Updates

On the value of actual human intelligence: The decade’s biggest fund scandal broke on Monday when the SEC accused the advisor of Infinity Q Diversified Alpha Fund (IQDNX) of “adjusting the methodology for obtaining certain asset valuations.” James Velissaris, founder and CIO, was placed on administrative leave while the investigation continues.

The remnants of the fund’s website describe it this way:

On Monday, February 22, 2021, the Infinity Q Diversified Alpha Fund and its investment adviser, Infinity Q Capital Management, sought and obtained an order from the Securities and Exchange Commission permitting the Fund to suspend redemptions and postpone the date of redemption payments beyond seven days. The Fund and Infinity Q took this step because Infinity Q has been unable to value certain assets held by the Fund. As disclosed by the Fund, Infinity Q, as the adviser, is responsible for pricing the Fund’s assets, and its valuation of assets for which current and reliable market quotations are not readily available is subject to review by the Board of Trustees.

According to the SEC’s Order, the Fund learned on Thursday, February 18 that the Chief Investment Officer of Infinity Q had been adjusting the methodology for obtaining certain asset valuations, and that the resulting valuations may not have accurately reflected the fair value of those assets. On Friday, February 19, Infinity Q confirmed these facts and stated that it could not value the assets for purposes of calculating the Fund’s net asset value. The Chief Investment Officer of Infinity Q has been relieved of his duties, effective February 21, 2021.

The advisor has frozen redemptions because they have no reliable idea of what a share of the fund is worth and are planning to liquidate the fund. Mr. Velissaris has, to the extent possible, disappeared from the internet. Through his company, Wildcat Capital Management, he also serves “a number of ultra-high net worth clients.” (A colleague prophesies that, if any of them are from Jersey, one might commence the search for Mr. Velissaris under the endzone at the Meadowlands.)

Morningstar’s “machine-learning model that uses the decision-making processes of our analysts” concluded that every indication is that Infinity Q is the best of the best, a GoldQ fund.

Morningstar hasn’t yet said anything about the fund or its endorsement, at least at Morningstar.com. Two reasonable statements might be: (1) oops and (2) not clear that any system could have been designed to intercept such fraud. Still, taking down the Gold rating would be good optics.

Briefly Noted . . .

Baron Focused Growth Fund shared the following prospectus update on 2/4/2021:

The following is added to “Principal Risks of Investing in the Fund”

Tesla. As of the date of this prospectus supplement, about 48% of the Fund’s assets are invested in Tesla stock. Therefore, the Fund is exposed to the risk that were Tesla stock to lose significant value, which could happen rapidly, the Fund’s performance would be adversely affected.

One might check with the folks at American Heritage, Sequoia, Fairholme, Third Avenue … on how that whole “bet the house on a single stock” thing plays out. Spoiler alert: “At first, brilliantly. Then …”

Karner Blue Biodiversity Impact Fund has decided to convert both their Investor and Institutional share classes into the … umm, Butterfly share class. (sigh) The investment minimum will be $2,000.

Wells Fargo has agreed to sell its asset management business, which has assets of $603 billion, to two private-equity firms: GTCR and Reverence Capital Partners for $2.1 billion. It seems very Wells Fargo of them to sell off the old portion of the business which doesn’t appear to be scandal-ridden. Wells Fargo funds, a small slice of the asset management business, have seen consistent outflows since 2015. The remainder of the asset management business appears to center on money markets.

SMALL WINS FOR INVESTORS

As of April 1, 2021, American Century Mid-Cap Value Fund will reopen to new investors. The fund has earned five stars at Morningstar and seems like a reasonably risk-conscious offering. As I looked at the fund’s metrics at MFO Premium, two things stand out. First, its long-term performance is far stronger than its short- or medium-term performance. Second, it’s both a little bit less volatile and a little bit less remunerative than its peers, so its five-year risk-adjusted returns are right in line with its peer group and its three-year record trails its peers by a tad.

I suppose if I were dabbling in the multi-cap value waters I might consider an equally—weighted SP 500 Index fund such as Index Funds S&P 500® Equal Weight NoLoad (INDEX) which has modestly outperformed its ETF competitors through a thoughtful trading strategy. For an active value play, you could do a lot worse than Monongahela All-Cap Value (MCMVX) which is a five-star fund, a Great Owl, and a member of MFO’s Honor Roll.

Effective immediately, Class I shares of the Issachar Fund (LIOTX) are available for purchase. It’s a small, four-star tactical allocation fund whose manager, Dexter Lyons, has heavily invested in the fund. The retail shares cost $1,000 and carry a 1.97% expense ratio. The numbers for the newly opened institutional shares are 1.72% and $100,000. Issachar, for folks fascinated by such stuff, was one of the 12 tribes of ancient Israel and also one of the 10 lost tribes.

CLOSINGS (and related inconveniences)

Grandeur Peak closed a series of funds on February 26. Grandeur Peak Global Opportunities, International Opportunities, International Stalwarts, and Global Micro Cap were hard closed to investors using financial intermediaries, and one was soft closed. All remain available for the retail investors who purchased the funds directly through Grandeur Peak.

Shares of the five-star Hillman Value Fund are temporarily unavailable for purchase while the fund transitions from Hillman Capital to ALPS. Once the dust settles, the $160 million fund will reopen.

Effective as of the close of business on March 12, 2021, JPMorgan Hedged Equity Fund will be closed to new investors, though existing investors will be able to add to their positions.

Effective at the close of business on May 5, 2021, Lord Abbett Developing Growth Portfolio will not be available for purchase by new investors.

Effective on March 19, 2021, Lord Abbett Micro Cap Growth Fund will not be available for purchase by new investors. Notwithstanding the fact that it’s a really good microcap fund, assets were scarce until the second half of 2020 when money came pouring in the door spurred by the fund’s 80% return in 2020.

Vanguard Capital Opportunity, Primecap, and PRIMECAP Core Funds have closed to new accounts, other than folks in their managed investment plans. Current shareholders are limited to $25,000/year in additions to the fund. (I briefly contemplate a world in which that sentence would have any remote relevance to me.)

Weitz Ultra Short Government Fund has limited sales of its shares through financial intermediaries.

OLD WINE, NEW BOTTLES

Bogle Investment Management, most famously Jack Bogle’s son, has decided to stop managing small, four-star Bogle Small Cap Growth Fund (BOGIX). The Board is giving that role to Summit Global Investments whose presence will cause the fund to be renamed SGI Small Cap Growth Fund. The reborn fund will also have a new ESG mandate.

On April 6, 2021, Capital Link NextGen Vehicles & Technology ETF becomes Capital Link Global Green Energy Transport and Technology Leaders ETF. Rather than frittering away time on “vehicle and technology companies,” as previously, they’ll invest (passively) in Green Energy Transport and Technology Leaders.

At the same time, Capital Link NextGen Protocol ETF becomes Capital Link Global Fintech Leaders ETF.

Effective April 26, 2021, the DCM/INNOVA Fund will change its name to DCM/INNOVA High Equity Income Innovation Fund. The only change in the fund’s principal investment strategy will be to delete the obligation to invest at least 80% in dividend-paying stocks. Nothing about “high equity income” or “innovation.” Longtime readers will recognize, and lament, the fund’s ticker: TILDX. When Zeke Ashton retired from managing the splendid Centaur Total Return fund, it was purchased by another adviser and completely rewired.

Diamond Hill Investment Group has committed to sell the five-star Diamond Hill High Yield and Corporate Credit Funds to enable Brandywine Global Investment Management sometime in the second quarter of 2021. Between them, the funds have $3 billion in assets. No reason for the sale is offered but the management teams are going to Brandywine along with their charges.

Horizon Defensive Multi-Factor Fund will jettison its “Risk Assist” strategy and become Horizon U.S. Defensive Equity Fund on or about March 29, 2021.

On or about July 1, the JPMorgan Intrepid Value Fund becomes the JPMorgan U.S. Applied Data Science Value Fund. What, you ask, does an applied data science fund do? Pretty much the same thing as every other fund:

… the adviser will employ a data science driven investment approach that combines research, data insights, and risk management. The adviser defines data science as the discipline of extracting useful insights from collections of information. The adviser will analyze a wide variety of data sources, including the adviser’s fundamental research, company fundamentals, and alternative data, in order to evaluate the financial prospects of each security.

Effective February 23, the Marmont Emerging Markets Fund was renamed the Dakota Emerging Markets Fund. No need to hurry to update your bookmarks, though. The filing also notes, “Shares of the Fund are not currently offered for sale.”

On April 30, 2021, Matthews Asia Small Companies becomes Matthews Emerging Markets Small Companies Fund. The new fund will be able to invest “in emerging market countries anywhere in the world.” Matthews notes that Asia is 75% of the EM small-cap universe so a broader mandate won’t necessarily cause turmoil in the portfolio and “shareholders of the Fund will benefit more from exposure to a broader investment universe.” This decision parallels Matthews’ decision to launch an all-world emerging markets fund, Matthews Emerging Markets Equity, in April 2020. The fund, with a smaller allocation to Asia than its peers, has easily outperformed its peers and benchmark since inception.

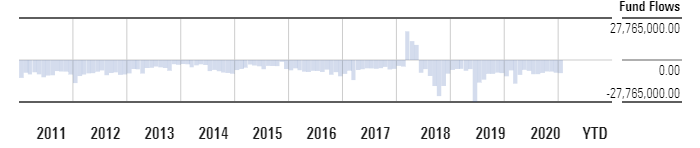

On April 1, 2021, Putnam Global Equity Fund will be “repositioned” as Putnam Focused International Equity Fund. That will likely occasion a considerable tax bill for its remaining shareholders since two-thirds of the current portfolio is invested in US stocks. The unstated reason for the change shows up when you look at the fund’s asset flows over the past decade.

The picture sort of suggests net outflows in 117 of the past 120 months perhaps because the fund isn’t very good (it’s okay). And, perhaps because advisors prefer “international” to “global” products so that they can guess wrong themselves about the ideal asset allocation rather than letting Putnam do it for them.

The parent company of THB Asset Management MicroCap Fund (THBVX) which, as you might expect, is THB Asset Management, has sold its business to Victory Capital Management. Toward the end of March, the fund – with its management team intact – is apt to be renamed Victory MicroCap Fund. It’s a four-star small blend fund that is a little more volatile but a lot more profitable than its SB peers.

On May 1, 2021, the T. Rowe Price New America Growth Portfolio will change its name to the T. Rowe Price All-Cap Opportunities Portfolio.

Westchester Capital Management, the adviser to the WCM funds, is in the process of being acquired by Virtus Investment Partners. Many hoops still to jump through but somewhere later this year, WCM Alternatives: Event-Driven Fund and WCM Alternatives: Credit Event Fund will be rebranded as Virtus funds, though their management teams will remain intact.

OFF TO THE DUSTBIN OF HISTORY

Sometime in the third quarter of 2021, the AIG funds either become or are eaten by the Touchstone funds.

| AIG Fund | Acquiring Touchstone Fund |

| AIG International Dividend Strategy Fund | Touchstone International Equity Fund, |

| AIG U.S. Government Securities Fund | Touchstone Active Bond Fund |

| AIG Flexible Credit Fund plus AIG Strategic Bond Fund | Touchstone Strategic Income Opportunities Fund, a new fund |

| AIG Senior Floating Rate Fund | Touchstone Credit Opportunities Fund |

| AIG Active Allocation Fund AIG Multi-Asset Allocation Fund | Touchstone Balanced Fund |

| AIG Strategic Value Fund | Touchstone Value Fund |

| AIG Focused Dividend Strategy Fund plus AIG Select Dividend Growth Fund | Touchstone Dividend Equity Fund, a new fund |

| AIG Focused Alpha Large-Cap Fund | Touchstone Large Cap Focused Fund |

| AIG Focused Growth Fund | Touchstone Sands Capital Select Growth Fund |

On May 7, 2021, the Alger 25 Fund merges with the Alger 35 Fund. Contrary to the laws of mathematics and my expectations, the result is not the Alger 60 Fund.

On the theme of “death and taxes,” AQR’s tax-managed line of funds will meet death sometime between March 8 and March 15, 2021.

| Target Funds | Acquiring Funds |

| AQR Emerging Multi-Style Fund | AQR TM Emerging Multi-Style Fund, which will thereafter be renamed AQR Emerging Multi-Style II Fund |

| AQR TM International Momentum Style Fund | AQR International Momentum Style Fund |

| AQR TM International Multi-Style Fund | AQR International Multi-Style Fund |

| AQR TM Large Cap Momentum Style Fund | AQR Large Cap Momentum Style Fund |

| AQR TM Large Cap Multi-Style Fund | AQR Large Cap Multi-Style Fund |

| AQR TM Small Cap Momentum Style Fund | AQR Small Cap Momentum Style Fund |

| AQR TM Small Cap Multi-Style Fund | AQR Small Cap Multi-Style Fund |

The one-star, $3 million Donoghue Forlines Dividend Mid-Cap Fund will cease operations and be liquidated on March 18, 2021. None of the four managers, including Mr. Forlines, had chosen to invest in the fund which, really, should be de rigueur if your name is above the door.

Eaton Vance Hexavest Global Equity Fund and Eaton Vance Hexavest International Equity Fund were liquidated on February 25, 2021. The funds have three stars and $60 million, total, between them.

After two slight delays, Emerald Small Cap Value Fund is now set to be liquidated on March 12, 2021.

In one of the oddest mergers ever, the Highland Socially Responsible fund is merging with the NexPoint Merger Arbitrage Fund which, shortly thereafter, will become a Virtus fund. Why odd? Usually in a merger, the fund’s board of trustees – charged by law with looking out for the interests of the fund’s shareholders – try to find an acquiring fund that sort of does the same thing that the investors originally signed up for but does it better. In this case, that’s not even vaguely true. The Highland fund seeks “long-term growth of capital and future income rather than current income” through a long-only equity portfolio. The Merger Arbitrage fund wants returns that are uncorrelated with the stock market, and seeks to “profit from the ‘spread’ between the purchase value and the value of a stock at the completion of a merger.” There is not even room for the ESG screening that’s the core of the Highland strategy.

The correlation between the two funds is 0.33; based on correlation alone, the Highland shareholders would have a better fit merging into RiverPark Short Term High Yield (0.53), Vanguard Emerging Markets Bond (0.56), or Vanguard Emerging Markets Stocks (0.71). A better explanation is that NexPoint was simply buying the $70 million in Highland assets to add to their $77 million in existing Merger Arbitrage assets.

Iron Strategic Income Fund will be liquidated on April 30, 2021.

Notwithstanding the burgeoning popularity of ESG investing, $35 million JHancock ESG All Cap Core Fund will be absorbed by John Hancock ESG Large Cap Core Fund, likely around April 16, 2021.

Leader High Quality Low Duration Bond Fund is merging into the Leader Total Return Fund but, as to timing, the adviser only says, “in early March 2021, shareholders will receive additional information.”

On or about April 30, 2021, Matthews Emerging Asia Fund will merge into the Matthews Asia Small Companies Fund which is expected to be renamed the Matthews Emerging Markets Small Companies Fund. The Emerging Asia fund has had a couple of pretty rough years (bottom 1% in 2017 and 2019) though Morningstar continues expressing its faith in the fund. Asia Small Companies, meanwhile, lost its star manager and team in August 2020, though its investors have remained loyal.

PIMCO Multi-Strategy Alternative Fund, a perfectly reasonable hedged mutual fund, has seen substantial outflows and will be liquidated on May 14, 2021.

Following inevitable shareholder approval, the $16 million Riverbridge Eco Leaders Fund will be merged into Riverbridge Growth Fund. Both have earned the Great Owl designation, with both receiving four stars from Morningstar. The management teams are the same, and the correlation between the two funds is .99, so the transition should be pretty much painless.

The Selective Opportunity Fund will be liquidated on June 21, 2021. Its sibling, Selective Premium Income Fund, will depart at the end of April.

The microscopic (and consistently underperforming) State Street Defensive Global Equity Fund will be liquidated on May 14, 2021.

On April 15, 2021, the one-star Transamerica Dynamic Income will be eaten by the five-star Transamerica Multi-Asset Income.

Victory Trivalent Emerging Markets Small-Cap Fund and Victory Sophus Emerging Markets Small Cap Fund will suffer their final defeat on April 28, 2021. The funds have $15 million and four stars between them.

The $1.4 million William Blair Small-Mid Cap Value Fund will be terminated on or before April 15, 2021