Dear friends,

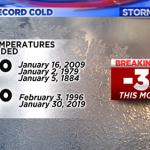

Please join me in bidding a fond adieu to January. It was a month in which our increasingly unstable global climate manifested itself in record-breaking cold and snow. Davenport, Iowa, my adopted hometown, saw the lowest temperature (-33, six degrees colder than the old record) and coldest wind chill readings (-54) in its recorded history. Despite having no precipitation in the first eleven days of January, it still managed 30.2” of snow by month’s end, the most since record-keeping began in 1884. Local drivers responded predictably.

That was all enriched by an electrical fire in Old Main, my campus home, a flu outbreak and five days of school (mall, bank, postal service … ) closures.

I suppose I could make a joke about the market heating up …

| January 2019 | |

Russell 2000 |

11.3% |

| S&P MidCap 400 | 10.5 |

| NASDAQ | 9.7 |

| NYSE | 8.1 |

| S&P 500 | 8.0 |

| DJIA | 7.3 |

but won’t.

The collective suspicion of the folks behind MFO is that, January notwithstanding, we face the prospect of serious and repeated challenges in the next couple years. While it would be nice to believe that the Christmas Eve sell-out represented the end of a rough stretch, there’s little reason to believe that’s true. Valuations remain stretched, the sugar buzz from the tax cuts have worn off while the prospects of trillion dollar annual deficits (and half trillion dollar annual interest charges) are beginning to sink in and investors are beginning to suspect that there are better games in town than ours.

The collective philosophy of the folks behind MFO is that it’s better to plan than panic. And so we’re using this happy pause in the action to begin offering resources that might help your planning. Those include thoughtful big picture advice from both Ed Studzinski and Bob Cochran, Charles’s primer on how to better use the MFO Premium screener to identify bear-resistant investments, my close look at which long-short funds seem positioned to best weather turbulent conditions, Dennis Baran’s profile of Marshfield Concentrated Opportunity, a long-only fund that’s weathered the storm, plus my introductions of Ladder Select Bond and FPA Flexible Income. It’s all designed to remind you that there are meaningful options available beyond the realm of domestic large-cap indexes and bond aggregates.

So, with just the briefest of thanks to you, to Greg, Deb, William and George, to Thomas Killian and the folks in the Bay Area, to the managers who reason with us, to the spouses who sustain us, and the 31,000 folks who read us, we’ll let you get to it.

Wishing you the warmth of good friends and good drink,