In real estate, it’s all about location.

In investing, it’s all about timing.

On February 5, 2020, which the Dow at 28,807, Direxion launched the Direxion Flight to Safety Strategy ETF (FLYT). The passive fund tracks an index comprised of gold, large-cap utility stocks, and long-dated US Treasury bonds. It rebalances quarterly, with the least volatile component of the index, based on trailing five-year volatility, receiving the greatest weight.

The initial weightings are roughly 43% bonds, 35% utilities, and 22% gold. Gold is capped at 22.5% of the portfolio. Because they had to put it somewhere, Morningstar benchmarks it against their 50-70% equity allocation category.

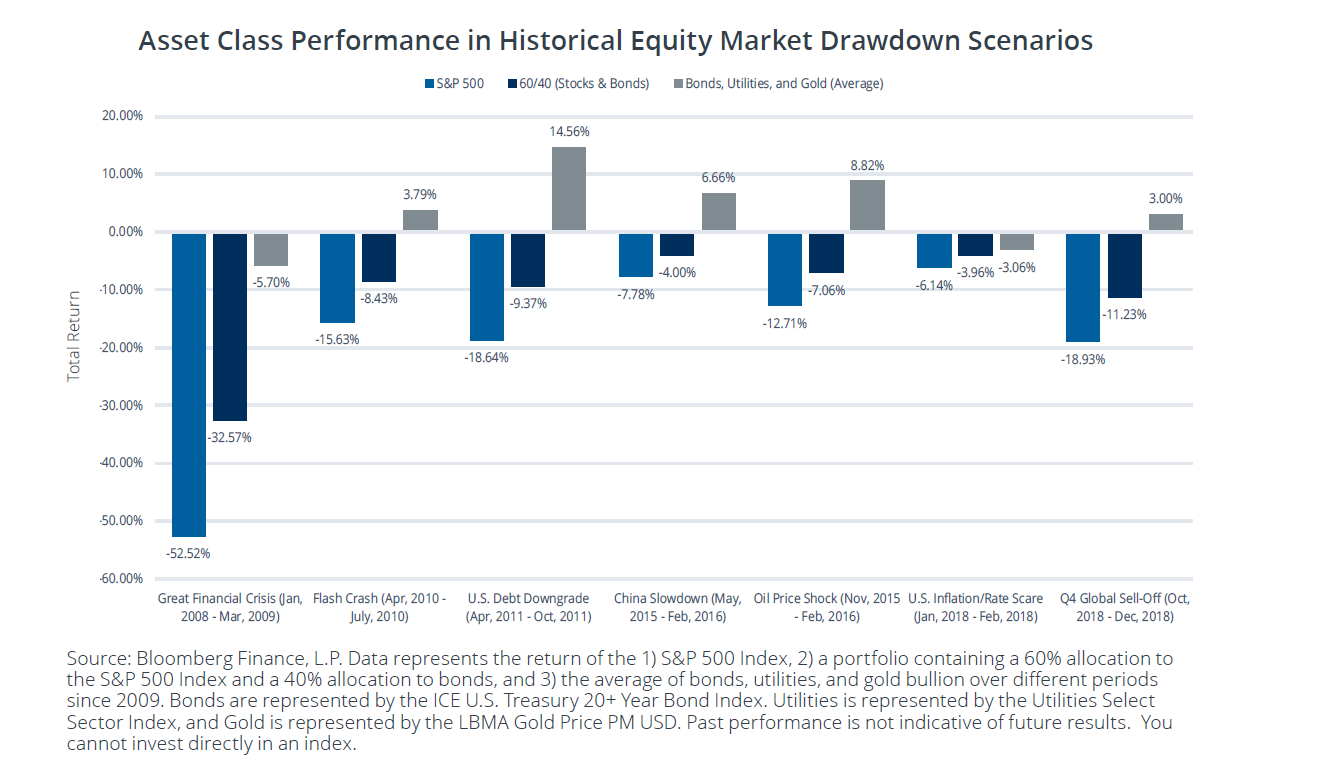

Direxion’s argument is that some assets are seen as safe havens, and tend to rise when people flee “risk assets.” They illustrate this tendency by looking at a relatively short period of market history, the events since the financial crisis in 2008.

The fund has risen about 1.0% from inception through March 27, 2020. The Vanguard Total Bond Market ETF (BND) declined 0.81% during the same period.

Magic shield? Haven’t found one yet. Useful balm? Maybe. You need to know that the underlying assets have been bid up by others who’ve already fled. Historically low-interest rates will undercut the appeal of long-term bonds once the crisis passes since any uptick in interest rates will reduce their price.

Here is a 10-year (through 2/28/2020) snapshot of the performance of the three components of FLYT against Vanguard STAR (VGSTX), a 60/40 balanced fund of funds. For simplicity, I targeted Vanguard funds to capture the asset classes but Vanguard shuttered its precious metals fund in 2002. I substituted a middle-of-the-road gold fund for it.

| Annual return | Standard deviation | Sharpe ratio | |

| Vanguard STAR | 8.6% | 8.6 | 0.93 |

| Vanguard Long-Term Treasury VUSTX | 7.9% | 11.8 | 0.62 |

| Vanguard Utilities Index VUIAX | 12.1 | 12.0 | 0.96 |

| Gabelli Gold AAA GOLDX | -2.0 | 32.9 | -0.08 |

The expense ratio is 0.40%.