Updates

As of August 13, 2020, SouthernSun Asset Management bought Affiliated Managers Group’s interest in SouthernSun. As a result, SouthernSun is no longer affiliated with AMG; it’s now wholly owned by its employees.

Briefly Noted . . .

AdvisorShares Vice ETF (ACT) has amended its prospectus to allow that “companies that derive at least 50% of their net revenue from the food and beverage industry” are sinful while, at the same time, “the Fund will no longer invest in cannabis or cannabinoid-related investments.” Let’s see: brownies = vice, unless they contain pot. Got it!

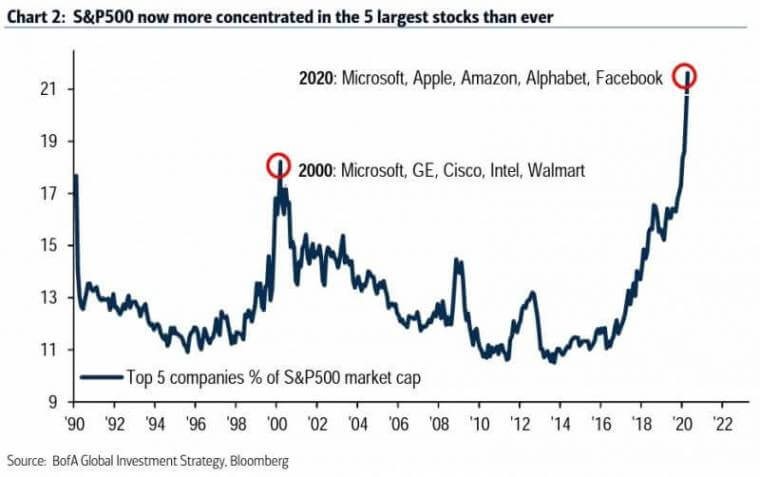

TIAA-CREF and T Rowe Price both filed equivalent, curious notices: their broad index funds (for example, the S&P 500 fund) will continue to track its benchmark index even if the funds becomes nondiversified as a result of a change in relative market capitalization or index weighting of one or more constituents of the index.

There’s a heads-up: serious people are beginning to plan for the contingency that the world’s largest indexes become so dominated by a handful of companies that they’re no longer diversified investments.

Source: FEDweek, August 26, 2020

The folks at Thrivent were deeply saddened to share news of the death of Darren M. Bagwell (1967-2020). Mr. Bagwell was a portfolio co-manager for all of their funds, a vice president, and their Chief Equity Strategist. He passed away at Mayo Clinic in Rochester, Minnesota on July 16, 2020, after a long illness. Before joining Thrivent he worked at BOA and Robert Baird but was also the publisher of The Spin Off Report in New York. We join the folks at Thrivent in extended our profound sympathies to his wife Duyen, his son Macalister “Mac” (20) who is a senior at Stanford University, and his daughter Dakota “Kodi” (16), a Junior at Appleton North High School.

The folks at Thrivent were deeply saddened to share news of the death of Darren M. Bagwell (1967-2020). Mr. Bagwell was a portfolio co-manager for all of their funds, a vice president, and their Chief Equity Strategist. He passed away at Mayo Clinic in Rochester, Minnesota on July 16, 2020, after a long illness. Before joining Thrivent he worked at BOA and Robert Baird but was also the publisher of The Spin Off Report in New York. We join the folks at Thrivent in extended our profound sympathies to his wife Duyen, his son Macalister “Mac” (20) who is a senior at Stanford University, and his daughter Dakota “Kodi” (16), a Junior at Appleton North High School.

SMALL WINS FOR INVESTORS

Eaton Vance Atlanta Capital SMID-Cap Fund (EISMX) reopened to new investors at the end of August 2020. The $11 billion fund saw some dramatic outflows in early 2020, likely hastening the reopening.

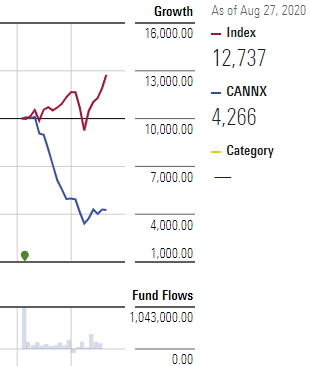

Cannabis Growth Fund (CANNX) has reduced the investment minimums for the Fund’s Class I Shares are lowered from $100,000 to $2,500 for initial purchases and from $5,000 to $100 for subsequent purchases. There are those who might suggest that “growth” is a misnomer.

Grandeur Peak made several shareholder-friendly changes, effective September 1, 2020. The fee waivers on three funds were modified to lower the cost of ownership:

Grandeur Peak Global Opportunities Fund (GPGOX/GPGIX): management fee lowered to 1.00% on assets above $500 million

Grandeur Peak International Opportunities Fund (GPIOX/GPIIX): management fee lowered to 1.00% on assets above $500 million

Grandeur Peak Emerging Markets Opportunities Fund (GPEOX/GPEIX): management fee lowered to 1.00% on assets above $400 million

Their intent, they explain, “is to share the economic success of these funds with shareholders. It has been our stated intent from the founding of the firm to share economic success with our team, our clients, and our local and global community.”

Grandeur Peak also lowered the minimum initial investment on their funds to $1,000 for folks who invest directly through them. (I do.) The intent here is to make it easier for young investors to get started. My preferred solution has always been to waive the investment minimum for accounts with an automatic investing plan (AIP) since folks are much more likely to keep investing if a modest sum ($50-100 or whatever) is drawn monthly (or quarterly) than they are if they have to get up the nerve to actually write a check or initiate a transfer. Still, a good move.

Polen Growth Fund (POLRX) ditched its redemption fee, effective September 1, 2020.

Effective immediately, Vanguard Treasury Money Market Fund is re-opened to all investors without limitations.

After a couple of years of steady outflows, the three-star Wells Fargo Small Company Growth Fund (WSCGX) reopened to new investors effective September 1, 2020.

CLOSINGS (and related inconveniences)

Meh, nothing that we noticed!

OLD WINE, NEW BOTTLES

On or about October 12, 2020, Amplify Advanced Battery Metals and Materials ETF becomes the Amplify Lithium & Battery Technology ETF with a new sub-adviser.

Effective October 15, 2020, the Buffalo Emerging Opportunities Fund (BUFOX) name will be changed to Buffalo Early Stage Growth Fund.

Effective August 31, 2020, the CAN SLIM Select Growth Fund (CANGX) changed its name to the CAN SLIM Tactical Growth Fund.

Guinness Atkinson Alternative Energy Fund (GAAEX) has been repackaged as the SmartETFs Sustainable Energy ETF. We’ve noted before that Guinness Atkinson is the first company to receive permission to directly translate open-end mutual funds into ETFs; other firms are merely opening new ETFs that clone existing funds.

On or about November 1, 2020, JPMorgan Growth & Income (VGRIX), a perfectly fine fund, becomes JPMorgan U.S. Value Fund. At the same point, JPMorgan Intrepid Mid Cap Fund (PECAX) becomes JPMorgan SMID Cap Equity Fund with the predictable “and small caps, too” tweak to the prospectus.

Integrity Growth & Income Fund (IGIAX) has become Integrity ESG Growth & Income Fund. The argument is that it was an ESG fund all along, they just forgot to highlight the fact.

On August 24, 2020, RG Tactical Market Neutral Fund (RFTIX) became RG Gold+ Fund (GLDPX). The “Gold” is gold (and other precious minerals); the “+” is cryptocurrencies. There was also a plan afoot for a reversal share split to boost the share price to $20, but that doesn’t seem to have happened yet.

Effective October 27, 2020, Swan Defined Risk Foreign Developed Fund (SDJAX) becomes Swan Defined Risk Foreign Fund

Effective October 1, 2020, T. Rowe Price U.S. Treasury Long-Term Fund becomes T. Rowe Price U.S. Treasury Long-Term Index Fund.

Effective October 1, 2020, USAA World Growth Fund (USAWX) becomes USAA Sustainable World Fund.

Virtus Rampart Equity Trend Fund is becoming Virtus FORT Trend Fund because, well, Rampart has been shown the door and FORT Investment Management has been brought in. For those reluctant to invest with managers-with-training-wheels, the prospectus helpfully notes: “The Fund’s subadviser has not previously managed a mutual fund. Accordingly, the Fund bears the risk that the subadviser’s inexperience with the restrictions and limitations applicable to mutual funds will limit the subadviser’s effectiveness.”

Effective September 30, 2020, Water Island Diversified Event-Driven Fund will change its name to Water Island Event-Driven Fund. Big reveal: the fund will no longer be considered “diversified.”

On or about October 30, 2020, Wells Fargo WealthBuilder Conservative Allocation Fund (WCAFX) becomes Wells Fargo Spectrum Income Allocation Fund. The fund will invest no more than 20% in equities with a neutral weighting of 10% equities. The rest of the WealthBuilder lineup undergoes parallel name changes.

| Current Fund Name | New Fund Name Effective on or about October 30, 2020 |

| Wells Fargo WealthBuilder Conservative Allocation Fund | Wells Fargo Spectrum Income Allocation Fund |

| Wells Fargo WealthBuilder Equity Fund | Wells Fargo Spectrum Aggressive Growth Fund |

| Wells Fargo WealthBuilder Growth Allocation Fund | Wells Fargo Spectrum Growth Fund |

| Wells Fargo WealthBuilder Growth Balanced Fund | Wells Fargo Spectrum Moderate Growth Fund |

| Wells Fargo WealthBuilder Moderate Balanced Fund | Wells Fargo Spectrum Conservative Growth Fund |

OFF TO THE DUSTBIN OF HISTORY

ETFs at the tipping point? Through the first eight months of 2020, for the first time, the number of ETFs liquidated exceeded the number of ETFs launched. Below we detail 29 ETF liquidations.

The $54 million, one-star AB Unconstrained Bond fund (AGSRX) has closed and will be liquidated around October 9, 2020.

Ascendant Tactical Yield Fund (ATYAX) is scheduled to be liquidated on September 29, 2020, but it seems already to have disappeared from Morningstar’s website. Cold.

AllianzGI is systematically shutting down a bunch of funds over the next four months.

| Fund Name | Effective Date |

| AllianzGI Core Bond Fund | September 28, 2020 |

| AllianzGI Emerging Markets Small Cap Fund | October 16, 2020 |

| AllianzGI Emerging Markets SRI Debt Fund | September 28, 2020 |

| AllianzGI Green Bond Fund | December 17, 2020 |

| AllianzGI Floating Rate Note Fund | September 28, 2020 |

| AllianzGI Best Styles Global Equity Fund | December 17, 2020 |

| AllianzGI Multi-Asset Income Fund | December 17, 2020 |

| AllianzGI PerformanceFee Managed Futures Strategy Fund | December 17, 2020 |

| AllianzGI Short Term Bond Fund | December 17, 2020 |

Camelot Premium Return Fund (CPRFX) will be liquidated on September 28, 2020.

Columbia Select International Equity Fund merged into the four-star Columbia Acorn International Select (ACFFX) on August 7, 2020.

The $4 million Comstock Capital Value Fund (DRCVX) is doing … something? I think it’s liquidating but this SEC filing is a bit obscure:

… approval of the Agreement and Plan of Reorganization, between the Company, on its own behalf and on behalf of the Fund, and a newly formed Delaware corporation and the transactions contemplated thereby, including, among other things: (a)transfer by the Fund of all of its assets to New Comstock, Inc. (“New Comstock”) (which has been established solely for the purpose of acquiring those assets and continuing the Fund’s business) in exchange solely for shares in New Comstock and New Comstock’s assumption of all of the Fund’s liabilities, (b) distributing those shares pro rata to the Fund’s shareholders in exchange for their shares of common stock therein and in complete liquidation thereof, and (c) liquidating and dissolving the Fund.

It’s in the nature of a bear fund that the long-term numbers look horrifying: $10,000 invested with the fund when it launched in 1985 would have been reduced to $1,350 today.

Delaware Government Cash Management Fund (FICXX) will liquidate and dissolve on or about Dec. 4, 2020.

A special meeting of Shareholders of Diamond Hill Research Opportunities Fund will, following shareholder approval, merge into the $2 billion Diamond Hill Long-Short Fund (DIAMX); the Reorganization is expected to occur on or about October 23, 2020. It’s a curious combination. The mostly-long Research fund has no assets but a substantially stronger record than its more traditionally long-short sibling.

EventShares U.S. Legislative Opportunities ETF (PLCY), named “Thematic ETF of the Year” by ETF.com, was liquidated on August 28, 2020.

Global X Scientific Beta Japan ETF (SJIC), Global X Scientific Beta U.S. ETF (SCIU), Global X Fertilizers/Potash ETF (SOIL), Global X Scientific Beta Europe ETF (SCID), and Global X Scientific Beta Asia ex-Japan ETF (SCIX) were plowed under on August 20, 2020.

ICON Risk-Managed Balanced Fund (IOCAX) lingers on in purgatory. The 17 ICON funds were slated to be merged in SCM funds, pending shareholder approval. So far, 16 funds have taken the plunge but the trustees have not been able to achieve a quorum from IOCAX shareholders. If they don’t achieve one by mid-September, they’re simply going to liquidate the fund. (A loss, really, to no one.)

iShares Edge MSCI Min Vol Europe ETF (EUMV), iShares Edge MSCI Min Vol Japan ETF (JPMV), iShares Europe Developed Real Estate ETF (IFEU) iShares Currency Hedged MSCI Australia ETF (HAUD), iShares Currency Hedged MSCI Italy ETF (HEWI), iShares Currency Hedged MSCI South Korea ETF (HEWY), iShares Currency Hedged MSCI Spain ETF (HEWP), and iShares Currency Hedged MSCI Switzerland ETF (HEWL) were liquidated effective August 20, 2020.

In a quick follow-up to the August liquidations, iShares then announced September’s executions: Direxion Daily 20+ Year Treasury Bear 1X Shares (TYBS),

Direxion Daily Small Cap Bull 2X Shares (SMLL), PortfolioPlus S&P 500® ETF (PPLC), PortfolioPlus S&P® Small Cap ETF (PPSC), PortfolioPlus S&P® Mid Cap ETF (PPMC), PortfolioPlus Developed Markets ETF (PPDM), PortfolioPlus Emerging Markets (PPEM), Direxion Russell Large Over Small Cap ETF (RWLS), Direxion Russell Small Over Large Cap ETF (RWSL), Direxion MSCI USA Cyclicals Over Defensives ETF (RWCD), Direxion MSCI USA Defensives Over Cyclicals ETF (RWDC), Direxion MSCI Emerging Over Developed Markets ETF (RWED), Direxion MSCI Developed Over Emerging Markets ETF (RWDE), Direxion FTSE Russell US Over International ETF (RWUI), and Direxion FTSE Russell International Over US ETF (RWIU). The boilerplate for each was; “each Fund could not conduct its business and operations in an economically efficient manner over the long term due to each Fund’s inability to attract sufficient investment assets to maintain a competitive operating structure.” One wonders how often “bad idea, poorly executed” would have been more to the point?

On August 12, 2020, the Board of Trustees of Stone Ridge Trust approved plans of liquidation for the Elements U.S. Portfolio (ELUSX), the Elements U.S. Small Cap Portfolio (ELSMX), the Elements International Portfolio (ELINX), the Elements International Small Cap Portfolio (ELISX) and the Elements Emerging Markets Portfolio (ELMMX) on or about October 1, 2020

Leland Real Asset Opportunities Fund (GHTAX, f/k/a Good Harbor Tactical Equity Income Fund) was liquidated on August 31, 2020.

Harbor High-Yield Opportunities Fund (HHYVX) liquidated on August 31, 2020. Not a terribly fund, just an unpopular one.

Matthews Asia Value Fund (MAVRX), a fine little fund, will be liquidated on or about September 30, 2020.

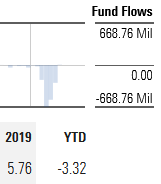

PIMCO Emerging Markets Currency and Short-Term Investments Fund (PLMAX) will close on November 20 and liquidate in early January. Those curious for an explanation might look at the fund’s 2020 asset flows:

Right, over $600 million a month out the door.

The $25 million Segall Bryant & Hamill Mid Cap Value Dividend Fund (WIMCX) will be closed and liquidated on or about September 17, 2020.

Stralem Equity Fund (STEFX) has closed to new investors and will be liquidated in the first few days of September 2020.

On or around November 30, 2020, the $430 million T. Rowe Price Institutional Core Plus Fund (TICPX) is expected to reorganize into the four-star T. Rowe Price Total Return Fund (PTKIX). They fall in the same Morningstar category but Total Return is smaller and stronger.

On October 2, 2020, Touchstone Anti-Benchmark US Core Equity Fund (TABOX) will be merged into Touchstone Dynamic Equity Fund (TDEAX), which will be immediately renamed … Touchstone Anti-Benchmark US Core Equity Fund. Why? Touchstone explains, “The Anti-Benchmark US Core Equity Fund will be the performance survivor as it has the record most reflective of the ongoing strategy of the combined fund. The Dynamic Equity Fund is the legal and operational survivor as it has the broader share ownership and distribution partners … shareholders of the combined fund will have the Dynamic Equity fund’s tickers with the Anti-Benchmark fund’s performance history.”

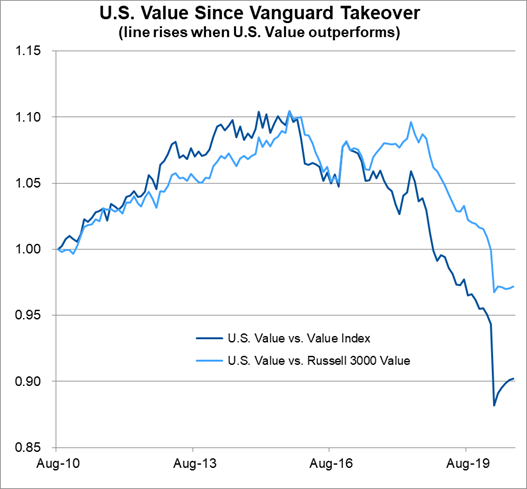

Vanguard U.S. Value Fund (VUVLX) has closed to new investors ahead of its planned merger into Vanguard Value Index Fund (VIVAX). The merger is expected in early January. Dan Wiener, editor of The Independent Adviser for Vanguard Investors and the industry’s sharpest outside commentator on all things Vanguard, reminds us that it has always been a quant fund, initially managed by GMO. After a few years of great performance and a few more of lagging performance, Vanguard decided to staple on a second management team from AXA Rosenberg, then fired GMO, then fired Rosenberg “under a cloud of mistrust.” Thereafter, Vanguard’s own internal Quantitative Equity team. Oops. “Performance has cratered,” Dan notes. Perhaps for slow learners, he adds “performance has been horrible,” sharing his disdain on its “ignominious 20th birthday. Presumably, “horrible” sorts of looks like “still underwater after 20 years.”

We’d been a little more generous about the fund in our original version of this announcement. Thanks, as ever, to Dan for making it a lot clearer for us (and you)!

Effective August 18, 2020, Virtus Herzfeld Fund and Virtus Horizon Wealth Masters Fund were liquidated.

Wells Fargo Emerging Markets Bond Fund, Wells Fargo High Yield Corporate Bond Fund, Wells Fargo International Government Bond Fund, and Wells Fargo U.S. Core Bond Fund were all liquidated on or about August 27, 2020.