| Ticker |

Fund |

Out with the old |

In with the new |

Dt |

| EGALX |

Aberdeen International Real Estate Equity Fund |

Bruce Ebnother will no longer serve as a portfolio manager for the fund. |

Svitlana Gubriy, Jon Stewart, and Toshio Tangiku will continue to manage the fund. |

5/19 |

| AEOVX |

AC Alternatives Emerging Opportunities Total Return Fund |

Kevin Akioka has announced his plans to leave American Century Investments. As a result, he will no longer serve as a portfolio manager for the fund. |

Alessandra Alecci, John Lovito, Margé Karner, and Abdelak Adjriou will continue to manage the fund. |

5/19 |

| ACOIX |

AC ONE China Fund |

Frederick Ruopp will no longer serve as a portfolio manager for the fund. |

Patrick Pascal will continue to manage the fund. |

5/19 |

| FNG |

AdvisorShares New Tech and Media ETF |

David Chojnacki is no longer listed as a portfolio manager for the fund. |

Scott Freeze will now manage the fund. |

5/19 |

| AAIPX |

American Beacon International Equity Fund |

Foster Corwith has retired and is no longer listed as a portfolio manager for the fund. |

The other twenty managers will continue to manage the fund. |

5/19 |

| KORP |

American Century Diversified Corporate Bond ETF |

Kevin Akioka is no longer listed as a portfolio manager for the fund. |

Le Tran, Gavin Fleischman, Jeffrey Houston, and Charles Tan will continue to manage the fund. |

5/19 |

| AEDVX |

American Century Emerging Markets Debt Fund |

Kevin Akioka has announced his plans to leave American Century Investments. As a result, he will no longer serve as a portfolio manager for the fund. |

Thomas Youn, John Lovito, Margé Karner, and Brian Howell will continue to manage the fund. |

5/19 |

| ABHIX |

American Century High-Yield Fund |

Kevin Akioka is no longer listed as a portfolio manager for the fund. |

Le Tran, Gavin Fleischman, Jeffrey Houston, and Charles Tan will continue to manage the fund. |

5/19 |

| BGESX |

Baillie Gifford EAFE Fund |

Kavé Sigaroudinia will no longer be a portfolio manager for the fund. |

James Anderson, Thomas Coutts, Lawrence Burns, Brian Lum, and Julia Angeles will continue to manage the fund. |

6/19 |

| BGBKX |

Baillie Gifford Multi Asset Fund |

No one, immediately, but Patrick Edwardson is expected to retire effective on or about May 1, 2020. |

The rest of the team will continue to manage the fund while keeping an eye on the calendar. |

6/19 |

| MDLOX |

BlackRock Global Allocation Fund |

Kent Hogshire is no longer listed as a portfolio manager for the fund. |

Rick Rieder joins Russ Koesterich, David Clayton, and Dan Chamby in managing the fund. |

5/19 |

| HRCVX |

Carillon Eagle Growth & Income Fund |

No one, but … |

Brad Erwin will join Edmund Cowart, David Blount, and Harald Hvideberg on the management team. |

6/19 |

| LIIAX |

Columbia Corporate Income Fund |

No one, but … |

Timothy Doubek has returned from a medical leave of absence to resume his investment responsibilities as co-manager with Thomas Murphy. |

5/19 |

| ALDAX |

Columbia Limited Duration Credit Fund |

No one, but … |

Timothy Doubek has returned from a medical leave of absence to resume his investment responsibilities as co-manager with Thomas Murphy and Royce Wilson. |

5/19 |

| CMIEX |

Columbia Multi-Manager International Equity Strategies Fund |

Foster Corwith has retired and is no longer listed as a portfolio manager for the fund. |

The other sixteen managers will continue to manage the fund. |

5/19 |

| CRMEX |

CRM All Cap Value Fund |

Jay Abramson has retired. |

Robert Maina will continue to manage the fund. |

5/19 |

| DBALX |

Davenport Balanced Income Fund |

William Noftsinger, Jr. has resigned from Davenport & Company LLC. |

Christopher Pearson joins David West, George Smith, Robert Giles, E. Trigg Brown, John Ackerly, Christopher Kelley, Charles Gomer, and Michael Beall on the management team. |

6/19 |

| DAVPX |

Davenport Core Fund |

William Noftsinger, Jr. has resigned from Davenport & Company LLC. |

Christopher Pearson joins David West, George Smith, Robert Giles, E. Trigg Brown, John Ackerly, and Michael Beall on the management team. |

6/19 |

| DVIPX |

Davenport Value & Income Fund |

William Noftsinger, Jr. has resigned from Davenport & Company LLC. |

Christopher Pearson joins David West, George Smith, Robert Giles, E. Trigg Brown, John Ackerly, and Michael Beall on the management team. |

6/19 |

| DTCAX |

Dreyfus Sustainable U.S. Equity Fund |

Raj Shant is no longer listed as a portfolio manager for the fund. |

Rob Stewart and Yuko Takano join Jeff Munroe in managing the fund. |

5/19 |

| SSTGX |

DWS ESG Global Bond Fund |

Rahmila Nadi and Bernhard Falk are no longer listed as portfolio managers for the fund. |

Thomas Farina and Joseph Bowen are now managing the fund. |

6/19 |

| MGSFX |

DWS Fixed Income Opportunities Fund |

John Ryan, Kevin Bliss, and Onur Uncu are no longer listed as portfolio managers for the fund. |

Rick Smith joins Thomas Sweeney in managing the fund. |

5/19 |

| KTRAX |

DWS Global Income Builder Fund |

John Ryan and Kevin Bliss are no longer listed as portfolio managers for the fund. |

Thomas Farina and Scott Agi join Dokyoung Lee, Di Kumble, and Darwei Kung in managing the fund. |

5/19 |

| SPDAX |

DWS Multi-Asset Conservative Allocation Fund |

Pankaj Bhatnagar and Darwei Kung are no longer listed as portfolio managers for the fund. |

Sophia Noisten joins Dokyoung Lee in managing the fund. |

5/19 |

| SPGRX |

DWS Multi-Asset Global Allocation Fund, which becomes DWS Multi-Asset Global Allocation Fund |

Pankaj Bhatnagar and Darwei Kung are no longer listed as portfolio managers for the fund after the change in name. |

Sophia Noisten joins Dokyoung Lee in managing the fund. |

5/19 |

| PPLSX |

DWS Multi-Asset Moderate Allocation Fund |

Pankaj Bhatnagar and Darwei Kung are no longer listed as portfolio managers for the fund. |

Sophia Noisten joins Dokyoung Lee in managing the fund. |

5/19 |

| KSTAX |

DWS Multisector Income Fund |

John Ryan and Kevin Bliss are no longer listed as portfolio managers for the fund. |

Kelly Beam and Thomas Farina will now manage the fund. |

5/19 |

| EBABX |

Eaton Vance Core Plus Bond Fund |

Henry Peabody and Kathleen Gaffney are no longer listed as portfolio managers for the fund. |

Vishal Khanduja and John Croft join Matthew Buckley in managing the fund. |

6/19 |

| EVBAX |

Eaton Vance Multisector Income Fund |

Henry Peabody and Kathleen Gaffney are no longer listed as portfolio managers for the fund. |

Kelley Baccei, Justin Bourgette, and John Redding will now manage the fund. |

6/19 |

| FEAAX |

Fidelity Advisor Emerging Asia Fund |

No one, immediately, but John Dance is expected to transition off of the fund effective on or about December 31, 2019. |

Xiaoting Zhao joins John Dance on the management team and will continue to manage the fund upon Mr. Dance’s departure. |

5/19 |

| FSEAX |

Fidelity Emerging Asia Fund |

No one, immediately, but John Dance is expected to transition off of the fund effective on or about December 31, 2019. |

Xiaoting Zhao joins John Dance on the management team and will continue to manage the fund upon Mr. Dance’s departure. |

5/19 |

| FNMIX |

Fidelity New Market Income Fund |

No one, immediately, but John Carlson is expected to retire on or about December 31, 2019. |

Jonathan Kelly and Timothy Gill will continue to manage the fund upon Mr. Carlson’s retirement. |

6/19 |

| FPBFX |

Fidelity Pacific Basin Fund |

No one, immediately, but John Dance is expected to transition off of the fund effective on or about December 31, 2019. |

Bruce MacDonald and Kirk Neureiter join John Dance on the management team and will continue to manage the fund upon Mr. Dance’s departure. |

5/19 |

| FTEMX |

Fidelity Total Emerging Markets Fund |

No one, immediately, but John Carlson is expected to retire on or about December 31, 2019. |

Jonathan Kelly joins the rest of the team and will remain upon Mr. Carlson’s retirement. |

6/19 |

| FCARX |

Fiera Capital Diversified Alternatives Fund |

Geoffrey B. Doyle no longer serves as portfolio manager of the fund. |

Mark Jurish and Kazuhiro Shimbo will continue to manage the fund. |

6/19 |

| FEBAX |

First Eagle Global Income Builder Fund |

No one, but … |

Julien Albertini joins Edward Meigs, Sean Slein, and Kimball Brooker on the management team. |

5/19 |

| GABAX |

Gabelli Asset Fund |

No one, but … |

Brian Sponheimer joins Mario Gabelli, Kevin Dreyer, Christopher Marangi, and Jeffrey Jonas on the management team. |

6/19 |

| GNOM |

Global X Genomics & Biotechnology ETF |

James Ong is no longer listed as a portfolio manager for the fund. |

Kimberly Chan joins Chang Kim, Nam To, and Wayne Xie on the management team. |

6/19 |

| GDAFX |

Goldman Sachs Alternative Premia Fund |

Evgeny Gladchenko will no longer serve as a portfolio manager for the fund. |

Federico Gilly and Matthew Schwab will continue to serve as portfolio managers for the fund. |

6/19 |

| SFAFX |

Goldman Sachs Strategic Factor Allocation Fund |

Christian Morgenstern will no longer serve as a portfolio manager for the fund |

Matthew Schwab and Nishank Modi will manage the fund. |

6/19 |

| TTIFX |

Goldman Sachs Tactical Tilt Overlay Fund |

No one, but … |

Siwen Wu will join Sergey Kraytman and David Hale in managing the fund. |

6/19 |

| Various |

Goldman Sachs Target Date Funds |

Scott de Haai will no longer serve as a portfolio manager for the fund. |

Neill Nuttall joins Christopher Lvoff in managing the funds. |

5/19 |

| HNISX |

Harbor International Small Cap Fund |

Colin Riddles, Rosemary Simmonds, and Nicholas Williams are no longer listed as portfolio managers for the fund. |

Waldemar Mozes and Jonathan Brodsky will now manage the fund. |

5/19 |

| HSFAX |

HSBC Frontier Markets Fund |

Talib Saifee no longer serves as a portfolio manager of the fund. |

Jennifer Passmoor joins Razmi Sidani in managing the fund. |

5/19 |

| ICCCX |

ICON Consumer Discretionary Fund |

Scott Snyder is no longer listed as a portfolio manager for the fund. |

Brian Callahan, Craig Callahan, and Scott Callahan will now manage the fund. |

5/19 |

| ICLEX |

ICON Consumer Staples Fund |

Scott Snyder is no longer listed as a portfolio manager for the fund. |

Brian Callahan, Craig Callahan, and Scott Callahan will now manage the fund. |

5/19 |

| ICARX |

ICON Emerging Markets Fund |

Scott Snyder and Rob Young are no longer listed as portfolio managers for the fund. |

Brian Callahan, Craig Callahan, and Scott Callahan will now manage the fund. |

5/19 |

| ICENX |

ICON Energy Fund |

Derek Rollingson will no longer serve as a portfolio manager for the fund. |

Brian Callahan, Craig Callahan, and Scott Callahan will now manage the fund. |

5/19 |

| IOEZX |

ICON Equity Income Fund |

Derek Rollingson will no longer serve as a portfolio manager for the fund. |

Brian Callahan, Scott Callahan, and Donovan Paul will now manage the fund. |

5/19 |

| ICFSX |

ICON Financial Fund |

Derek Rollingson will no longer serve as a portfolio manager for the fund. |

Brian Callahan, Craig Callahan, and Scott Callahan will now manage the fund. |

5/19 |

| ICTRX |

ICON Industrials Fund |

Rob Young is no longer listed as a portfolio manager for the fund. |

Brian Callahan, Craig Callahan, and Scott Callahan will now manage the fund. |

5/19 |

| ICTEX |

ICON Information Technology Fund |

Derek Rollingson will no longer serve as a portfolio manager for the fund. |

Brian Callahan, Craig Callahan, and Scott Callahan will now manage the fund. |

5/19 |

| ICNEX |

ICON International Equity Fund |

Scott Snyder and Rob Young are no longer listed as portfolio managers for the fund. |

Brian Callahan, Craig Callahan, and Scott Callahan will now manage the fund. |

5/19 |

| ICBMX |

ICON Natural Resources Fund |

Rob Young is no longer listed as a portfolio manager for the fund. |

Brian Callahan, Craig Callahan, and Scott Callahan will now manage the fund. |

5/19 |

| IOCZX |

ICON Risk-Managed Balanced Fund |

Craig Callahan will no longer serve as a portfolio manager for the fund. |

Brian Callahan joins Scott Callahan and Donovan Paul in managing the fund. |

5/19 |

| ICTUX |

ICON Utilities Fund |

Derek Rollingson will no longer serve as a portfolio manager for the fund. |

Brian Callahan, Craig Callahan, and Scott Callahan will now manage the fund. |

5/19 |

| ICMBX |

Intrepid Capital Fund |

Ben Franklin is no longer listed as a portfolio manager for the fund. |

Joe Van Cavage, Matt Parker, Clay Kirkland, Hunter Hayes, and Mark Travis will continue to manage the fund. |

6/19 |

| ICMIX |

Intrepid International Fund |

Ben Franklin is no longer listed as a portfolio manager for the fund. |

Matt Parker will manage the fund. |

6/19 |

| CHTRX |

Invesco Charter Fund |

Ronald Sloan will no longer serve as a portfolio manager for the fund. |

Benajmin Ram, Paul Larson, and Manind Govil will now manage the fund. |

6/19 |

| AGAAX |

Invesco Global Small & Mid Cap Growth Fund |

James Leach is no longer listed as a portfolio manager for the fund. |

Ryan Amerman joins Borge Endresen, Shuxin Cao, and Jason Holzer on the management team. |

6/19 |

| GTAGX |

Invesco Mid Cap Core Equity Fund |

Ronald Sloan will no longer serve as a portfolio manager for the fund. |

Matthew Ziehl, Adam Weiner, Raman Vardharaj, Magnus Krantz, Kristin Ketner, Joy Budzinski, and Raymond Anellow will now manage the fund. |

6/19 |

| VGRAX |

Invesco Mid Cap Growth Fund |

James Leach is no longer listed as a portfolio manager for the fund. |

Ronald Zibelli and Justin Livengood |

6/19 |

| OPTFX |

Invesco Oppenheimer Capital Appreciation Fund |

Paul Larson will no longer serve as a portfolio manager for the fund. |

Erik Voss and Ido Cohen are now managing the fund. |

6/19 |

| OPPEX |

Invesco Oppenheimer Capital Income Fund |

Michelle Elena Borré Massick and Krishna Memani are no longer listed as portfolio managers for the fund. |

Scott Wolle, Christian Ulrich, Scott Hixon, Chris Devine, John Burrello, and Mark Ahnrud will now manage the fund. |

6/19 |

| OSVAX |

Invesco Oppenheimer Dividend Opportunity Fund |

Laton Spahr is no longer listed as a portfolio manager for the fund. |

Meggan Walsh, Christopher McMeans, Kristina Bradshaw, and Robert Botard are now managing the fund. |

6/19 |

| OAEIX |

Invesco Oppenheimer Equity Income Fund |

Laton Spahr is no longer listed as a portfolio manager for the fund. |

Meggan Walsh, Christopher McMeans, Kristina Bradshaw, and Robert Botard are now managing the fund. |

6/19 |

| QMGIX |

Invesco Oppenheimer Global Multi-Asset Growth Fund |

Benjamin Rockmuller and Alessio de Longis are no longer listed as portfolio managers for the fund. |

Scott Wolle, Christian Ulrich, Scott Hixon, Chris Devine, John Burrello, and Mark Ahnrud will now manage the fund. |

6/19 |

| QMAIX |

Invesco Oppenheimer Global Multi-Asset Income Fund |

Benjamin Rockmuller and Alessio de Longis are no longer listed as portfolio managers for the fund. |

Scott Wolle, Christian Ulrich, Scott Hixon, Chris Devine, John Burrello, and Mark Ahnrud will now manage the fund. |

6/19 |

| QVSCX |

Invesco Oppenheimer Mid Cap Value Fund |

Eric Hewitt and Laton Spahr are no longer listed as portfolio managers for the fund. |

Jeffrey Vancavage will manage the fund. |

6/19 |

| OVSIX |

Invesco Oppenheimer Small Cap Value Fund |

Eric Hewitt will no longer serve as a portfolio manager for the fund. |

Jonathan Mueller and Jonathan Edwards are now managing the fund. |

6/19 |

| CGRWX |

Invesco Oppenheimer Value Fund |

Laton Spahr is no longer listed as a portfolio manager for the fund. |

James Warwick, Kevin Holt, Charles DyReyes, and Davin Armstrong are now managing the fund. |

6/19 |

| IECAX |

Ivy Pictet Emerging Markets Local Currency Debt Fund |

No one, but … |

Robert Simpson has joined Mary-Therese Barton, Philippe Petit, Guido Chamorro, Carrie Liaw, and Alper Gocer on the management team. |

6/19 |

| MNVAX |

Madison Investors Fund |

Adam Sweet will no longer serve as a portfolio manager for the fund. |

Richard Eisinger joins Matthew Hayner in managing the fund. |

6/19 |

| MIGFX |

Massachusetts Investors Growth Stock Fund |

No one, but … |

Joseph Skorski joins Jeffrey Constantino in managing the fund. |

5/19 |

| MGJRX |

MassMutual Select BlackRock Global Allocation Fund |

Kent Hogshire is no longer listed as a portfolio manager for the fund. |

Rick Rieder joins Russ Koesterich, David Clayton, and Dan Chamby in managing the fund. |

5/19 |

| MMVYX |

MassMutual Select Small Company Value Fund |

Stephen Gutch, J. David Wagner, Glen Murphy, Martin Jarzebowski, Michael Abata, and Brian Morandi are no longer listed as portfolio managers for the fund. |

Shri Singhvi, James MacGregor, Miles Lewis, and Jeff John are managing the fund. |

6/19 |

| DIFAX |

MFS Diversified Income Fund |

Effective September 1, 2019, Ward Brown will no longer serve as a portfolio manager for the fund. |

In September, Neeraj Arora will join Robert Almeida, David Cole, Rick Gable, Matt Ryan, Jonathan Sage, Geoffrey Schechter, and Michael Skatrud on the management team. |

5/19 |

| MEDAX |

MFS Emerging Markets Debt Fund |

No one, but … |

Effective September 1, 2019, Neeraj Arora will join Ward Brown and Matthew Ryan in managing the fund. |

5/19 |

| TALTX |

Morgan Stanley Alternative Strategies Fund |

Matthew Rizzo is no longer listed as a portfolio manager for the fund. |

Zachary Apoian joins Sukru Saman in managing the fund. |

5/19 |

| MELAX |

Morgan Stanley Emerging Markets Leaders Portfolio |

Ashutosh Sinha will no longer serve as a portfolio manager for the fund. |

Vishal Gupta will continue to manage the fund. |

6/19 |

| TILUX |

Morgan Stanley Inflation-Linked Fixed Income Fund |

Jeremie Banet no longer serves as a portfolio manager for the fund. |

Stephen Rodosky joins Mihir Worah in managing the fund. |

5/19 |

| TSGUX |

Morgan Stanley Pathway Funds Small-Mid Cap Equity Fund |

Michael Whitfield, Stephen Knightly, Christopher Scarpa, John Schaeffer, Brent Miley, N. Carter Newbold, Dennis Scannell, and Peter Schliemann are no longer listed as portfolio managers for the fund. |

Thomas O’Neil, Scott Moore, Gary Mitchell, John McPherson, Bruce Kennedy, Matthew Dent, Chad Baumler, and David Adams join the other eight team members on the management team. |

5/19 |

| NDNAX |

Navigator Duration Neutral Bond Fund |

No one, but … |

Alexander Meyer joins K. Sean Clark and Jonathan Fiebach in managing the fund. |

5/19 |

| NTBAX |

Navigator Tactical Fixed Income Fund |

No one, but … |

Alexander Meyer joins Robert Bennett, Mason Wev, David Rights, K. Sean Clark, and Jonathan Fiebach in managing the fund. |

5/19 |

| NUSAX |

Navigator Ultra Short Bond Fund |

No one, but … |

Alexander Meyer joins Robert Bennett and Jonathan Fiebach in managing the fund. |

5/19 |

| NHINX |

Neuberger Berman High Income Bond Fund |

Patrick Flynn is no longer listed as a portfolio manager for the fund. |

Christopher Kocinski joins Joseph Lind, Daniel Doyle, William Covode, and Thomas O’Reilly on the management team. |

5/19 |

| NHSAX |

Neuberger Berman Short Duration High Income Fund |

Patrick Flynn is no longer listed as a portfolio manager for the fund. |

Christopher Kocinski joins Joseph Lind, Daniel Doyle, William Covode, and Thomas O’Reilly on the management team. |

5/19 |

| NCGFX |

New Covenant Growth Fund |

Patrick Kaser, James Clarke, Peter Thompson, Brian Kramp, Patrick Kelly, and Ankur Crawford are no longer listed as portfolio managers for the fund. |

David Hintz, Stephen Dolce, Paul Bouchey, and Thomas Seto will continue to manage the fund. |

5/19 |

| NCEGX |

North Country Equity Growth Fund |

Peter Capozzola is no longer listed as a portfolio manager for the fund. |

Alina Kindron joins Adam Horowitz in managing the fund. |

6/19 |

| NSBRX |

Nuveen Santa Barbara Dividend Growth Fund |

James Boothe will no longer serve as a portfolio manager for the fund. |

David Chalupnik and David Park have taken over management of the fund. |

6/19 |

| NUGIX |

Nuveen Santa Barbara Global Dividend Growth Fund |

James Boothe will no longer serve as a portfolio manager for the fund. |

David Chalupnik and David Park have taken over management of the fund. |

6/19 |

| NUIIX |

Nuveen Santa Barbara International Dividend Growth Fund |

James Boothe will no longer serve as a portfolio manager for the fund. |

David Chalupnik and David Park have taken over management of the fund. |

6/19 |

| NCOAX |

Nuveen Symphony Credit Opportunities Fund |

No one, but … |

Scott Caraher joins Jenny Rhee in managing the fund. |

5/19 |

| NFRAX |

Nuveen Symphony Floating Rate Income Fund |

No one, but … |

Jenny Rhee joins Scott Caraher in managing the fund. |

5/19 |

| PEBIX |

PIMCO Emerging Markets Bond Fund |

Michael Gomex and Francesc Balcells are no longer listed as portfolio managers for the fund. |

Yacov Arnopolin is joined by Javier Romo and Pramol Dhawan on the management team. |

5/19 |

| PLMAX |

PIMCO Emerging Markets Currency and Short-Term Investments Fund |

Michael Gomex and Francesc Balcells are no longer listed as portfolio managers for the fund. |

Pramol Dhawan is joined by Ismaiel Orenstein in managing the fund. |

5/19 |

| PLMAX |

PIMCO Emerging Markets Currency and Short-Term Investments Fund |

Michael Gomez and Francesc Balcells are no longer listed as portfolio managers for the fund. |

Ismael Orenstein joins Pramol Dhawan in managing the fund. |

5/19 |

| PFSIX |

PIMCO Emerging Markets Full Spectrum Bond Fund |

Michael Gomex and Francesc Balcells are no longer listed as portfolio managers for the fund. |

Yacov Arnopolin and Pramol Dhawan will continue to manage the fund. |

5/19 |

| PELAX |

PIMCO Emerging Markets Local Currency and Bond Fund |

Francesc Balcells and Michael Gomez are no longer listed as portfolio managers for the fund. |

Ismael Orenstein joins Pramol Dhawan in managing the fund. |

6/19 |

| PWLIX |

PIMCO RAE Worldwide Long/Short PLUS Fund |

Josh Davis is no longer listed as a portfolio manager for the fund. |

Graham Rennison joins Robert Arnott, Christopher Brightman, Mohsen Fahmi, Bryan Tsu, and Jing Yang on the management team. |

5/19 |

| POLRX |

Polen Growth Fund |

Damon Ficklin will no longer serve as a portfolio manager for the fund. |

Dan Davidowitz and Brandon Ladoff will continue to manage the fund. |

6/19 |

| RMPLX |

RiverNorth Marketplace Lending Corporation |

Philip Bartow will no longer serve as a portfolio manager for the fund. |

Janae Stanton joins Patrick Galley and Andrew Kerai on the management team. |

5/19 |

| RMBTX |

RMB International Fund |

Robert Gwin and Egor Rybakov are no longer listed as portfolio managers for the fund. |

Masakazu Hosomizu will now manage the fund. |

6/19 |

| RMBSX |

RMB International Small Cap Fund |

Robert Gwin and Egor Rybakov are no longer listed as portfolio managers for the fund. |

Masakazu Hosomizu will now manage the fund. |

6/19 |

| ULST |

SPDR SSGA Ultra Short Term Bond ETF |

No one, but … |

John Mele joins James Palmieri in managing the fund. |

6/19 |

| SKLCX |

Steben Managed Futures Strategy Fund |

Basak Akiska is no longer listed as a portfolio manager for the fund. |

Carl Serger joins Kenneth Steben and John Dolfin on the management team. |

6/19 |

| TRIGX |

T. Rowe Price International Value Equity Fund |

Sebastien Mallet will no longer serve as a portfolio manager for the fund. |

Colin McQueen takes over management of the fund. |

6/19 |

| TGPNX |

TCW Conservative Allocation Fund |

Jess Ravich will no longer serve as a portfolio manager for the fund. |

Adam Coppersmith, Stephen Kane, and Michael Reilly will continue to manage the fund. |

6/19 |

| TIGIX |

Timothy Plan Growth & Income Fund |

David James, Barry James, R. Brian Culpepper, Matthew Watson, and Trent Dysert will no longer serve as portfolio managers for the fund. James Investment Research is no longer sub-advising the fund. |

Barrow, Hanley, Mewhinney & Strauss, LLC will subadvise the fund, with Arthur Ally, David Hardin, Mark Luchsinger, and Scott McDonald serving on the management team. |

6/19 |

| TARBX |

Touchstone Credit Opportunities II Fund |

David Stuehr, Barbara McKenna, Alexander Graham, and Andrew Bail are no longer listed as portfolio managers for the fund. |

Kapil Singh, Jason Duko, and Seth Brufsky will now manage the fund. |

6/19 |

| TPYAX |

Touchstone Premium Yield Equity Fund |

Deepak Ahuja is no longer listed as a portfolio manager for the fund. |

Gregory Powell, Bryan Spratt, Lowell Miller, and John Leslie will continue to manage the fund. |

5/19 |

| STITX |

Virtus SGA International Growth Fund |

Kurt Winrich, Michael Trigg, Peter Hunkel, and Paul Black are no longer listed as portfolio managers for the fund. |

Gordon Marchand, Alexandra Lee, and Tucker Brown are now managing the fund. |

6/19 |

| WFRPX |

Wealthfront Risk Parity Fund |

Celine Sun has resigned as a porfolio manager to the fund. |

Alex Michalka joins Ashley Johnson in managing the fund. |

6/19 |

| EWEAX |

Wells Fargo Intrinsic World Equity Fund |

Jen Robertson will no longer serve as a portfolio manager for the fund. |

Miguel Giaconi joins Amit Kumar and Jean Baptiste in managing the fund. |

6/19 |

| SMVAX |

Wells Fargo Small Cap Value Fund |

Michael Schneider and Erik Astheimer are no longer listed as portfolio managers for the fund. |

Craig Pieringer, Garth Nisbet, and Jeff Goverman will manage the fund. |

6/19 |

| WHGMX |

Westwood SMidCap Fund |

Thomas Lieu is no longer listed as a portfolio manager for the fund. |

William Costello, Prashant Inamdar, and Grant Taber will continue to manage the fund. |

5/19 |

| WHGPX |

Westwood SMidCap Plus Fund |

Thomas Lieu is no longer listed as a portfolio manager for the fund. |

William Costello, Prashant Inamdar, and Grant Taber will continue to manage the fund. |

5/19 |

| WMRIX |

Wilmington Real Asset Fund |

Timothy Atwill is no longer listed as a portfolio manager for the fund. |

Stephen Rodosky, Matthew Glaser, Jordan Strauss, Paul Bouchey, Thomas Seto, and Mihir Worah continue to manage the fund. |

5/19 |

| CZOVX |

Zacks All-Cap Core Fund |

Benjamin Zacks will no longer serve as a portfolio manager of the fund. |

Mitch Zacks will continue to manage the fund. |

6/19 |

| ZDIVX |

Zacks Dividend Fund |

Benjamin Zacks will no longer serve as a portfolio manager of the fund. |

Mitch Zacks will continue to manage the fund. |

6/19 |

| ZMNVX |

Zacks Market Neutral Fund |

Benjamin Zacks will no longer serve as a portfolio manager of the fund. |

Mitch Zacks will continue to manage the fund. |

6/19 |

| ZSCCX |

Zacks Small-Cap Core Fund |

Benjamin Zacks will no longer serve as a portfolio manager of the fund. |

Mitch Zacks will continue to manage the fund. |

6/19 |

This presents a familiar picture of a firm, H2O Asset Management, where strong performance and large inflows led to growth in assets undermanagement as well as profitability at the firm level that flowed up to the parent. Illiquidity in investments is not a problem in and of itself but can lead to problems when the position sizes increase as withdrawals from funds (with daily redemptions permitted) increase. This, as we saw with Woodford, often leads to the more liquid investments being sold to meet redemptions. The follow-on is that that often leads to increased concentrations of illiquid investments. And if you are running concentrated portfolios to begin with, the problems can be exacerbated.

This presents a familiar picture of a firm, H2O Asset Management, where strong performance and large inflows led to growth in assets undermanagement as well as profitability at the firm level that flowed up to the parent. Illiquidity in investments is not a problem in and of itself but can lead to problems when the position sizes increase as withdrawals from funds (with daily redemptions permitted) increase. This, as we saw with Woodford, often leads to the more liquid investments being sold to meet redemptions. The follow-on is that that often leads to increased concentrations of illiquid investments. And if you are running concentrated portfolios to begin with, the problems can be exacerbated.

MFO’s position about the fund industry is clear, consistent and realistic: 80% of all extant mutual funds could disappear without any loss to anyone except their advisors. That includes not only freakish little funds peddling some advisor’s weird vision of the investment world but also the vast numbers of large, timid, undistinguished, index-hugging funds whose only goal in life is maintaining the invisible mediocrity that keeps people from yanking their money in horror.

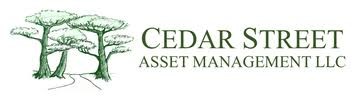

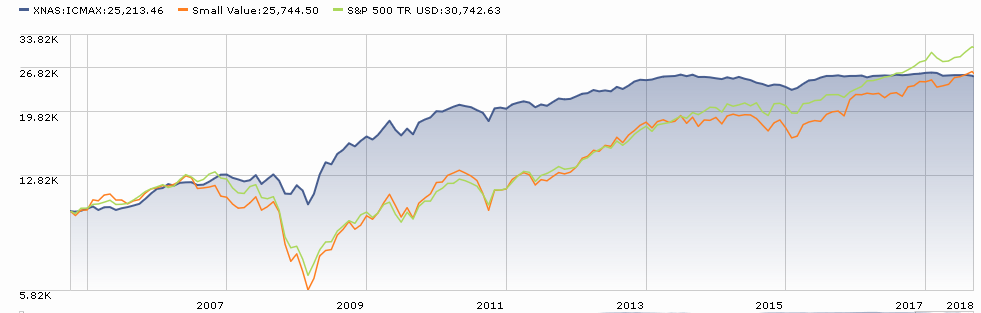

MFO’s position about the fund industry is clear, consistent and realistic: 80% of all extant mutual funds could disappear without any loss to anyone except their advisors. That includes not only freakish little funds peddling some advisor’s weird vision of the investment world but also the vast numbers of large, timid, undistinguished, index-hugging funds whose only goal in life is maintaining the invisible mediocrity that keeps people from yanking their money in horror. The managers are seeking long-term growth of capital. The plan is to invest in a fairly compact portfolio of small cap stocks, primarily but not exclusively domiciled in developed international markets, using Cedar Street’s disciplined, valued-oriented approach.

The managers are seeking long-term growth of capital. The plan is to invest in a fairly compact portfolio of small cap stocks, primarily but not exclusively domiciled in developed international markets, using Cedar Street’s disciplined, valued-oriented approach.

It’s an island. The best way to see it is by boat. Take a Sea Safari from Dingle around the coast and travel with pods of dolphins. Take a small ferry to gaze at the Cliffs of Moher from below. Take a high-speed ferry to the Aran Islands and a pony trap to the heights of Dun Aengus.

It’s an island. The best way to see it is by boat. Take a Sea Safari from Dingle around the coast and travel with pods of dolphins. Take a small ferry to gaze at the Cliffs of Moher from below. Take a high-speed ferry to the Aran Islands and a pony trap to the heights of Dun Aengus.

Morningstar’s sustainability coverage is becoming broader and deeper. On June 6, 2019, they will host the Inaugural Edition of

Morningstar’s sustainability coverage is becoming broader and deeper. On June 6, 2019, they will host the Inaugural Edition of  For the American Association of Individual Investors monthly AAII Journal, I reworked two essays that we published here into a single, compact, updated piece: “

For the American Association of Individual Investors monthly AAII Journal, I reworked two essays that we published here into a single, compact, updated piece: “ I appear, with some frequency, in the Bottom Line: Personal newsletter. Most of my articles there flow from a collaboration with Mark Gill. He asks, we talk, he drafts, I edit. There’s an art involved in making meaning in such short pieces, and Mark’s really good at it. Our most recent conversation led to

I appear, with some frequency, in the Bottom Line: Personal newsletter. Most of my articles there flow from a collaboration with Mark Gill. He asks, we talk, he drafts, I edit. There’s an art involved in making meaning in such short pieces, and Mark’s really good at it. Our most recent conversation led to  Because it conflicted with my teaching schedule, I was only able to attend part of the first day of the Morningstar Investment Conference. Charles, who was there throughout, reports on his experiences in this month’s issue.

Because it conflicted with my teaching schedule, I was only able to attend part of the first day of the Morningstar Investment Conference. Charles, who was there throughout, reports on his experiences in this month’s issue.

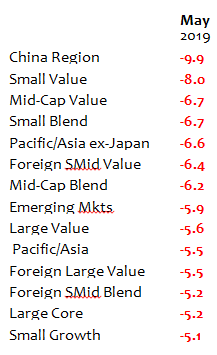

Look forward to almost the end of May. The total returns on those domestic and international funds have melted away by anywhere from five hundred to a thousand basis points. Those who were afraid that the train was leaving the station and piled back into the equity markets in the first week of May now find themselves sitting on some rather large paper losses. Coming on top of what was for many a disastrous 2018, the potential exists for another substantial drawdown in both assets and performance.

Look forward to almost the end of May. The total returns on those domestic and international funds have melted away by anywhere from five hundred to a thousand basis points. Those who were afraid that the train was leaving the station and piled back into the equity markets in the first week of May now find themselves sitting on some rather large paper losses. Coming on top of what was for many a disastrous 2018, the potential exists for another substantial drawdown in both assets and performance.

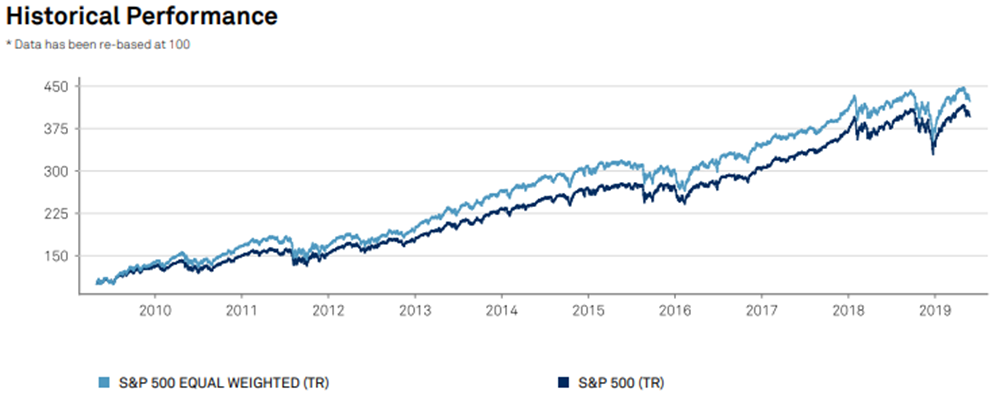

In the long-term, biases toward value, smallness and diversification have paid off handsomely. One attempt to calculate the returns of the equal-weight and cap-weight versions of the S&P 500 back to 1926 estimate that the equal-weight version outperforms the cap weighted version by 281 basis points per year;

In the long-term, biases toward value, smallness and diversification have paid off handsomely. One attempt to calculate the returns of the equal-weight and cap-weight versions of the S&P 500 back to 1926 estimate that the equal-weight version outperforms the cap weighted version by 281 basis points per year;

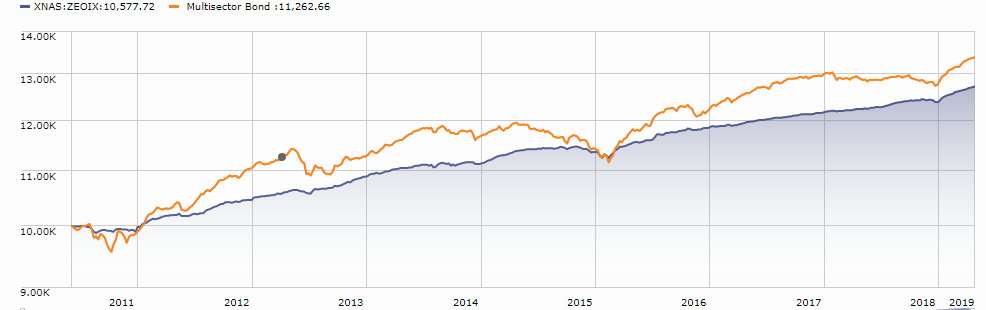

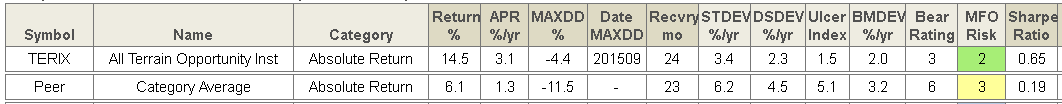

And that’s where Newfleet comes in. Newfleet Asset Management, now part of Virtus, is a $10.5 billion fixed-income manager that specializes in a multi-sector approach. While they don’t quite believe “there’s always a bull market somewhere,” they do believe that there’s always better value somewhere. You might think of them as “disciplined agnostics.” They are not “always and only muni bonds” or “always and only” anything. Instead, they’ve constructed an active strategy that allocates resources between two distinct but convergent non-investment-grade universes.

And that’s where Newfleet comes in. Newfleet Asset Management, now part of Virtus, is a $10.5 billion fixed-income manager that specializes in a multi-sector approach. While they don’t quite believe “there’s always a bull market somewhere,” they do believe that there’s always better value somewhere. You might think of them as “disciplined agnostics.” They are not “always and only muni bonds” or “always and only” anything. Instead, they’ve constructed an active strategy that allocates resources between two distinct but convergent non-investment-grade universes.

Here’s a quick rundown of the newly-launched fund:

Here’s a quick rundown of the newly-launched fund: And thanks, as ever, to The Shadow – a long-time stalwart of MFO’s discussion board – for his indefatigable reading of SEC filings each month. He finds things before the SEC even knows they’ve been filed. It helps a lot to be able to scan his list of finds on the Board each month, just to be sure that I haven’t missed anything significant.

And thanks, as ever, to The Shadow – a long-time stalwart of MFO’s discussion board – for his indefatigable reading of SEC filings each month. He finds things before the SEC even knows they’ve been filed. It helps a lot to be able to scan his list of finds on the Board each month, just to be sure that I haven’t missed anything significant.