ESG funds drew over $50 billion of net inflows in 2020, more than double their gains in 2019, according to Morningstar. On the whole, they performed splendidly.

A particularly surprising finding is that ESG-screened funds perform exceptionally well in sharp market corrections, both in market crashes between 2000-2011 and in the 2020 Covid crash. While such funds might marginally trail broader markets in good times, their down-market performance gives them an attractive long-term profile.

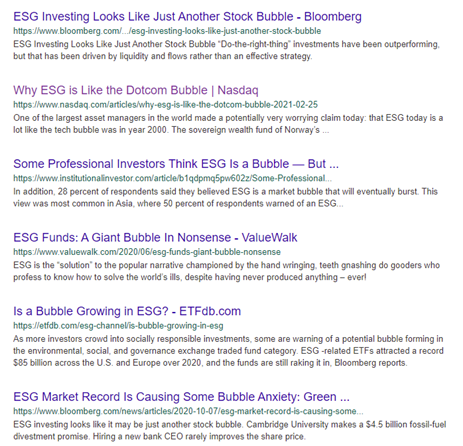

A panicked crowd immediately gathered and cried, “bubble!!!!”

Four quick bits of perspective here:

-

-

The total bubblicious inflows are less than the market cap of Pinterest, the 333rd largest company by market cap.

-

Anyone linked to NASDAQ.com pointing elsewhere and crying “bubble” is like a Kardashian pointing at someone and crying “botox bimbo!” (The most recent Khloe K Khontroversy involves suspicions of “finger stretching surgery.” Ick.)

Anyone linked to NASDAQ.com pointing elsewhere and crying “bubble” is like a Kardashian pointing at someone and crying “botox bimbo!” (The most recent Khloe K Khontroversy involves suspicions of “finger stretching surgery.” Ick.) -

You need to read the articles, not the headlines. The NASDAQ bubble article, for instance, uses the head of Norway’s sovereign wealth fund as their authority. That’s fine, except the quote from the Norwegian is, “What is interesting is, if you compare the situation now with the situation before the year 2000, then the stock market was right that technology companies were going to do well in the future … But the valuation went a little high, so it came down again, but the technological development continued. We may see something of the same sort now, that what is happening in the green shift is extremely important and real.”

Likewise, the Institutional Investor article notes, “63% [of the 200 gatekeepers surveyed] predicted that all funds would incorporate environmental, social, and governance factors in five years,

And several of the authors come across as blowhards desperate for attention, which is signaled by their delight in insulting those “hand-wringing, teeth-gnashing do-gooders …who have never produced anything” with whom they disagree by their extremely selective use of evidence.

-

Funds are not asset classes. Socially responsible funds cannot be “in a bubble” because they are simply vehicles for accessing assets or asset classes. It is certainly possible for a manager to chase “bubble stocks,” but that’s not an automatic outcome.

-

Morningstar reports that there are 169 value-oriented funds whose portfolios have above average or high sustainability scores. Of those, 22 have five-star ratings. Highlights include:

| Morningstar category | 3-year return | Status | |

| Smead Value | Large value | 13.4 | 5 star + Gold |

| Clarkston Founders | Mid-cap blend | 13.1 | 5 star + Silver |

| Applied Finance Select | Large value | 12.4 | 5 star + Silver |

| Clifford Capital Partners | Mid-cap value | 10.7 | 5 star + Silver |

| Fidelity Low-Priced Stock | Mid-cap value | 8.5 | 5 star + Silver |

| Parnassus Endeavor | Large value | 16.2 | 5 star + Neutral |

| Yacktman Focused | Large value | 14.0 | 5 star + Silver |

| Yacktman | Large value | 12.7 | 5 star + Silver |

| Sterling Capital Equity Income | Large value | 10.3 | 5 star + Neutral |

| American Century Disciplined Core Value | Large value | 9.1 | 5 star + Neutral |

| Madison Dividend Income | Large value | 8.9 | 5 star + Neutral |

The “neutral” ratings for American Century and Parnassus are driven by recent or impending manager retirements.

The list above focuses on the fund’s portfolio, not its objective. A manager with no interest in socially responsible investing might create an objectively socially responsible portfolio because they favored tech and avoid energy.

Using a narrower set of criteria, focusing on funds who have consciously adopted social responsibility screens, the screener at MFO Premium turns up 60 equity funds that (1) fall in the domestic, global, or international value style box and (2) are flagged as socially conscious. Of those, seven have earned MFO’s Great Owl designation for consistently top-tier risk-adjusted-performance.

| Lipper category | 3-year return | Status | |

| Saturna Amana Income | Equity Income | 9.0% | Great Owl + Honor Roll |

| Parnassus Core Equity | Equity Income | 14.0 | Great Owl + Honor Roll |

| Steward Global Equity Income | Global Equity Income | 6.5 | Great Owl + Honor Roll |

| Calvert US Large-Cap Value Responsible Index | Multi-Cap Value | 6.6 | Great Owl |

| Hartford Climate Opportunities | Global Multi-Cap Value | 15.6 | Great Owl |

| Pax ESG Beta Dividend | Equity Income | 9.8 | Great Owl |

| Franklin ClearBridge Dividend Strategy ESG ETF | Equity Income | 8.8 | Great Owl |

| Neuberger Berman Large Cap Value | Multi-cap value | 11.1 | Honor Roll |

| Ariel | Mid-cap value | 5.1 | Honor Roll |

| Eaton Vance Tax-Managed Global Dividend Income | Global equity income | 7.1 | Honor Roll |

Bottom line

The reality of ESG / socially-responsible investing is that it will become a dominant market force because smarter environmental, social, and governance choices by corporations are increasingly a matter of survival. While ESG investing will not save the world, it may accelerate the corporate decisions that might.

The demand for those investments is likely to rise with each new headline: whether it’s the weather-triggered collapse of the Texas power grid, the death of the Atlantic Ocean currents, or the calving of icebergs the size of New York City, consumers grow anxious, legislators pass laws, regulators take action … and “green” companies benefit. University of Chicago researchers note, “whenever there’s bad climate news, green stocks benefit, and such stocks effectively become a hedge against headlines about climate change” (When green investments pay off, 2/23/2021)

The negative consequence of that demand is that unqualified, and sometimes unscrupulous, actors will move in to meet it. Firms with no notable competence will rebrand (have rebranded) failing mainline funds as green ones or hastily launch … well, something marketable. (We already have funds for Low Carbon, Carbon Transition, Carbon Impact, Carbon Free, Climate, Climate Opportunities, Climate Change, Climate Leadership, and Vegan Climate investing.)

For investors seeking to make responsible choices, three bits of advice:

- Don’t wait for the perfect investment to come along. It won’t.

- Trust the people who have earned your trust. There are a host of outstanding new options (readers know that I invest in Brown Advisory Sustainable Growth), but there are also firms that have been working to act responsibly and earn your trust for decades. They’re exemplified by Vanguard FTSE Social Index or Vanguard Global ESG Select, Fidelity US Sustainability Index, Northern US Quality ESG, the upcoming T Rowe Price Global Impact Equity fund, and BlackRock Advantage ESG US Equity … as well as the work of ESG specialists such as Parnassus, Pax, New Alternatives, Green Century and others.

- Don’t let your portfolio be the end of your involvement. Both political parties need to (a) move and (b) move together to craft solutions that will reverse decades of neglect and shape decades of new investment, perhaps using those investments to strengthen the prospects of both rural America and hollowed-out urban neighborhoods.

Keep reading, and we’ll try to keep helping.