On April 30, 2019, Palm Valley Capital Management launched their first, and likely only, fund: Palm Valley Capital Fund (PVCMX). The managers are seeking long-term total return. The plan is to invest in a compact portfolio of high-quality, substantially undervalued small cap stocks.

What are they planning to do?

Their goal is to provide “an attractive absolute return” over the course of a full market cycle. A market cycle encompasses the period between the peak of one bull market (October 2007 for the current one, for example), through the subsequent bear market and bull market phases, to the peak of the next one. Such cycles typically run from 7-10 years. By highlighting the “full market cycle” as the right period for judgment, they’re reminding investors that over shorter spans within the cycle they’ll look, variously, like heroes, geniuses, fuddy-duddies then idiots. For long-term investors, none of those individual phases should sway your investment decisions: charging into the fund after they’ve established themselves as geniuses is about as destructive to wealth as charging out of the fund when you’ve concluded they’re idiots.

The portfolio construction process has three steps:

- Identify good businesses – their universe is about 300 small cap U.S. blue chip companies: established firms, profitable businesses, predictable cash flows and a strong balance sheet.

- Buy them when they’re available at a good price – using a discounted free cash-flow model that accounts for the short-term ebbs and flows of a firm’s cash flow.

- Sell them when the price exceeds value, or when you can no longer be certain of the value.

As absolute value investors, the corollary of all that is: if they can’t find companies and stocks that meet our criteria, they will not buy stocks just for the sake of being fully invested. That means during each cycle, it is utterly predictable that the fund will hold a cash stake that’s somewhere between negligible (0% when the market is tanking and values abound), substantial (say, 40% as values become scarce) and huge (90% at the market’s frothy peak). The short-term judgment of “genius” or “idiot” will be determined by where in the market cycle we are, rather than by any change in the managers’ behavior.

Who’s going to do it?

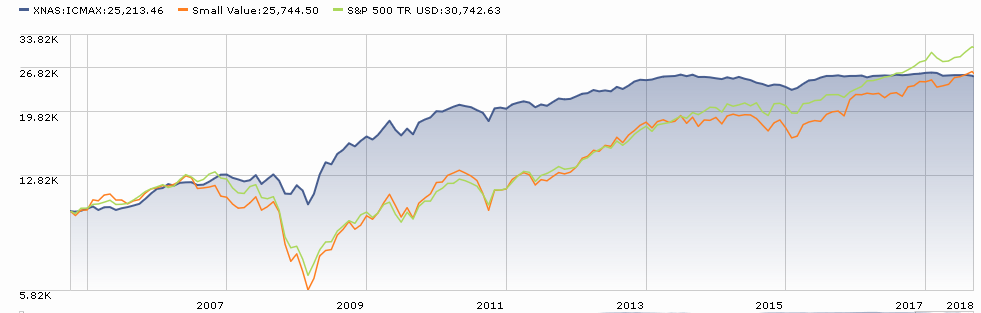

The fund will be managed by Eric Cinnamond and Jayme Wiggins. This fund’s first incarnation appeared in 1996, when Mr. Cinnamond’s Evergreen Small Cap Equity Income fund earned a five-star designation from Morningstar and was twice recognized by Barron’s as a Top 100 mutual fund. In the late 90s, he moved to Florida and was hired by Intrepid to replicate the strategy in a series of separately managed accounts. From 2005-2010, Mr. Cinnamond built and managed the five-star Intrepid Endurance (ICMAX) then, from 2010 – 2016, he managed Aston / River Road Independent Value (ARIVX). In an exceptional move, Mr. Cinnamond recommended return of capital to his investors, noting that the market was fundamentally hostile to his investment style and that he was unwilling to charge investors “equity fund prices” while sitting at 90% cash. That struck me as a singularly sensible and principled decision.

Mr. Wiggins managed Intrepid Endurance from the day after Mr. Cinnamond’s departure in 2010 to September, 2018. He’d worked with Endurance as a member of its investment team since the fund’s launch.

Why might the fund warrant your attention?

Absolute value investors are the industry’s most sensible and most endangered species. They start with the simple principles that stocks are risky and stocks aren’t always worth the risks they pose. Absolute value investors only own stocks when the likely rewards substantially outweigh the likely risks. Every market cycle has phases when stocks, on whole, are wildly undervalued, more-or-less reasonably valued, and wildly overvalued. On average, absolute value investors pour money into the market during the first phase when everyone else is fleeing, ride the market back up during the second phase, and sell down their holdings during the third phase. Because the third, frothy phase can last a long time, executing the strategy requires fortitude and patience on the part of both managers and shareholders.

Since most investors have limited patience, most absolute value investors have limited careers.

That said, Messrs. Cinnamond and Wiggins have performed exceptionally well over the course of two lengthy careers. Below is the combined record for their tenures as lead manager for Intrepid Endurance (10/03/2005 – 9/10/2018).

For much of those 13 years, Endurance crushed both the S&P 500 and its small cap peers. As the frothy phase – depending on your metrics, 2013-present – dragged on, its raw performance advance dwindled then disappeared. (As did most of its investors.)

The strength of the managers’ stock-picking is understated by the fund’s total returns, since their portfolios often held substantial cash reserves. Over the years, several spot calculations showed that the fund’s stocks were returning a multiple of the index’s returns.

The stock market remains, in the managers’ view, frothy. As a result, the fund’s initial portfolio remains lightly invested and focused on liquidity.

Given our views on valuation and risk, we are currently placing considerable emphasis on liquidity, quality, and minimizing mistakes. T-bills, in our opinion, are particularly attractive relative to many of the small cap stocks we’ve analyzed and valued. In addition to protecting capital, T-bills are liquid, provide a competitive yield, and allow investors to act decisively when future opportunities return.

In addition to T-bills, we are attracted to a handful of small cap equities with strong balance sheets. Our goal is to focus on businesses we believe will survive and gain market share during the next economic downturn. In summary, at this stage of the cycle, we want liquidity in the portfolio and liquidity in the balance sheets of the businesses we own.

The administrative details

The minimum initial investment for PVCMX is $2,500 and the opening expense ratio, after waivers, is 1.25%. That’s 13 bps lower than the expenses for ICMAX. The fund is available from the advisor, which is working hard to arrange access through various online brokerages. Its website is PalmValleyCapital.com. There’s a fair richness of market analyses on site already, which would give potential investors an insight into the managers’ approach.