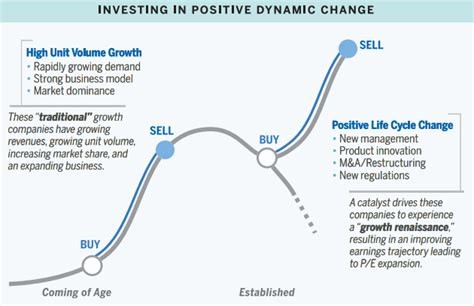

They believe that one of the firm’s signature advantages is its ability to identify growth companies, that are emerging from a plateau or period of consolidation, and which are about to resume their upward trajectory. That might be because of the arrival of new management, corporate restructuring, and the launch of new products. Their term for this growth renaissance is “positive dynamic change.”

As of mid-2021, all of Alger’s funds and separately managed account composites receive either four- or five-star ratings from Morningstar.

The prime attraction of the Alger 35 ETF is Dan Chung and the Alger 35 Fund. Mr. Chung is Alger’s CEO and Chief Investment Officer. He’s worked at Alger since the mid-1990s and became CEO in the wake of the attack on the World Trade Center, in which Alger’s entire senior management team perished. Mr. Chung says, “The number 35 has special and personal meaning to me, as I lost 35 of my colleagues on September 11th nearly 20 years ago. As a way of honoring them, we will donate 5% of the net management fee of ATFV to charities and causes that were important to these Alger employees who perished.” Mr. Chung has a law degree from Harvard, edited the Harvard Law Review, and clerked for Justice Anthony Kennedy.

The prime attraction of the Alger 35 ETF is Dan Chung and the Alger 35 Fund. Mr. Chung is Alger’s CEO and Chief Investment Officer. He’s worked at Alger since the mid-1990s and became CEO in the wake of the attack on the World Trade Center, in which Alger’s entire senior management team perished. Mr. Chung says, “The number 35 has special and personal meaning to me, as I lost 35 of my colleagues on September 11th nearly 20 years ago. As a way of honoring them, we will donate 5% of the net management fee of ATFV to charities and causes that were important to these Alger employees who perished.” Mr. Chung has a law degree from Harvard, edited the Harvard Law Review, and clerked for Justice Anthony Kennedy.

The Alger 35 Fund launched on March 29, 2018. It builds on the experience of their first focused strategy, launched in 2012. It has earned a five-star rating from Morningstar and a Great Owl designation from MFO for consistently top-tier risk-adjusted returns. While the market has been favorable to growth investing, in general, Alger 35 has posted a particularly noticeable record for offering higher returns and lower volatility than its peers.

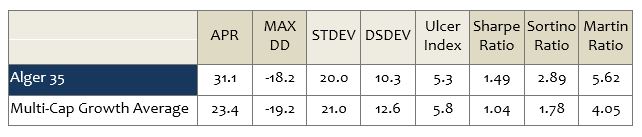

Comparison of Lifetime Performance (Since 201805)

In sum: 7.7% higher annual returns with a smaller maximum drawdown, lower “normal” volatility, lower “bad” volatility, and substantially better risk-return metrics (the last four columns) than its peers.

The special attractions of the ETF are its economics (you are charged the same expense ratio as the $500,000 institutional share class but face no investment minimum yourself) and its prospects for higher tax efficiency (which is a structural advantage of active ETFs over mutual funds).

While the winds will not always favor Alger’s style and almost all of its long-established funds have recovered maximum drawdowns of more than 60%, Alger hews to a disciplined, transparent, repeated process that has paid off handsomely for long-term investors.