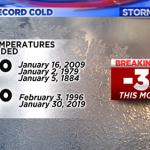

It’s minus 3 degrees this morning, with a thick blanket of snow on the ground, and winds are making it feel like 20 below. There is little compelling reason for this retired guy to hustle around and get outdoors, so it’s as good a time as any to think about the so-called market meltdown of 2018 and offer some perspective on what is really important for individual investors to consider.

A quick look at my Schwab accounts tells me that since January 1, 2018, through January 18 of this year (12 ½ months), my total portfolio value is down 1.31%. As I have mentioned before, I rarely look at these values, so I was actually surprised the return has been that good. One would think last year was a disaster, given the massively negative press over the last many months. Yes, the year-end numbers were down more than today’s, but a loss of less than 6% over 12 months doesn’t get me excited at all. In fact, that is the same return as the average 50%-70% Allocation Fund, and my allocation is more aggressive.

During my 30-plus years as an investment advisor, I was witness to numerous bull and bear markets, market crashes, market meltdowns, interest rate swings, recessions, wild one-day roller coaster rides, domestic and international political disasters, and more economic forecasts of doom and gloom than I can possibly recount. When we also consider the current state of affairs in Washington (and that’s really hard to avoid), it’s no wonder folks, especially retirees, are a bit nervous about their investments. This morning’s paper says that a majority of economists believe we will have a recession in 2020. Am I going to make changes based on that? Of course not. I seem to remember a quote from a while back, saying “Economists have predicted 12 of the last three recessions.”

Broadcast business media have discovered a gold mine of advertising resulting from scaring people on a daily basis. I suggest a simple solution: don’t watch or listen to this drivel. Few are real journalists, and even fewer have financial education and experience. Those that offer alternative viewpoints may be ridiculed or even blackballed from future appearances. Remember, the goal of these programs is to sell advertising, not to provide unbiased commentary. Fortunately some investors rely on a competent, fee-only advisor to keep them from self-immolation!

Broadcast business media have discovered a gold mine of advertising resulting from scaring people on a daily basis. I suggest a simple solution: don’t watch or listen to this drivel. Few are real journalists, and even fewer have financial education and experience. Those that offer alternative viewpoints may be ridiculed or even blackballed from future appearances. Remember, the goal of these programs is to sell advertising, not to provide unbiased commentary. Fortunately some investors rely on a competent, fee-only advisor to keep them from self-immolation!

Through all of the above, the most important factors in the overall success or failure of investment goals have been time and timing. It’s important to remember that folks who are investors, and not traders, are not concerned about time and timing. While working, they continue to add to their retirement accounts through good times and bad. Investors look at the big picture and do not try to pick a time to exit or enter the stock markets like traders. Investors set an overall portfolio allocation that allows them to sleep at night. Traders do not. Traders are constantly tweaking this or that holding. Investors are not. Investors understand there will be some tough times as well as some great times. (Since 1980, the average intra-year decline of the S&P 500 has been nearly 14%, yet annual returns have been positive in 29 of those 39 years.) Traders will attempt to time these declines.

Some retirees are fortunate to not need income from their investment portfolios. This allows them to be more aggressive with allocations, if they are comfortable with that. Those that need portfolio income should set aside about 5 years of that income in cash, CDs, or short-term bonds. This may avoid having to sell stocks during a down market. Numerous studies suggest that a sensible annual withdrawal rate is 4-5% of the portfolio’s value. Some investors are able and willing to reduce income needs following a down-market year. Some might consider delaying retirement to avoid starting regular portfolio withdrawals during a down market.

Perhaps the reason some retirees fixate on portfolio valuation is because of time…they have too much time on their hands. For those who fall into this situation, I would suggest reading my prior commentary: Living a Rewarding Retirement – Make a Difference.

Investors who enter retirement with no mortgage or credit card debt are in a much better situation than those whose monthly cash flow necessitates these big payments. That is why I have been a strong advocate of paying off debt prior to retirement. It makes a huge difference and reduces potential pressure for portfolio income. I can speak to this personally. It really works.

There is yet to be anyone who can accurately predict what the markets will do on a regular basis. Predicting what will happen each day is nearly impossible, but economists and other self-anointed experts want us to buy into their yearly predictions. Understand this, and you will come a long ways toward shutting out some noise. Volatility appears to be with us for now. This is something many investors had forgotten during the past five years, and it adds to heightened anxiety. But consider this: despite all the wild swings in the markets, there was no meltdown in the last 12 months. It’s another year, the economy remains fairly strong, employment numbers are still very good, and inflation remains very low.

If all the noise is keeping you awake at night, if you are afraid to open your monthly account statements, or if you spend more than five minutes each day fussing over your investments, the solution is clear: reset your portfolio allocation to achieve a lower risk profile. Perhaps you should have zero dollars in stocks. Yes, your potential returns may be lower, but your potential drawdown should be correspondingly lower. If you don’t know how to accomplish this, find a good fee-only advisor who can assist. As the saying goes, “Set it and forget it.” And also consider the impact mutual fund fees can have on your portfolio, especially if we continue to see single-digit returns. As investors, we can’t control the markets, but we can make decisions on portfolio risk and portfolio expenses.

So, tune out the broadcast-business programming, get an allocation you can live with, and spend your free time making a difference for others. This last, by itself, can help to reduce retiree angst.