Dear friends,

It’s not yet the height of summer, but it’s starting to feel like it at Augustana. Our summer classes, held only in June, have ended and the hubbub of the new year is still a distant cloud on the horizon. I visit campus to catch up on my reading – it’s what scholars do – and to pursue bits and pieces of administrative work for my dean. Rather than camp in my office all day, I wander around at lunchtime and recently discovered our always-bustling patio and picnic lawn look a bit quiet.

I approve.

I approve.

As many of you know, Chip and I celebrated the beginning of summer with a ten-day jaunt around Ireland. Many of you celebrated our departure (hmmmm…) and others offered tips on sights, restaurants and music. We’re deeply grateful to you all, and vastly enjoyed the trip. We essayed to share some of the highlights in a photo-essay, Around the Island in Eleven Days with a thoughtful appendix, Tips for Traveling in Ireland. We hope you enjoy both and are emboldened in your own adventuring!

Summertime with T. Rowe Price

T. Rowe Price is my preferred retirement firm. Their work on asset allocation strikes me as way ahead of the pack, they have stable management teams, sensible strategies and an aversion to taking silly risks. Morningstar avers, “T. Rowe Price remains best-in-class.”

Four mid-summer T. Rowe notes.

-

I’ve finished cleaning my retirement portfolio. The portion under my control is invested primarily in T. Rowe Price Retirement 2025 (TRRHX), T. Rowe Price Emerging Markets Discovery Stock (PRIJX, formerly TRP EM Value) and Spectrum Income (RPSIX).

As many of you know, changes in Augustana’s retirement plan meant that I could no longer invest in T. Rowe or Fidelity. I prefer simplicity so it made sense to consolidate and, between the two, I far prefer T. Rowe. Fidelity forever seems to be scrambling to expand The Fidelity Empire, T. Rowe seems to be focused on managing my portfolio. So I moved money from Fidelity to T. Rowe.

For a market in which there were no obvious pockets of value, picking a good target-date retirement fund made sense. Price offers two series, one more cautious and the other more venturesome. I went with venturesome. In June, I eliminated almost all of my individual fund positions since most were already part of the TRRHX portfolio (great minds think alike). That said, I have maintained two equal-sized side bets: Emerging Markets Discovery because every projection for the next 5-10 years says that the emerging markets will outperform and I’m most comfortable with a value orientation and Spectrum Income as a sort of volatility hedge on EM Discovery.

There are 15 retirement date funds that have existed through this entire market cycle; counting newer funds, there are 57 options now available. In comparison with the 15 funds with the longest records, TRRHX shows a risk-return pattern that I’m comfortable with.

Value Total Stock Market Rank out of 15 Range within the group Annual percentage return 5.3% 7.4 1st 2.9 – 5.3% Standard deviation 13.4 15.6 14th 9.7 – 14.1 Sharpe ratio 0.35 0.43 4th 0.18 – 0.44 -

I’m opening a Roth IRA for my 18-year-0ld. There is not yet a Retirement 2070 fund (oh, dear God, 2070) so our plan is to invest $1,000, likely in T. Rowe Price Global Allocation (RPGAX), Price’s most wide-ranging fund of funds. The base allocation is 30% US equity, 30% international equity, 30% income and 10% alternative investments. It uses other T Rowe Price funds for its income and EM exposure, but invests directly in US and developed market stocks.

I know that with a 50 year time horizon, it pays to be aggressive. That said, I wonder a lot about what asset class to bet on for an investment that likely won’t be redeemed until I’m … well, working for that Great Blogger in the Sky. The most recent factsheet shows that the fund has a larger-than-normal hedge.

With no further additions, assuming a 7% rate of return, that $1,000 will grow to $25,000 at Will’s retirement. At 10%, it would be worth about $110,000.

-

Give up your obsession with “beating the market”! It’s corrosive, stupid and unproductive. Just sayin’.

A criticism of active funds is that so few of them “beat the market,” much less beat it consistently. The best rejoinder is: why on earth do you care? Beating the market is relevant if and only if your portfolio goal isn’t “live a comfortable life” or “gain financial security” but, instead, is “have something to brag to the guys about.”

What would it take to beat the market? One answer is, “anything over 4.8%” because that’s all you would have earned over the course of the current century: an investment in the S&P 500 made on January 1, 2000 would have grown, on average, by 4.8% through the end of 2018. And, as it turns out, 4.8% a year probably won’t meet any of those other “good life” goals.

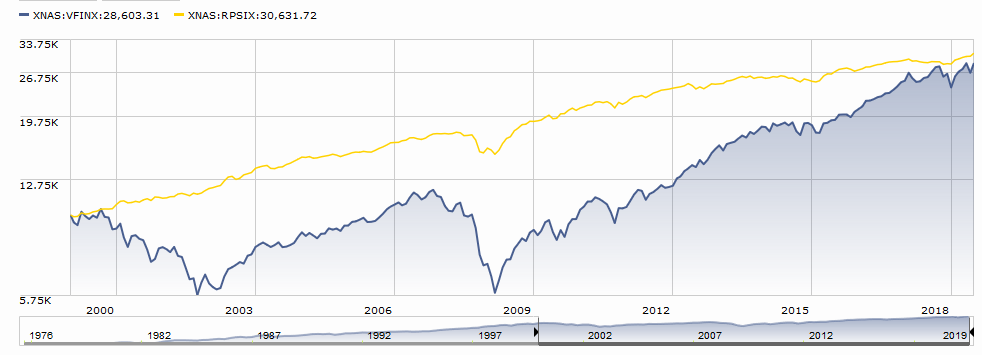

The other answer is, “a sensible, diversified portfolio with minimal exposure to stocks.” The chart below compares the returns of T. Rowe Price Spectrum Income (RPSIX), which I hold in both personal and retirement accounts, with the mighty S&P 500. As it turns out, over the course of this century, slow-and-steady has been winning the race. “Beating the market” has been illusory and unprofitable.

-

T. Rowe channels their inner rock star: “It’s not time to be a hero

“Markets are near highs and risks are rising, so it’s not time to be a hero. It’s a good time to be diversified, invest strategically, and have your shopping list ready in case stocks pull back and go on sale.” Rob Sharps, head of investments and group chief investment officer, T. Rowe Price , June 2019 .

“Markets are near highs and risks are rising, so it’s not time to be a hero. It’s a good time to be diversified, invest strategically, and have your shopping list ready in case stocks pull back and go on sale.” Rob Sharps, head of investments and group chief investment officer, T. Rowe Price , June 2019 .That sounds, on whole, both eminently sensible and eminently T. Rowe. If you were meaning to look at your portfolio in January with an eye to rebalancing but didn’t, you should move now. Domestic stocks have roared, your allocation is further out of balance than ever and, with it, your risk exposure might be way higher than you intend.

Thanks, as ever

… to our faithful subscribers, Doug, Deborah, Greg, William, Brian, Seshadri and David; to our new donors W.E. Sperry and Francis; and our long-time friend and contributor, David Moran. You all make a difference, both fiscal and spiritual.

As ever,