It’s become increasingly clear that the global climate is becoming dangerous. Google Earth now has a time-lapse feature that allows us to watch changes in the planet – from the disappearance of glaciers to the drying of the Aral sea to the disappearance of Brazilian rainforests – over the past 37 years. The West and Southwest are locked in drought with record-low reservoir levels. Atmospheric CO2 is at its highest level in 650,000 years with the 20 hottest years in recorded history all occurring since 1998.

But you knew that already. Increasingly we (young and old, liberal and conservative, individual and corporation) accept that we’re in trouble … and in deep trouble, if we don’t get our acts together quickly. Two pieces of evidence support that conclusion. First, President Biden’s infrastructure proposals – which embed a bunch of climate management investment – garner a lot of support, even from folks who wouldn’t ordinarily support Democrats or multi-trillion dollar government plans. Second, investors – professional and individual – are rushing toward sustainable / ESG-screened investments. Morningstar reports that the number of ESG funds has risen 400% in a decade, with 400 options for investors at the end of 2020. Depending on what counts, ESG-centered investments range from the hundreds of billions to tens of trillions of dollars.

Four hundred options! That’s a paralyzing amount of stuff to sort through. The challenge is made greater by the fact that many of them stink, a fair number are marketing scams, and few will make sense in your portfolio.

Sensing critical opportunities, marketers have been pasting bright green ESG stickers on the front of any prospectus they can grab. The WisdomTree Cybersecurity Fund (WCBR) suddenly avers “The Index also excludes companies based on environmental, social and governance criteria.” In April 2021, the SoFi 50 ETF (SFYF) became the SoFi Social 50 ETF with “no changes to the Fund’s investment objective, principal investment strategy or portfolio management as a result of the name change.” On July 21, 2021, JPMorgan Small Cap Core Fund becomes JPMorgan Small Cap Sustainable Leaders Fund. On December 1, 2020, Aberdeen Focused U.S. Equity Fund (GGUIX), a bad large growth fund, found a new passion as Aberdeen U.S. Sustainable Leaders Smaller Companies Fund. Effective November 1, 2020, the tiny, one-star Dana Small Cap Equity Fund (DSCIX) became the Dana Epiphany ESG Small Cap Equity Fund. Effective October 1, 2020, the USAA World Growth Fund (USWGX) changed its name to the USAA Sustainable World Fund. Eight more green (or green-ish, green-lite, or greenwashed) funds, including Viridi ESG Crypto Mining ETF, are currently in registration with the SEC. Often the word “sustainable” is defined as “business that will continue to make a profit” rather than “green,” which is misleading but not illegal.

By the way, the SEC is pissed off with the behavior and their Division of Examinations just issued a Risk Alert (4/9/2021) which complained,

The staff noted, despite claims to have formal processes in place for ESG investing, a lack of policies and procedures related to ESG investing; policies and procedures that did not appear to be reasonably designed to prevent violations of law, or that were not implemented; documentation of ESG-related investment decisions that was weak or unclear; and compliance programs that did not appear to be reasonably designed to guard against inaccurate ESG-related disclosures and marketing materials.

Without naming names, the SEC staff complained that they found “portfolio management practices [which] were inconsistent with disclosures about ESG approaches” and ESG funds filled with distinctly non-ESG investments.

How can an investor find their way to reasonable, sustainable choices?

- Start by understanding your portfolio. What’s your time horizon? How much risk can you tolerate? How much equity exposure do you need to meet your goals?

- Assess any fund in light of the portfolio. Ask if, setting ESG factors aside, a particular fund would make sense in your portfolio. Do you have any earthly need for a crypto-mining fund, green or otherwise? What would real estate or health care innovators add to the quality of your life?

- Understand what “socially responsible” means to them. Some managers care about the physical environment but don’t much worry about corporate governance. Some want to work with companies whose practices advance gender equity. Others pursue the goals of the US Council of Bishops or the UN Development Goals. Some embrace traditional families, others would empower diverse ones. None of those stances is right or wrong, they’re just more or less aligned with what you want. So do spend time in the “Investment Strategies” section of the prospectus.

- Favor funds that get the basics right. Check to see if the managers eat their own cooking; that is, are they investing alongside you. Morningstar discloses that information and it’s found in each fund’s Statement of Additional information on their website. With few exceptions, I wouldn’t consider a fund that the manager won’t risk their own money in. (The most compelling exception is for managers domiciled in other countries, where investing in a US fund or ETF would be a major hassle.) Check to see if the expenses align with the value a manager offers. There are still people charging over 2% per year for their products, which is a nearly insurmountable barrier for even the best manager. Read the prospectus, annual report and shareholder letter to understand the managers’ perspectives on risk. In general, if there’s no clear and satisfying discussion of the matter, stay away!

- Favor managers who don’t need training wheels. If they’re new to running a mutual fund or new to implementing ESG screens, let them learn with someone else’s money. In particular, I would not seek out a fund that has only recently discovered the faith. If you own a fund, are happy with it and it slaps on a prospectus sticker, that’s one thing. Feel free to stay and watch. But if you don’t yet own a fund and it’s a recent convert, stay away until they’ve proven themselves.

- Favor “impact” funds, when possible. Broadly speaking, ESG funds come in two flavors. One sort of fund merely avoids bad actors: “we’ll buy anything except coal.” The other sort actively seeks out corporations whose success might benefit everyone and channels capital in their direction. Those are called “impact” funds and,if you’re investing in part based on your principles, they probably offer more bang for the buck.

Morningstar and MFO Premium both embody formidable strengths. Our screeners offer far more detailed insights into risks and rewards than their website does. Conversely, their screeners have some cool and detailed portfolio analyses that we don’t offer. In particular, Morningstar has launched a screener for ESG funds. It allows folks to toggle on a series of values to quickly generate a short list of ESG candidates.

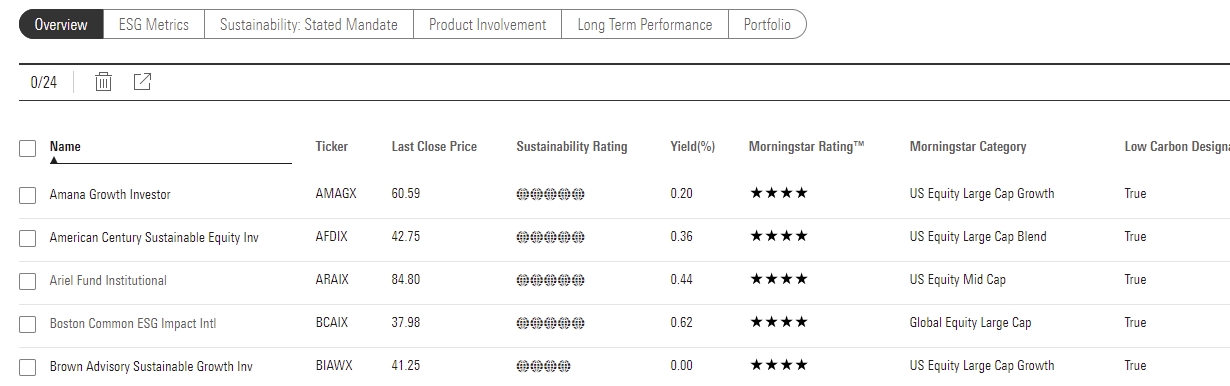

By way of illustration, I searched for funds with a low-carbon profile, an “impact” mandate written into their prospectus, and a current Morningstar rating of four stars or above. That led to 95 candidates, many of which were just multiple share classes of the same portfolio. To winnow the list, I selected the investor share class of each fund with special concern for funds from firms that have long-standing specialties in ESG / SRI / green / socially responsible investing.

I ended up with a list of about 20 funds, which looked like this:

Each fund name is clickable to its profile and each of the six tabs (“ESG Metrics” or “Long Term Performance” is also clickable to show additional information. Finally, the entire screen can be exported to a spreadsheet.

| Name | Ticker | Sustainability Rating | Yield | Morningstar Rating™ | Morningstar Category |

| Amana Growth | AMAGX | 5 | 0.2% | 4 | US Large Cap Growth |

| American Century Sustainable Equity | AFDIX | 5 | 0.36 | 4 | US Large Cap Blend |

| Ariel Fund | ARAIX | 5 | 0.44 | 4 | US Mid Cap |

| Boston Common ESG Impact Intl | BCAIX | 5 | 0.62 | 4 | Global Large Cap |

| Brown Advisory Sustainable Growth | BIAWX | 4 | 0 | 4 | US Large Cap Growth |

| Calvert Balanced | CSIFX | 4 | 0.83 | 4 | Moderate Allocation |

| Calvert Emerging Markets Equity | CVMAX | 4 | 0.26 | 4 | Global Emerging Markets |

| Calvert Growth Allocation | CAAAX | 4 | 0.44 | 4 | Aggressive Allocation |

| Calvert International Equity | CWVGX | 4 | 0.18 | 5 | Global Large Cap |

| Domini Impact International Equity | DOMIX | 4 | 0.48 | 4 | Global Large Cap |

| Green Century Balanced | GCBLX | 5 | 0.21 | 4 | Moderate Allocation |

| Mirova Global Sustainable Equity | ESGNX | 4 | 0.05 | 5 | Global Large Cap |

| New Alternatives | NAEFX | 4 | 4.8 | 5 | Global Mid/Small Cap |

| Northern US Quality ESG | NUESX | 5 | 0.89 | 5 | US Large Cap Blend |

| Parnassus Core Equity | PRBLX | 5 | 0.4 | 5 | US Large Cap Blend |

| Parnassus Endeavor | PARWX | 5 | 0.57 | 5 | US Large Cap Blend |

| Parnassus Mid-Cap | PARMX | 5 | 0.18 | 5 | US Mid Cap |

| Pax Global Environmental Markets | PGRNX | 4 | 0.36 | 4 | Global Large Cap |

| Praxis Genesis Growth | MGAFX | 4 | 2.05 | 4 | Aggressive Allocation |

| Saturna Sustainable Equity | SEEFX | 5 | 0.33 | 4 | Global Large Cap |

| Thornburg Better World International | TBWAX | 4 | 0 | 5 | Global Large Cap |

| TIAA-CREF Social Choice LowCarbon Eq | TLWCX | 4 | 0.59 | 5 | US Large Cap Blend |

| Trillium ESG Global Equity Fund | PORTX | 5 | 0.1 | 4 | Global Large Cap |

The spreadsheet offers 36 columns of data on everything from “social” ratings to fund size (Saturna is the smallest) and median market cap (Ariel is the only small-cap in the bunch). It’s worth exploring. Go!

In our June issue, we’ll profile two of the funds that have been on our radar for a long time: New Alternatives (NALFX) which has been plying these waters since 1982, and Northern Quality ESG (NUESX) which combines several desirable sets of traits.