Updates

PIMCO Emerging Markets Currency and Short-Term Investments Fund (PLMAX) is coming back from the dead.

Last month, PIMCO announced its intention to close the $600 million fund on November 20 and liquidate it by January 7, 2021. Morningstar benchmarks it against their global long/short currency group, which is so small – just 5-8 funds – that peer comparisons are mostly nonsense. Nonetheless, the fund has a negative 10-year return, and it has lost money in seven of the past ten years.

This month, not so much. Here’s the text:

This month, not so much. Here’s the text:

“PIMCO subsequently reconsidered its recommendation, particularly in light of its desire to offer a diverse range of funds for different possible market scenarios given unique market conditions, and determined that it would recommend that the Fund continue its operations.”

(nods) A mind is a terrible thing to waste. As, from an adviser’s perspective, is the revenue off $660 million in assets.

In December 2020, the large-cap Thornburg Value Fund (TVAFX) will become Thornburg Small/Mid Cap Core Fund. The large-cap Thornburg Core Growth Fund (THCGX) becomes Thornburg Small/Mid Cap Growth Fund. Pretty dramatic switch and potentially an expensive one for investors in taxable accounts. Thornburg has no small- or mid-cap exposure and sports a market cap of $130 billion now but will begin investing in stocks no larger than $22 billion.

That said, we really do appreciate the apparent thoughtfulness of the decision. By Thornburg’s report, they looked at their funds’ lagging performance and asked, “where can we add value for our investors?” The answer appeared not to be “large cap core investing, a stronghold of the index funds.” They write:

Thornburg as well as both of these portfolios have a long history across a variety of different market conditions. Nevertheless, more recently we at Thornburg have been concerned that as active, benchmark-agnostic investors, the environment of mega-cap company dominance in U.S. equity indexes may not offer us the future opportunity to add value for investors.

As stewards of your capital, we have analyzed where our process, people, and philosophy are effective and where they are not. Our observation is that a broader universe of small-and-mid capitalization companies is a market segment in which we believe our investment framework and process have helped generate excess return over many years. With these two portfolios, our conclusion is that we will focus on maximizing the outcome for shareholders given what we do best: generating the positive, differentiated returns that have characterized our shareholders’ experience over multiple decades.

They may or may not succeed, but it’s an honorable attempt.

Briefly Noted . . .

We saddened to report that Tim Jagger, head of emerging market debt at Columbia Threadneedle, passed away suddenly on Friday, 2 October. Jagger first joined Columbia Threadneedle in Singapore in 2017, before relocating to London upon being promoted to head of EMD a year later. Mr. Jagger earned his MA at the University of St. Andrews in 1991 and spent most of his early career at the Royal Bank of Scotland.

Adrian Hilton, head of global rates and currencies, will become head of emerging market debt on an interim basis.

Morgan Stanley is buying the asset management firm Eaton Vance (and its 88 mutual funds) for about $7 billion in a cash-and-stock deal. In theory, the deal diversifies Morgan Stanley’s revenue stream a bit. Current MS advises 59 funds, mostly solid, with $72 billion AUM. The Eaton acquisition adds 87 funds and a mostly stagnant asset base of $77 billion.

Morgan Stanley said the acquisition would boost assets under management to about $1.2 trillion and revenue to $5 billion.

Direxion dials back. Effective October 29, 2020, Direxion throttled back three of its 3x leveraged funds to make them 2X leveraged.

| Current Fund Name | New Fund Name |

| Direxion Daily MSCI India Bull 3X Shares | Direxion Daily MSCI India Bull 2X Shares |

| Direxion Daily Latin America Bull 3X Shares | Direxion Daily Latin America Bull 2X Shares |

| Direxion Daily Robotics, Artificial Intelligence, & Automation Index Bull 3X Shares | Direxion Daily Robotics, Artificial Intelligence, & Automation Index Bull 2X Shares |

SMALL WINS FOR INVESTORS

Ummm … got nuthin.

CLOSINGS (and related inconveniences)

Hmmm … Cutler Equity (CALEX) converted all their outstanding shares to Class II shares (DIVHX) on October 28, 2020, without the slightest explanation, in their SEC filing or on their website, of what on earth that means. I guess that qualifies as “a related inconvenience.” After poking around the SEC’s database, it appears that class II has lower expenses but a marginally higher ($2500 versus $1000) minimum initial investment requirement. Not sure why, exactly, that required a new share class.

As an aside, really good, small dividend-oriented equity fund.

OLD WINE, NEW BOTTLES

Columbia Global Dividend Opportunity Fund has changed its name to Columbia International Dividend Income Fund.

Effective November 1, 2020, the tiny, one-star Dana Small Cap Equity Fund (DSCIX) became the Dana Epiphany ESG Small Cap Equity Fund. The fund is implementing ESG screens “based on the belief in responsible investing consistent with Christian moral and social justice principals as outlined by the U.S. Conference of Catholic Bishops Socially Responsible Investment Guidelines and other Christian teachings.”

First Western Financial has entered into an agreement with Lido Advisors, LLC and Oakhurst Advisors “to sell its Los Angeles based fixed-income portfolio management team” (quick note to FWF: read the 13th Amendment to the Constitution before proceeding; it pretty much says you don’t get to sell your portfolio team or anyone else) and its mutual fund business to Lido and Oakhurst. As of November 16, 2020, the name of the Trust and the Funds will be changed as follows:

| Current Name | New Name |

| First Western Fixed Income Fund | Oakhurst Fixed Income Fund |

| First Western Short Duration Bond Fund | Oakhurst Short Duration Bond Fund |

| First Western Short Duration High Yield Credit Fund | Oakhurst Short Duration High Yield Credit Fund |

For what it’s worth, all three are three-star institutional funds with perfectly decent track records.

Effective November 6, 2020, Ideanomics Nextgen Vehicles & Technology ETF (EKAR) switches to the less-cumbersome name Capital Link NextGen Vehicles & Technology ETF. Its sibling Innovation Shares Nextgen Protocol ETF (KOIN) becomes the obscurely named Capital Link NextGen Protocol ETF on the same day.

On or about December 31, 2020, Jackson Square All-Cap Growth Fund (JSSSX) becomes Jackson Square International Growth Fund. The fund’s shareholders have declared that that’s (a) okay to become non-diversified and (b) equally okay to raise the fund’s advisory fee by 20%, from 65 bps to 80 bps. None of the fund’s 10 managers have run an international portfolio though three are responsible for the (markedly better) Jackson Square Global Growth (JSPTX). With minimums of $100,000 – $1 million, it’s a tiny bit irrelevant to most of us.

Effective December 31, 2020, the Jacob Micro Cap Growth Fund (JMCGX) change to Jacob Discovery Fund. “Discovery” is in vogue this year. It’s vague enough to avoid the SEC’s name rule yet still hints at “small and exotic.” Of the 31 funds that bear the name, 17 are some combination of small-cap, global, emerging, or frontier. No fixed income manager, by the way, professes to “discover” anything.

Kellner Merger Fund (GAKAX) will eventually become AXS Merger Arbitrage. Management, strategy, and fees are likely to remain the same. The SEC filing is a bit vague about timing and details. It’s a three-star fund that tends to make zero, give or take one percent.

The Stadion Funds are all slated to be North Square Investments funds. Several of the Stadion Funds are entirely reasonable offerings, including Stadion Tactical Growth (ETFAX), which has a four-star rating and top 20% returns over the past five years.

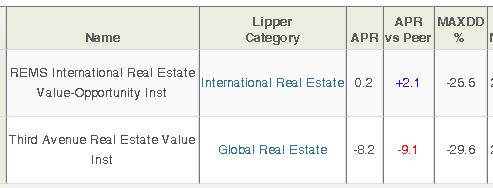

On or about November 23, 2020, REMS International Real Estate Value-Opportunity Fund (REIFX) will become Third Avenue International Real Estate Value Fund. REIFX is a four-star fund with $37 million in assets, a $50,000 minimum, and a six-year record. The new fund will retain one of its two current managers, Quentin Wellesley.

Third Avenue was, of course, famous for Third Avenue Real Estate Value Fund (TAREX), which Michael Winer led for 20 years. Mr. Winer retired two-and-a-half years ago and, despite Morningstar’s calm assurance that his former co-managers are “more than capable” of executing the strategy, performance has been weak:

That’s a 2.5-year record, generated by MFO Premium, to roughly correspond with the change in management and, perhaps, market conditions. “Value” is rarely used in the name or principal strategies of real estate funds, so it’s hard to know how much of the struggles to assign to market conditions and how much to manager skill. Regardless, this seems a net gain for the Third Avenue complex.

Effective October 1, 2020, the USAA World Growth Fund (USWGX) changed its name to the USAA Sustainable World Fund.

OFF TO THE DUSTBIN OF HISTORY

“On October 15, 2020, the AlphaSimplex Tactical U.S. Market Fund was liquidated. The Fund no longer exists, and as a result, shares of the Fund are no longer available for purchase or exchange.” Thanks for that clarification!

Effective October 8, 2020, the subadviser of AMG Managers Cadence Emerging Companies Fund (MECAX) changed from Cadence Capital Management LLC to GW&K Investment Management, LLC whereupon the name of the fund changed to AMG GW&K International Small Cap Fund.

The BNY Mellon Inflation Adjusted Securities Fund (DIAVX) will be liquidated on or about December 21, 2020.

On November 20, 2020, following a recommendation by the Fund’s investment adviser, Checchi Capital Advisers, LLC, the $24 million CCA Aggressive Return Fund (RSKIX) will be liquidated.

On October 30, 2020, Center Coast Brookfield Energy Infrastructure Fund (CEN, a closed-end balanced fund) was liquidated.

Don’t have details, but we’re guessing that the 85% drop in March followed by stagnation was … hmm, net negative to the fund’s survival.

On November 13, 2020, Convergence Market Neutral Fund (CPMNX) shifts from “neutral” to “nonexistent.” Morningstar gave it a “Gold” analyst rating. The market disagreed: the fund is underwater since launch, has about $5 million in AUM, and had an 83% correlation (that is, an R-squared of 83) with the S&P 500.

The Cornerstone Capital Access Impact Fund (CCIIX) will be liquidated on December 3, 2020. It was a high-performing fund that launched less than a year ago. I’ve always been vexed by advisors whose vision of “the long term” leads them to keep new funds in operation for months before surrendering. It’s a tough business, and if you don’t have the wherewithal to push through with negligible income for the first three years, don’t get in it.

Driehaus Active Income Fund (LCMAX) is slated to become inactive on November 6, 2020. The fund was adopted from Lotsoff Capital in 2009. As you might infer from the fact that it’s made 1.25% annually over the past ten years, it has not really flourished under Driehaus’ aegis.

Fiera Capital Diversified Alternatives Fund (FCARX) was liquidated on October 30, 2020. The five managers, none of whom chose to invest in the fund, were the 12th – 16th in the fund’s six-year history.

Goldman Sachs Imprint Emerging Markets Opportunities Fund (GSYAX) is slated to merge with Goldman Sachs ESG Emerging Markets Equity Fund (GEBNX) sometime in January 2021. The stated rationale: the merger “(i) would rationalize Funds that have the same investment objective and similar investment strategies (albeit with some notable differences); (ii) may provide enhanced opportunities to realize greater efficiencies in the form of lower total operating expenses over time; and (iii) would enable the combined Fund to be better positioned for asset growth.” Alternately: GSYAX is a tiny, terrible fund. GEBNX is a tinier, decent fund in a trendy part of the market; eating its doomed sibling gave it its best chance for survival.

Heartland Select Value Fund (HRSVX/HNSVX) was liquidated on October 19, 2020.

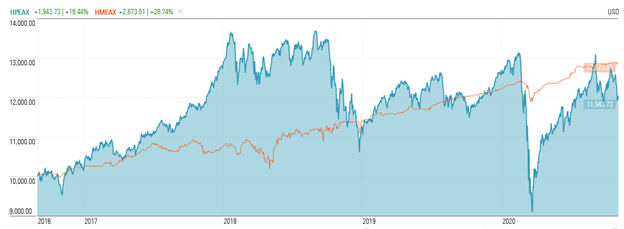

“Following discussions held at meetings on February 27-28, 2020, June 16-17, 2020 and October 28, 2020, the Board of Trustees unanimously approved [merging] Highland Socially Responsible Fund (HPEAX) into NexPoint Merger Arbitrage Fund (HMEAX) … on or around January 15, 2021 Shareholders of record as of November 20, 2020, will be entitled to vote on the Plan.” NexPoint is a Highland subsidiary, which explains but does not justify the merger. Notes to HPEAX shareholders. First, you’re investing in a volatile, one-star fund that has trailed 99-100% of its peers of the past 1, 3, 5, 10- and 15-year periods. Get out. Second, HMEAX is a fine fund for what it does but what it does is not what you signed up for. In truth, I’m not sure what you signed up for since the fund became “socially responsible” just a year ago. Regardless, both the earlier Highland Premier Growth and the new Highland Socially Responsible were equity funds aiming for “long-term growth of capital and future income rather than current income.” NexPoint shoots for steady, positive returns – generally in the single digits – capturing short term stock price movements when one firm announces its intention to acquire another. Two markers of the complete disconnect between the two: first, the lifetime correlation between the two funds is 0.31. You’ve got more in common with an EM stock fund (heck, you’ve got more in common with an EM bond fund) than with a merger arbitrage fund. Second, here’s the lifetime performance charts for the two.

Fine fund, but not what you signed up for.

“Later in the year,” according to the filing, the Holland Balanced Fund (HOLBX) will be liquidated. It’s a perfectly nice fund, run since 1995 by Michael Holland, albeit one with a tiny asset base and an egregious expense ratio (2.0%). Now in his mid-70s, Mr. Holland has had a long and storied career with stints at The Blackstone Group, Salomon Group, Oppenheimer Funds, JPMorgan and a while working with the endowment at his alma mater, Harvard University. We wish him well in this next chapter of his life.

“Later in the year,” according to the filing, the Holland Balanced Fund (HOLBX) will be liquidated. It’s a perfectly nice fund, run since 1995 by Michael Holland, albeit one with a tiny asset base and an egregious expense ratio (2.0%). Now in his mid-70s, Mr. Holland has had a long and storied career with stints at The Blackstone Group, Salomon Group, Oppenheimer Funds, JPMorgan and a while working with the endowment at his alma mater, Harvard University. We wish him well in this next chapter of his life.

Horizon Multi-Asset Income Fund (HMANX), launched in June 2019 and underwater since then, won’t be around to celebrate New Years Day, 2021.

On December 15, 2020, Invesco All Cap Market Neutral Fund and Invesco Select Opportunities Fund will cease to exist.

A couple of months later, February 18, 2021, Invesco Balanced-Risk Retirement Now Fund, Invesco Balanced-Risk Retirement 2020 Fund, Invesco Balanced-Risk Retirement 2030 Fund, Invesco Balanced-Risk Retirement 2040 Fund , and Invesco Balanced-Risk Retirement 2050 Fund will join them in oblivion.

Mission-Auour Risk-Managed Global Equity Fund (OURAX) will merge with Union Street Partners Value Fund (USPVX) on December 18, 2020. The Union Street fund is tiny, and the managers don’t invest in it, but it’s otherwise a pretty okay offering.

The Patriot Fund (TRFAX) will snap off its last salute on November 20, 2020.

PPM Floating Rate Income Fund (PKFIX), PPM Long Short Credit Fund (PKLIX), PPM Large Cap Value Fund (PZLIX), and PPM Mid Cap Value Fund (PZMIX) have all closed and will all soon be liquidated, though the exact date has not been disclosed.

Effective October 13, 2020, ProShares Ultra Communication Services Select Sector (XCOM) and ProShares UltraShort Communication Services Select Sector (YCOM) were liquidated

As of October 19, 2020, Virtus was still trying to arrange for a merger of Virtus Rampart Sector Trend Fund (PWBAX) with and into Virtus Tactical Allocation Fund (NAINX). The latter is both larger and vastly more successful. Sadly, the shareholder meeting at which the merger was to be considered had to be adjourned without action. Generally, that means that they couldn’t get enough votes – for or against – to conclude the matter. Inevitably, time, effort, and money will be spent trying to get shareholders to, oh, pay attention to their investments. We’ll update you soon.

On (or around) October 27, 2020, Rareview Longevity Income Generation Fund (RLIGX) was liquidated. Good news: “the liquidation is not expected to be a taxable event for the Fund.” Bad news: it is a taxable event for the fund’s shareholders. Good news: with a three-year gain of just 0.75% annually, a 5% loss this year, and low tax efficiency all along, there wasn’t much to be taxed on.

The Two Rivers board of trustees concluded that liquidating Redwood AlphaFactor Tactical Core Fund (RWTNX) and the Redwood Activist Leaders Fund (RWLNX) was in the best interests of the funds and their shareholders. The deed was done on October 30, 2020. Given that both funds have lost shareholder money (though not the managers’ money, since none of them chose to invest in the funds) since inception, they might well be right.

The REMS Real Estate Income 50/50 Fund (RREFX) is merging into the REMS Real Estate Value-Opportunity Fund (HLRRX) “on or about December 18, 2020, or as soon as possible thereafter.” One would have thought that the “or about” made the “or soon as possible” superfluous.

Rothko Emerging Markets Equity Fund (RKEMX) went from “tiny and bad” (10/16) to “vanished” (10/29) in under two weeks. Rothko is a Mondrian affiliate, and we’ll note that Mondrian’s EM Value Equity Fund (MPEMX, $25 million, two stars) is not looking all that healthy itself.

“Ryan Labs Core Bond Fund (RLCBX) has terminated the public offering of its shares and will discontinue its operations effective November 16, 2020.” Curious decision. The stated rationale was boilerplate (“in the best interest of shareholders”), which is questionable in the case of a four-star, silver-rated fund with absolutely top-tier performance. The likelier explanations involve the fund’s size ($50 million) and flagging interest on the part of its Canadian parent.

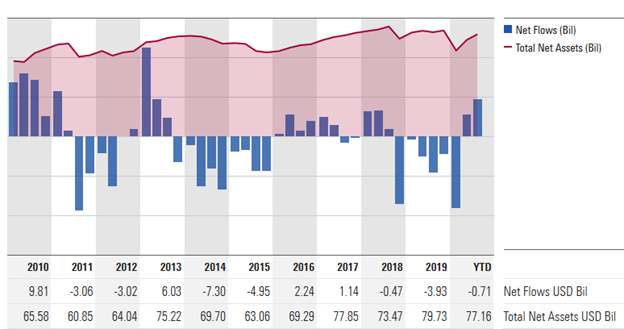

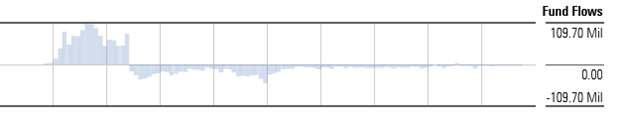

The one-star Transamerica Dynamic Income (IGTAX) will, pending shareholder approval, merge with Transamerica Multi-Asset Income “in the first quarter of 2021.” The asset flows for IGTAX are fascinating.

Hundreds of millions rushed in, in Year One, to a fund with no track record and unremarkable managers, which turned out to be a middling performer. Then suddenly, around the 18-month mark, it looks like a switch got flipped. One might surmise that the fund was on an internal buy list until it wasn’t.

On October 5, 2020, T. Rowe Price Institutional International Growth Equity Fund was merged into T. Rowe Price International Stock Fund (PRITX). The decedent is a clone of the survivor, with the same manager, strategy, and portfolio. A gain for the merging shareholders: the institutional share class of their new fund is 9 bps lower than their previous funds’.

On or around March 8, 2021, the $2.4 billion T. Rowe Price Growth & Income Fund (PRGIX) is expected to merge into the $1.9 billion T. Rowe Price U.S. Large-Cap Core Fund (TRULX). The funds share the same manager, Jeff Rottinghaus, virtually identical performance and a correlation of 0.99 with one another.

| Growth & Income | Large Cap Core | |

| 10 year annualized returns | 12.8 | 13.4 |

| Maximum drawdown | -20.2 | -20.2 |

| Standard deviation | 12.8 | 12.7 |

| Downside deviation | 8.1 | 8.1 |

| Down market deviation | 8.0 | 8.0 |

| Ulcer Index | 4.0 | 4.0 |

| Sharpe ratio | 0.97 | 1.01 |

| Capture / S&P500 | 1.0 | 1.0 |

| R-squared / S&P500 | 0.97 | 0.97 |

T. Rowe has reduced the expense ratio on Large Cap Core to match Growth & Income’s lower fees.

UP Fintech China-U.S. Internet Titans ETF (TTTN) isn’t going to make it to Thanksgiving this year. Its shareholders might pause and offer a word of thanks for the fund’s 48% YTD gains.