Before funds and ETFs can be offered to the public, they’ve got to be submitted to the SEC which has 70 days to review the application. In general, advisers try to launch just before year’s end because that allows them to have clean “year to date” and calendar year results to share. These launches will likely occur in late June so that they’ll at least have full-quarter results for 2019 Q3.

The dominant themes this month seem to be enhanced risk-management (Aptus, Horizon, Hussman, Quadratic, RG) and ESG emphasis (Horizon, Kennedy, Wahed). Also cannabis.

Aptus Collared Income Opportunity ETF

Aptus Collared Income Opportunity ETF, an actively-managed ETF, will seek current income and capital appreciation. The plan is to invest in a portfolio of large capitalization U.S.-listed stocks and an options collar (i.e., a mix of written (sold) call options and long (bought) put options) on the same underlying equity securities. The fund will be managed by John D. (“JD”) Gardner and Beckham Wyrick of Aptus Capital Advisors. Its opening expense ratio is 0.79%.

Cannabis Growth Fund

Cannabis Growth Fund will seek long-term capital appreciation. The plan is to create a global stock portfolio populated with companies “in legal cannabis-related businesses.” That might include biotechnology firms and industrial hemp producers as well as firms that sell cannabis. The fund will be managed by Korey Bauer of Foothill Advisors. Its opening expense ratio is 1.35% after waivers, and the minimum initial investment will be $2,500.

ETFMG Sit Short Term ETF

ETFMG Sit Short Term ETF, an actively-managed ETF, seeks maximum current income to the extent consistent with preserving capital and maintaining liquidity. The plan is to invest in a diversified portfolio of high-quality short-term U.S. dollar denominated domestic and foreign debt securities. The fund will be managed by Bryce Doty, Mark Book, and Christopher Rasmussen of Sit Fixed Income Advisers. Its opening expense ratio has not been disclosed.

Gryphon International Equity Fund

Gryphon International Equity Fund will seek to achieve long-term capital appreciation. The plan is to build an international all-cap growth-at-a-reasonable-price portfolio. The managers may use currency hedging. The fund will be managed by a largish team from Gryphon International Investment Corporation. Its opening expense ratio is 1.30%, and the minimum initial investment will be $5,000, reduced to $3000 for tax-advantaged accounts.

Horizon U.S. Risk Assist Fund

Horizon U.S. Risk Assist Fund will seek to capture the majority of the returns associated with domestic equity market investments, while mitigating downside risk through use of a risk overlay strategy. The plan is to have a mid- to large-cap defensive equity portfolio which will be supplemented by an options portfolio and its Risk Assist Strategy which appears to be a bunch of Treasury bonds. Complicated stuff will determine the extent to which the risk overlays are invoked; the managers are comfortable lagging the market during its up legs as a price for substantially protecting capital during sharp declines. The fund will be managed by Scott Ladner, Mike Dickson, and Josh Rohauer of Horizon Investments. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $2,500.

Horizon Risk Assist Impact Fund

Horizon Risk Assist Impact Fund will seek to capture the majority of the returns associated with domestic equity market investments, while mitigating downside risk through use of a risk overlay strategy. The plan is to have a mid- to large-cap defensive equity portfolio which will be supplemented by an options portfolio and its Risk Assist Strategy which appears to be a bunch of Treasury bonds. The equity selection process includes an ESG screen. Complicated stuff will determine the extent to which the risk overlays are invoked; the managers are comfortable lagging the market during its up legs as a price for substantially protecting capital during sharp declines. The fund will be managed by Scott Ladner, Mike Dickson, and Josh Rohauer of Horizon Investments. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $2,500.

Horizon Multi-Asset Income Fund

Horizon Multi-Asset Income Fund will seek to maximize current income while maintaining capital appreciation. The plan is to create a global portfolio with 30-70% invested in broad palette of fixed-income securities which may be supplemented by an options portfolio. The options can generate income and hedge volatility, depending on their expectation of market conditions. The fund will be managed by Ronald Saba and Mike Dickson of Horizon Investments. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $2,500.

Hussman Strategic Endowment Fund

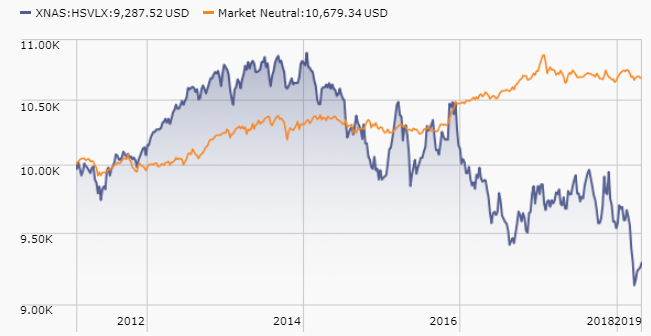

Hussman Strategic Endowment Fund (HSENX) will seek to achieve total return “and enhance the long-term spending potential of investors.” The plan is to invest in some combination of stocks, bonds and cash with the weighting determined by (1) where the better values lie and (2) how speculative the markets have become. The fund will be managed by John D. Hussman, PhD. The registration is virtually coincident with the liquidation of Hussman Strategic Value whose performance chart looks like this:

The volume of Dr. Hussman’s writing output would put many romance novelists to shame and he tends to provoke strong visceral reactions; people tend to see him as either the last sane man left or an eloquent loon. Its opening expense ratio is 1.25%, and the minimum initial investment will be $1,000.

Kennedy Capital ESG SMID Cap Fund

Kennedy Capital ESG SMID Cap Fund will seek capital appreciation. The plan is to buy ESG-screened stocks. Nothing about the discipline seems immediately exceptional: internal and external data sources but they do their own rankings, growth as a reasonable price, they engage in dialogue with management teams, and it will be fossil-fuel free. The fund will be managed by Christian McDonald of Kennedy Capital. Mr. Kennedy’s separate account composite is only 18 months old, but it has so far outperformed the Russell 2500. Its opening expense ratio is 1.14%, and the minimum initial investment will be $2500.

Pioneer Emerging Markets Equity Fund

Pioneer Emerging Markets Equity Fund will seek long-term capital growth. The plan is to do all of the usual stuff: top down, bottom up, quantitative, qualitative, located in the EMs, not located in the EMs, yada, yada. They can hold up 10% high-yield bonds and have the ability to hedge currency exposure. The fund will be managed by Patrice Lemonnier, Head of EM Equity at Amundi and Mickael Tricot. Its opening expense ratio is 1.33% for “A” shares plus a nominal 5.75% front load, and the minimum initial investment will be $1,000.

Quadratic Interest Rate Volatility and Inflation Hedge ETF

Quadratic Interest Rate Volatility and Inflation Hedge ETF, an actively-managed ETF, seeks to hedge the risk of rising long-term interest rates, an increase in inflation and inflation expectations, and an increase in interest rate volatility, while providing inflation-protected income. The plan is to invest in a mix of U.S. Treasury Inflation-Protected Securities and long options tied to the shape of the interest rate yield curve. The fund will be managed by Nancy Davis, Chief Investment Officer of Quadratic Capital Management. Its opening expense ratio is 0.99%.

Rational Special Situations Income Fund

Rational Special Situations Income Fund will seek current income and long-term capital appreciation. The plan is invest in agency and non-agency residential and commercial mortgage-backed securities, with a focus on non-agency residential mortgage-backed securities. The average effective duration ranges between -9 and 9 years, which reflects the presence of floating-rate securities whose value rises as interest rates do. The fund is the reorganized version of a hedge fund, ESM Fund, L.P., which returned 16.8% annualized from 2009 – 2018 while its benchmark rose 3% annually. The fund will be managed by Eric Meyer and William Van de Water, the hedge fund’s managers. Its opening expense ratio is 2.00% on “A” shares with also carry a sales load, and the minimum initial investment will be $1,000.

RG Tactical Market Neutral Fund

RG Tactical Market Neutral Fund will seek long-term capital appreciation. The plan is to build a global market neutral strategy using a quant process to select between 200-1,000 stocks. It might invest in them directly or through derivatives. The fund will be managed by Ben McMillan of RG Liquid Alts, LP. He’s previously managed RSQI Small Cap Hedged Fund and Van Eck Long/Short Equity Index Fund. Its opening expense ratio is 3.38% for Investor shares, and the minimum initial investment will be $10,000.

UBS All China Equity Fund

UBS All China Equity Fund will seek to maximize capital appreciation. The plan is invest in “upcoming industry leaders in key secular growth sectors early in the company’s lifecycle and when the company’s share price trades far below our estimate of the firm’s fair value.” They’re also permitted to do a fair amount of hedging. The fund will be managed by Bin Shi of USB Asset Management. Prior to joining UBS in 2006, Mr. Shi was a portfolio manager at one of China’s largest domestic mutual fund companies. (I didn’t even know they existed.) Its opening expense ratio has not been disclosed, though it does carry at 5.5% sales load, and the minimum initial investment will be $1,000 for “A” shares.

Vanguard Commodity Strategy Fund

Vanguard Commodity Strategy Fund will seek broad commodities exposure and capital appreciation. The plan is to gain exposure to commodities by investing in a wholly owned subsidiary organized under the laws of the Cayman Islands, which in turn will invest in commodity-linked derivatives and fixed income securities. The fund will be managed by Anatoly Shtekhman, Fei Xu, and Joshua Barrickman of Vanguard. Its opening expense ratio has not been disclosed (but will be very low) , and the minimum initial investment will be $50,000.

Wahed FTSE USA Shariah ETF

Wahed FTSE USA Shariah ETF, an actively-managed ETF, seeks to track the performance of a broad-based index of Shariah-compliant stocks. We don’t normally track the launch of index funds and ETFs but Muslim investors have so few fund options (no ETFs and just three fund companies) that we felt compelled to make an exception. As a practical matter, the portfolio will screen out a bunch of suspect activities (production of alcohol, tobacco, weapons or pork, as examples), and will invest mostly in mid- to large-cap stocks of companies that have strong balance sheets. You could do worse. The fund will be managed by Samim Abedi of Wahed Invest LLC. Its opening expense ratio is 0.50%.