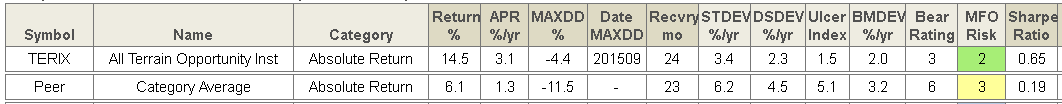

On February 22, 2019, Foothill Capital Management launched the Cannabis Growth Fund (CANNX/CANIX). The fund seeks to provide long-term capital appreciation through investing globally in companies “engaged exclusively in legal cannabis activities under applicable national and local laws, including U.S. federal and state law.” This marks the launch of Foothill’s second fund, after All-Terrain Opportunity Fund (TERIX), a four-year-old fund of funds that’s done quite well since inception.

Morningstar rates TERIX as a four-star fund (as of 5/29/19).

MFO’s May issue incorrectly identified CANNX as a “fund in registration,” that is, a fund not yet available for sale.

Here’s a quick rundown of the newly-launched fund:

Here’s a quick rundown of the newly-launched fund:

- Its investable universe includes the 350 or so publicly-traded firms which derive 50% or more of their earnings from the cannabis industry.

- Those firms are located in a variety of sectors, including agricultural and bio-technology, cultivation and retail, and industrial hemp.

- Their universe is populated primarily by micro- to mid-cap growth companies, though they won’t invest in any stock with a market cap below $100 million and their largest single holding is a large cap Canadian firm, Canopy Growth (CGC) as of March 31, 2019.

- The fund is non-diversified with about 32 stocks in the portfolio currently; it anticipates relatively high turnover.

- The manager uses options in an attempt to (partially) manage volatility and increase performance.

- The portfolio manager is Korey Bauer, who co-manages All-Terrain Opportunity Fund (TERIX) and previously managed Catalyst Macro Strategy Fund in 2014.

The upside, by the manager’s reckoning, is that you’re gaining early access to an exploding market. They write:

More than 22 countries covering a population of nearly 1 billion have laws that cover the legal use of medical cannabis as well as the decriminalization and use of hemp. With legalization helping to expand various health care and consumer uses, the global cannabis market is anticipated to grow 60% to over $30 billion by 2021.

Other estimates are rather more aggressive. One places the global cannabis market at $340 billion by 2025 with the legal industry capturing about 25% of the total. Canopy Growth published a 2019 analysis of the global market that suggested that cannabis products could disrupt a half trillion dollar market for products ranging from pain relief and animal health to sleep aids and … recreational alternatives to alcohol.

The downside, of course, is that the stuff is illegal in the U.S. The use, sale, and possession of cannabis with over 0.3% THC in the United States is illegal under the federal Controlled Substances Act of 1970. While states, eyeing a potential tax windfall, have been merrily legalizing medical and recreational marijuana, under the Supremacy Clause of the U.S. Constitution, federal law preempts conflicting state and local laws. On the upside, the 2018 Farm Bill made low-THC cannabis, sometimes called “industrial hemp,” legal though highly regulated. A second channel might be the incredibly popular cannabis-derived product cannabidiol (CBD), which has been faddishly added to everything. The New York Times announced that

cannabidiol is everywhere. We are bombarded by a dizzying variety of CBD-infused products: beers, gummies, chocolates and marshmallows; lotions to rub on aching joints; oils to swallow; vaginal suppositories for “soothing,” in one company’s words, “the area that needs it most.” (Can CBD really do all that? 5/14/19)

The fund’s retail shares (CANNX) carry a $2,500 minimum initial investment and expenses of 1.35% (after waivers in effect through 2020). The institutional shares (CANIX) require $100,000 and charge 1.10%. The fund is available through direct purchase or the online TD Ameritrade and InteractiveBrokers sites. The Cannabis Growth homepage offers a reasonable amount of information about the strategy and its investable universe.