On May 31, 2019, Harbor Funds launched Harbor Focused International (HNFIX/HNFSX). Harbor has eight international and global funds, of which three were either launched or relaunched this year. HNFIX is the most recent of those innovations.

Harbor Focused International will pursue capital appreciation. The fund will invest in 25-40 stocks from developed and emerging international markets. It will be an all-cap portfolio (minimum cap is just $1.5 billion) that is benchmark-agnostic. As a result, it might substantially overweigh some regions, sectors or styles if that’s what they think is going to work.

The managers are looking for high-quality growth companies with strong management and sustainability records. “High quality growth” translates to:

- Strong competitive position

- Strong and sustainable free cash flow generation

- Above average profit margins and returns on equity

- A sound balance sheet

- Capable management with a record of sensible capital allocation

Comgest has incorporated ESG screens into all of their investment decisions and they have done so for a decade.

All of Harbor funds use outside managers and Harbor has a very strong record in selecting and monitoring their times. This fund is sub-advised by Comgest, a French multinational investment firm with operations worldwide. Comgest is employee-owned, has own something like 100 international awards, and has never had a manager leave in order to work for a competitor. They manage about $30 billion in asset.

Let me be clear: The fund warrants close attention, not least because Comgest seems to be ![]() freakishly successful in managing the strategy. Comgest Growth World, whose strategy is embodied here, has three-year returns that place it 61st among 2800 funds tracked by CityWire, with exceptionally low risk and maximum drawdown scores. Morningstar has it beating its peers by 400-500 bps over the past 3-5 years, with “above average return” and “low risk” scores for the past 1-, 3-, 5- and 10-year periods.

freakishly successful in managing the strategy. Comgest Growth World, whose strategy is embodied here, has three-year returns that place it 61st among 2800 funds tracked by CityWire, with exceptionally low risk and maximum drawdown scores. Morningstar has it beating its peers by 400-500 bps over the past 3-5 years, with “above average return” and “low risk” scores for the past 1-, 3-, 5- and 10-year periods.

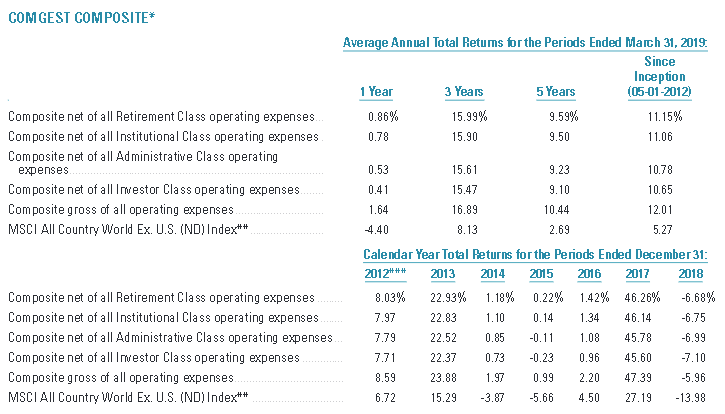

Harbor uses the Comgest Global-ex-US composite, which is the audited performance of all fee-paying accounts managed by Comgest that have investment objectives, policies and strategies substantially similar to those of the Fund, as the basic for its performance comparison.

Two highlights there. First, the total returns of the composite since inception, about 11% depending on expenses, approximately double the returns of its benchmark index. Second, in all years in which the index loses money, Comgest excels. In two of three such years, the index lost money and Comgest made money.

The fund is managed by a four-person team. The senior member of that team, Vincent Houghton, has announced his plans to retire at the end of this year. The remaining members have substantial experience, both in the industry and in working together.

The fund has $26 million in AUM. The expense ratio for the Investor class shares is 1.22% and the minimum initial investment is $2,500. The corresponding numbers for the Institutional share class are 0.85% and $50,000. The fund’s homepage is only modestly useful. A recent article in Investment Europe (“Comgest’s sustainable long term investing focuses on quality research,” 11/27/18) offers good insight into the firm’s investment process. The strategy in Harbor Focus will parallel the one that the managers use in Comgest Growth World, whose performance profile is available from CityWire and Morningstar UK.